Dealing in currency pairs can be lucrative, provided you know what you are doing. The Forex market often makes unpredictable movements and for a novice trader, it can be quite challenging to keep up with all the latest developments. Also, trading on your own requires a certain level of technical expertise. This is why many traders these days resort to Forex signals.

Top 5 Best Forex Signals

Let’s take a look at the top Forex signal providers in the market:

1. TechBerry

TechBerry caters to the needs of both professionals and novice traders by offering them to produce over 100% gains each year. The platform uses its AI-driven technology to create a highly profitable strategy implemented over subscribers’ funds. There are multiple plans available to choose from. There is also a free trial to test the social trading platform beforehand.

Advantages

- High monthly gains of 11.2%

- Trade monitoring

- Trading loss reimbursement

- Plan configurator to calculate your profits

- Service fee is as low as 15%

Disadvantages

- There is little information on the strategy

2. 1000pip Builder

Best for: Novice traders

Let’s look at the main features of this platform:

- Verified performance: You can check the live statistics for the signals on a verified Myfxbook account active since 2019. This account has a decent win rate of 56% and has generated a total profit of $2,635.84 to date.

- Every time zone: Here, you can get trading recommendations for the European, Asian, and US trading sessions. Thus, you can get robust signals regardless of your time zone. Even if you follow the signals for a few hours each day, there will be lucrative trades you can take advantage of.

- Advanced trading schemes: The trading schemes employed by this Forex signal provider include Trend Capture, Range Trap, and Momentum Rider.

- Different platforms: 1000pip Builder delivers signals via SMS, Telegram, and email. Signals come in the form of suggestions: take profit level, stop loss, and entry price. The signals are delivered 24 hours a day, 5 days a week.

- Educational content: In the blog section of the official website, you can find various articles related to Forex. Here, you can learn a lot about technical and fundamental analysis. 1000pip Builder also shares day trading tips, and all of these are quite beneficial for newcomers.

Advantages

- Verified trading statistics

- Suitable for newcomers

- Multiple advanced strategies

- Expert support

- Growing community of traders

Disadvantages

- High monthly fees

- Complex trading strategies

3. Learn2Trade

Best for: High-frequency traders

Here are the main features of this service:

- Special offer: By registering with one of the partner brokerages and making a minimum deposit, you can get lifetime access to VIP trading signals for free.

- Economic events notification: With Learn2Trade, you can closely follow the latest economic events impacting the price of currency pairs. This allows you to make more informed decisions with regard to trading.

- Wide range of pairs supported: This Forex signals service supports a wide range of currency pairs like AUDUSD, AUDNZD, AUDJPY, EURUSD, EURGBP, EURCHF, EURAUD, CADJPY, CADCHF, EURNZD, GBPUSD, GBPJPY, GBPAUD, GBPCHF, GBPCAD, USDCAD, USDCHF, etc.

- Detailed signals: With each signal generated by this platform, you get details like currency pair, the logic behind the signal, type of order, entrance fee, take profit, and stop loss.

- Free service available: By joining the free Telegram group, you can receive 3 signals each week without paying any fee. This allows you to try out the signals before subscribing to one of the plans.

Advantages

- Large collection of educational resources

- Free Telegram group

- 76% success rate

- Amount of risk per transaction specified

- Telegram and mobile alerts

Disadvantages

- No verified track record

- Expensive premium service

4. MQL5

Best for: Social traders

Here’s what you can expect from MQL5:

- Detailed statistics: For every independent Forex trading signals provider on this platform, you can see the percentage of risk, the initial deposit, profit, number of subscribers, account activity time, and current balance.

- Financial charts: On MQL5, you can find the growth charts for each signals provider’s performance over time. You will be able to compare the performance with the average performance of individuals on this platform.

- Risk analysis: For each provider, you can see the risk analytics. This includes drawdown, deposit loading, maximum loss, and maximum profit charts. You can also see the slippage statistics for MQL5 brokers.

- Social trading: MQL5 is one of the largest trading communities in the world. You will find traders providing trading recommendations here.

- Free demo account: Here, you can sign up for a free demo account that lets you test the signals using virtual money.

- MT4 integration: MQL5 has direct integrations with the MT4 and MT5 trading platforms.

Advantages

- Public information on each signal provider

- Transparent trading history

- Customer feedback of signal provider’s page

- Wide range of options for brokers

Disadvantages

- Not regulated

- Commission based on the subscription fee

5. Forex Signal Factory

Best for: Free signals

Let’s look at the main features available on this platform:

- Risk-averse operation: Forex Signal Factory avoids using martingale money management techniques. The provider’s performance is assessed in terms of total pip change as opposed to percentage or profit. The performance does not take into account the lot size of the trader.

- Broker-independent: This service does not have tie-ups with any broker. As such, you can keep your spreads intact. Unlike other free services, it does not require you to sign up with a particular broker in exchange for commissions.

- High-frequency of signals: This provider delivers 10-20 profitable Forex signals on a daily basis. In the positions, you can see the entry price, the optimal trading times, as well as the take profit and stop loss levels.

- Large global community: By signing up with this service, you can be a part of a global trading community with more than 45,000 members. You can also follow the Facebook and Twitter accounts of Forex Signal Factory to see the latest updates.

Advantages

- Free service with no hidden charges

- Possible to use your existing trading account

- Large trading community and social media presence

- Large number of signals daily

- No need to sign up with a partner broker

Disadvantages

- No verified track record

- Lack of vendor transparency

- Unregulated service

6. FXLeaders

Best for: Advanced trading tools

Here are the principal offerings of this service:

- Newsfeed: In the website’s newsfeed, you can access market analysis reports and news updates released by experts every day. These reports cover different trading sessions like the US, Europe, and Asia. In the economic calendar, you can see the analyses for vital financial developments and how they impact the price of currencies.

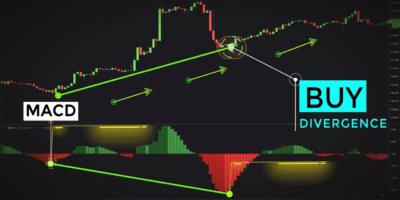

- Advanced tools: By clicking on a particular asset, you can access the technical charts. Here, you can draw comparisons between different assets and use multiple indicators like RSI, MACD, Bollinger Bands, EMA, Parabolic SAR, Stochastic, etc.

- Profit/loss report: For each pair, you get a detailed profit/loss report. By signing up for the premium service, you can see the historical reports for the signals as well. You have multiple options for filtering the reports. Premium members can export the reports to an excel file for additional analysis.

- Trading alerts: Premium users are notified of trades via email messages and mobile notifications. Apart from live signals, the platform also notifies you when the analysts notice a favorable trading setup.

Advantages

- Live newsfeed

- Signals generated by experienced professionals

- Advanced charting tools

- Profit/loss analysis

Disadvantages

- Some features only available for premium users

- No verified statistics

Our website does not give financial advice and this guide should be used for the sole aim of financial education. It is important to conduct your own research and analysis before making any decisions on your investments to avoid the risk of losing capital.

Table of Contents

What are Forex signals?

Forex signals are trade recommendations for a particular pair. Generally, they come with a specified time, price, and trade direction: Buy or Sell. The recommendations are either produced by seasoned analysts or an algorithmic trading system that is offered to someone who has subscribed to a signal service. The analyst might send the signals via different mediums like SMS, RSS, messengers, emails or specific online platforms. They are ideal for novice speculators and individuals whose tight schedule does not allow them to analyze the market.

Are FX signals a good choice for both beginners and experienced traders?

Newcomers typically are not familiar with the technical aspects of the Forex market. They don’t know how to interpret the price charts and forecast future price shifts. Successfully analyzing the price action is something that requires expertise. As such novice traders often take the help of trading signals that aid them with their decision-making.

Seasoned forex market participants might be accustomed to the various economic factors affecting the price of currency pairs, but they might not be able to invest enough time studying charts, due to their busy schedule. Even if they can invest enough time, they might want to receive the signals as confirmation of their analysis.

How do Forex signals work?

Signal providers can be broadly categorized into manual and automated. The former is provided by experienced analysts using fundamental analysis and technical indicators. They analyze historical price trends for a particular pair. Unlike automated services, they take into account the latest financial developments.

Automated signal providers are the result of analysts and traders collaborating with coders. The resulting systems seek out trading opportunities with the help of technical indicators. Since they work on the basis of algorithms, you don’t need to manually intervene in the trades. It is common for these systems to allow the customization of pairs and spreads.

Pros & cons of using FX signals

Not all individuals can dedicate the majority of their time to monitoring the charts 24/7. Trading signals can save a lot of time for such people. If you have signed up with a service that provides reliable suggestions, you can spend your time perfecting your trading scheme.

Since the signals tell you about the live price shifts, it reduces the risk. Since they are generated by seasoned professionals, there is a good chance that the suggestions are highly precise. For beginners, they can provide a deep insight into the market. By studying the signals, you can determine the factors based on which they are produced.

The main disadvantage of Forex signal services is the presence of numerous scam services. Since they are generated by a third person, there is always the risk of faulty analysis. For this reason, it is imperative to go through the trading history of the system and look at the performance statistics.

When you register with an automated signal service, the suggestions you get are not based on fundamental analysis. These systems might have technical faults that can affect performance.

How to choose the best Forex signals?

Since there are many dishonest vendors offering free but unreliable signals, you need to know what you are getting into. Every trader needs to consider certain factors based on which they can judge the reliability of the provider.

Past performance

Before subscribing to a signals service, you should go through their track record. Many vendors publish their past results on their websites, but these cannot be considered authentic. You should look for trading results authenticated by independent bodies. When there is a third-party moderator, the seller doesn’t have the chance to manipulate the results.

Success rate

It is a wrong notion that win rate is the most vital parameter for a reliable signals provider. Many dishonest service providers claim above 80% profitability to lure in novice traders. Usually, such trading schemes involve a high level of risk and they can lead to disastrous consequences for the trader. What you should really look for is the risk/reward ratio.

Signals per day/week/month

Each individual has their own trading technique, and not all of them may be comfortable with high-frequency trading. This is why it is imperative to determine how many signals the service generates daily, weekly, and monthly.

Signal delivery

The mode of signal delivery is another factor you need to take into account. Most providers these days send signals through mobile apps, Telegram, and SMS. However, some are strictly web-based. You should choose one based on the platform you are most comfortable with.

Customer reviews

It is prudent to consult the customer reviews on third-party websites. A vendor can make unrealistic promises and even the trading statistics might be manipulated. However, when you study the user reviews, you get a clear idea of what real customers face while using the service.

Currency pairs traded

No service will provide you with signals for all pairs. If you wish to deal in an exotic pair, for example, you must make sure the system supports it. You can generally find this data on the official website.

Price

With the majority of services, you need to pay a fixed amount each month. The best Forex signals providers charge around $75-$150 monthly. You shouldn’t blindly trust those that demand exorbitant fees while promising an unrealistic win rate.

Free trial

Beginners must always go for a service that offers a free trial. This allows you to assess the system’s performance without incurring monthly fees. At the end of the trial period, you can judge whether or not the service will be suitable for you.

Money-back guarantee

Reliable vendors are always ready to stand behind their promises. As such, best trading signal providers have refund policies in place that allow you to get your subscription amount back in case the signals turn out to be unprofitable. You should be wary of services that do not offer a money-back guarantee as they might be scams.

What data do Forex signals provide?

They hold vital data like the pair to be traded, the type of order, the entry price, the stop loss, and the take profit. By studying them, you know whether to place a buy or sell trade for the particular pair and as well as the point of entry. Stop-loss is the point where you buy or sell the asset once it reaches a particular price. Take profit defines the point at which to close the position in profit.

Why is a monthly subscription better than a one-time fee?

When you pay a monthly subscription fee, the signal provider is motivated to maintain the quality of the signals. They know that if the quality drops, the clients might cancel the subscription at any time. On the other hand, a one-time fee frees them from the obligation to provide high-quality trading suggestions at all times, since they have already received the money from the user.

How to start trading with Forex signals?

Remember, signals can be short-term or long-term. For day traders, it makes more sense to invest in short-term signals, while long-term signals are used for many days. The suggestions are usually time-sensitive, so you should use the signals soon after receiving them. If you have signed up with an automated service, you should first use a demo account to test the performance before investing real money.

Is it safe to trade with Forex signals?

Yes, they are entirely safe. However, a handful of scam companies might promise unrealistically high win rates and deliver signals that are not based on any reliable research. You are more likely to get poor outcomes when you register for a free service.

Conclusion

After going through this article, you can hopefully find the best Forex trading platform for live signals. You should always do additional research at your end and go through customer reviews to find out what real users are saying about the services.

Every signal provider has its advantages and disadvantages. Ultimately, your decision should be based on what you want from the service as well as your long-term or short-term profit objectives. It is important to choose a service that compliments your trading style. With a trustworthy provider, you can drastically improve your trading experience.

Comments