Quantum computing offers the potential to harness big data, make intricate predictions and use artificial intelligence to revolutionize business operations. Many industries such as automotive, agriculture, finance, energy, and space will be affected by the growth in this technology.

Quantum approaches to computing have the potential to boost many industries. Big names in the tech space, such as Microsoft Corp., Alphabet Inc., and International Business Machines Corp., have invested heavily in such projects. Academic institutions are also exploring possibilities in the field. The global quantum computing market size is expected to grow at a 25.4% CAGR between 2021 and 2030.

With that information, here are the top three best stocks to buy in 2022.

What are quantum computing stocks?

This technology is approaching the mainstream. A quantum computer offers computational power 100 million times faster than regular computers today. A detailed study issued under Harvard Business Review explains quantum technology as below.

In commercial computing, quantum translates to machines and software that can, in principle, do many of the things that classical digital computers can and do one big thing classical computers can’t: perform combinatorics calculations quickly.

Technology companies are in focus for investors and offer great opportunities. Technology companies are in the direction of investors and provide great opportunities. Get to know the best quantum stocks.

How to buy quantum computing stocks?

You’ll first need a brokerage account to buy stocks. Once you’ve added money to the account, you can find, select and invest in individual companies.

Top 3 quantum computing stocks in 2022

Quantum computing essentially makes computing-intensive processes easier. There are dozens of industries that require lots of computing power in today’s world. Thus, AI, self-driving cars, and Bitcoin mining. Pending a slight breakthrough, quantum computing could quickly emerge as a critical technology for the next decade. Due to this, getting into the best stocks today could easily set your portfolio up for a successful future.

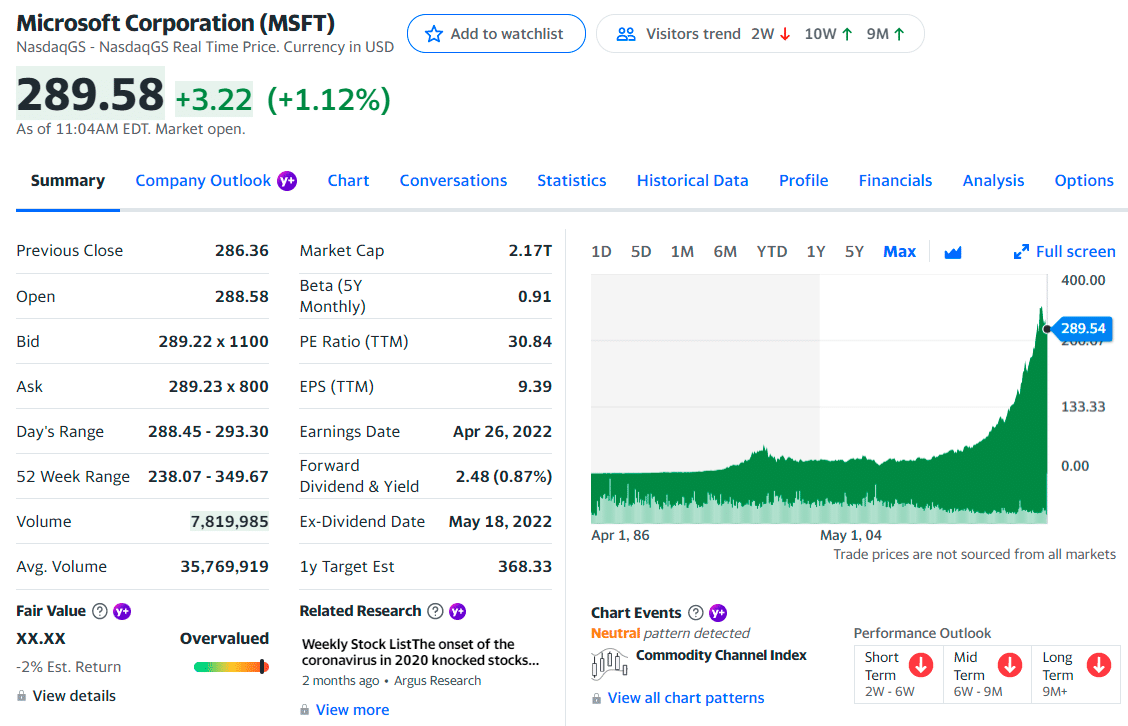

No. 1. Microsoft Corp. (MSFT)

Price: $289.58

EPS: $9.39

Market cap: $2.17T

MSFT summary

It takes a comprehensive approach to quantum computing. The company working on all the technologies required to scale commercial apps. It is advancing all layers of its computing stack, including the controls, software, and development tools.

The company also created the Azure Quantum open cloud ecosystem, which helps speed up innovation. It’s a promising technology that should reward shareholders down the road. In 2021, MSFT reported $168 billion in annual revenue. It also reported a total net income of $61 billion.

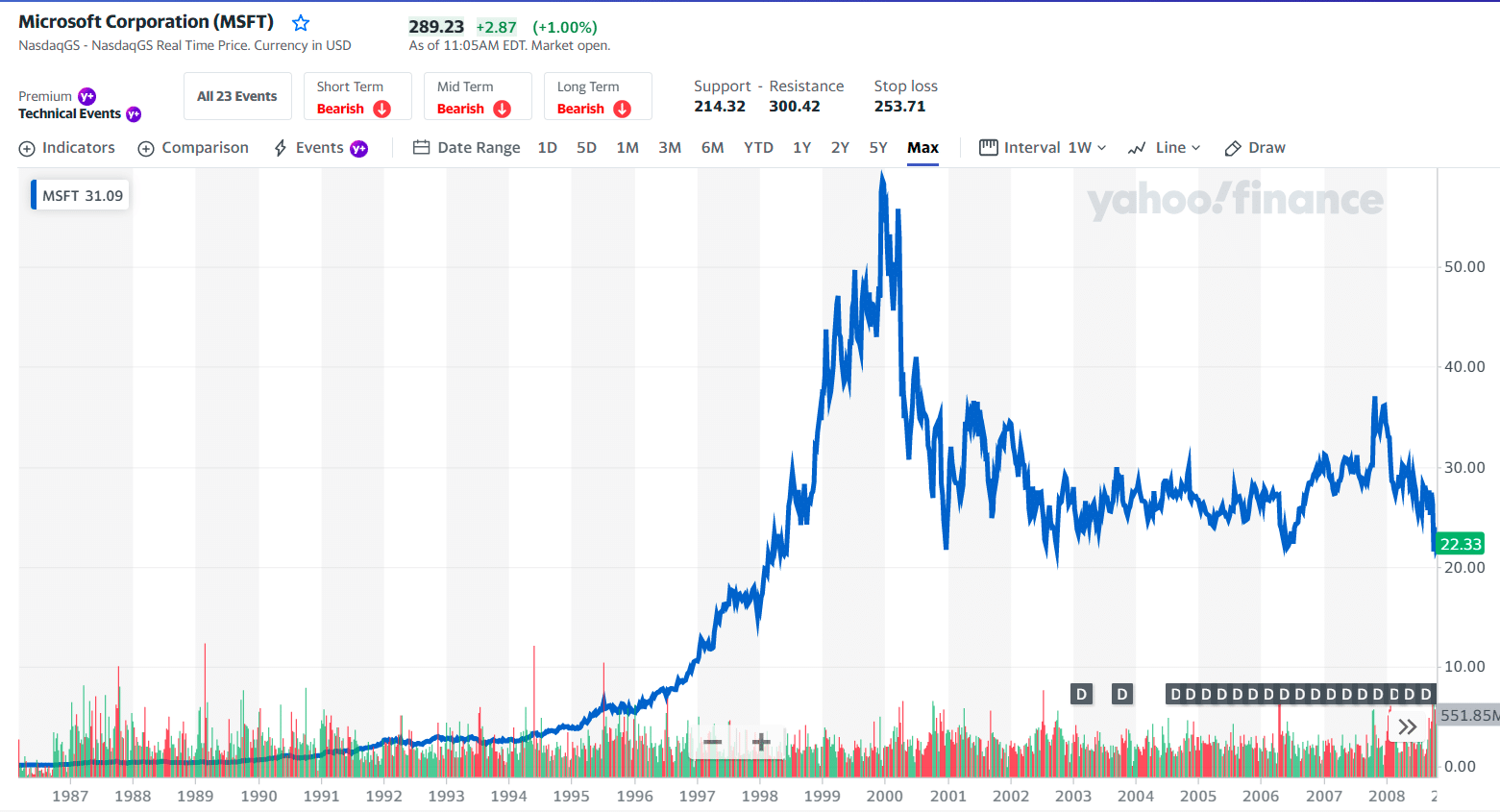

MSFT price chart

Quantum computing may be a relatively small part of Microsoft’s overall cloud services and software business. Still, Bank of America analyst Brad Sills says there are plenty of other reasons to love Microsoft, including its Office 365 products and its gaming division – which will be newly beefed-up if its proposed acquisition of Activision Blizzard Inc. goes through.

MSFT stock currently trades just under $289, up 27% over the past 12 months. Shares support a valuation of 32.6 times forward earnings and 12.3 times trailing sales. And the 12-month median price forecast for the stock stands at $370.

The first three holdings:

- Vanguard Group, Inc. — 8.22%

- Blackrock Inc. — 6.92%

- State Street Corp. — 4.04%

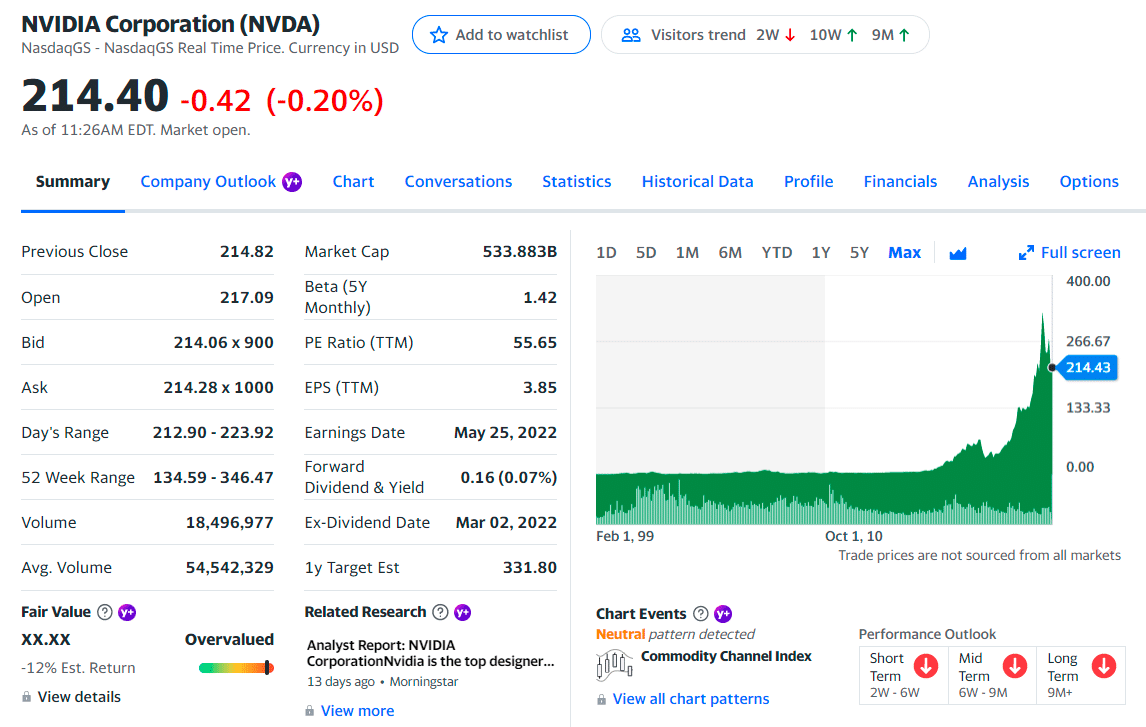

No. 2. Nvidia Corp. (NVDA)

Price: $214.40

EPS: $3.85

Market cap: 533.88B

NVDA summary

It is a tech giant that designs graphics processing units for the gaming and professional markets and systems on a chip unit for the mobile computing and automotive market. It is another company that has been accelerating the quantum computing industry with tools and resources for developers and researchers.

Since the company is already a significant player in the graphics processing unit space, there’s little doubt it will be a competitor in the quantum processor space as it continues to grow.

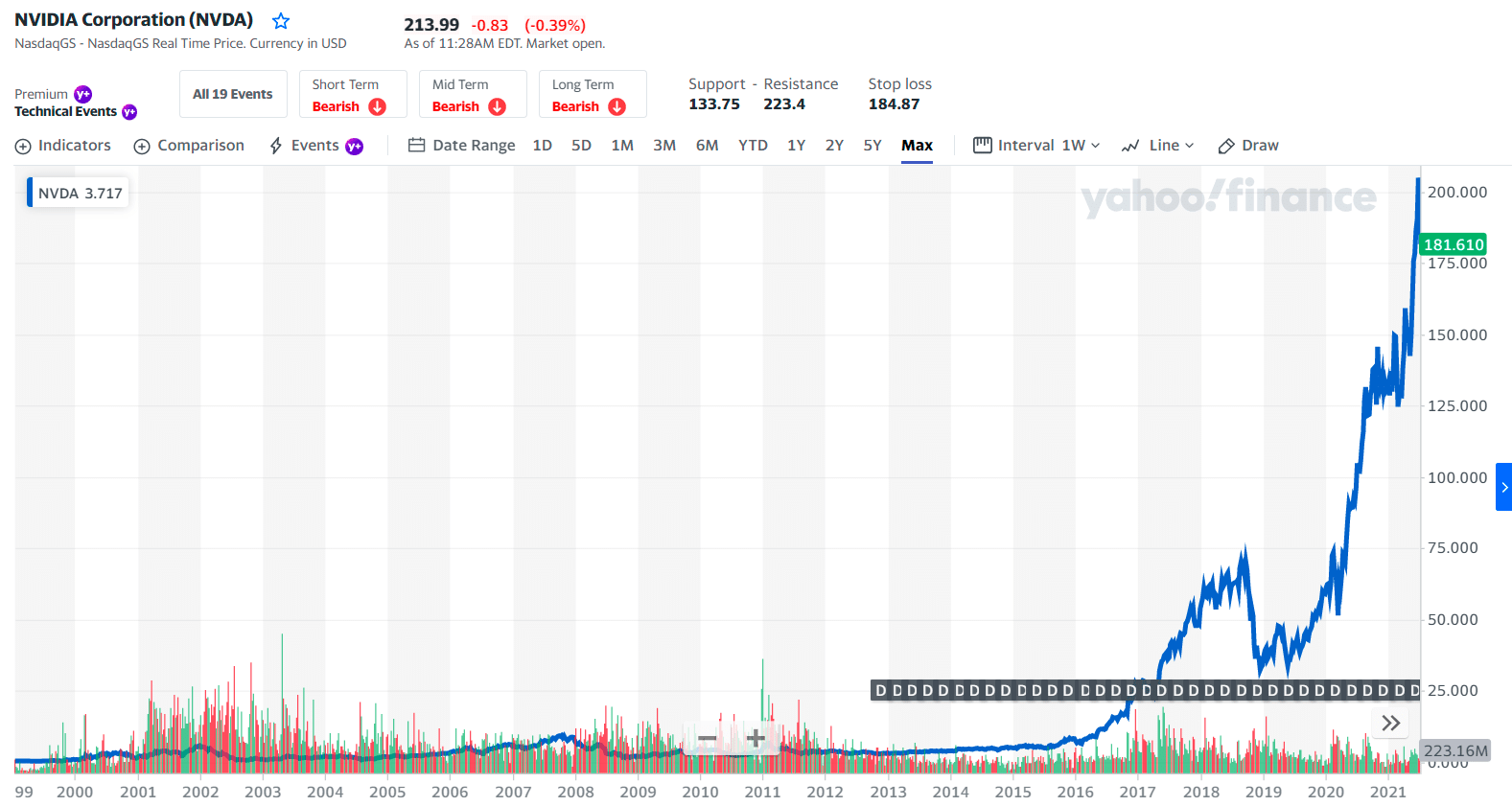

NVDA price chart

Given its growing addressable market in cloud computing, gaming, AI, and, more recently, the Metaverse, NVDA stock deserves your attention. Share are changing hands at around $245, up nearly 80% over the past year. However, despite an 18% decline YTD, shares are trading at 46.5 times forward earnings and 25 times trailing sales.

Finally, the 12-month median price forecast for Nvidia stock is $350. As the company gets ready to report earnings soon, investors should expect increased choppiness in price.

The first three holdings:

- The Vanguard Group, Inc. — 7.40%

- Fidelity Management & Research Corp. — 5.94%

- BlackRock Fund Advisors — 4.57%

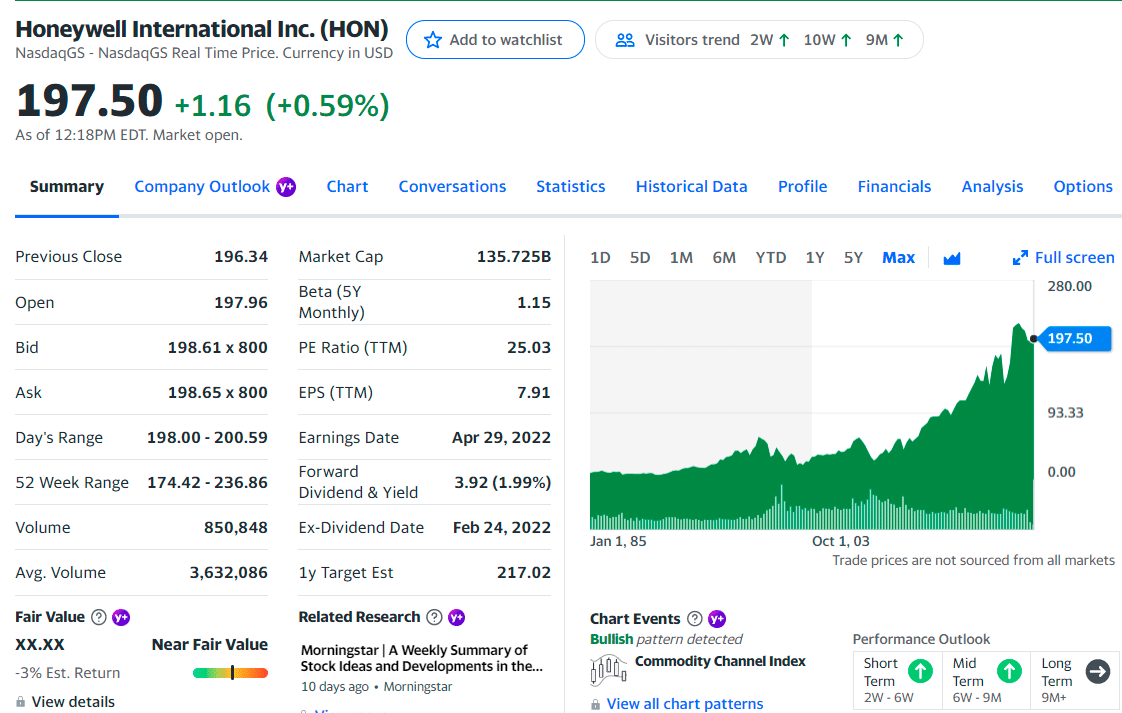

No. 3. Honeywell International (HON)

Price: $197.50

EPS: $7.97

Market cap: 135.72B

HON summary

It is a leading technology company. It primarily operates in four areas of business: aerospace, building technologies, performance materials and technologies, and safety and productivity solutions.

Wall Street expects Quantinuum to go public by the end of 2022. Investors also seem excited about Quantinuum’s first product, which involves a platform-agnostic and device-independent cybersecurity solution.

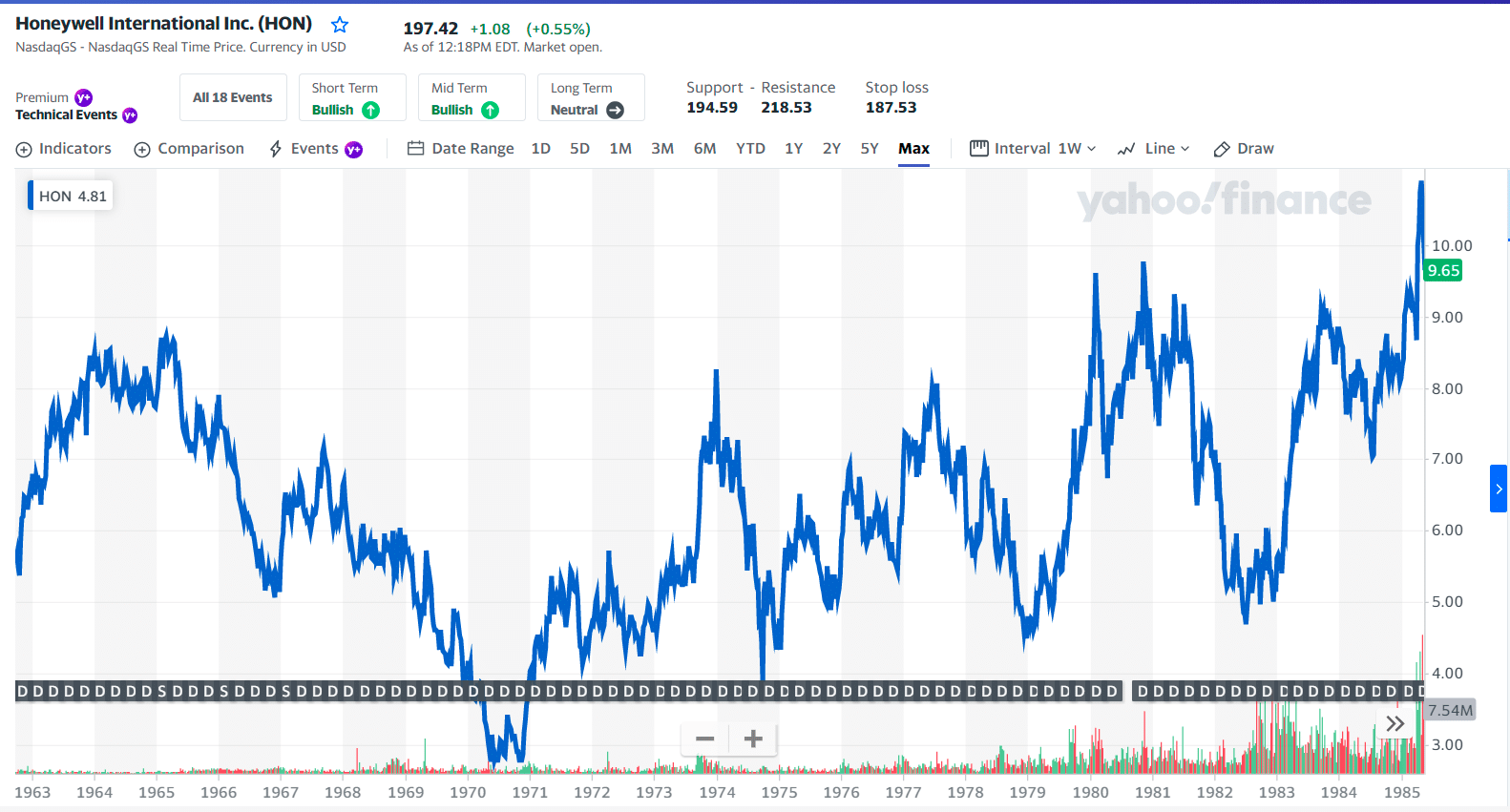

HOD price chart

HON stock is down almost 8% over the past year and 6.8% year-to-date. Shares are trading at 22.4 times forward earnings and 3.9 trailing sales. Meanwhile, HON stock’s 12-month median price forecast stands at $220.

The first three holdings:

- Vanguard Group Inc. — 6.73%

- Blackrock Inc. — 6.11%

- FMR, LLC — 5.37%

Final thoughts

Hundreds of companies and organizations are now considering how quantum computing might fit into their plans and wondering what advantages it could give them. Investors following this developing technology will want to view these and other stocks or opt for broader exposure.

Comments