The first thing that might come to mind when you hear the word ‘budget’ is that you have to cut your spending. It’s a tedious exercise that most people do not enjoy. But the aim of budgeting is not to spoil your fun but to help you determine your spending, how much you have left, and how you can plan your finances better.

Many people use a budgeting tool, but they are not getting value from it and have given up altogether.

It would be helpful to apply these tips to make the process less daunting and perhaps more enjoyable.

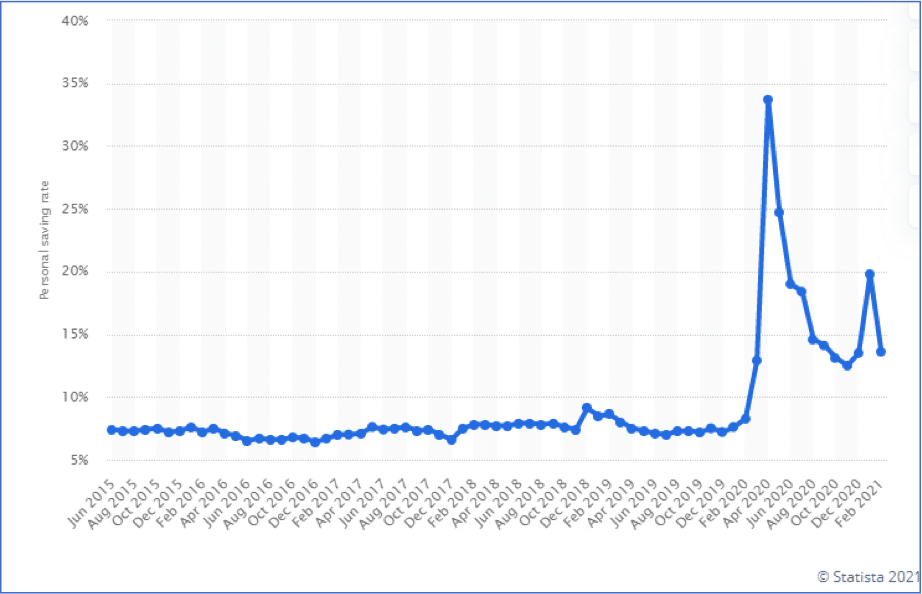

The personal savings rate in the US – data based on a survey done from June 2015-Feb, 2021.

-

Collect all the information

Before drawing up your budget, you need to gather all the information that feeds into it. Organize all your receipts and keep them in a safe place until needed. In addition, note all your sources of income that you receive monthly.

A good idea would be to note down expenditures timeously; this way, you keep your budget a working document, and you avoid sitting at the end of the month to try and figure out all the statements.

-

Draw up a budget

A budget is like a profit and loss statement for your household. There are many templates available on the internet, and you do not have to design your own. In addition, some budgeting tools automate the calculation on your behalf; all you have to do is input the values.

However, if you prefer to draw up your template, the main categories that you should account for are the following:

- Monthly income

- Expenditures

- Household

- Transport

- Food

- Personal care

- Taxes

- Savings

- Emergency fund

- Debt/loans

- Insurance

- Nett income (difference between Income and Expenditures)

- This value should be positive or zero; a negative value means your expenses are higher than your income.

-

Set realistic goals

When planning your budget, you need to determine realistic goals. And a way to achieve this is to determine what your needs vs. wants are. When listing all expenses, you can identify what a ‘want’ is and what a ‘need’ is.

- Applying the 50-30-20 budgeting rule will help to distinguish and set goals.

- Whereby you allocate 50% of your budget to your essential needs.

- 30% to non-essentials and the remaining 20% towards savings.

Essential needs include rent/mortgage, utilities, school fees, health care, food, and transportation. Non-essentials would be things like entertainment, club memberships, and dining out.

-

Make changes as needed

The budget is a working document, and you are allowed to make the necessary changes. Once you drew up the budget, you will know where your highest expenses are, and you can determine what to cut down and maybe add a little more to your savings or investments. Or perhaps you can afford to spend more on entertainment or other categories, and you can change the numbers to suit your needs.

The idea is not to change it too often, but it should not impact your finances negatively when you decide to make changes.

-

Prioritize debt repayments

If you have a considerable amount of debt, prioritizing these payments is advisable. Prioritizing debt payments will help you pay them off quickly so that you can focus on saving money. However, you might have to re-arrange some other areas of the budget to increase debt payments.

A tip to pay off the debt quicker is to pay more than the minimum required payment, this way, thereby saving on interest rates.

-

Break it down

Depending on the size of your household, you might have many different expenditures. Other than the regular expenses like rent or mortgage, utilities, and food, other categories make yours different from the next person.

A good tip is to divide the costs into sections:

- Household

- Entertainment

- Food

- Personal

- Transportation

- Savings

- Pets

Breaking down the budget into smaller segments will give you a better idea of your spending habits.

-

Plan for the unexpected

Unexpected things happen, and it’s a good idea to plan. Creating an emergency fund helps to prepare for such events. It is advisable to keep at least $1000 in your emergency fund. Using the emergency fund for non-essential items can be tempting, and perhaps keeping this money in a separate interest-bearing bank account is a good practice.

-

Be honest

Another essential tip is, to be honest when drawing up your budget. Initially, it is a daunting task to budget, and it can be a bit of a headache recalling all the amounts, but once you are familiar with it, you will find it gets easier with time. Being honest with yourself only helps to plan your finances better.

-

Commit to your budget

Committing to your budget means you have to do it monthly, and you have to follow through with your plans. Sticking to your budget also means controlling your spending; practicing self-control will help you achieve this.

Doing the budget with your spouse or partner makes it a team effort, and you can hold each other accountable. This way, you also have someone else to keep your spending in check.

-

Track your budget

The only way to know if your budget is working is to keep track thereof monthly. Regular checking helps to ensure that you are keeping to your commitments. And this will allow you to make changes where you deem necessary. Placing the budget in a spot where you can see it often is an excellent way to keep track of it.

Conclusion

Budgeting is a way to organize your finances formally. Using the right tool or template is not good enough. More importantly, it is the information and how you use it to plan your finances.

In addition, the tips that we reviewed in this article will help you draw up an adequate budget and plan your finances better.

Comments