An attraction to the AI stock market has shown its long-term potential, and AI stocks are rarer than you would assume. If you have a little money to invest, you may still make money with minimal risk. Invest in a company that will benefit from the rise of artificial intelligence and machine learning. In terms of global investment in AI, an all-time high is being set.

According to CB Insights, AI projects have made 4.6 times as many agreements since 2005, and startup funding in this field has increased from $282 million to $2.4 billion.

Artificial intelligence (AI) has been used successfully in different business tactics to accelerate their economic goals and raise their stock prices. The incredible increase in the value of these assets in recent years has also highlighted their importance. If you know the best and reasonable AI stocks under $10, this article will explain artificial intelligence stocks under $10.

What are artificial intelligence stocks?

It used to be a tiny part of sci-fi stories, but now AI is a major force in the worlds of technology startups and an enormous number of corporations. Computer vision, machine learning, and the intelligent assimilation of natural language have played critical roles in almost every industry’s transformation thanks to the AI world’s capabilities.

Artificial intelligence is seen as a potential field by venture investors in the US, Germany, Japan, China, Russia, etc.

Artificial intelligence stocks under $10

The following are three artificial intelligence stocks under $10.

1. Lantronix Inc. (LTRX)

One of the best companies in the AI industry is Lantronix, Inc. (LTRX), which has mastered software as a service and hardware for the edge of computer and engineering services.

There is a tight link between application hosting, secure network connection, protocol conversions, safe access to dispersed IoT deployment, and many other activities. IoT telematics is responsible for ensuring that power-efficient solutions are provided that are specifically designed to boost communication across different industrial protocols, such as asset management and tracking, fleet, or for the vehicle.

Lantronix, Inc. chart

Price

Investing in Lantronix Inc. can be a good choice if you look for a company with good returns. On 2021-11-28, Lantronix Inc’s quote is 7.261 USD. Its 52 week range is from 4.06-10.25. Our forecasts indicate that LTRX stock’s price will increase over the long term; it is expected to reach 17.592 USD by 2026. A 5-year investment is expected to produce a revenue increase of 142.32%.

By 2026, $100 could be worth $242.32.

EPS

Lantronix currently earns -$0.21 Earnings Per Share (EPS). The EPS for LTRX is expected to be $0.19 (min: $0.19, max: $0.19) in 2022.

Market capitalisation

In November 2021, Lantronix had a market capitalization of $0.25 billion. In terms of market cap, Lantronix is ranked 5087th worldwide. As a measure of a company’s value, market capitalization is the total market value of its outstanding shares, also known as the market cap.

2. Veritone Inc. (VERI)

AiWARE is exclusive to Veritone Inc. It was the world’s first AI OS. But in a fast-paced IT business, it’s also well-known.

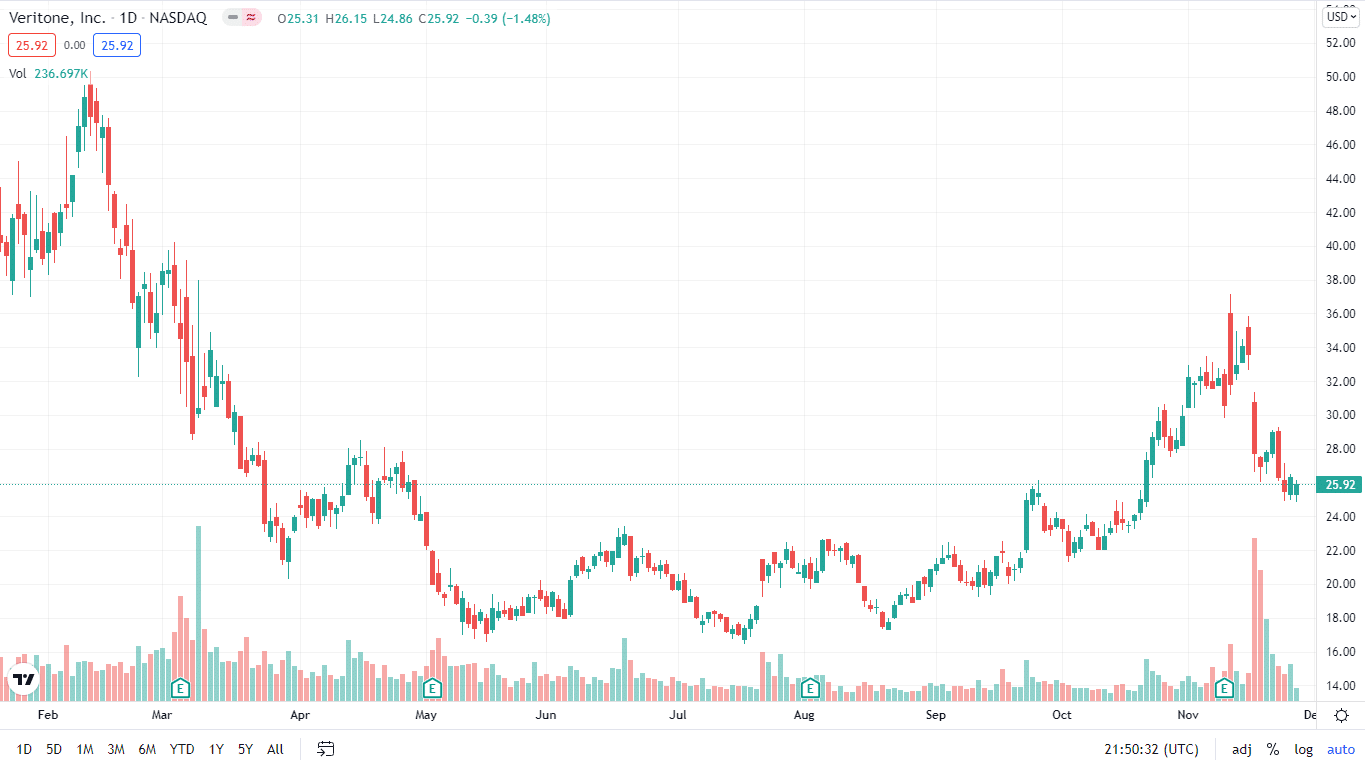

VERI chart

Price

On 2021-11-28, the Veritone quote is 25.92 USD. It’s 52 Week ranging from 16.45 – 50.34. Veritone Inc.’s price target estimates from analysts range from 40.00 to 51.00 for the next 12 months, with a high estimate of 51.00 and a low estimate of 27.00. This represents a +54.08% gain from last year’s closing price of 25.92.

EPS

Veritone Inc. currently earns -$2.11 in Earnings Per Share (EPS). The EPS for LTRX is expected to be ($1.75) per share to ($0.56) per share by 2022.

Market capitalisation

Veritone currently has a market cap of $0.90 billion as of November 2021. As a result, Veritone is still ranked 4294th by market cap in the world. It is commonly used to measure how much a company is worth. Generally, a company’s market capitalization is the total market value of its outstanding shares.

3. AudioEye Inc. (AEYE)

AudioEye utilizes AI to discover and rectify errors in digital content that prevent disabled individuals from accessing it.

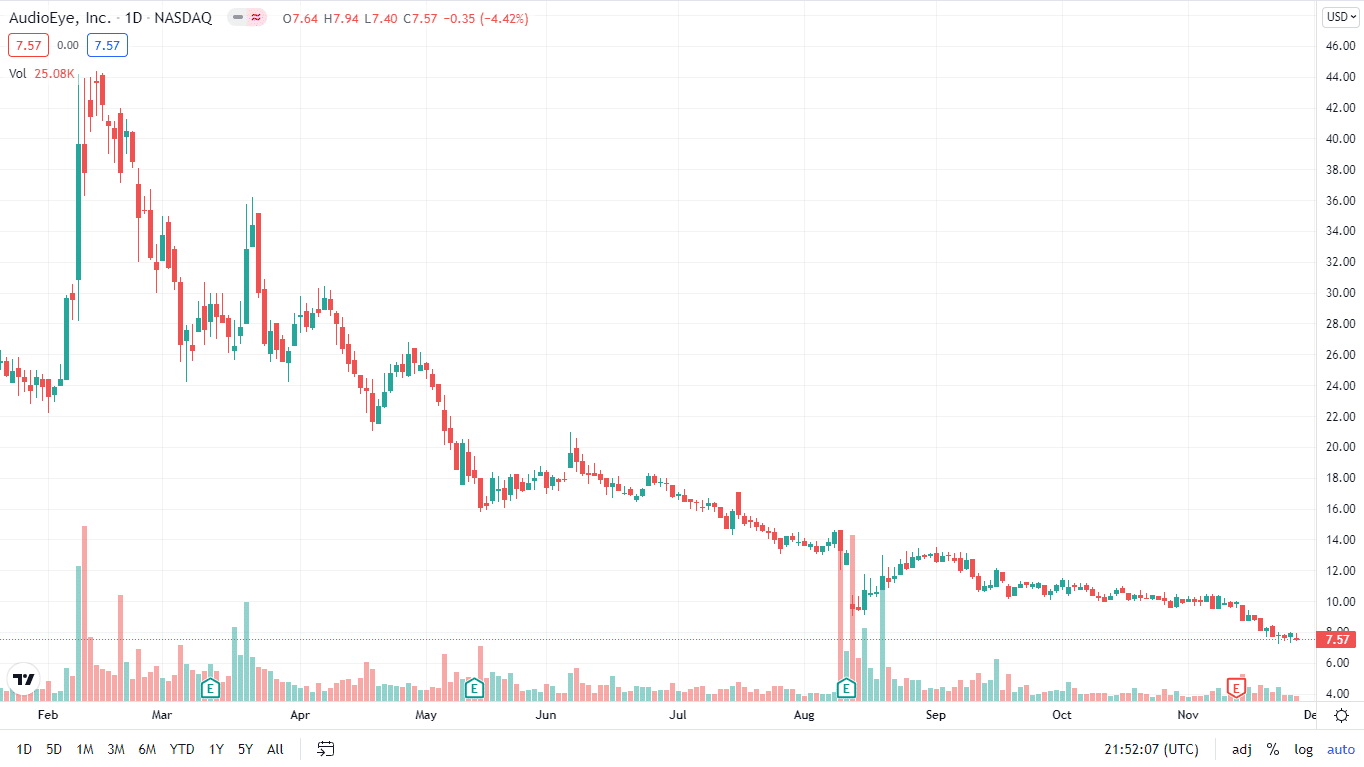

AudioEye Inc. chart

Price

On 2021-11-28, AudioEye Inc’s stock price was 7.64 USD. It’s 52 week ranging from 7.22-44.37. Analysts expect AudioEye Inc’s share price to reach 16.00 within the next year, with a high prediction of 17.00 and a low prediction of 15.00. The median estimate represents a +107.52% increase from the last price of 7.64.

EPS

AEYE’s current Earnings Per Share (EPS) stands at -1.14. Analysts forecast that AEYE’s EPS will be $-1.23 for 2021, with the lowest estimate of $-1.23 and the highest estimate of $-1.22. Analysts expect AEYE’s EPS to be $-1.30 in 2022, with the lowest estimate at $-1.48 and the highest estimate at $-1.12. The company’s EPS is forecast to reach $1.12 in 2023.

Market capitalisation

Audioeye has a market capitalization of 85.95 million. Shares in Audioeye’s equity are measured by market capitalization.

How to buy artificial intelligence stocks?

Let’s explore the steps to buy stocks.

Step1. Select a broker

The broker permits you to purchase and sell stocks and receives dividends. To establish an account, you must provide basic financial information, such as your bank account number.

Start by looking for a broker online. Most brokers don’t charge commissions for stock trading and don’t need a minimum deposit. To trade less regularly, you may use a trading app.

Step 2. Calculate the investment for trade

Before continuing, figure out how much stock you can afford right now. Good news for new investors. Many brokers provide fractional share trading. So you may even buy a little piece of the most costly stocks. Begin small. Using no-commission internet brokers might save you a lot.

If you want to invest more than a few thousand dollars, diversify your portfolio by buying many stocks.

Step 3. Understand the stock market

To decide whether or not to invest in a business, you must first investigate it. To accomplish this takes a lot of time and work.

To invest wisely, you must understand the company, its products, finances, and industry. So you’ll need to review the company’s SEC filings (SEC). This is the ideal location to learn about what you’re investing in, and its potential. You may also use professional tactics, such as studying, to your benefit.

Step 4. Make a trade

Buy or sell at the current market price. You won’t be able to control the trading price. A limit order enables you to purchase or sell at a specific price. The order will not go through without a better offer. Limit orders might last up to three months, depending on the broker.

Market orders are better when there are few shares, or the stock is liquid. With fewer shares traded, limit orders are preferable for smaller firms and those who do not wish to affect the price.

Step 5. Tracking of your stock

Investments do not cease when shares are purchased. Keep track of quarterly or annual earnings and market developments for your new job. If the company is performing well, you may be able to boost the salary. As your expertise grows, you may add to your portfolio by buying more stocks.

Your stock price will drop at some point, even if just temporarily. Knowing more about the company might help you decide whether to acquire more shares at a bargain or sell them.

Final thoughts

According to a comprehensive analysis of all artificial intelligence (AI) stocks under $10, the AI market has tremendous potential for increasing its stock value.

Stocks with high AI potential are those that meet the stocker’s specific needs and provide a strong prediction. This is a common occurrence that the AI stock prediction receives its roots from AI penny stocks, and it is recommended that these stocks be taken into account.

Comments