In a move that seemed hard to imagine last year, widespread crypto market crashes have seen the price of Bitcoin tumble under $27,000, with another significant altcoin, Luna, being wiped out completely.

The collapse has pushed BTC/USD more than 55% adrift from its all-time high, which was recorded as recently as November 2021. But what does this recent collapse mean for investors? And could a recovery be expected?

Will the crypto recover?

The news about the crypto crash has raised questions about whether the market has reached an expected cooling-off period – previously dubbed a “crypto winter.”

The market is caught in the broader adversity of investment markets battling to decide where comfortable levels are in the wake of interest rate hikes designed to quell soaring inflation around the Western world.

One factor that could provide hope to crypto investors is that big players are starting to join the party.

On Wall Street, JPMorgan Chase, Morgan Stanley, and Goldman Sachs are among the firms that have dedicated crypto teams.

The future is unclear: both a brief winter break or an epoch-ending ice age seem possible.

Top 5 coins predictions after crypto crash

Several investors are cutting their losses and moving out of the crypto space, while some are weighing whether it is an excellent time to enter the space. Read on to find out what you should do.

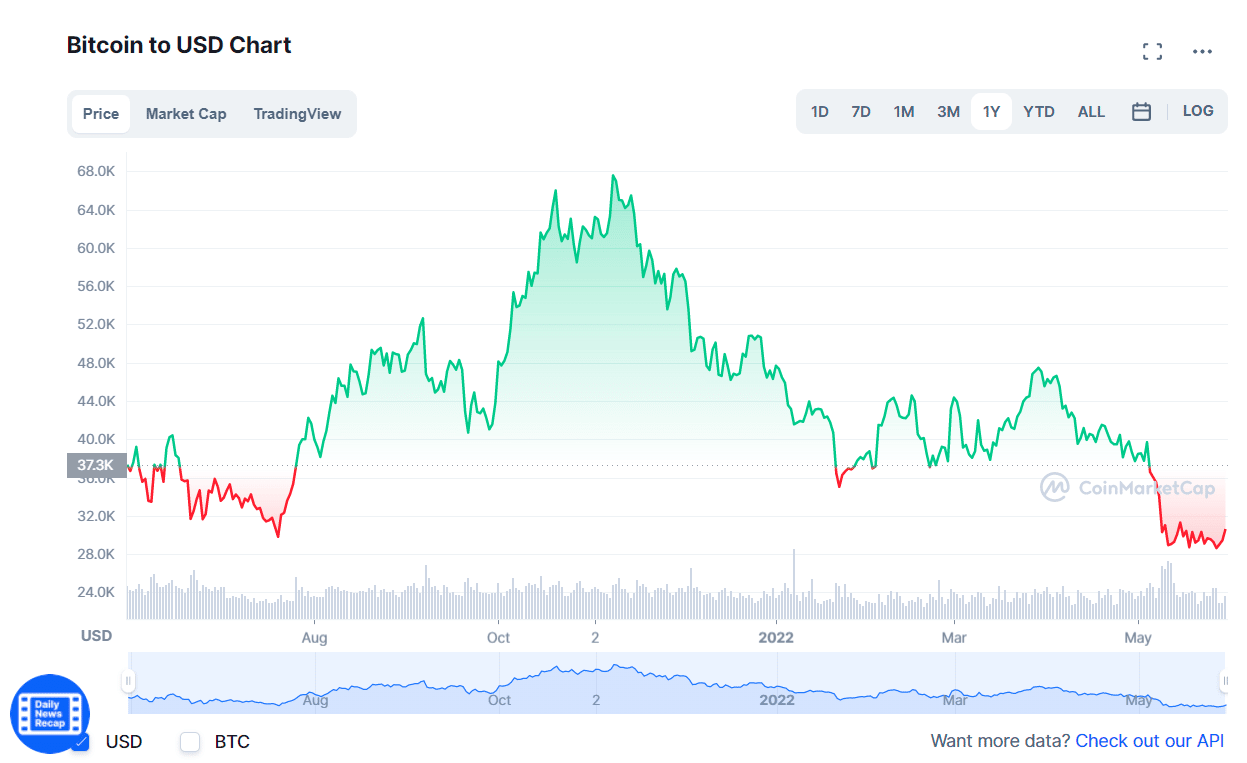

Bitcoin (BTC)

As the crypto that started when it launched in 2009, Bitcoin’s first-mover advantage has given it scale, mainstream acceptance, and brand recognition. These characteristics could help it hold its value during this challenging market and bounce back more vital than ever.

BTC price chart

BTC features

Bitcoin has fallen behind newer cryptos in technical capabilities like transaction speed and support for decentralized applications, which offer services on the blockchain. But its strong brand allows it to dominate the industry. With almost $700 billion, BTC represents more than 41% of the entire crypto market.

Bitcoin’s network effects, immutability, censorship resistance, capped supply, and decentralization make it unique and set it apart as a unique asset class.

BTC price prediction 2025

It has vast potential, with specific collaborations and innovations that may increase the number of users. If the market concentrates on investing in this crypto, the price might rise much higher. By 2025, it can reach a maximum value of $128,034.74. It is expected that it will turn around a little bit if the market goes down. The year 2025 can end with an average price of $108,154.95 with a minimum price of $104,468.69 and the maximum price of $128,034.74.

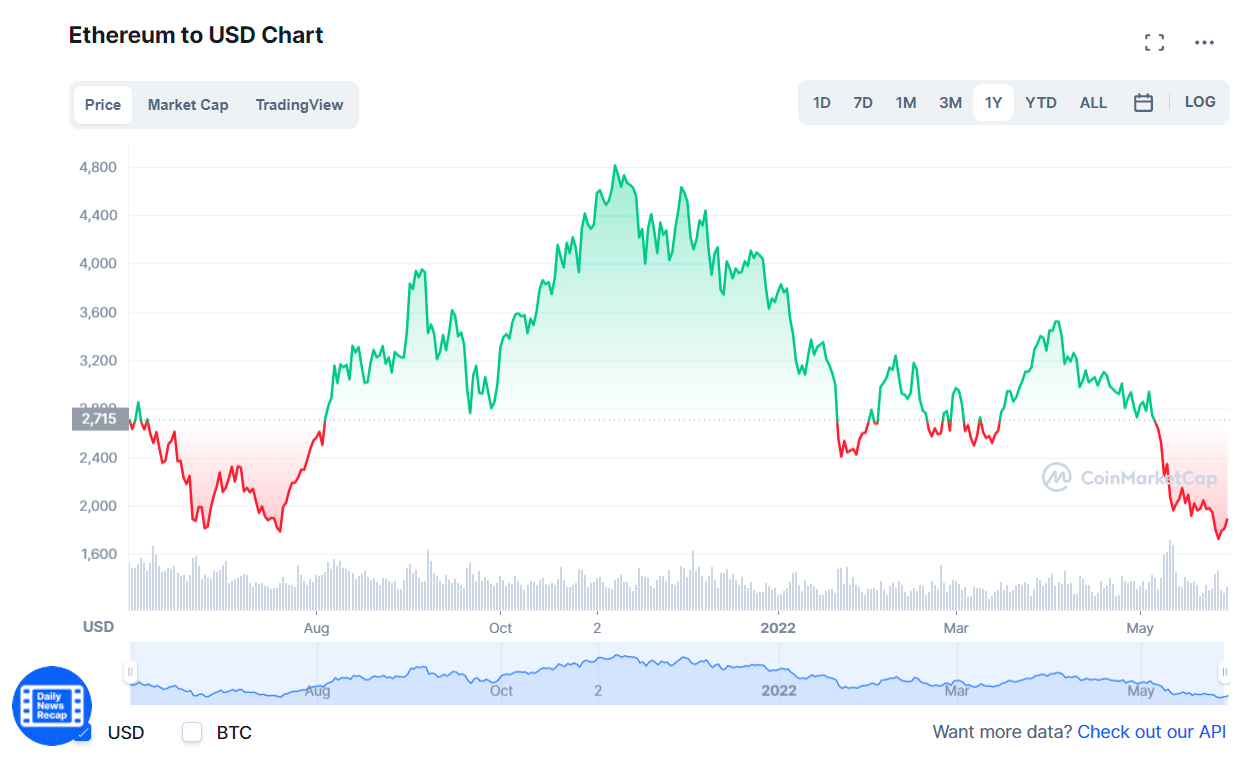

Ethereum (ETH)

Ethereum, the second-largest crypto by market capitalization of $229 447 228 036, saw a substantial drop. However, Ethereum’s world of decentralized applications or dApps is fast gaining traction and is responsible for a slew of tokens, such as Populous, built on its platform.

ETH price chart

ETH features

A smart contract is a simple computer program that facilitates the exchange of any valuable asset between two parties. This is the digital token of the Ethereum blockchain. Ethereum allows the development and deployment of smart contracts.

ETH price prediction 2025

By 2025, ETH prices will have reached a level similar to their previous all-time high. If everything goes smoothly, we predict the maximum price could be up to $9,323.86 in 2025. We may also expect an average price of $7,772.33.

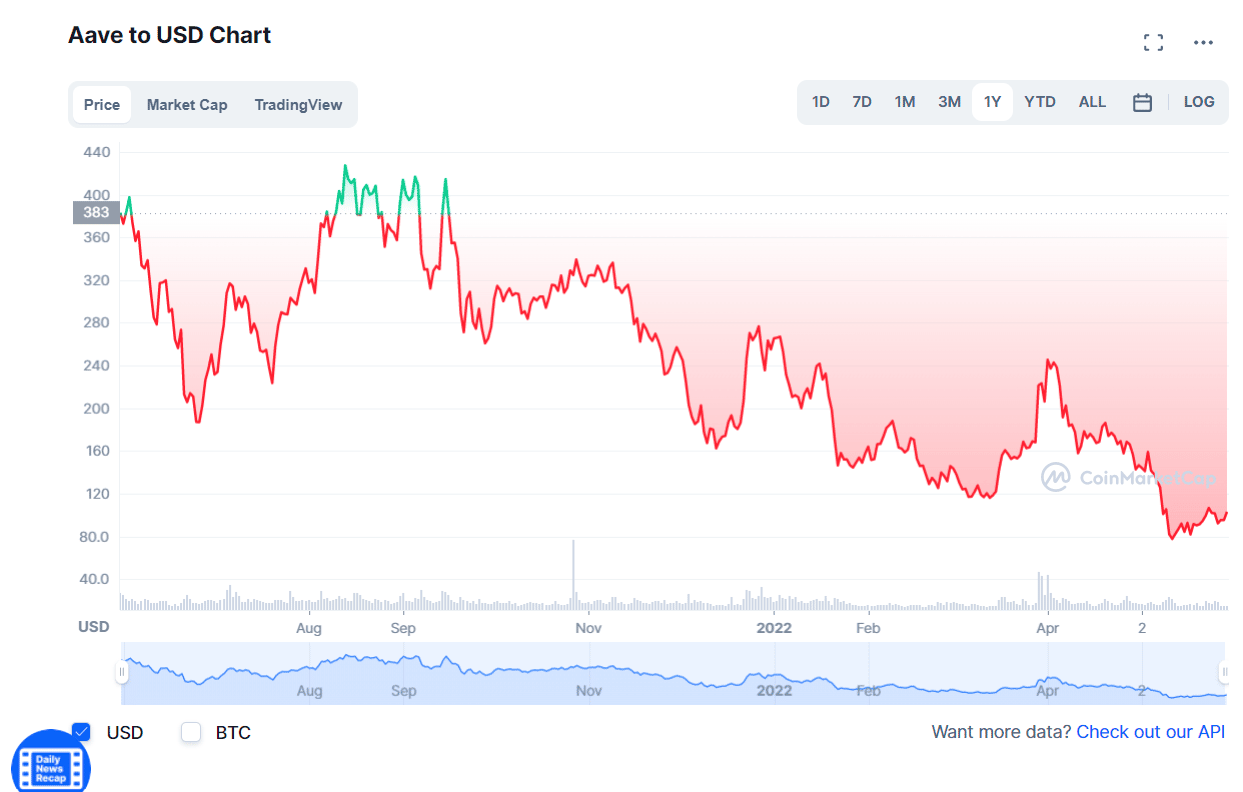

Aave (AAVE)

It is currently ranked as the 42nd biggest crypto asset in market capitalization. With a market cap of $1.9 billion, Aave is down 79% from its all-time high reached in May last year. But the asset’s dirt-cheap valuation and innovative fintech use case give it impressive long-term potential.

Aave fits into a class of cryptos known as DeFi, which aims to replace traditional financial services like banks with blockchain-based equivalents to give investors more options and control over their wealth.

AAVE price chart

AAVE features

Aave is a decentralized lending protocol that lets users lend or borrow crypto without going to a centralized intermediary. Users deposit digital assets into “liquidity pools,” which become funds that the protocol can lend out.

Aave loans are collateralized at 100%, which means their primary purpose is to allow the borrower to “cash out” of their crypto holdings without selling. This service could benefit investors who need liquidity but still want to benefit from their asset’s long-term appreciation. Aave’s appeal will naturally improve in a crypto bull market, making it an excellent way for investors to bet on a recovery in the industry.

AAVE price prediction 2025

We will be seen this crypto as a better option, and with the vast community, its price will touch new highs. The price fluctuations are hard to predict, especially if the market is more bullish or bearish. This crypto average price forecast at the end of 2025 can be around $375.84, and the maximum price can get $425.52. A vast price turnover is expected within the range defined by the crypto market.

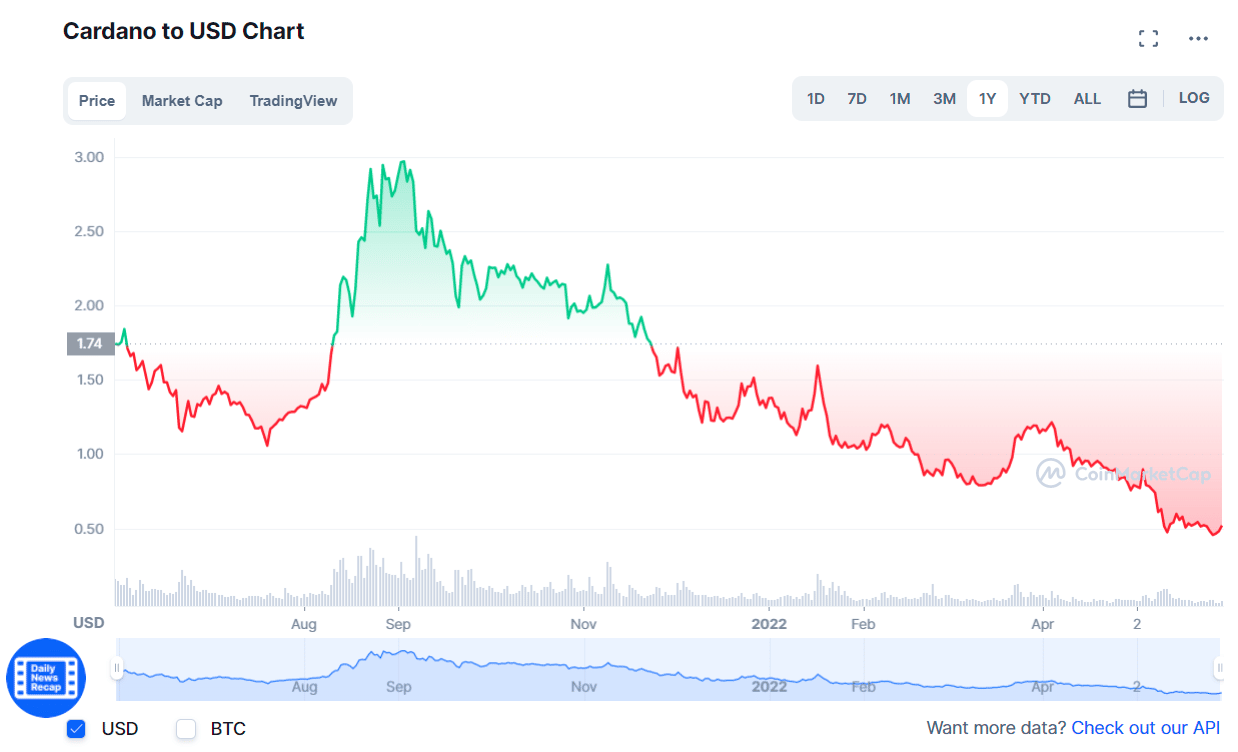

Cardano (ADA)

It is currently ranked as the 8th biggest crypto asset in market capitalization. Cardano is research-based crypto built by engineers, mathematicians, and cryptography experts. It is open-sourced and decentralized, with consensus achieved using proof-of-stake. It can also facilitate peer-to-peer transactions with the ADA token. Cardano is one of the cryptos recovering from a crash in 2022.

ADA price chart

ADA features

Features of ADA include strong typing, modular programming mechanisms, run-time checking, parallel processing (tasks, synchronous message passing, protected objects, and nondeterministic select statements), exception handling, and generics.

ADA price prediction 2025

This crypto will be seen as a better option, and with the vast community, Cardano price will touch new highs. The price fluctuations are hard to predict, especially if the market is more bullish or bearish. For the year 2025, its price will be almost $2.08. The maximum price can get $2.48, and the average forecast can be around $2.14. A vast price turnover is expected within the range defined by the crypto market.

Polygon (MATIC)

It is currently ranked as the 17th biggest crypto asset in market capitalization.

This platform looks to address many ETH blockchain issues while still providing DeFi solutions. Namely, the platform looks to create “Ethereum’s internet of blockchains” by connecting ETH-compatible blockchain networks and aggregating scalable solutions on Ethereum. It is also one of the cryptos that are recovering from a crash.

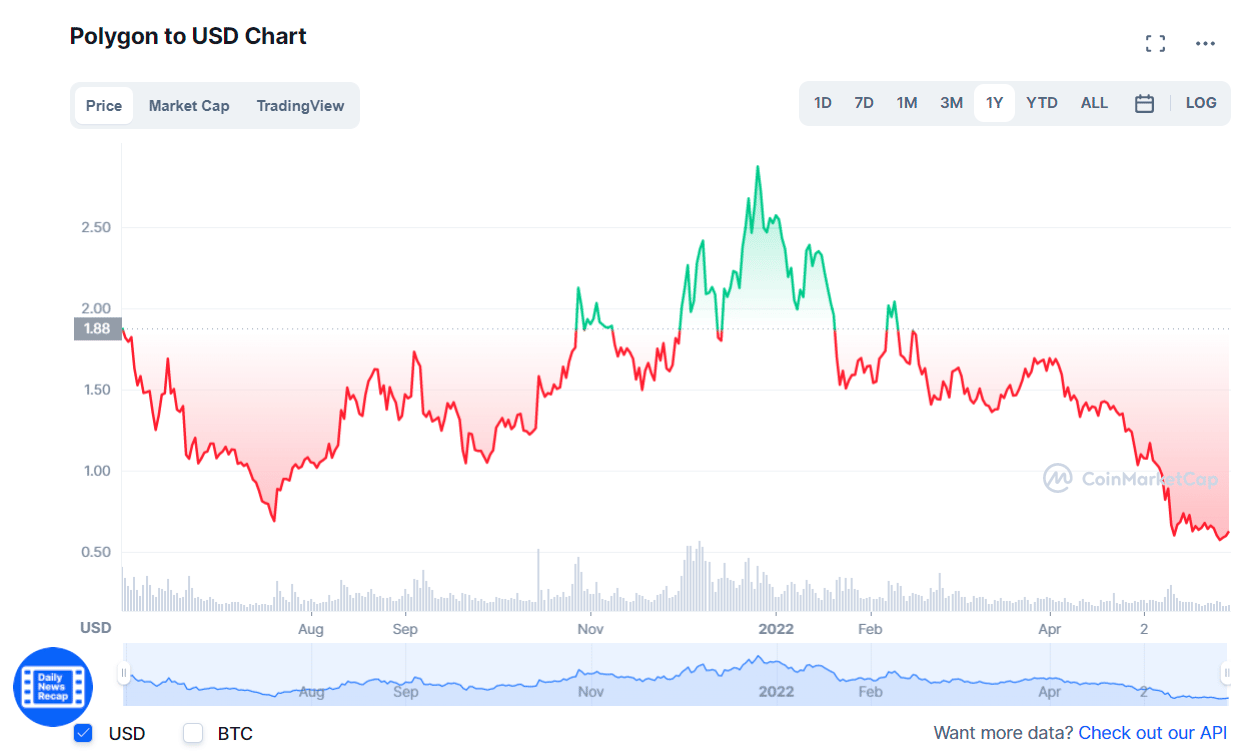

MATIC price chart

MATIC features

Transactions are processed faster, and the fee is significantly lower. Its primary goal is to create a foundation for blockchain networks. Instead of being completely disconnected, users would be able to establish blockchain networks that interconnect. It is Ethereum Virtual Machine (EVM) compatible.

MATIC price prediction 2025

The Polygon value will increase because of the efforts of the network developers and community investors. Therefore, the calculated price for the year 2025 is bullish. According to analysts, it was anticipated to touch a maximum price level of $3.14 by 2025. On the other hand, it is highly optimistic that Polygon’s future will ultimately grow. Therefore, the predicted average price of this crypto will be around $2.60 to $2.70 is expected in 2025, depending on the market.

Final thoughts

Organizations’ continuing embrace of cryptos indicates that the cryptocurrency market’s best is yet to come.

Comments