The growth in the energy sector in North America has something to do not only with oil but also with natural gas. While oil drilling has exploded on one front, natural gas production has blasted on another front. The latter sent the wholesale price of natural gas down by more than 50% in the past three years.

Lately, the rate of producing natural gas seems to fall behind the demand, sending the commodity price higher again. When this happens, companies operating in the field could see a boost in their bottom line, which may reward investors holding on to their portfolios.

Apart from owning individual stocks, one way to get involved with the natural gas sector is through natural gas ETFs. One benefit to this investment vehicle is that active management is not necessary. Also, your investment is more likely to survive bad market conditions than individual stocks. The trade-off is that you are not expected to make significant returns possible withholding performing stocks.

What are natural gas ETFs?

Natural gas ETFs give investors exposure to natural gas without keeping the commodity in its physical form and without the hassle of trading natural gas in the futures market. Natural gas is mainly utilized as an energy source for cooking, heating, electricity generation, and fuel applications. As with other types of commodities, supply and demand affect natural gas prices.

How to buy natural gas ETFs?

To buy natural-gas ETFs, you need to find and create an account with sellers that sell them. Your main options are traditional brokerage firms and online brokers. However, you may find these products as investment options in your retirement package. Another seller is a robo-advisor such as Wealthfront and Betterment.

You can trade natural-gas ETFs as you would any stock when you get a brokerage account. If you are an active investor, consider getting an account from a broker-dealer. If you want a passive approach to investing, a robo-advisor might make sense. The investment portfolios of robo-advisors typically cover ETFs.

Top five natural gas ETFs to buy in 2022

You can find a multitude of ETFs that could provide you with exposure to natural gas. You might find one or two that fit your investing style. We present five natural gas ETFs in this section that differently approaches investing in this commodity.

№ 1. First Trust Natural Gas ETF (FCG)

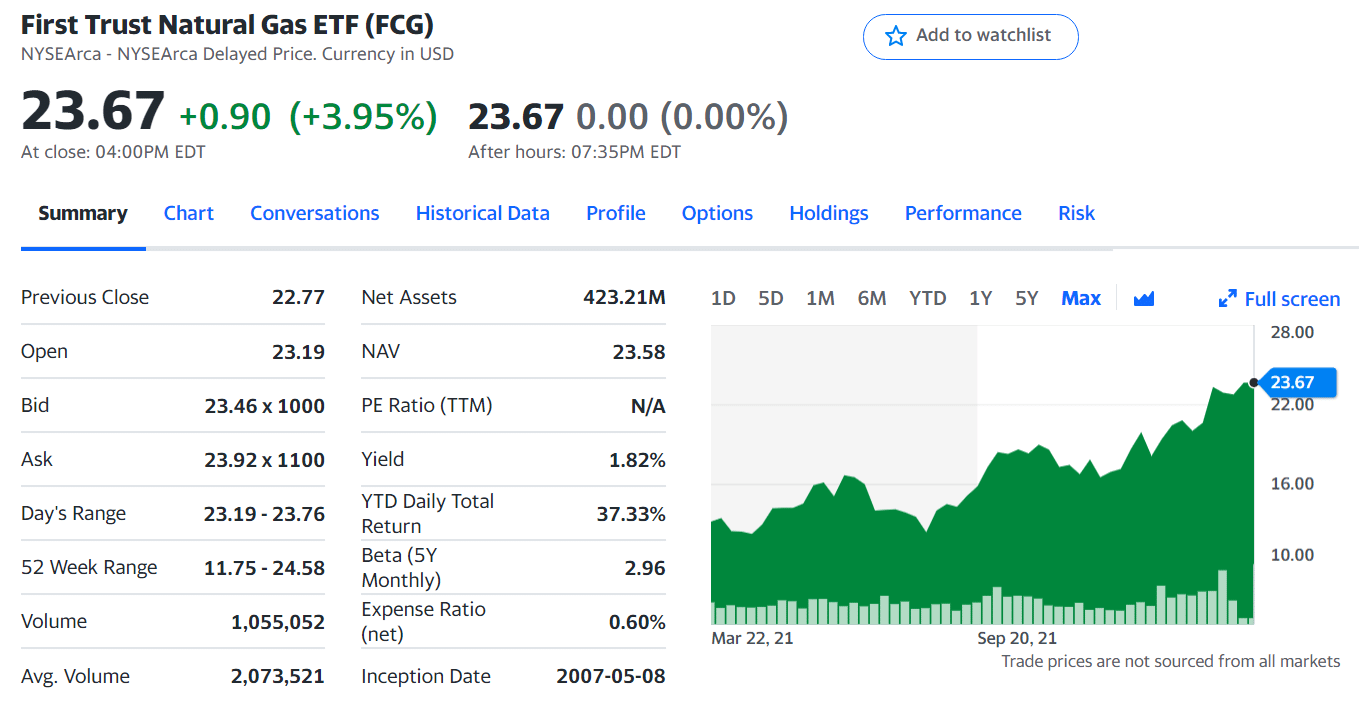

FCG ETF summary

FCG aims to imitate the results, in terms of return and valuation, of the ISE-Revere Natural Gas Index, an equity index. To achieve this, the FCG fund puts the majority of its funds in MLP units, depositary receipts, and common stocks.

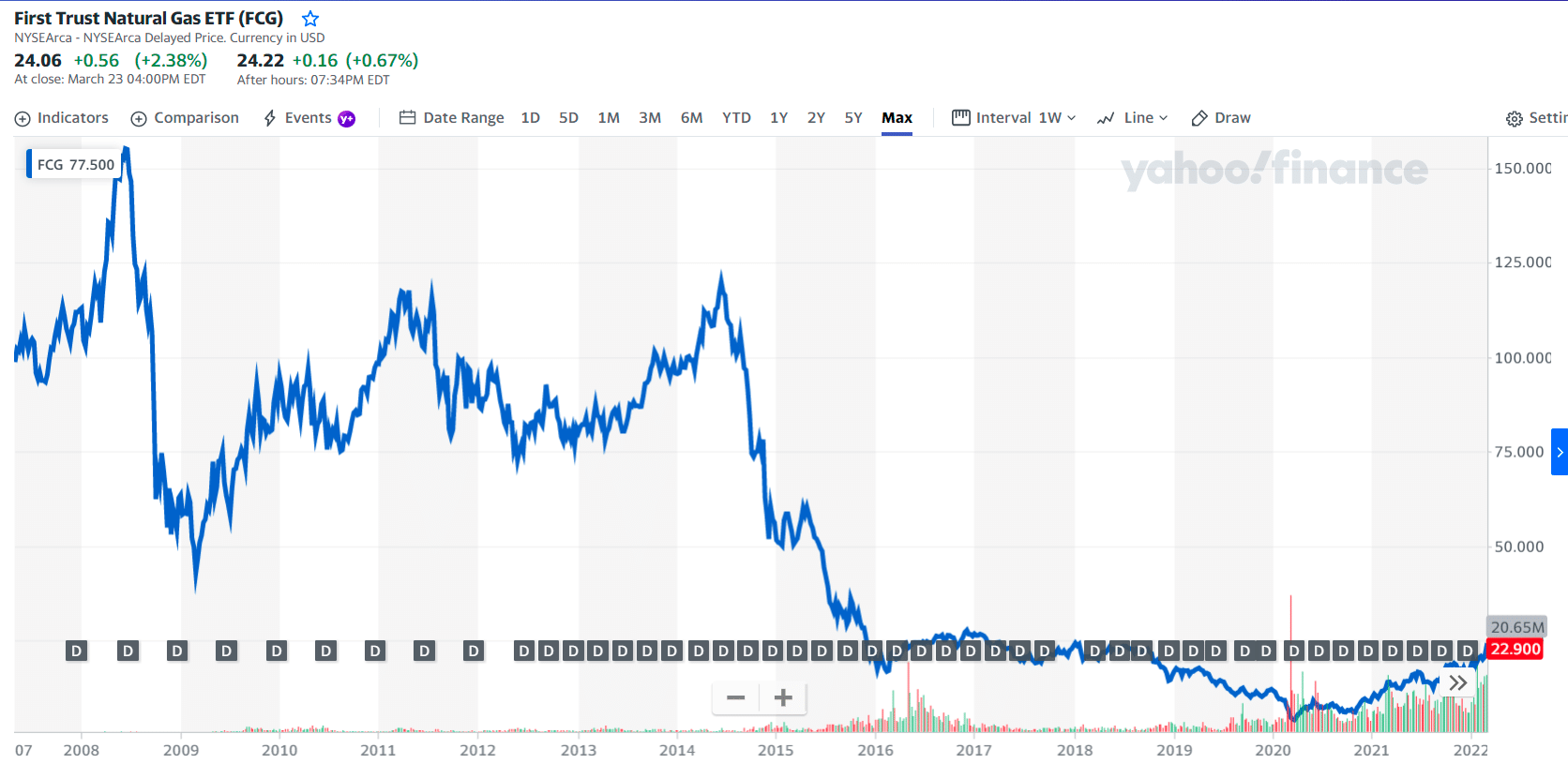

FCG price chart

Almost 100% of the fund’s investments are dedicated to stocks. Below are their top three holdings:

- DCP Midstream LP (DCP) – 4.83%

- Occidental Petroleum Corp (OXY) – 4.78%

- ConocoPhillips (COP) – 4.33%

Established in 2007, the FCG ETF has been in operation for 14 years, and its history is fraught with challenges. It encountered nine losing years, though it managed to survive to this day. The good thing is that the fund made a decent gain of 98.76% in 2021, its biggest gain so far. In recent times, FCG is doing so well, having a three-year return of 16.22%, one-year return of 71.58%, and YTD return of 37.33%.

№ 2. United States 12 Month Natural Gas Fund (UNL)

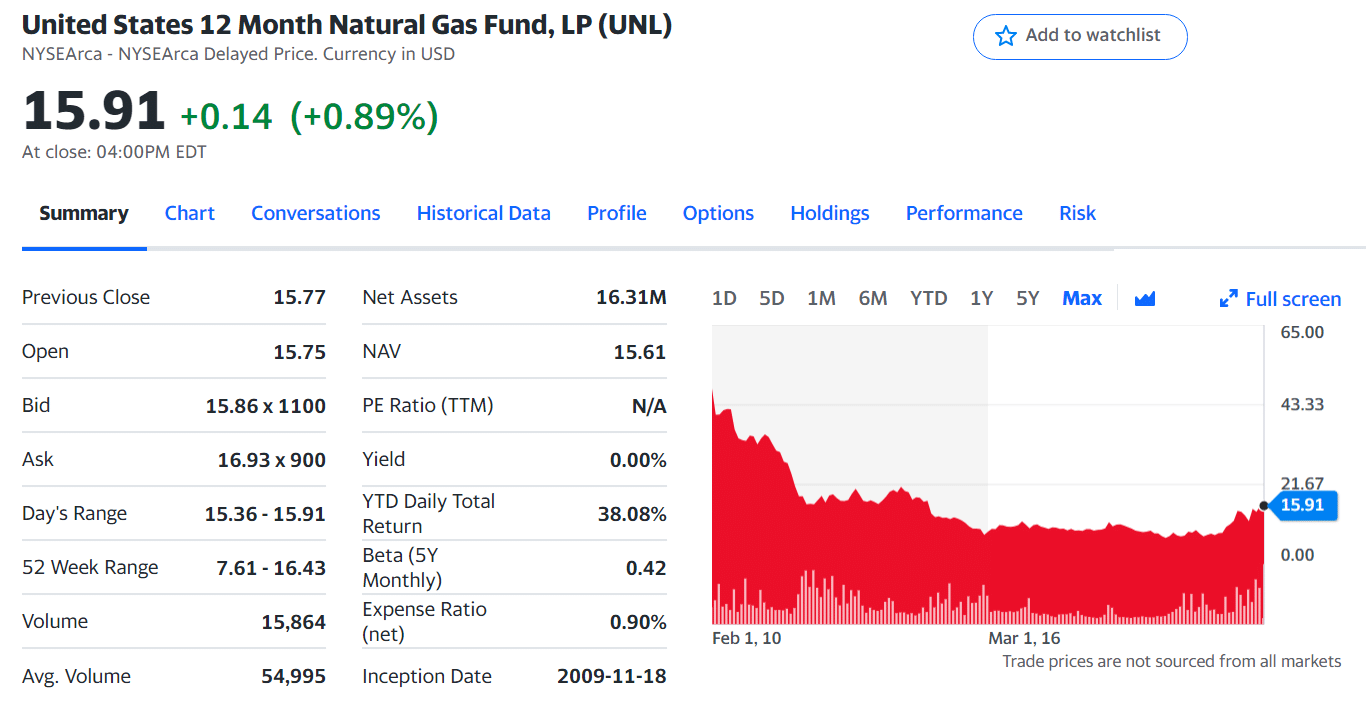

UNL ETF summary

The UNL ETF attempts to closely follow the daily fluctuations in the price of natural gas in Louisiana as represented by the average daily fluctuations of the values of some defined short-term natural-gas futures contracts. The benchmark assets are natural-gas futures contracts being traded on NYMEX.

It is not so clear how the ETF specifically appropriates its investment funds. However, one thing is for sure it puts 13.87% of its funds on bonds.

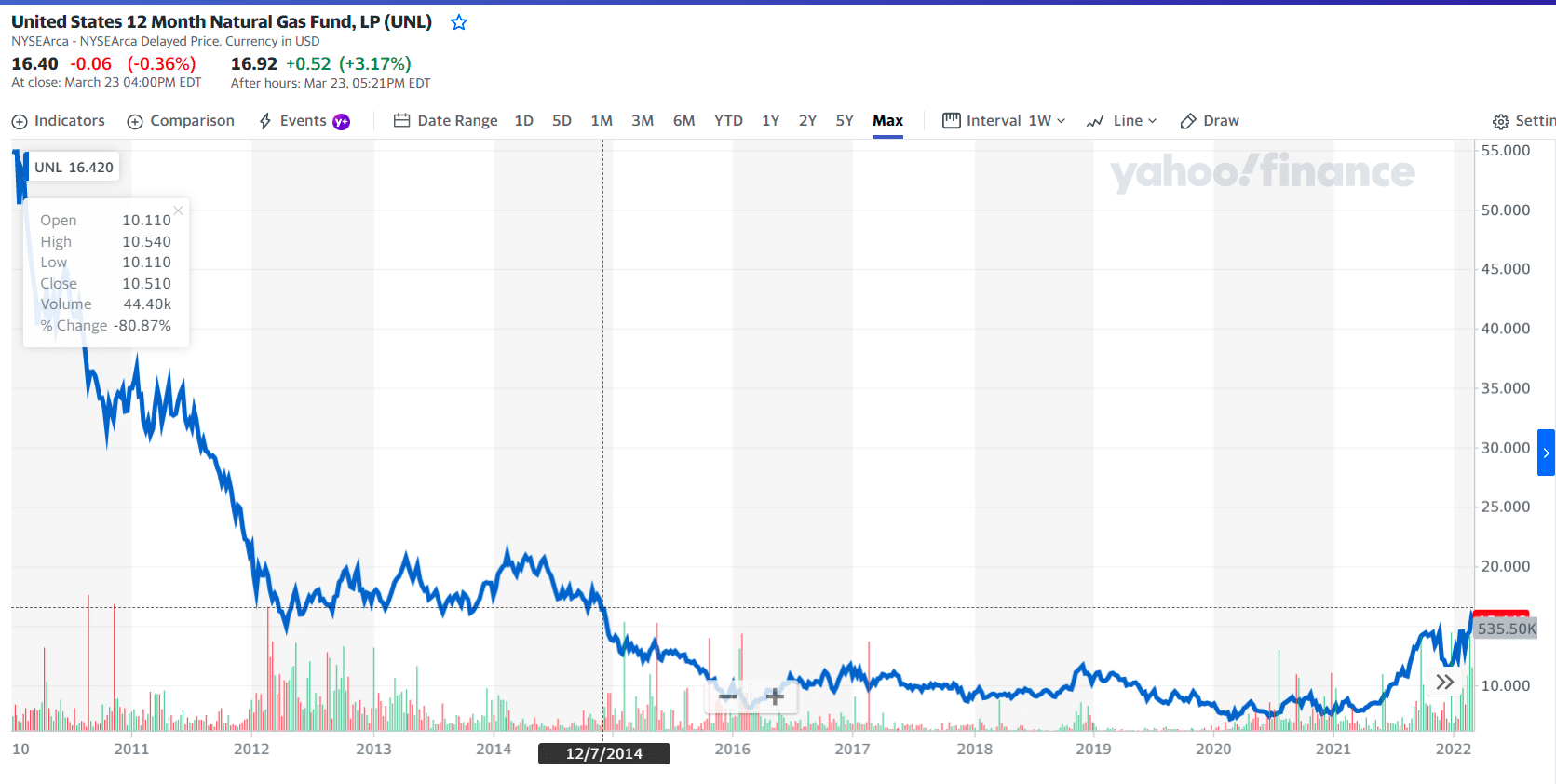

UNL price chart

UNL’s top three holdings are:

- Future Contract on Natural Gas Futr Jan21 – 5.08%

- Natural Gas Futr Feb21 – 4.6%

- Future Contract on Natural Gas Futr Dec20 – 4.46%

Launched in 2009, UNL has been around for 12 years, and eight of these years were losing years for the fund. The fund’s recent performance looks good, having a three-year return of 13.5%, a one-year return of 93.82%, and a YTD return of 38.08%. Its most considerable profit came in 2021 at 50.58%.

№ 3. United States Natural Gas Fund (UNG)

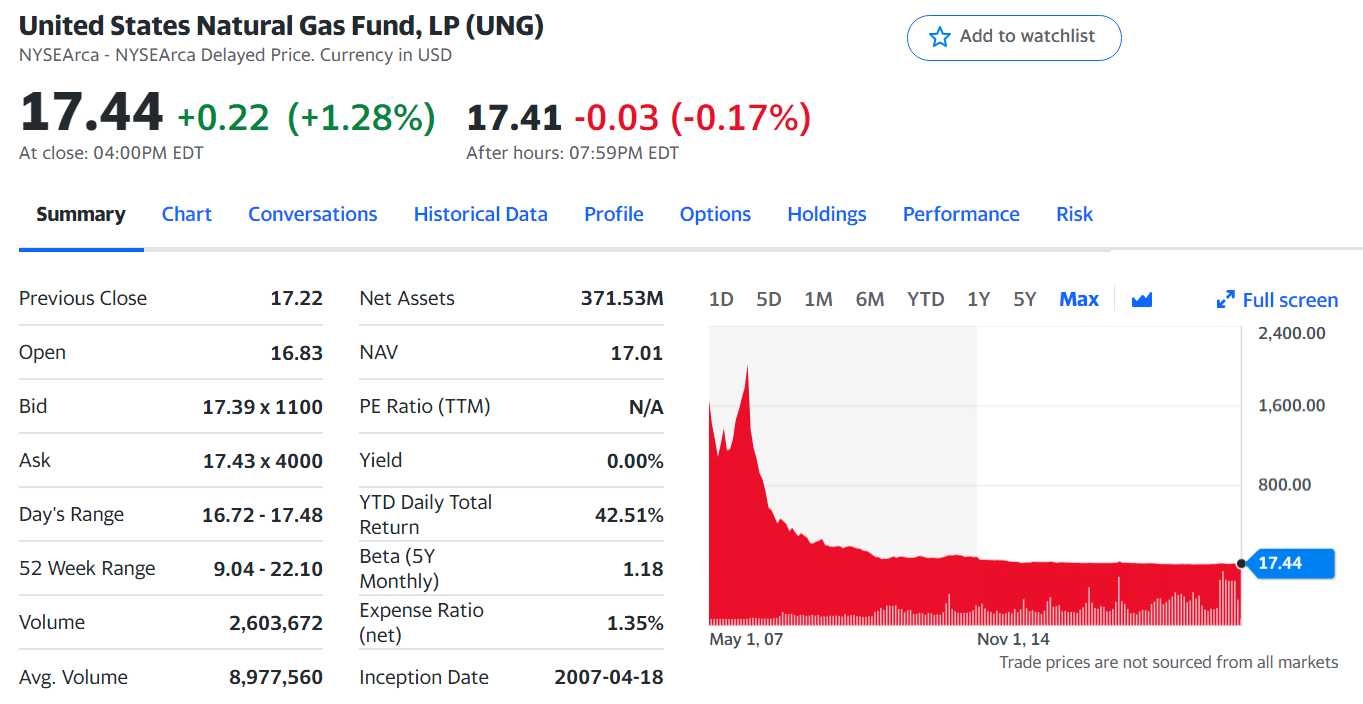

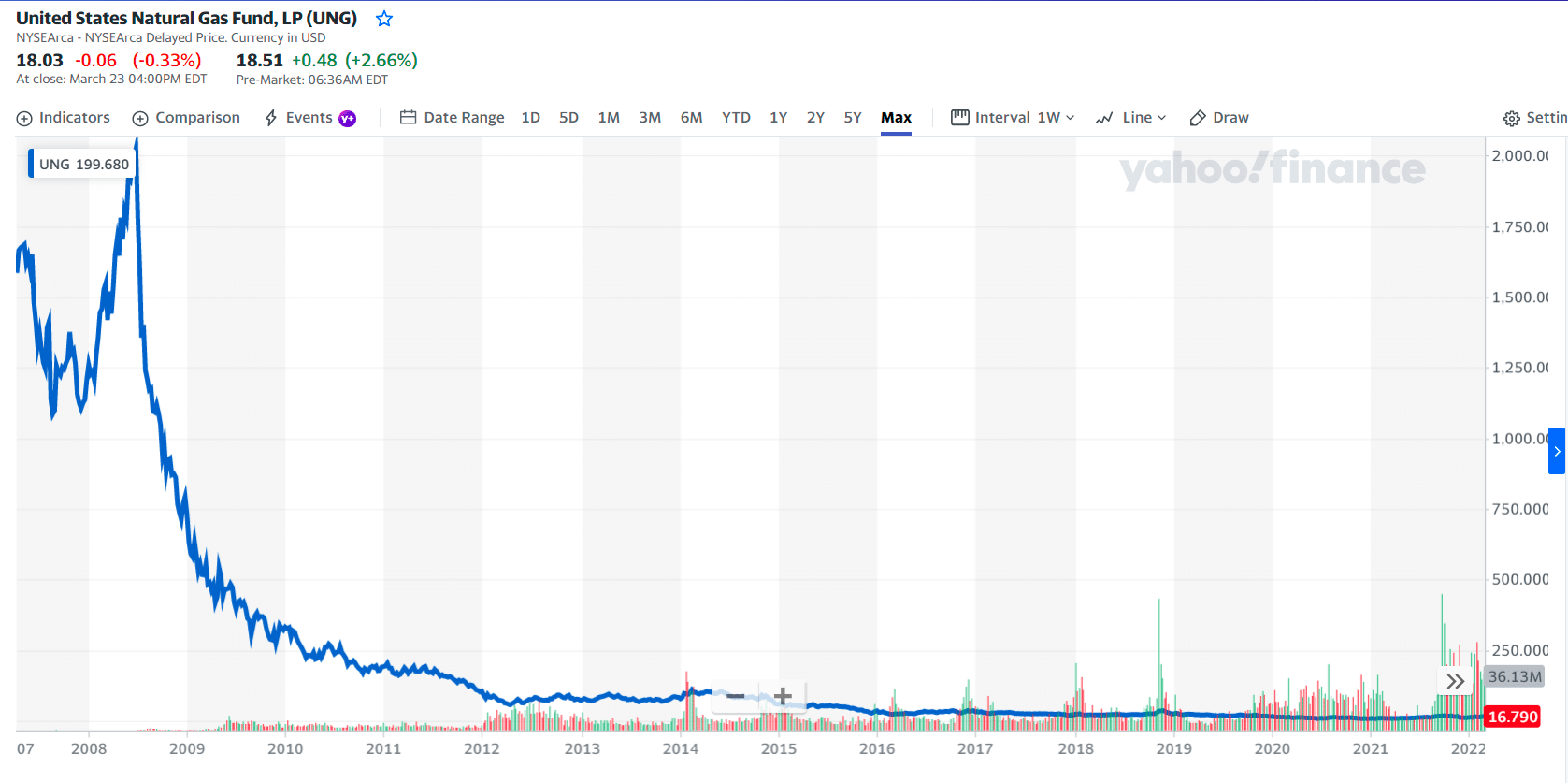

UNG ETF summary

The UNG ETF attempts to closely follow the daily fluctuations in the price of natural gas in Louisiana as represented by the average daily fluctuations of the values of some defined short-term natural-gas futures contracts. The ETF heavily devotes its funds to natural-gas futures contracts traded in ICE Futures Europe, NYMEX, ICE Futures US, and other domestic and international exchanges.

UNG price chart

UNG puts 14.39% of its funds in bonds, and the top three holdings are as follows:

- Future Contract on Natural Gas Futr May20 – 48.85%

- Goldman Sachs FS Government Instl (FGTXX) – 7.95%

- FidelityA Inv MM Fds Government Instl (FRGXX) – 6.94%

UNG’s 14 years of existence has experienced ten losing years, making its profitability low at around 28%. The ETF has returned an average of -11.16% in the last three years. Meanwhile, its one-year return is positive at 72.1%, and its YTD return is 42.51%. That is why the fund has a zero dividend yield as of this time. The fund might attract few investors because of a somewhat high expense ratio of 1.35%.

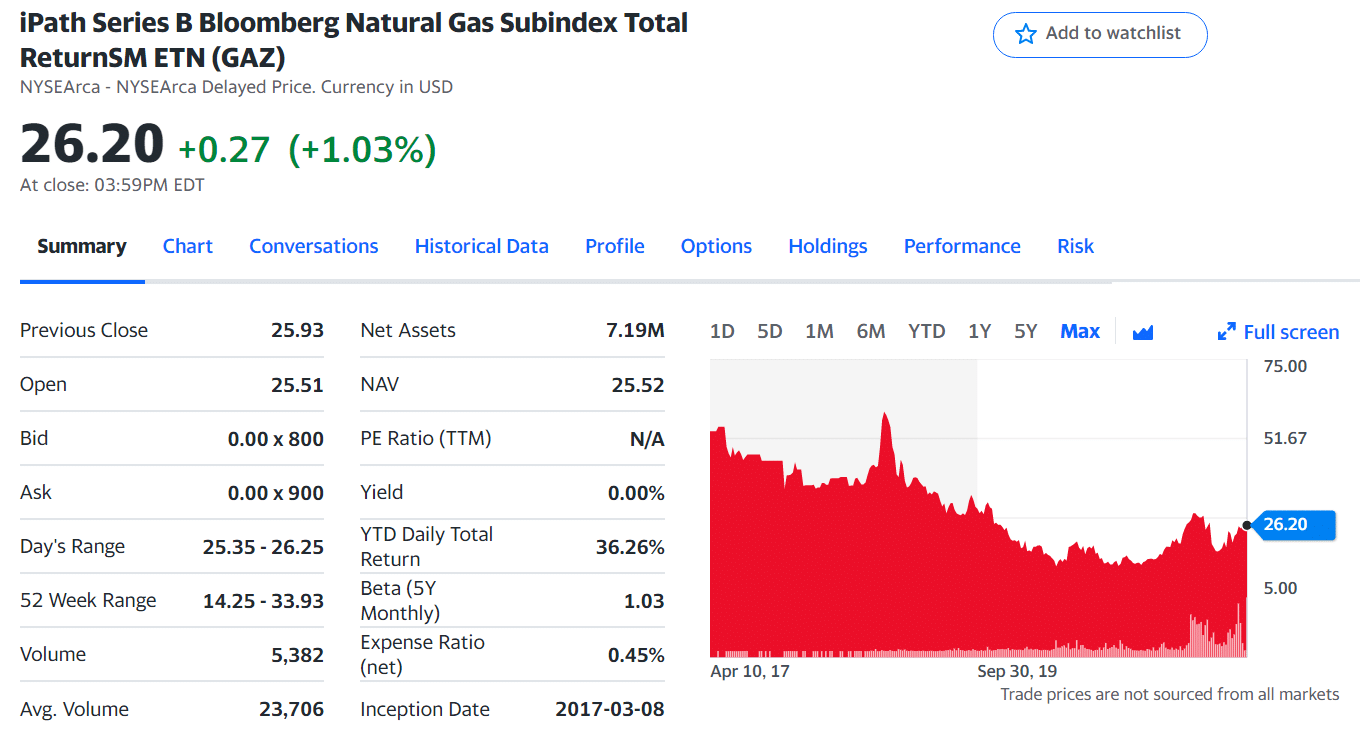

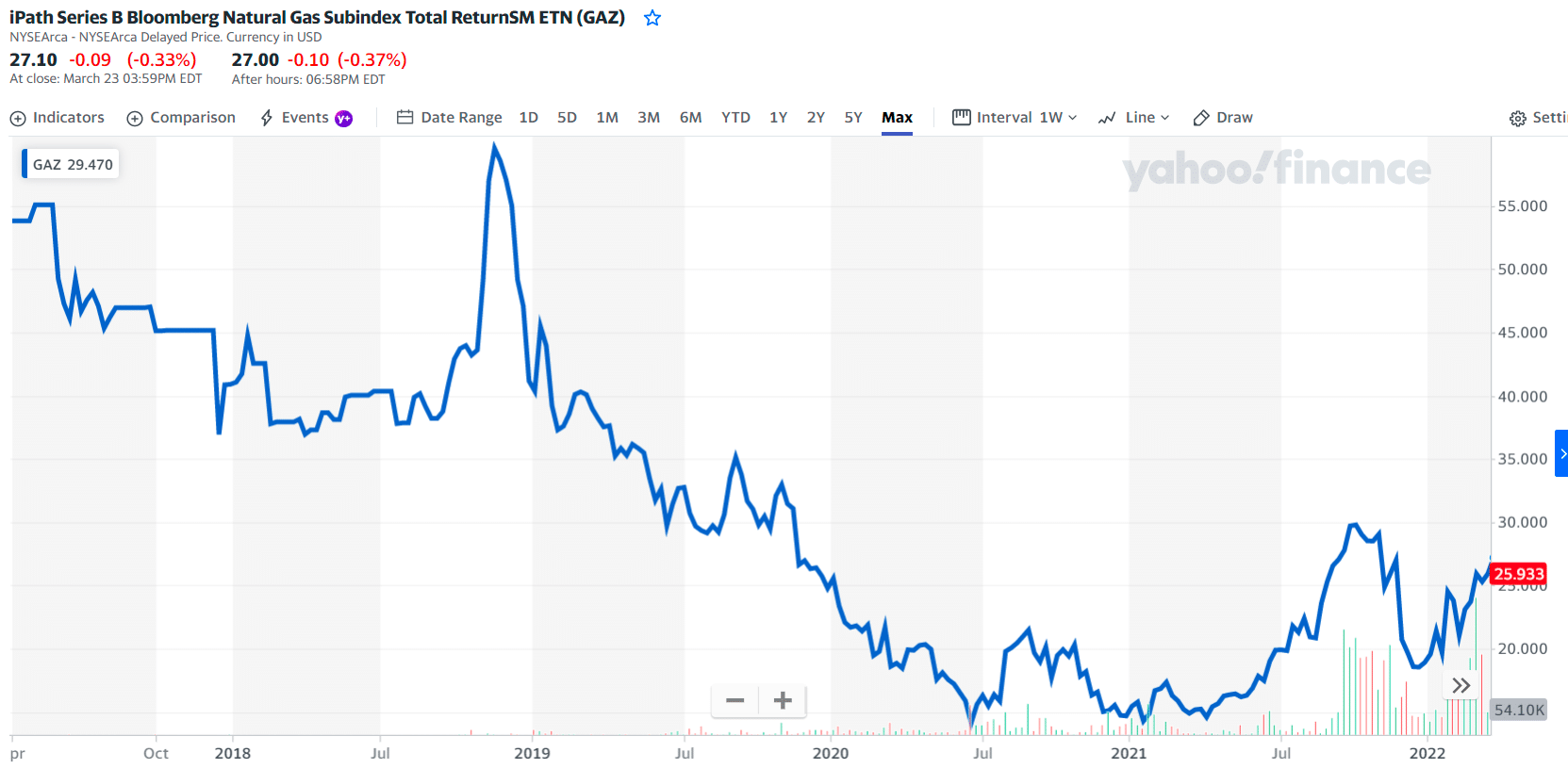

№ 4. iPath Series B Bloomberg Natural Gas Subindex Total Return ETN (GAZ)

GAZ ETF summary

The GAZ ETF exposes investors to the Bloomberg NG Subindex Total Return Index. This index embodies yields available via unleveraged security in futures contracts and interest generated on cash deposited in particular Treasury Bills. The ETF does not provide information on how it appropriates its investment funds and where it invests its money.

GAZ price chart

The GAZ ETF is barely six years in business, and it encountered losses in the first three years of operation. However, it managed to make profits in 2021 at 27.49%. While its three-year return is negative at -14.14%, its one-year return is positive at 60.7% and YTD return at 36.26%. Its current dividend yield is zero.

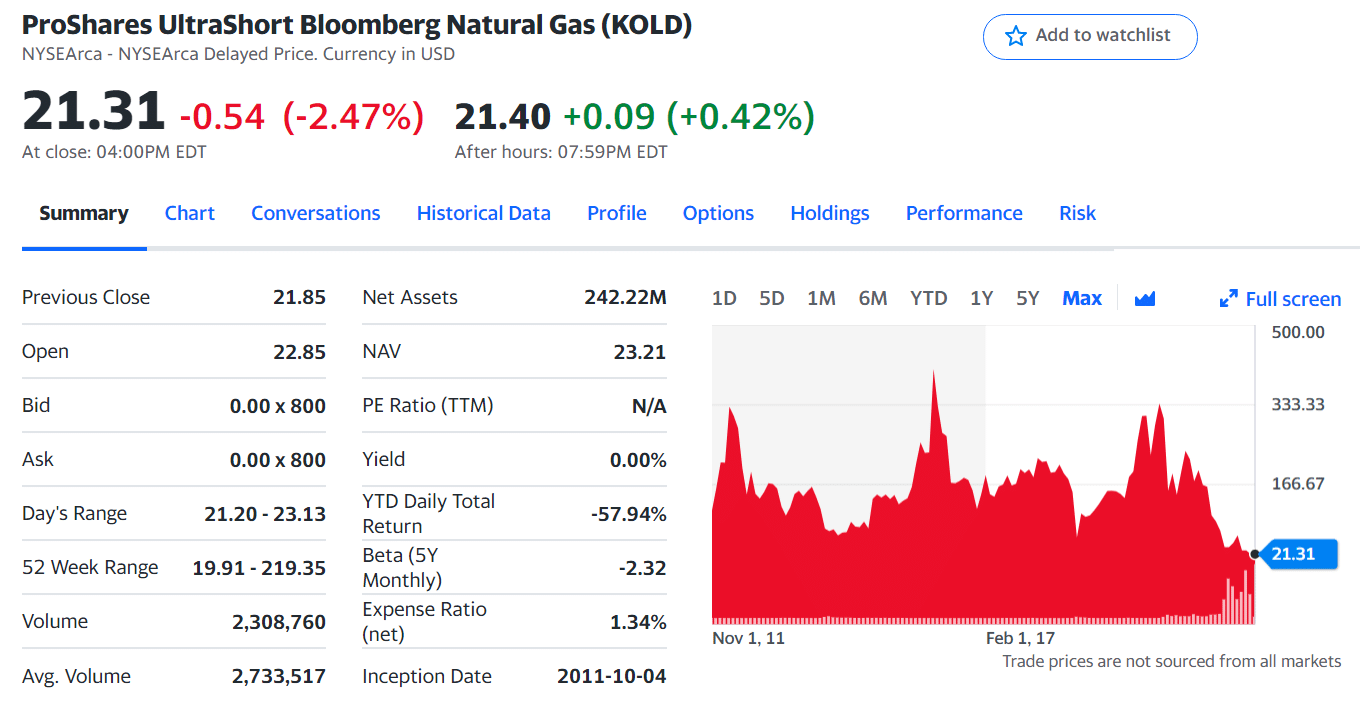

№ 5. ProShares UltraShort Bloomberg Natural Gas (KOLD)

KOLD ETF summary

The KOLD ETF desires to generate returns double the reverse of the daily results of the Dow Jones-UBS Natural Gas Subindex. Though it looks counterintuitive, the fund allocates 200% of its funds in Natural Gas Futr Sep21.

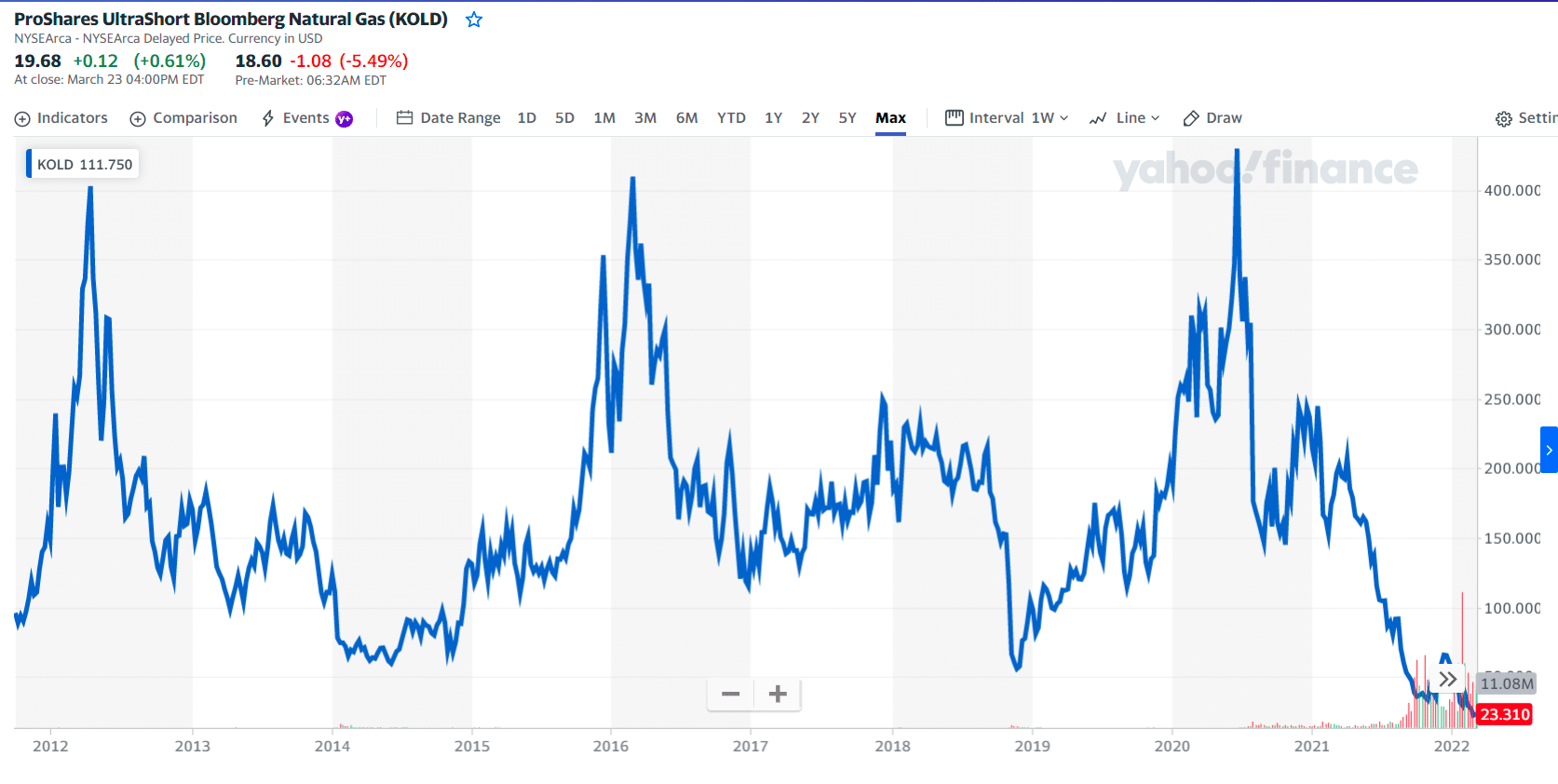

KOLD price chart

KOLD has been in operation for ten years, with four years in the loss. In contrast with the ETFs previously mentioned, this ETF suffered a -74.01% loss in 2021, its most significant loss so far. That is why its three-year, one-year, and YTD returns are negative at -35.79%, -86.05%, and -57.94%, respectively.

Final thoughts

Companies operating in the natural gas industry could not produce consistent returns over the years due to the falling prices of the commodity. You can see that the ETFs covered in this post encountered multiple losing years, but they are still in the game.

Recently, particularly in the previous year (2021), the industry looks poised to make a huge run. If the trend continues in the coming years, investors might greatly benefit. If you think that the price of natural gas will make a recovery shortly based on your market analysis, then now may be the best time to get on board.

Comments