Wood and lumber ETFs are funds that investors can invest in to get exposure to the wood and lumber industry. Be aware that no specific ETF is dedicated to tracking the value of this commodity. As a commodity, lumber is not liquid. To have a functional ETF, a market must be liquid and have a significant trading volume.

What are wood and lumber ETFs?

The liquidity issue is one of the reasons cited for the supply and demand imbalance, leading to the appreciation of the price of lumber. Other reasons presented are labor shortage, low inventory, and trucking hiccups. There are few ETFs in the US markets providing indirect exposure to this sector, and these stocks normally operate in home furnishing, homebuilding, and forestry industries.

Best wood and lumber ETFs to watch right now

Lumber has become one of the hottest commodities in America lately, primarily due to the rising lumber prices in the market. This surge in price is attributed to many factors, such as people moving out of urban areas to settle in the suburbs, low mortgage rates, and the home renovation frenzy. Below are three wood and lumber ETFs that have been at the forefront of the massive growth of this sector.

№ 1. iShares Global Timber & Forestry ETF (WOOD)

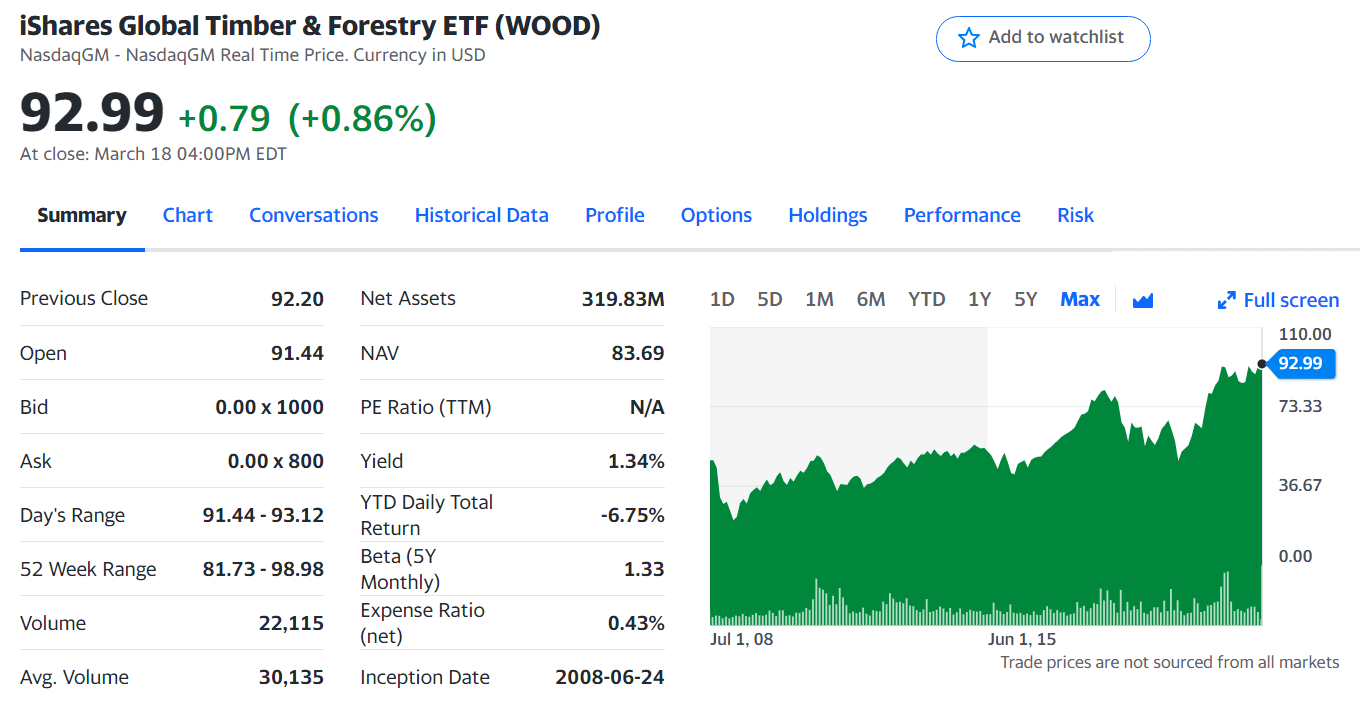

WOOD ETF summary

The WOOD ETF desires to mimic the results, in terms of performance and price, of the S&P Global Timber & Forestry Index. This benchmark index consists of about 25 large stocks involved in producing paper and agricultural, forestry, and packaging products.

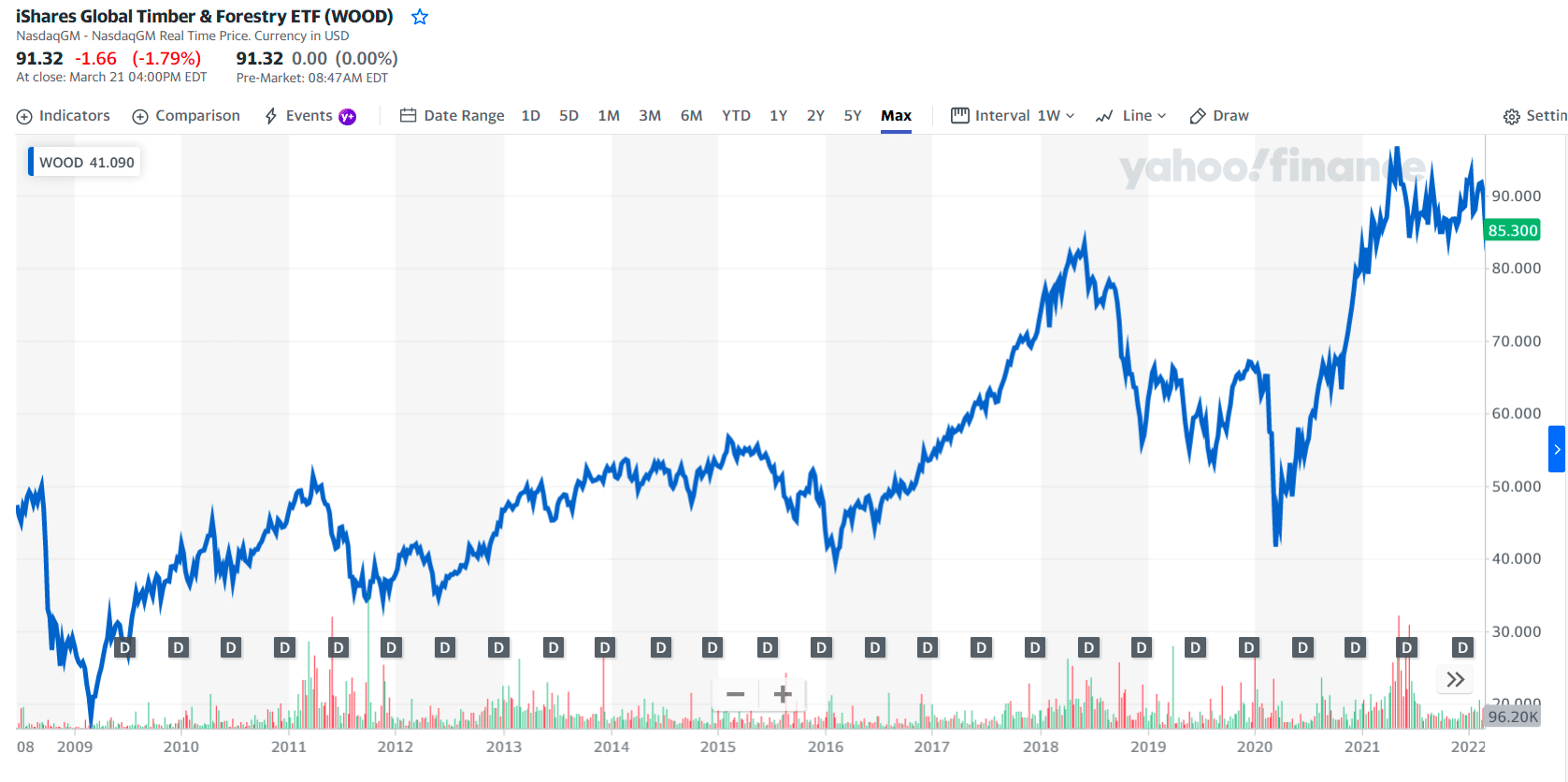

WOOD price chart

The top three holdings of WOOD ETF are:

- West Fraser Timber Co. Ltd. (WFG) – 10.09%

- Weyerhaeuser Co. (WY) – 8.71%

- Rayonier Inc. (RYN) – 8.57%

Established on 24 June 2008, the WOOD ETF has been trading for 14 years. There were only three years when the ETF failed to deliver profits (i.e., 2011, 2015, and 2018). It managed to generate profits in the past three years, though. While the YTD return is negative at -6.75%, the one-year return is positive at 3.73%, and the three-year return is at 11.81%. Despite experiencing losses, the fund has continued to give dividends to its investors each year since its inception.

From the opening price of $49.15, WOOD is now hovering at $92.99, which represents an 89% gain in value. Looking at the monthly chart, you can see that the fund is highly bullish, so it might be a good time to buy this ETF. Right now, the fund gives investors a 1.34% dividend yield, which is equal to $134 for each $10,000 invested. With a low expense ratio of 0.43%, this fund looks like a good buy for investors.

№ 2. Invesco MSCI Global Timber ETF (CUT)

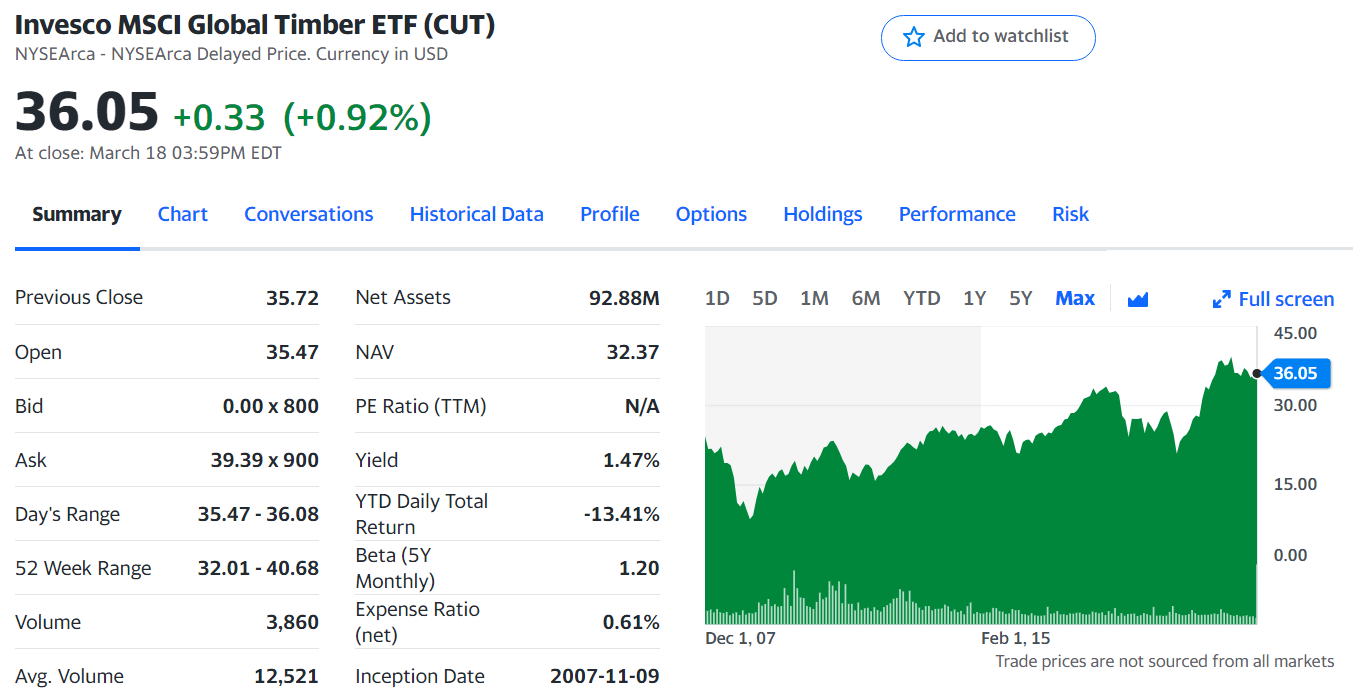

CUT ETF summary

The CUT ETF aims to follow the price and performance of the MSCI ACWI IMI Timber Select Capped Index. At least 90 percent of the fund’s assets is allocated to investing in the holdings making up the index. Part of the investment fund is dedicated to global and American depositary receipts that embody instruments in this index.

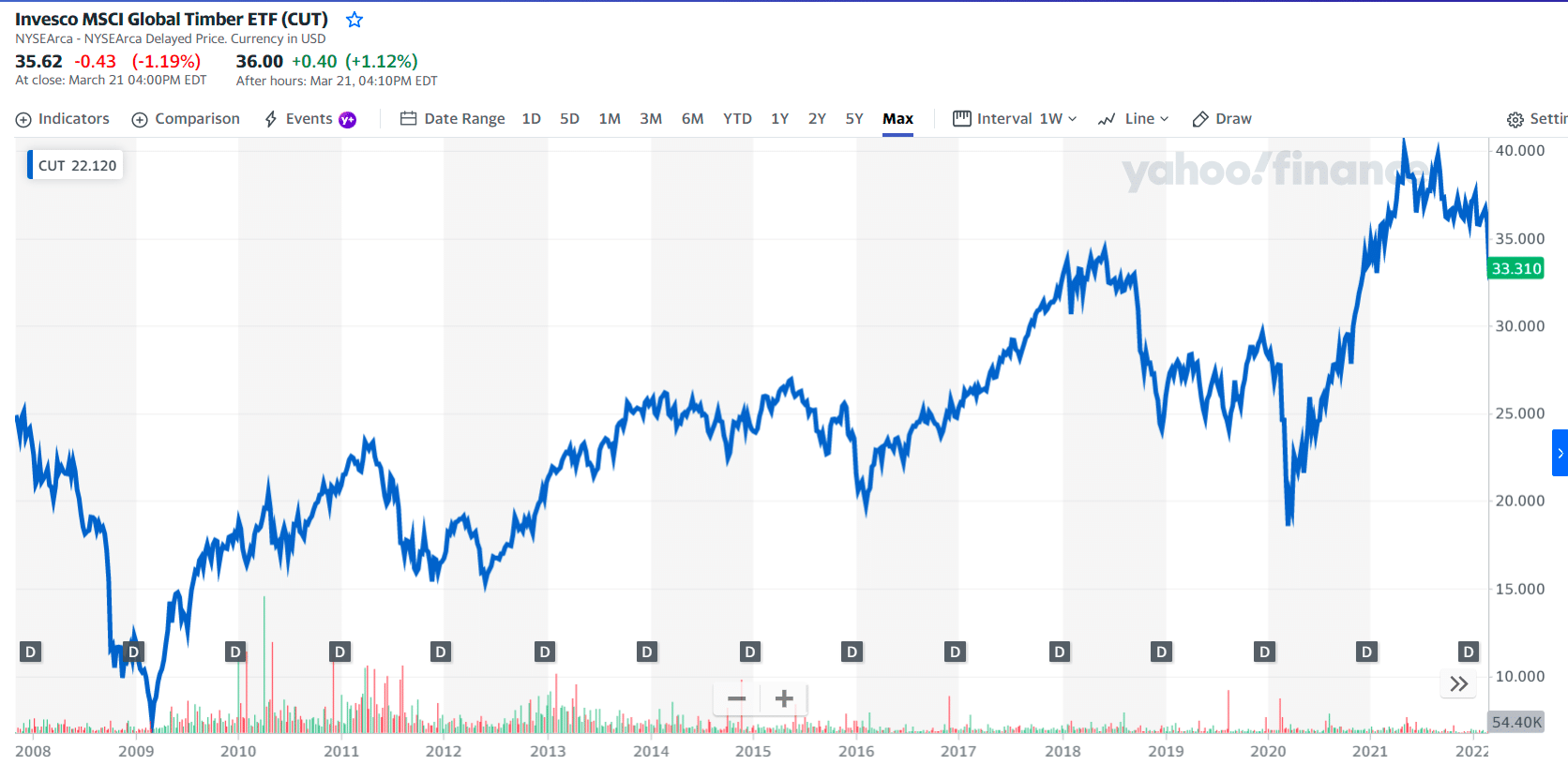

CUT price chart

The top three holdings of CUT ETF are:

- International Paper Co. (IP) – 5%

- UPM-Kymmene Oyj (UPM) – 5%

- Avery Dennison Corp. (AVY) – 4.98%

Launched on 9 November 2007, the CUT ETF has been around for 15 years. The ETF suffered heavy losses in three years only (i.e., 2008, 2011, and 2018). Although its three-year return is positive at 8.01%, its one-year return is negative at -8.93%, and its YTD return is at -13.41%. While the ETF encountered losses as of the time of this writing, it could make a recovery as it heads toward the closure of 2022.

Despite the occurrence of losses, the fund made sure to give dividends to investors year after year. From the opening price of $25.2 in its exchange debut, the ETF generated a capital gain of 43% based on the latest price of $36.05. Overall, as you can see in the monthly chart, the long-term trend is very bullish, which may give investors confidence to hold on to their shares despite the temporary setbacks.

№ 3. SPDR S&P Homebuilders ETF (XHB)

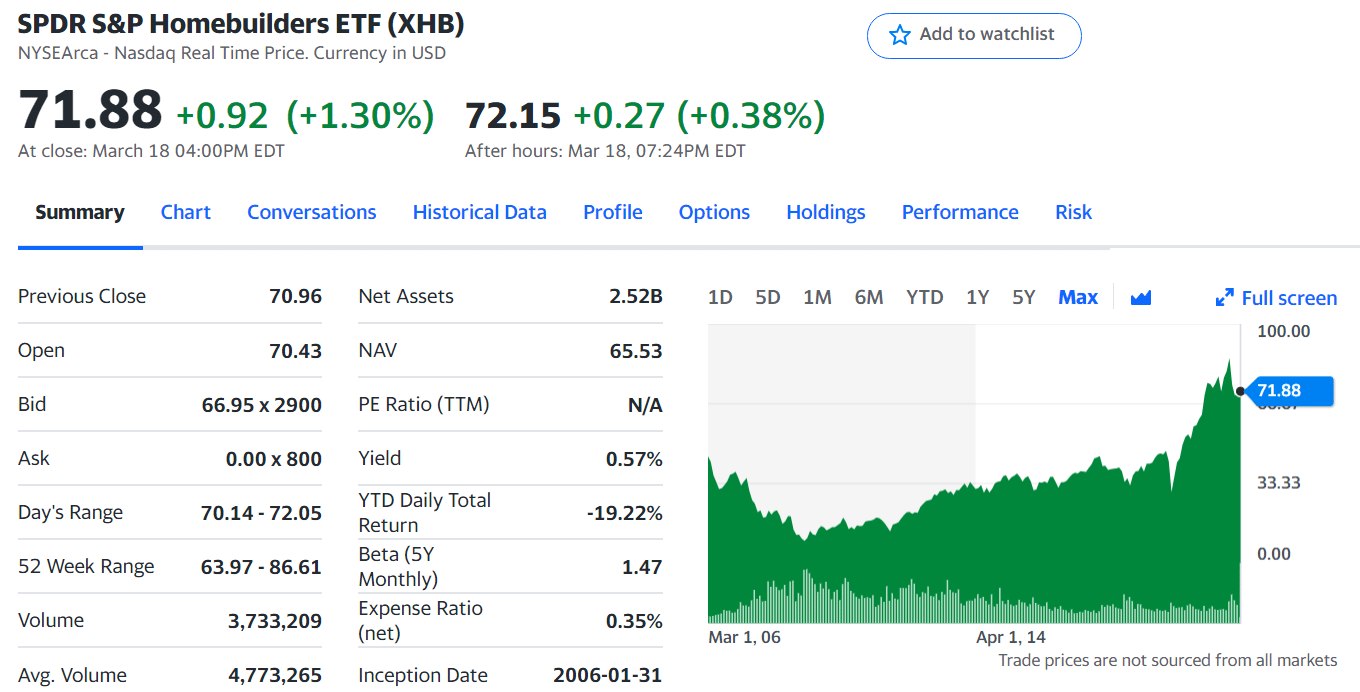

XHB ETF summary

The XHB ETF attempts to mimic the results of an index developed from the homebuilding sector of a market composite index in the US. This is the S&P Homebuilders Select Industry Index. This is done through the use of a passive approach to fund management.

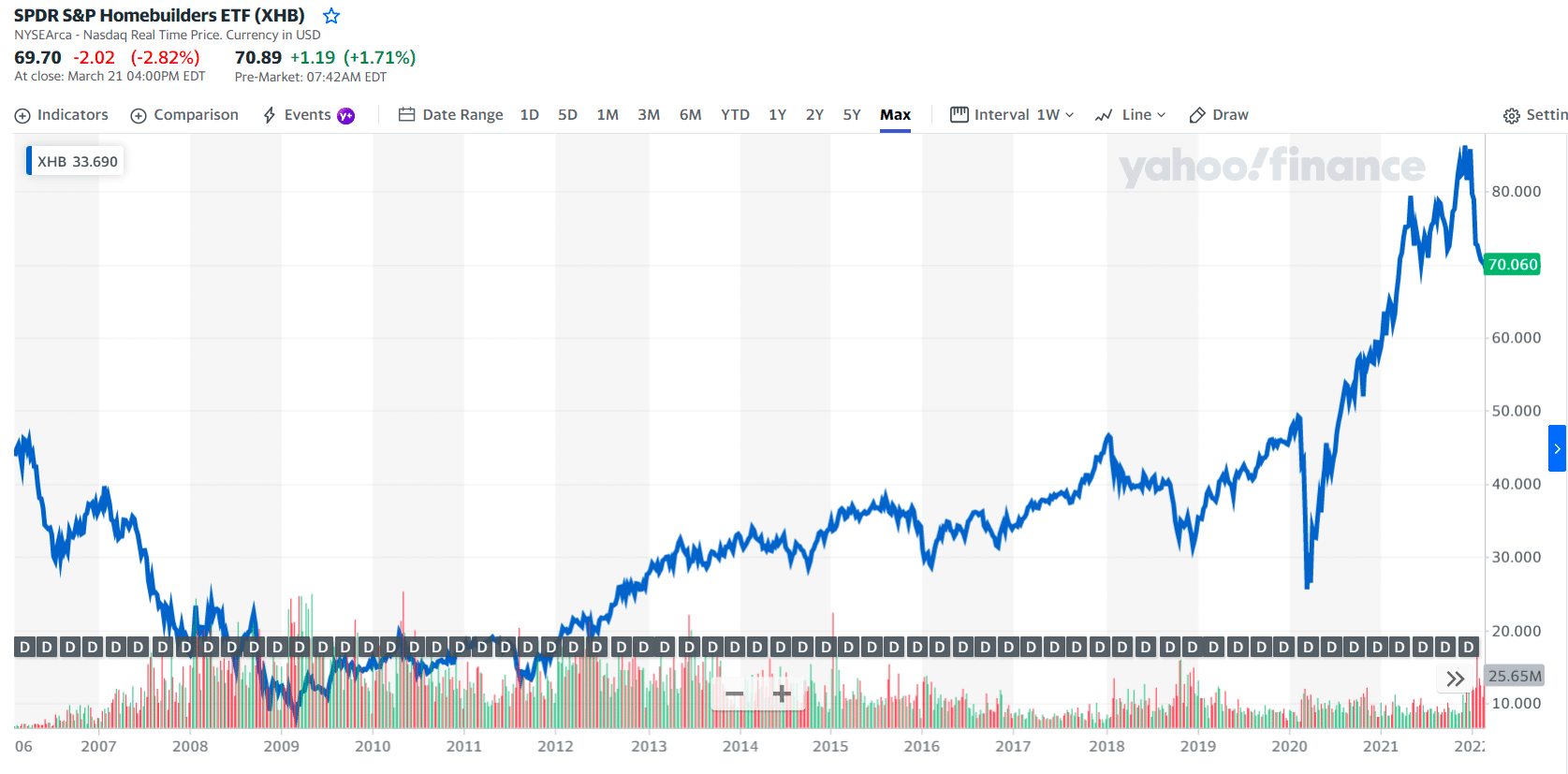

XHB price chart

The top three holdings of XHB ETF are:

- Floor & Decor Holdings Inc. (FND) – 3.82%

- Lennar Corp. (LEN) – 3.79%

- NVR Inc. (NVR) – 3.77%

Established on 31 January 2006, XHB ETF boasts a 22.27% three-year return and a 14.43% one-year return, though its YTD is currently negative at -19.22%. Although the fund is profitable overall, it encountered some losing years in its 16 years. This happened in 2007, 2008, and 2018.

Considering its current price, from the debut price of $45.81, the ETF is still up by 57%. Despite the losing years, the fund did not fail to pay its investors dividends every year. At present, XHB pays a 0.57% dividend yield, equal to $57 for each $10,000 invested.

Final thoughts

Lumber became a massive hit recently as it made an all-time high of $1,500 by April 2021 and is sitting at $980 per thousand board feet in January 2022. This peak increased about 478% from the price of $260 when the pandemic broke out more than 18 months ago. Today, lumber is available at a discount with the prevailing price.

If you have meant to invest in this commodity through an ETF, this could be the best time to get on board. You can start your analysis with the three assets presented above. While dividend yield often changes due to a company’s profitability, the expense ratio is relatively more stable. This is one thing to consider when you ultimately decide to buy an ETF in this sector.

Comments