Many things happened in 2021, both inside and outside of investing. You must have learned a lot of important lessons as an investor. One of the things you might have realized is that social media can tremendously affect the stock market. Think about the meme stock craze that sent some stocks violently up and down in quick transitions.

Perhaps the most remarkable events transpired in the crypto market. This includes the growth of a few meme coins that made millionaires quickly. The best example is the Shiba Inu coin.

Some other major developments are the rise of NFT gaming that allowed users to make real money while playing and the introduction of the Metaverse, which attracted a lot of attention from technology giants.

As investing wanes a bit as we head toward the end of the year, it may be an opportune time to ponder on the things you have learned this year. You can develop an investing plan for the coming year based on that learning.

What is in store for investors in the upcoming year? We list down in this post five areas that might see a lot of growth in 2022.

Top five investments for 2022

Below are the markets or sectors that might perform well in the upcoming year. This is based on the current trend and the challenges we expect to face in the future.

No. 1. Cybersecurity

Cybersecurity has become a significant issue during the outbreak of the Covid-19 pandemic and even after it. As a coping mechanism, businesses are forced to send employees to work from home to keep the operations alive. Even if the situation is starting to go back to normal, some things have changed for good.

Many people get so accustomed to the teleworking arrangement that they shun the idea of going back to the office setup. As a result, the hybrid work arrangement came to life. This new development puts a big challenge on the company, client, and personal data security. Companies will have to contend with cybersecurity issues in the medium term to the long term.

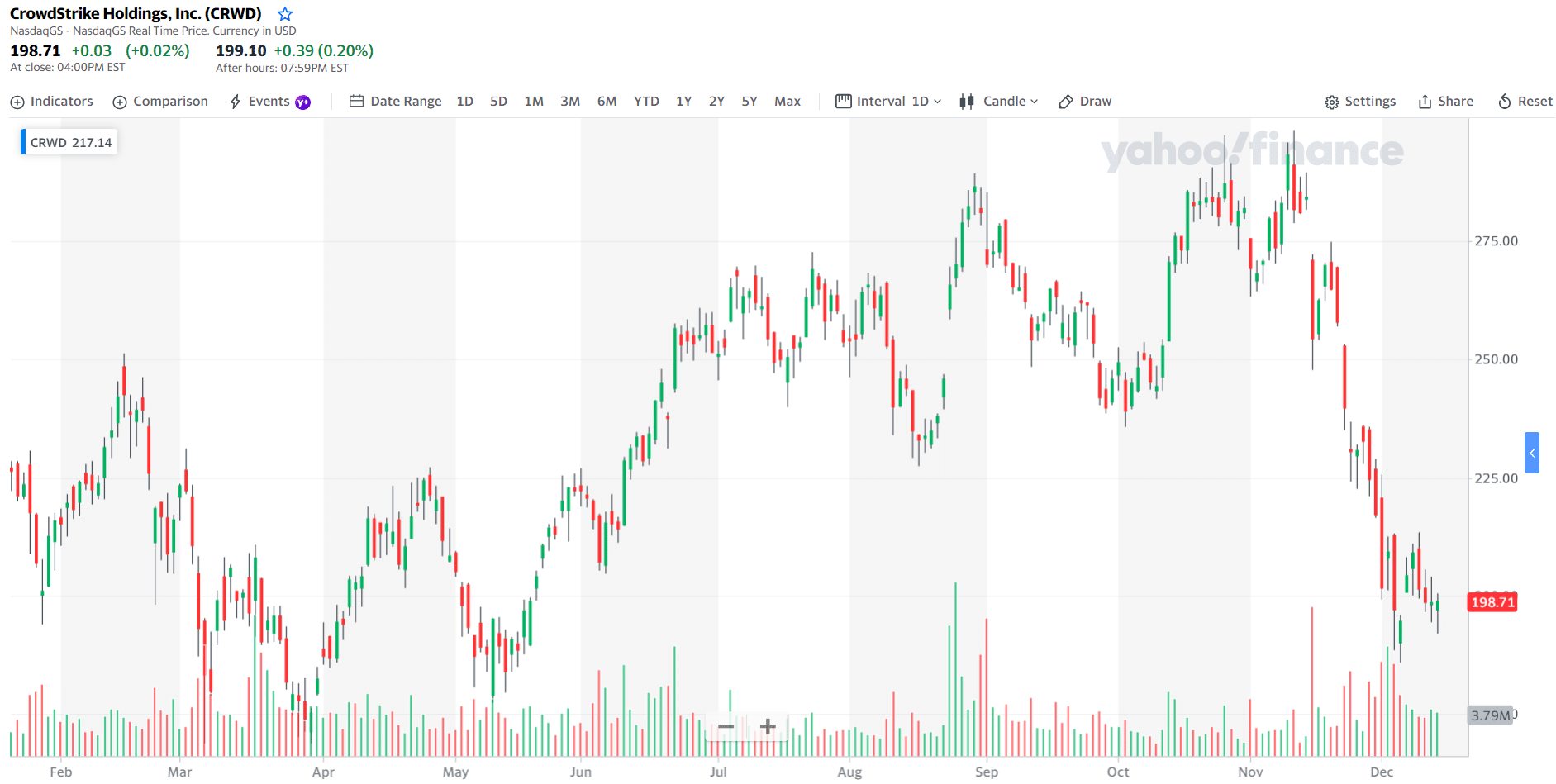

If you are looking for a stock to invest in, then look into some stocks that specialize in cybersecurity. One famous name in this industry is CrowdStrike (CRWD). This company boasts a next-gen anti-malware solution that sits on the cloud. It goes by the name Falcon, which leverages the power of artificial intelligence to identify existing threats and detect emerging threats. As a result, Falcon can quickly recognize and respond to threats better than on-premise solutions.

CRWD daily price chart

No. 2. Telemedicine

The apparent issue with telehealth is the anticipation that its momentum will slow down in the coming months as vaccination accelerates and patients go back to the hospital and clinics for healthcare. While this could be true, the demand for telemedicine is still high. One research shows that telemedicine may grow by 38.2 percent yearly until 2025.

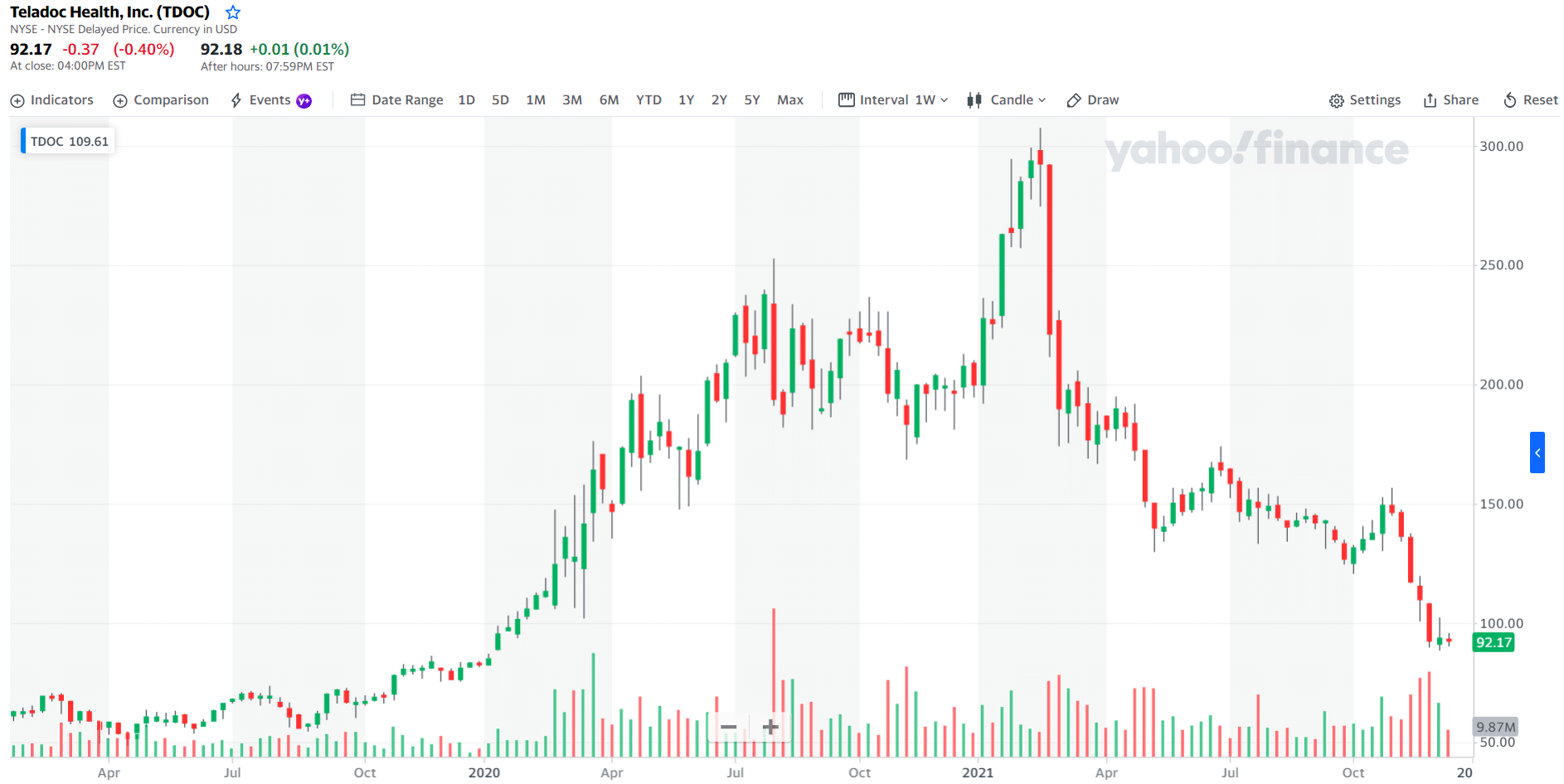

Telemedicine is a sector you must consider when investing in stocks next year. One potential stock in this sector is Teladoc (TDOC). The company has had around 750,000 patients enrolling for Livongo, a subsidiary, since 2020. With Teladoc’s 74 percent sales growth for six years before the pandemic and the Livongo platform’s targeting of the American adult population, this stock looks like a candidate wins in the coming year.

TDOC weekly price chart

No. 3. Fintech

During the pandemic, banks direct customers to transact via mobile or online for safety purposes. However, even before the pandemic broke out, consumers, especially the younger generation, had already started shifting to mobile devices when trading and investing in crypto and stocks, transferring money and purchasing products and services.

While many companies are under the fintech sector, one name is gaining popularity. This company is called Block (SQ), otherwise known as Square. Block relies on its seller ecosystem to grow its bottom line for over ten years. From 2012 to 2021, the company has grown its payment volume from $6.5 billion to $167 billion annually by the end of September 2021.

SQ weekly price chart

No. 4. Pets

Data shows that 70 percent of American households will own a pet or two in 2022. This figure equates to more than 90 million families having either a scaled, gilled, feathered, or furry pet. This was no surprise as people mainly stayed at home in the previous year and needed a company to get past the most trying time.

If you are an investor who is also a pet lover, one stock you might love putting money into is Petco (WOOF). This company sells pet accessories, toys, treats, food, etc., is looking to open several in-store veterinary clinics, and is considering putting in place subscription channels to push revenue higher. Another plan is to offer pet insurance, which is unprecedented in the pet industry.

WOOF daily price chart

No. 5. Metaverse

Metaverse allows users to interact socially with other people, play, and work in a virtual environment. While this new development is still young, the number of ways to make income in the Metaverse grows week after week. As an investor, you can buy tokens and digital currencies used as a medium of exchange in virtual ecosystems. When these assets grow in value over time, your investment will also appreciate.

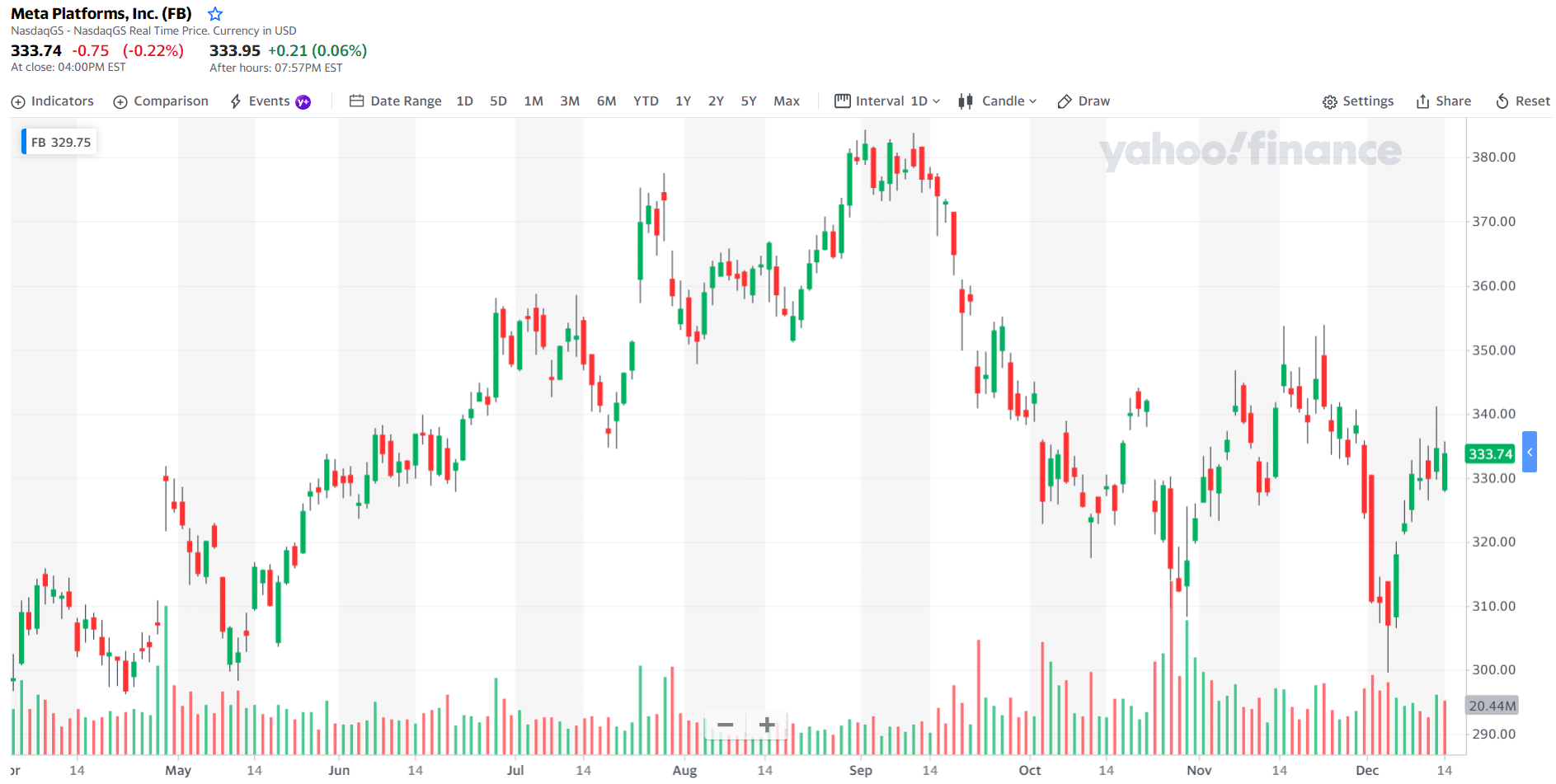

One big company looking to capitalize on the metaverse trend is Facebook, now called Meta (FB). After the company name change, Meta engaged in intensive game development to catch up with other companies that made earlier excursions. Meta will probably use online campaigns, particularly in its social media platform Facebook to attract users and hence revenue. Because of its strong online presence and financial standing, Meta is a strong contender in the Metaverse race.

FB daily price chart

Final thoughts

Although the world has changed so much in the wake of the pandemic, new opportunities have come to life that ready investors like you can take advantage of. There is a good chance that the stock market will spring back to life next year and in the years ahead. However, the industry that showed a lot of action this year is crypto, blockchain, NFT, and Metaverse. Many blockchain projects are in the works and are set for a big release next year. This is one market to keep tabs on in the coming year.

Comments