Crypto trading is the process of speculating on the price movement of cryptocurrency. By speculation, we mean predicting whether the price will go up or down in the future and then trading the market based on that prediction. If you think the price of a crypto asset will go up in the near term, you will buy the asset now and then sell it later when the price has appreciated.

There are three ways to do speculative trading in crypto. Your options are the following:

- Contract for difference (CFD)

- Crypto exchange

- Crypto wallet

In this article, you will learn how to trade crypto using a crypto wallet. This is the easiest way to trade altcoins out of the three options. We will guide you on how to do this, so keep reading.

A simple way to trade crypto

Let’s learn the steps you should take to trade crypto through a crypto wallet.

1. Create an account in a digital wallet

Use any digital wallet of your choice. It is often straightforward to open an account in a crypto wallet. You can do this using a web-based browser or even a mobile app. Then you must submit documents for identity verification. Once your account is verified, you are ready for the next step.

2. Fund your account

After account signup and verification, you must fund your account to start buying coins. Your funding options may include a debit card, online bank transfer, online wallets, etc. Typically, cashing in does not involve costs. What is reflected in your account is the actual money in your local currency that you top up to your account.

3. Know what coins are available

Now you have funds to buy coins. Do not be too excited, though. Before you do that, make sure you know your options. Check out what crypto assets are available for purchase in your wallet. The most common options are:

- Bitcoin

- Ethereum

- Bitcoin cash

- Cardano

- Ripple

Crypto wallets differ in their offerings. Some offer Litecoin, Dogecoin, and others. You can expect wallets to provide the most famous names in crypto. You can easily find this information in your wallet.

4. Analyze the market

Once you know the coin offerings, you must analyze each market to determine which ones hold promise in the near and long term. You can use either technical or fundamental analysis or even both. Technical analysis focuses on price history and price action.

It is a known fact that crypto revisits the highest price it has reached after a while. For fundamental analysis, determine which metrics affect the price of crypto and do your due diligence. The standard metrics are project, financial, and blockchain.

5. Start buying coins

Now you can start buying coins, whichever ones look promising based on your market analysis. If you want, you can allocate the same percentage to each coin available in your wallet. Alternatively, you can buy more crypto on the crypto assets that you believe have tremendous potential.

Buying multiple coins instead of one is a sound trading idea. Diversification is critical in every type of investment. Not every crypto may perform, but one or two crypto assets might be able to bring in profits now and then.

The price of coins is also worth attention. You may get higher prices than actual market prices in exchanges when you buy coins in a crypto wallet. This is the downside of this trading method, but this is how crypto wallets do business. Just be aware of this fact.

6. Monitor your trades

You must monitor your trades to check how each one performs and if you are ready to take profits. You can easily track the performance of your trades using the mobile app of your wallet. Just knowing that one trade is profitable and has generated profits is not enough. You might think the gain is already sizable because you have significant capital. This is not the right way to judge the profitability of trades.

The right way to monitor trades is to look at your entry price. Note down your entry price for each coin you buy. Then decide at what price you are going to close the trade based on your technical analysis. Sometimes the amount of profit is misleading.

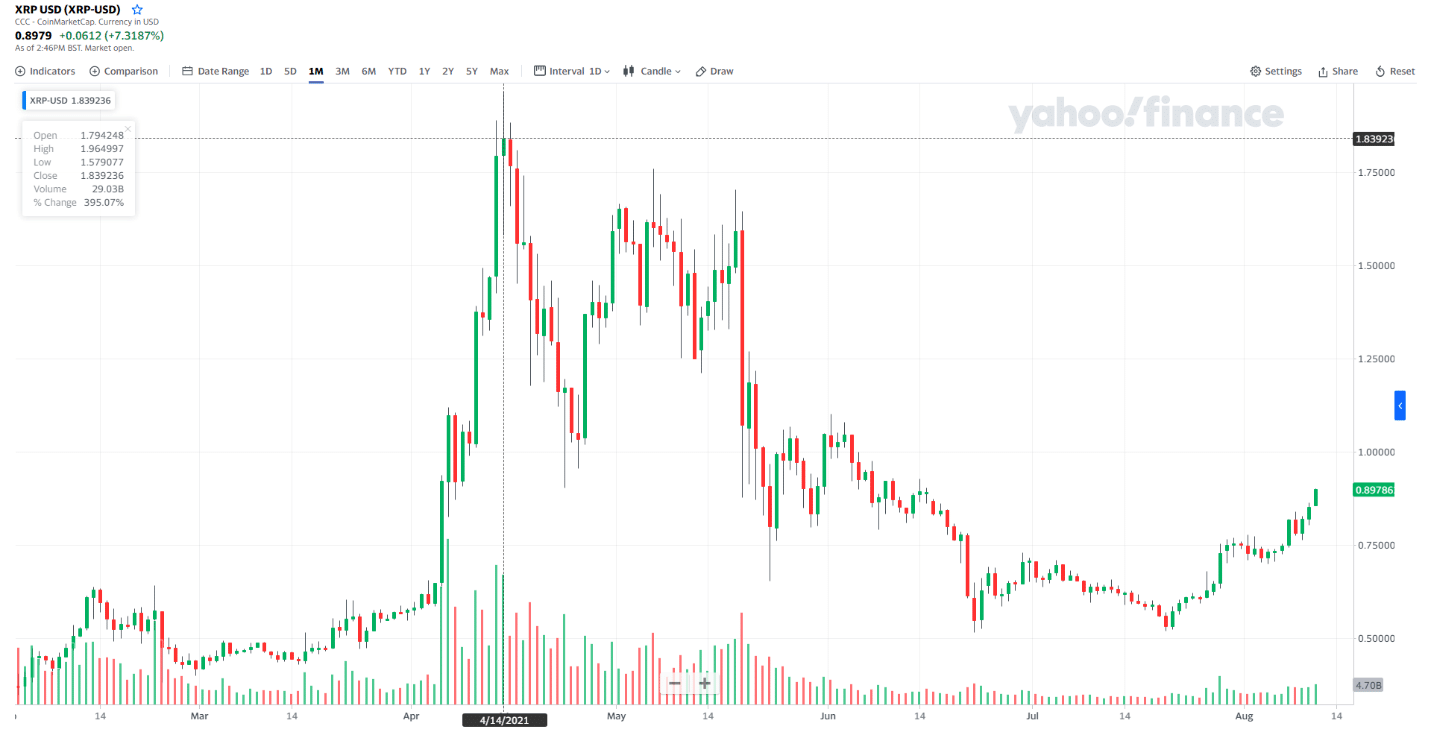

XRP/USD

Let us consider an example to compute potential profit. Let us take the Ripple coin. On 11 August 2021, the price of Ripple was $0.88. If you have a capital of $1,000, you could buy 1,136 coins. The most recent highest high of Ripple is $1.96. This happened on 14 April 2021.

Refer to the above daily chart of Ripple. If that is your target closing price, how much would you earn when XRP hits that price again?

To get the new amount of your coins in dollars, multiply the number of coins with the new price. Then you will get approximately $2,226 (1,136 x $1.96). This means you realize a profit of $1,226. What do you do then?

7. Withdraw profit

Since you are not investing, you should close your profitable trades and withdraw profit regularly. Let us continue our discussion from the above example. When you realize some profits from a trade, you can do any of the following:

- Withdraw everything, including your profit and capital, and start all over again.

- Withdraw all your profit and keep your initial capital. So you withdraw $1,226 and save $1,000 worth of Ripple coins. Here the number of your coins will not be 1,136, but only 510 ($1,000 ÷ $1.96) because of your withdrawal. If the price of Ripple continues to go up, you can make profits along the way.

- Withdraw half of your profit to enjoy the result of your effort. Then you keep half of the profit so that your capital is more extensive than when you started. By doing this, when you withdraw half of your profit in the future, the profit amount is greater than the previous withdrawal amount because your capital is continually growing. This is what we call compounding.

When you withdraw your profits, take note that you might incur a withdrawal fee. Try to understand what percentage is being deducted from the withdrawal amount. If that is huge, consider using another wallet with a lower percentage fee.

Risks of crypto trading

There are at least two risks involved when you trade crypto through a digital wallet. These risks are the following:

- Higher buy price than actual market price

- Price goes down after entry

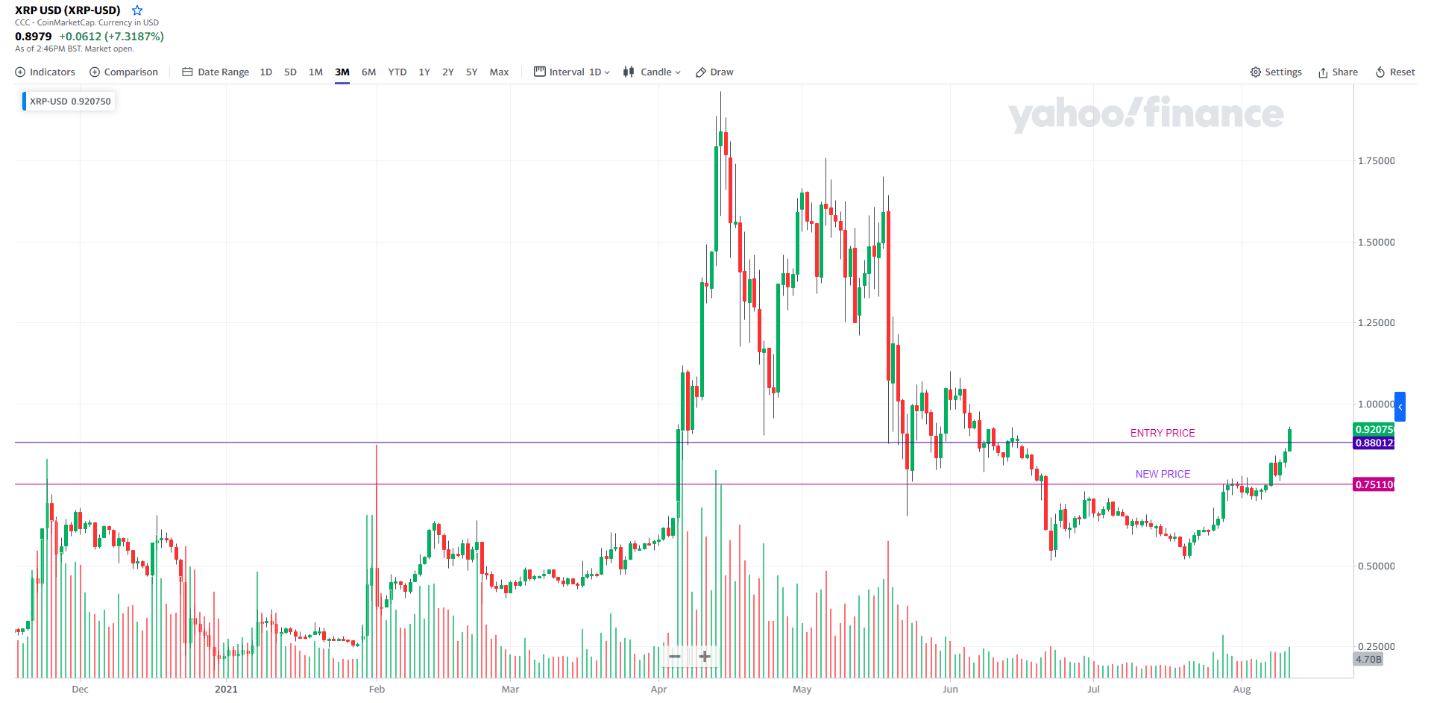

XRP/USD

We only covered the first risk in the previous section. The second risk is widespread. The price may go down right after you buy a coin.

For example, say you buy Ripple at the current market price of $0.88, but it went down to, say, $0.75. Refer to the above chart. When this happens, the value of your crypto investment goes down. You have not lost money yet so long as you do not close the trade. Keep in mind that as long as the price of Ripple does not go down to zero, your investment is acceptable.

The only thing to do is wait until the coin recovers and its price increases and breaks above your entry-level. Alternatively, you can top up money to your account to buy more Ripple coins at the new lower price — another sound trading method. You are bound to make a lot of money soon when the price begins to rally.

Final thoughts

If you have been using crypto to conduct online transactions, you can start trading crypto in no time. If you are new to crypto trading, following the above steps will get you in the right direction. With this method, you can participate in crypto trading on the side even if you have a day job or doing something else.

Comments