Silver exchange-traded funds closely track the price of silver and are generally more liquid than owning the precious metal itself. Like other precious metals, silver tends to be favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil.

Silver will always come a lackluster second to gold when comparing metals’ prices in the physical market. However, a lesser-known fact is that silver funds often outperform gold funds in the stock market. This beginners’ guide features the best silver ETFs for your portfolio.

What are silver ETFs?

An ETF allows you to invest in a basket of stocks instead of a single tradable instrument. Therefore, if you buy shares in a fund, you hold a portion of all the underlying assets. In this case, ETFs invest in hard silver, and a custodian or fund manager manages the assets.

Silver is a precious metal and a commodity used in many end products, including jewelry, tableware, electronics, and batteries. Silver also has a long history of use as coinage and as a store of value, given its relatively high value-to-weight ratio.

A silver ETF seeks to track the price of silver with fewer expenses. To track the price of silver, a silver ETF may hold physical silver, stocks in silver mining companies, or silver futures. Such funds provide investors with indirect exposure to the price movements of silver without holding the underlying asset physically.

Silver funds hold silver metal or silver-related instruments, not the stocks of mining silver or related business companies. Consequently, the performance of such fund is based on changes in the domestic price of silver (referred to as LBMA silver daily spot-fixing price).

How to buy silver ETFs?

Buying and selling funds is a simple process that can be done the same way as any ordinary stock. As with any other investment type, choosing the best silver funds to suit an investor’s needs may begin with an ETF screener narrowing down the choices.

Top five silver ETFs to buy in 2022

Our analysts have selected five of the best silver funds for this year, as displayed below. Continue scrolling further to learn more about each.

№ 1. Aberdeen Standard Physical Silver Shares ETF (SIVR)

SIVR ETF summary

SIVR tracks silver prices with fewer trust expenses compared to other funds. The issuer of this fund is Aberdeen Standard Investments. It gives investors pure exposure to silver by holding the physical metal in trust.

JPMorgan Chase Bank holds the metal in London in a secured vault. This fund was founded on 24 July 2009. As of this writing, it is worth $982.41 million in assets with an expense ratio of 0.30%. It is one of the best silver ETF funds to trade, primarily due to its 50% returns over the last year.

SIVR price chart

Because it holds only physical silver, this fund does not utilize futures contracts. Like other silver and precious metals ETFs, this fund may be a valuable safe haven during market uncertainty, but it may not be attractive as a long-term, buy-and-hold investment.

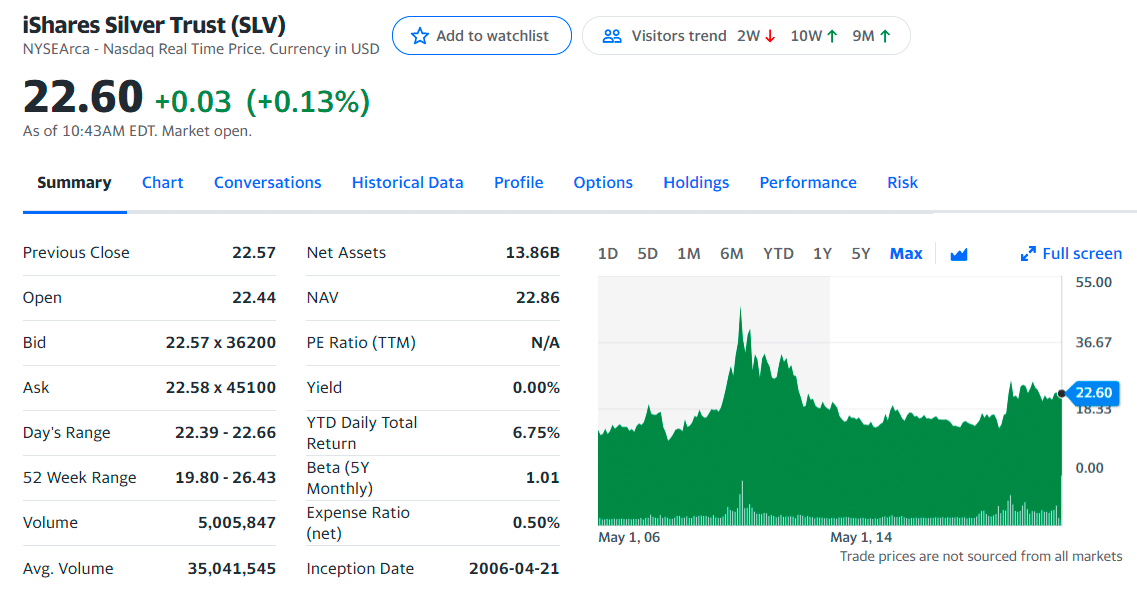

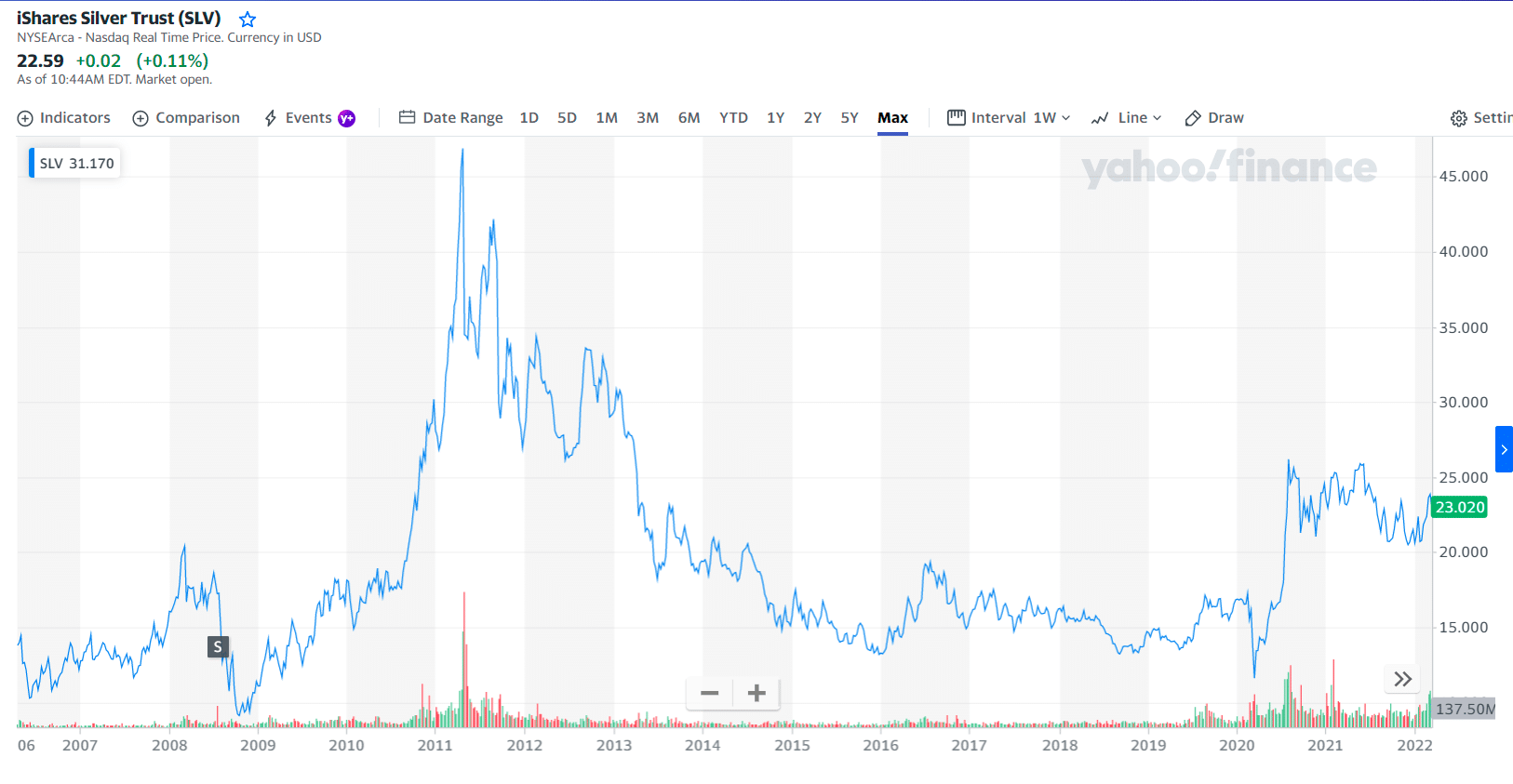

№ 2. iShares Silver Trust (SLV)

SLV ETF summary

This fund was founded in April 2006 and tracks the silver spot price using silver bullion held in London. It is worth $17.28 billion in assets as of this writing. In 2020, this fund generated 50% annual returns with an expense ratio of 0.50%.

When it comes to physically-backed silver, SIVR and SLV are nearly identical, although the second one does charge a slightly higher expense ratio. The fund provides stability for buy-and-hold strategies.

SLV price chart

The fund currently holds 16,511 tonnes of silver worth over 12 billion USD. Investors can be assured that the fund was issued by Blackrock Financial Management, a highly reputed firm. Investing in this fund can prove ideal for gaining exposure to the day-by-day movement in the price of the silver bullion. You can use it to balance diversification in your portfolio and hedge against potential inflation. The fund is also an affordable means of gaining access with low fees.

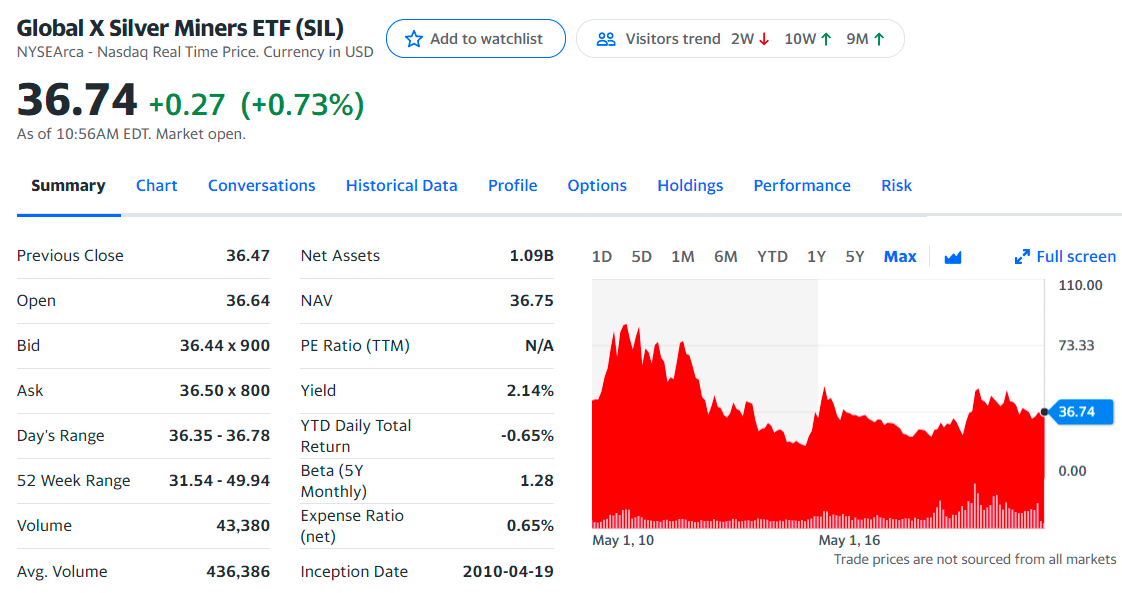

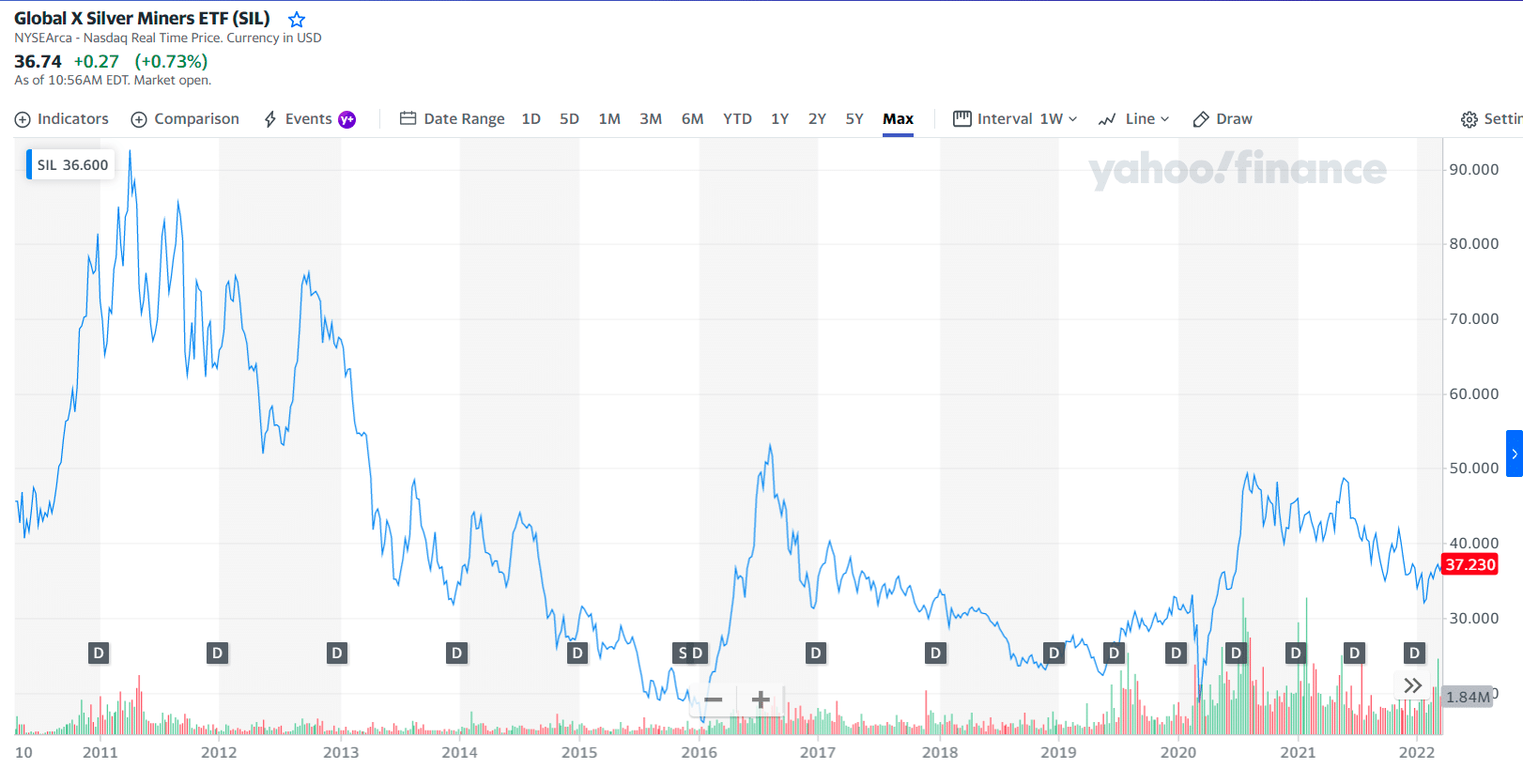

№ 3. Global X Silver Miners ETF (SIL)

SIL ETF summary

This fund seeks to track the performance of the Solactive Global Silver Miners Total Return Index, which invests in international companies involved in exploration, mining, and the refining of silver. The index will own between 20 and 40 stocks at any given time and primarily uses a market cap to weigh the companies in the index.

SIL price chart

This fund subjects investors to less currency risk than the iShares fund. Approximately 42% of its investments were US dollar-denominated. The Canadian dollar, Great British pound, and Mexican peso-denominated assets comprised 35%, 18%, and 5% of its assets.

It holds just 23 different companies. The five most prominent positions made up more than half of the fund. Fewer holdings result in a significantly higher average market cap for stocks in its portfolio, with the average company being 50% larger than the constituents of the iShares MSCI Global Silver Miners. The fund carries an annual expense ratio of 0.65%.

The first three holdings with their asset percentage are:

- Wheaton Precious Metals Corp. — 26.94%

- Pan American Silver Corp. — 9.79%

- SSR Mining Inc. — 6.59%

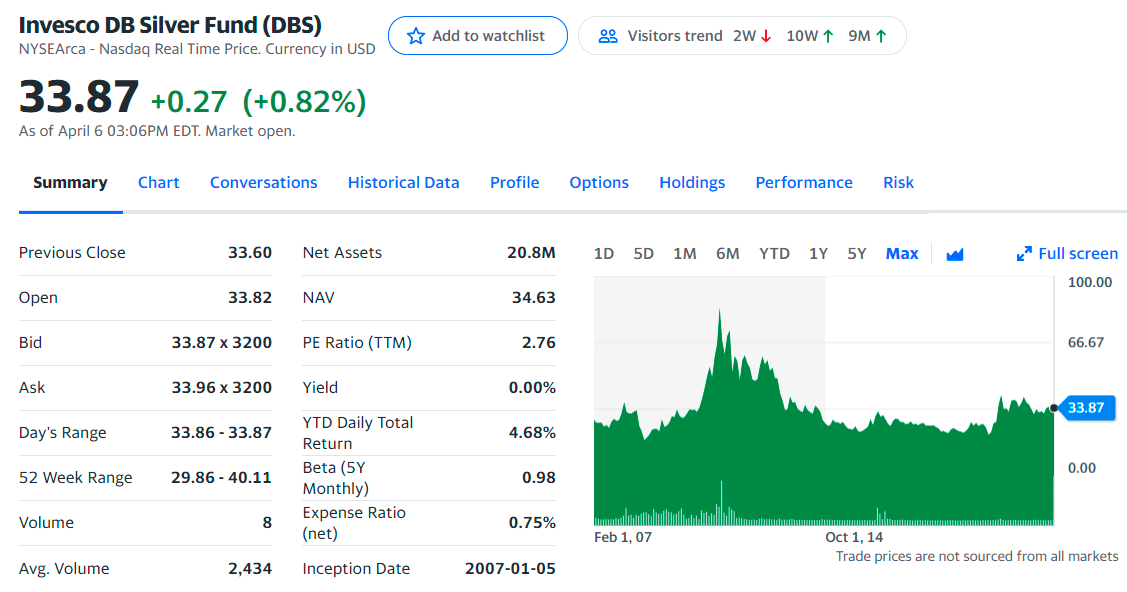

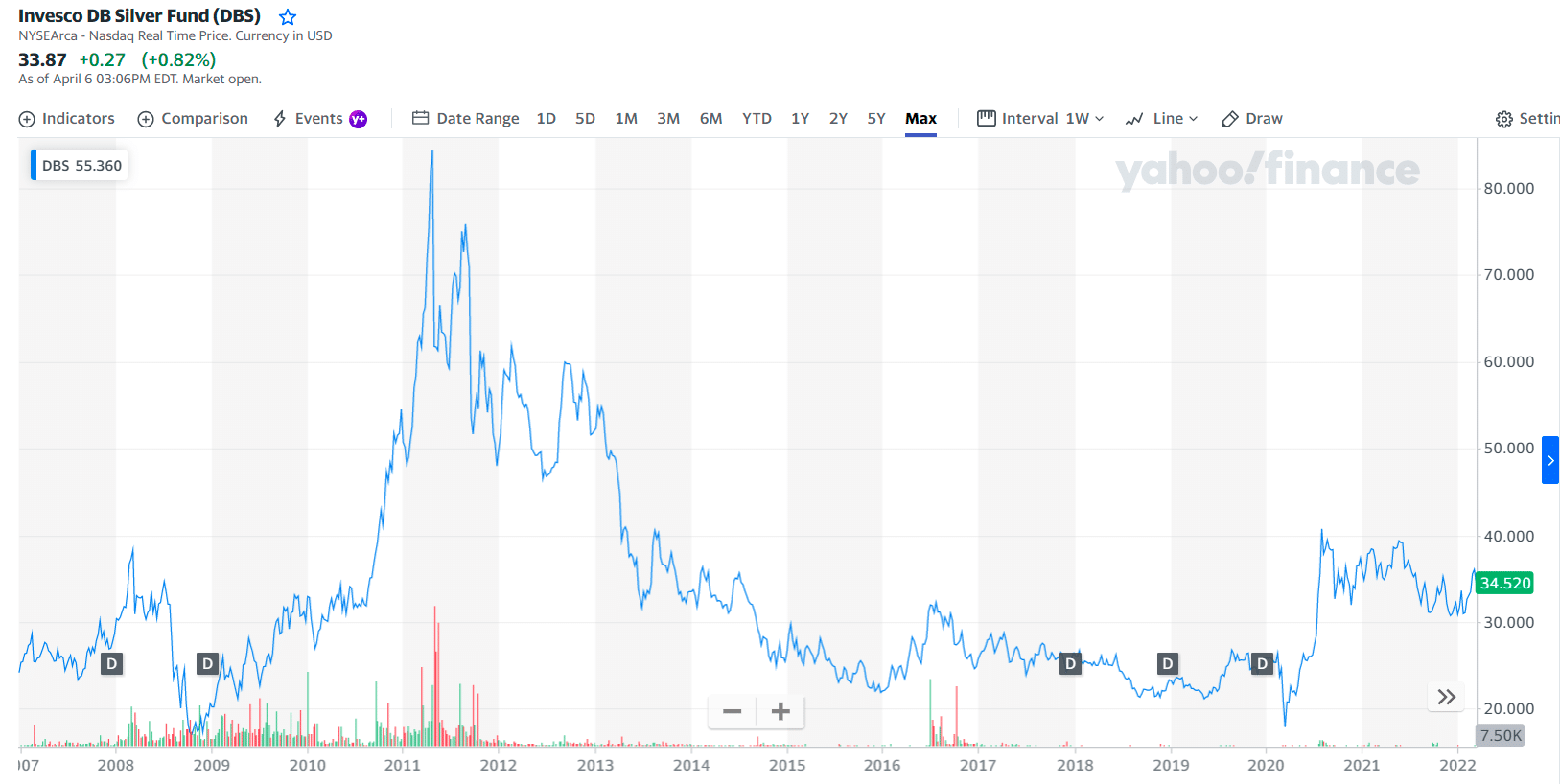

№ 4. Invesco DB Silver Fund ETF (DBS)

DBS ETF summary

This fund seeks to replicate the DBIQ Optimum Yield Silver Index Excess Return, which composed of futures contracts on silver. It is intended for investors interested in a cost-effective and convenient means of investing in commodity futures.

Commodity futures are highly speculative investments, and therefore, the fund is not suited for risk-averse investors. Such investing is volatile and can result in considerable losses for new market participants. However, if you are a seasoned investor with a risk appetite, there is potential for high reward when investing in this fund.

DBS price chart

Holding with its asset percentage is:

- Invesco Government & Agency Portfolio Institutional Cl — 63.96%

Silver is one of the most popular precious metals, as it is much cheaper and more abundant than gold and, therefore, easier to invest in. The fund may be a good choice for investors seeking futures-based exposure to silver but who wish to avoid the hassle of trading on a futures account.

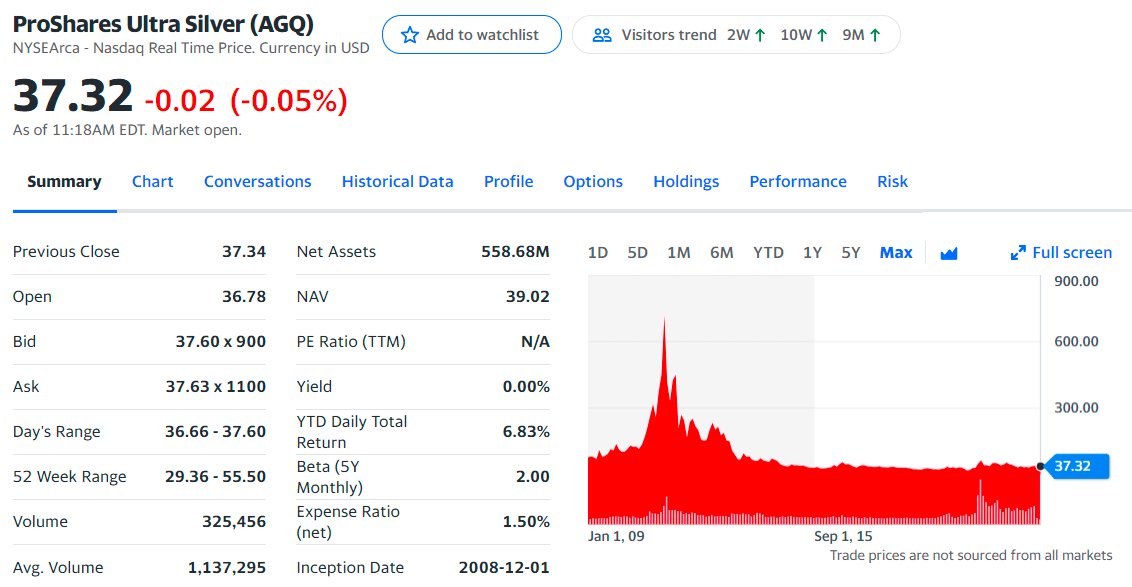

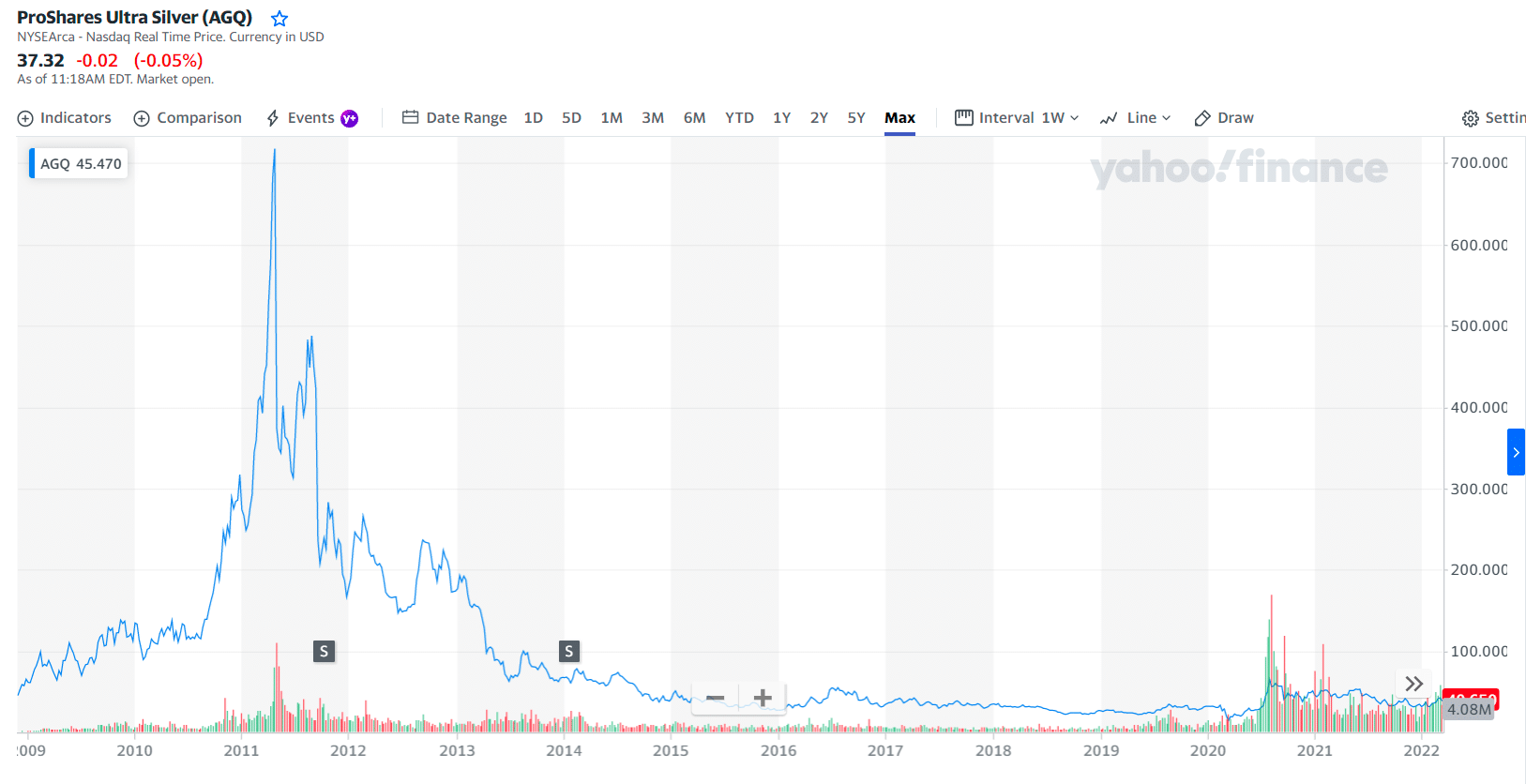

№ 5. ProShares Ultra Silver (AGQ)

AGQ ETF summary

AGQ provides twice the daily performance of silver bullion as measured by the fixing price. It was founded on 1 December 2008 by ProShares. The fund is worth $1.55 billion with $715.54 million shares in the marketplace and an expense ratio of 1.50%. Despite its higher expense ratio, the holding cost is less important for this fund if you are looking for short-term trading.

AGQ price chart

This fund offers 2x daily long leverage to the silver bullion, making it a powerful tool for investors with a bullish short-term outlook for silver. Investors should note that AGQ’s leverage resets daily, resulting in compounding returns when held for multiple periods. The fund can be a powerful tool for sophisticated investors, but those with a low risk tolerance or a buy-and-hold strategy should be avoided.

Final thoughts

Investors should maintain a cautious approach while investing in silver ETFs as the demand for silver comes from industrial houses. During economic turmoil, it can affect silver prices, making it risky to invest in the asset.

Moreover, it doesn’t provide many diversification benefits because of the moderate correlation with equity stocks and has sometimes failed to protect from inflation. Therefore, following a cautious approach is better to deal with the uncertainties of the new asset class and the market.

Comments