When the economy goes smoothly, you might think about consumer stocks running the show. However, this is not the only sector that performs well in a bullish stock market. Another performing sector is the hotel industry. WTO stated that ten percent of the global GDP comes from tourism. When the economy is good, hotel accommodation goes up.

In normal market situations, people travel a lot, going to great destinations and visiting family and friends. Meanwhile, companies send employees to various places to attend seminars, learn new skills, close business deals, or find locations to expand their businesses.

As the world is going back to normal after the pandemic era, hotel stocks will likely pick up the pace, especially in 2022. Let us explore some of the best hotel stocks to buy in 2022. First, let us review what hotel stocks are and how to buy these stocks.

What are hotel stocks?

Hotel stocks are companies engaged in the business of providing lodging and accommodation. These companies provide a place where leisure and business travelers can relax and enjoy. The hotel sector is just one part of the bigger leisure or hospitality industry. This sector is divided into two categories: hotel REITs and C-corporation hotels.

The first category is composed of companies engaged in acquiring, owning, and operating hotel real estate. Some hotel REITs manage their hotels. Meanwhile, the second category comprises companies doing marketing, branding, franchising, and hotel management. They do not necessarily own and operate hotels.

Hotel with a pool amenity

How to buy hotel stocks?

Before you buy any hotel stock, make sure you do your research. You should consider at least four things when looking to invest in hotel stocks.

Understand demand catalysts

Real estate developers do not erect hotels first and try to figure out how to get customers next. Rather, they think about potential customers when designing hotels. Before you buy a hotel stock, consider what factors will drive hotel revenue.

Generally, there are three main drivers:

- Tourism

- Business travel

- Group activities (e.g., conventions, seminars, events, and more)

If a hotel attempts to tap into different kinds of guests instead of one type of customer, that is worth buying for.

Check out the branding

Each hotel targets one or more markets and looks to provide a unique experience. As an investor, you have to understand what type of hotel the stock being considered is. Is it limited service, select service, or full service? The hotel type can greatly affect performance in different market phases.

Look into the hotel management

The success of a hotel company depends to a large extent on the skill and attitude of the management directing the operations. You have to know a bit about the company culture that exists. You can use customer reviews to get insights. Make sure that you put money in a hotel stock with a low attrition rate. This figure is suggestive of good management.

Look for other potential income streams

Check out what amenities your prospective hotel stocks offer. If possible, guests should not go out to get services that the hotel can easily deliver. Does the hotel have a restaurant, bars, spa, conference room, and others? These facilities could help generate additional income. Plus, guests will have a more satisfying experience if they can get what they need in one place.

Top three hotel stocks to buy in 2022

Below is our pick of the three best hotel stocks to consider buying in 2022.

No. 1: Marriott (MAR)

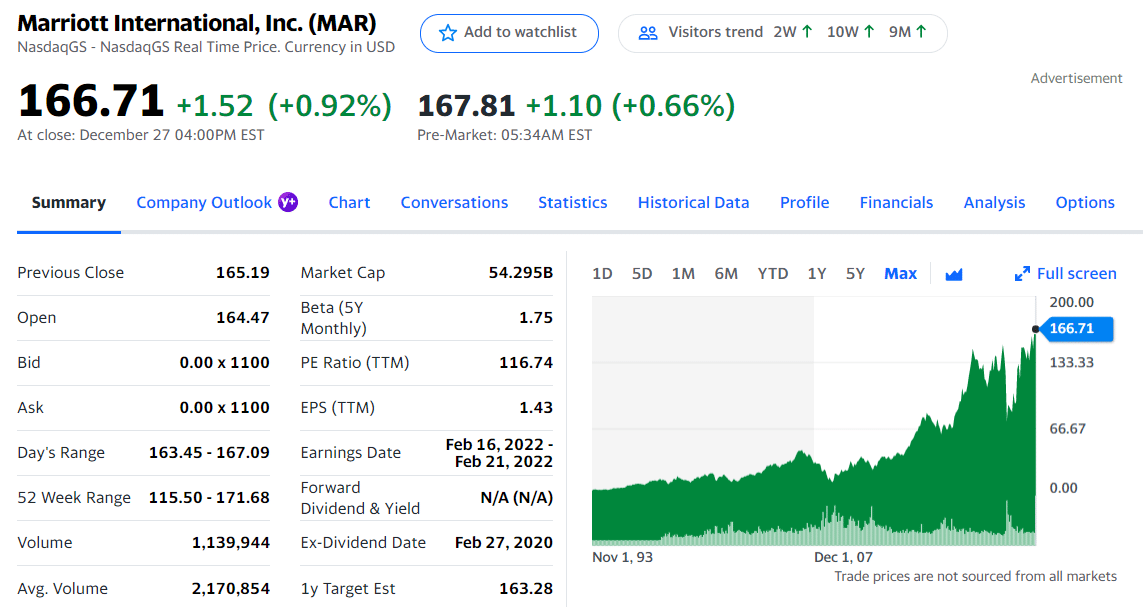

Price: $166.71

EPS: 1.43

Market capitalization: $48.914 billion

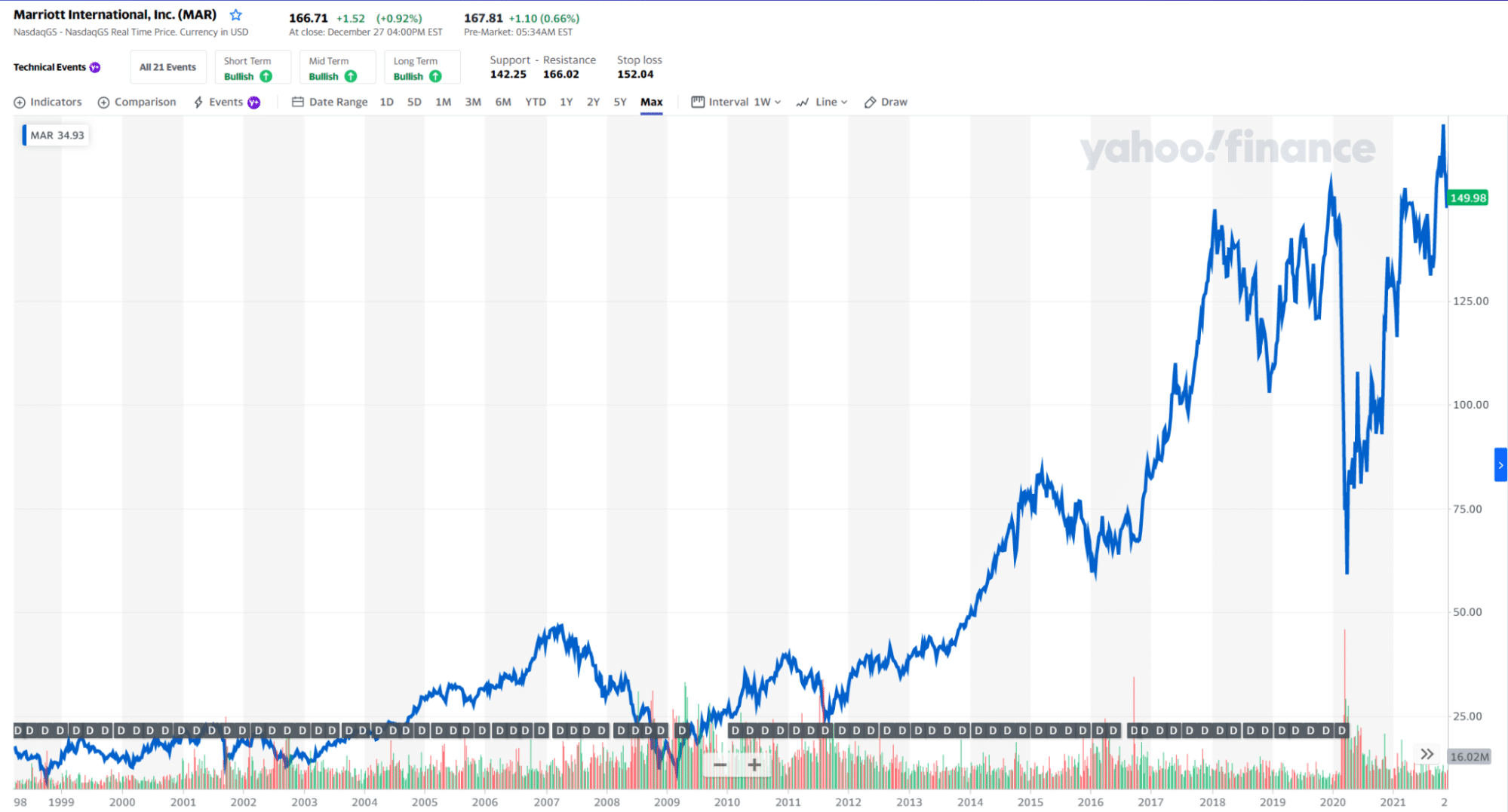

Marriott stock price chart 1998-2021

Marriott is the biggest hotel operator in the world. It has around 7,000 hotels in about 130 countries. Marriott can keep up with the changing market environment rather quickly despite its size. It posted a gain of $100 million in November 2020, much to investors’ surprise. It achieved this feat against a backdrop of a sector that is barely thriving.

Marriot stock summary

This stock managed to make a return of 40 percent in 2020. It generated earnings close to $811 million in quarter two of 2021. At the same period, the stock netted an income of $422 million, which is equal to 280 percent of growth every year.

No. 2: Sunstone (SHO)

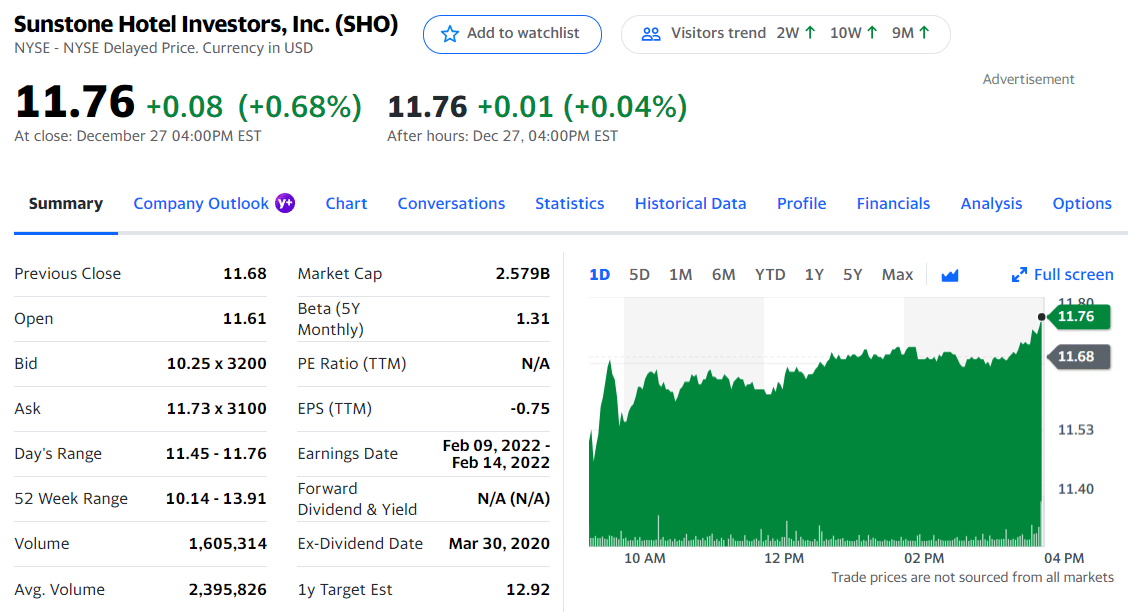

Price: $11.76

EPS: – 0.75

Market capitalization: $2.371 billion

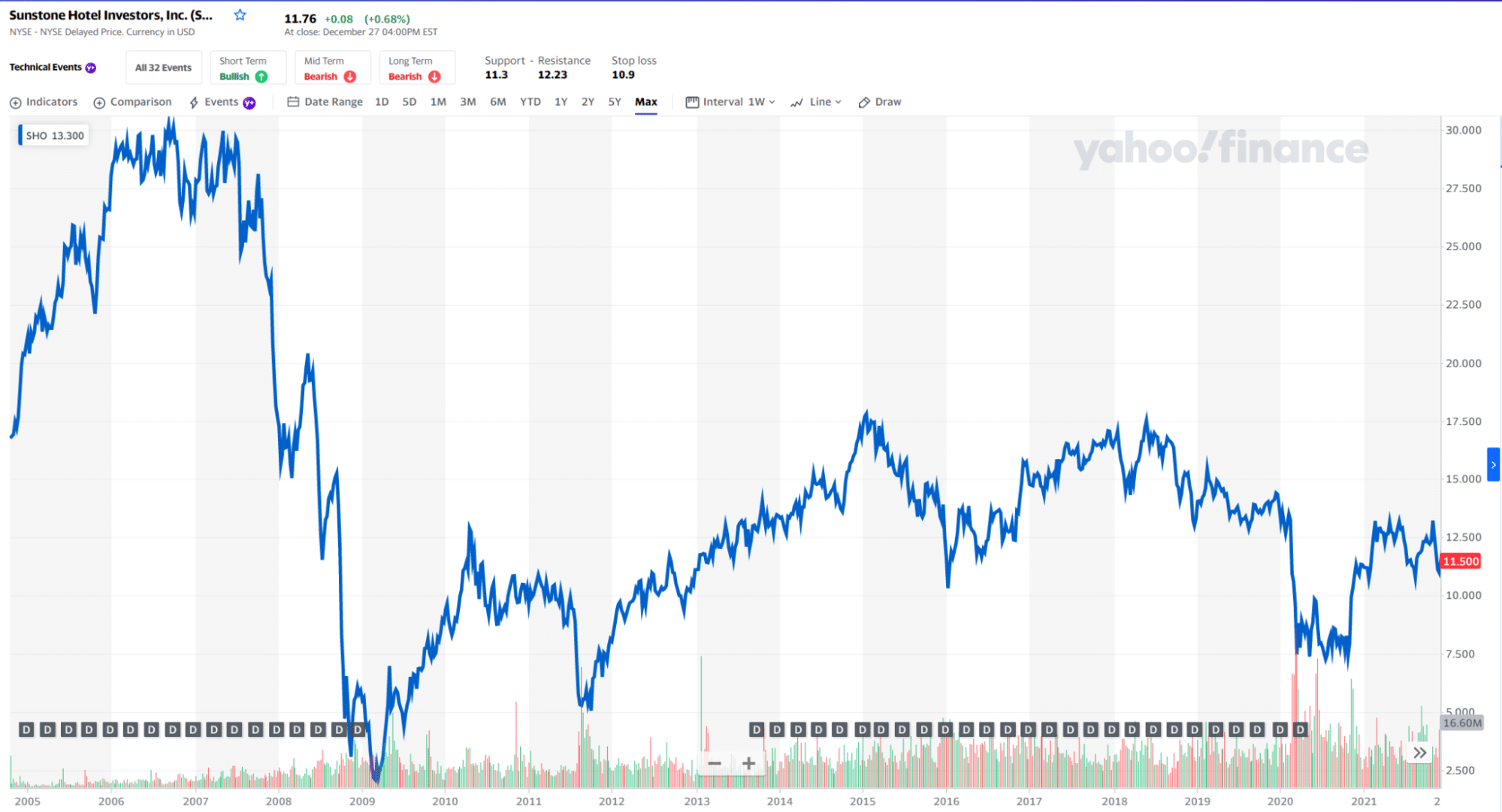

Sunstone stock price chart 2005-2021

Sunstone holds shares in 21 hotels spread across nine US states. Despite the small number of properties to its name, Sunstone works mostly with popular companies in the sector, such as Hyatt, Hilton, and Marriott. All properties of Sunstone belong to the category of upscale or luxury. Sunstone is not directly involved in the operations of these properties. Its partner companies do the management activities.

Sunstone stock summary

Sunstone specializes on properties that, in its estimate, offer something unique to customers and are not easy to imitate. It makes sure that its properties have great locations such as Orlando, New Orleans, New York, Boston, etc. This business focus helps the company maintain its upward trajectory. The stock has an impressive financial standing that you can bank on, such as low leverage, regulated debt, and solid cash position.

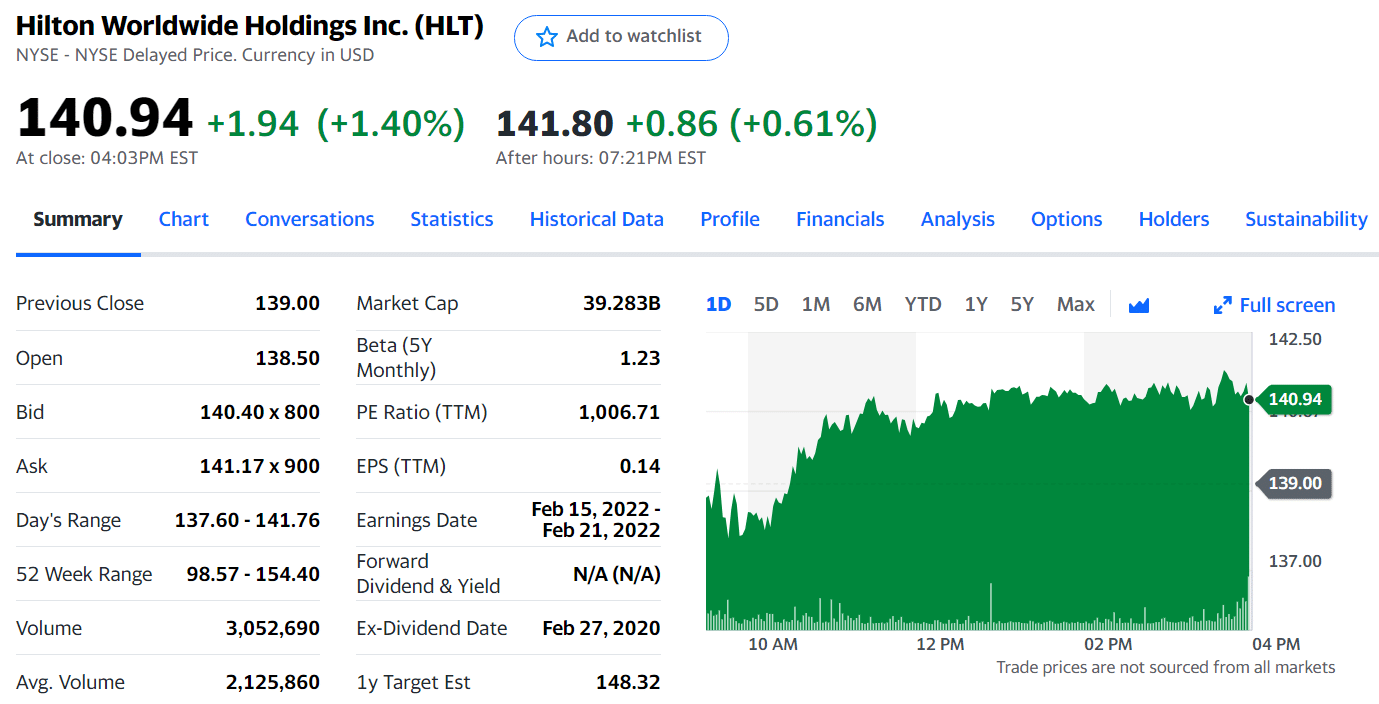

No. 3: Hilton (HLT)

Price: $140.94

EPS: 0.14

Market capitalization: $39.283 billion

Hilton holds 5,685 properties in its database, with 689 being directly managed by the company and 4,874 handled by franchises. The properties held by Hilton belong to the middle class to high-class category. Recently, the company released two new labels (LXR and Motto) to add to its already extensive collection of luxury hotels.

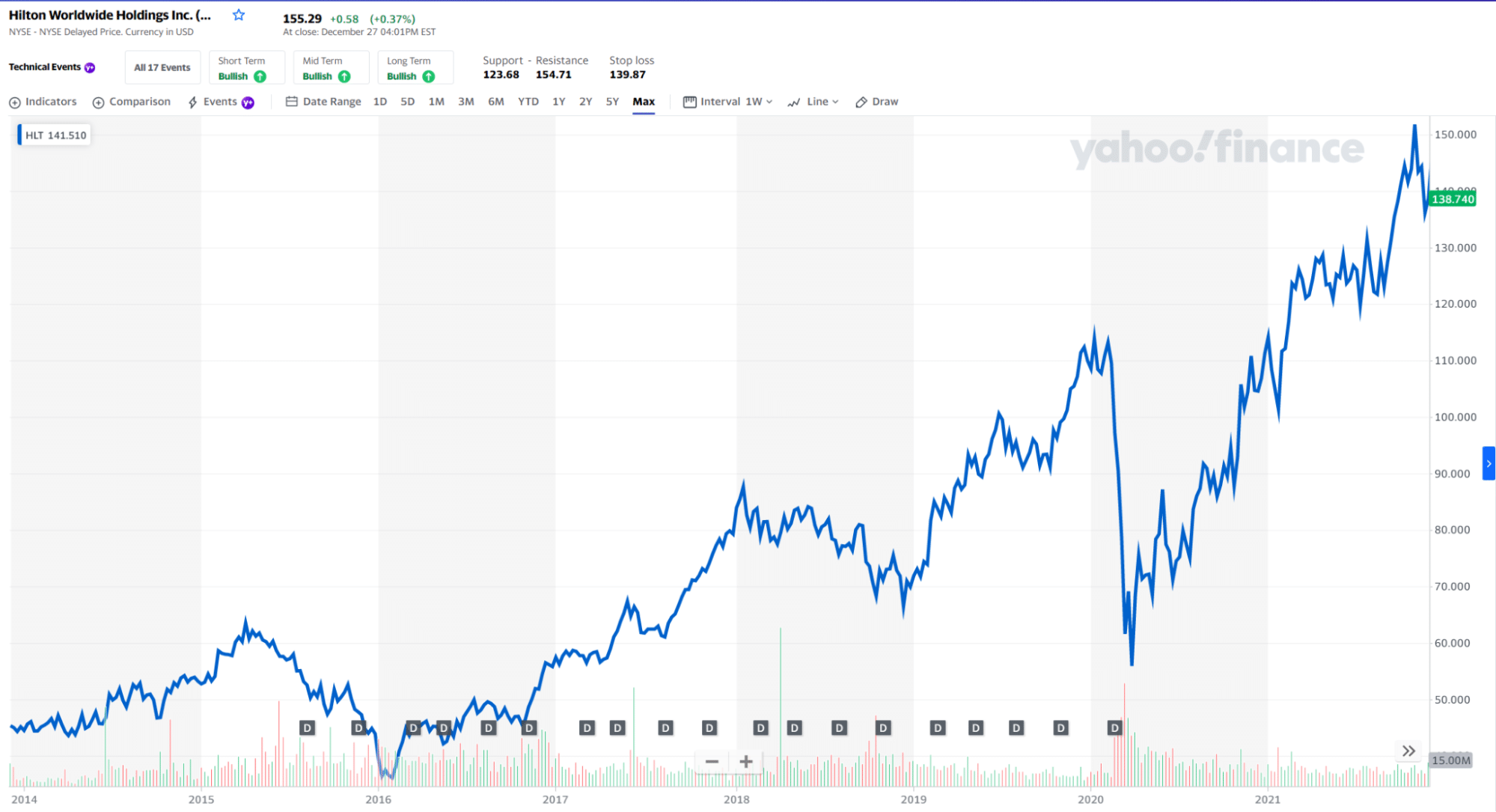

Hilton stock price chart 2014-2021

Hilton stock summary

Hilton is continually expanding its scope and operations to this day. By the end of 2018, Hilton had more than 2,400 projects in the development stage, with more than 50 percent situated outside of the US. These new projects allow Hilton to make a name in the industry and establish its presence in about 35 countries overseas.

Final thoughts

People do not always travel abroad, but when they go to other places, they need a place to stay. Most of the time, they stay in hotels, which tend to reside in the heart of business districts. As we enter a new era with less travel restrictions and quarantine protocols, the hotel industry might spring back to life again. We could see this growth in 2022 if the current trend continues.

Comments