You can gain access to huge trading funds in spot trading while holding minimal capital. This is possible through leverage or margin trading. The concept is similar to taking a home mortgage. For instance, to get a house that costs $1 million, you must put a down payment of $100,000 and pay the rest through a bank loan. In doing so, you pay the bank some interest.

Nowadays, crypto trading is available to everyone due to the low barrier to entry. You can just put in a small capital and command large trading volumes. Lately, margin or leveraging trading is starting to manifest in the crypto market. Some brokers and platforms now make it possible to purchase leveraged crypto products. You must decide if you get this type of account and how much leverage you would like to utilize.

Before you trade with leverage, there are at least five things you must know. You will learn that shortly as you read this material. For now, let us get a good idea of what leveraged crypto trading is.

What is leveraged crypto trading?

It is a feature that brokers offer traders engaged in crypto spot trading. With this feature, you can buy and sell large volumes of crypto assets using capital borrowed from your broker. Typically, this capital goes beyond the deposited amount in your brokerage account. This feature increases the buying power of ordinary traders to maximize profits.

Although the concept of making huge money with a small capital sounds fascinating, the other side of the coin is an elevated risk. Let us take an example to explain this concept. With leverage, you can get a $5,000 margin account using a capital of $500 by taking ten times leverage.

Crypto trading itself is already risky. Leverage only magnifies the risk, subjecting your account to significant drawdown or potential liquidation. Because experienced traders are susceptible to substantial losses, novice traders should decide very carefully. You can dabble a small amount of money when trading on a margin to limit the risk.

Margin trading concept

How does crypto margin trading work?

Margin trading lets you command bigger positions concerning your account balance and thus potentially make more enormous profits. You can often command anywhere from five to 300 times the amount necessary to initiate a trade. The amount of capital required to open a position in crypto margin trading is called margin.

Let us use an example to grasp the concept. Your broker requires a two percent margin to initiate a trade with 50 times leverage. In this case, you must set aside two percent of your account balance and encumber it to a specific position you want to take. If you want to buy, say, $25,000 worth of Bitcoin, and your broker requires a two percent margin, you must have at least $500 in your account to initiate this trade.

Top five things to know about margin crypto trading

Before engaging in margin trading, make sure you understand the five things below.

Margin trading cuts both ways

Take note, however, that this type of trading opens up your account to elevated market risk. This will happen if the position you have taken does not work in your favor.

Liquidating your entire account is possible with margin trading. It may not come quickly, but it can happen. If you buy Bitcoin, for example, a ten percent swing in your account in both directions in a matter of one week is not impossible. In the past, when the volatility of BTC was extreme, the value of the asset plummeted 30 percent in just one week.

Control the trade risk

No matter what the win rate of your trading system is, each trade that you execute has the potential to fail. Due to the inherent high volatility, the market can quickly go against your trade. Because of this, you need to control the risk in each deal. Risking more than five percent of your balance is generally regarded as an excessive risk. Most experts counsel novice traders to risk at most two percent of their capital in each trade.

Protect your capital with a stop loss

Setting the maximum risk always involves defining the risk percentage and using a static stop loss. While the risk percentage defines the risk in dollar amount, the stop-loss translates the risk in trading volume.

You can first decide the amount to risk in a trade and then adjust the trade volume depending on the distance of your stop loss from your entry. This distance rests on your trading approach. Depending on your broker or platform, you can use a stop based on price, dollar amount, or percentage loss.

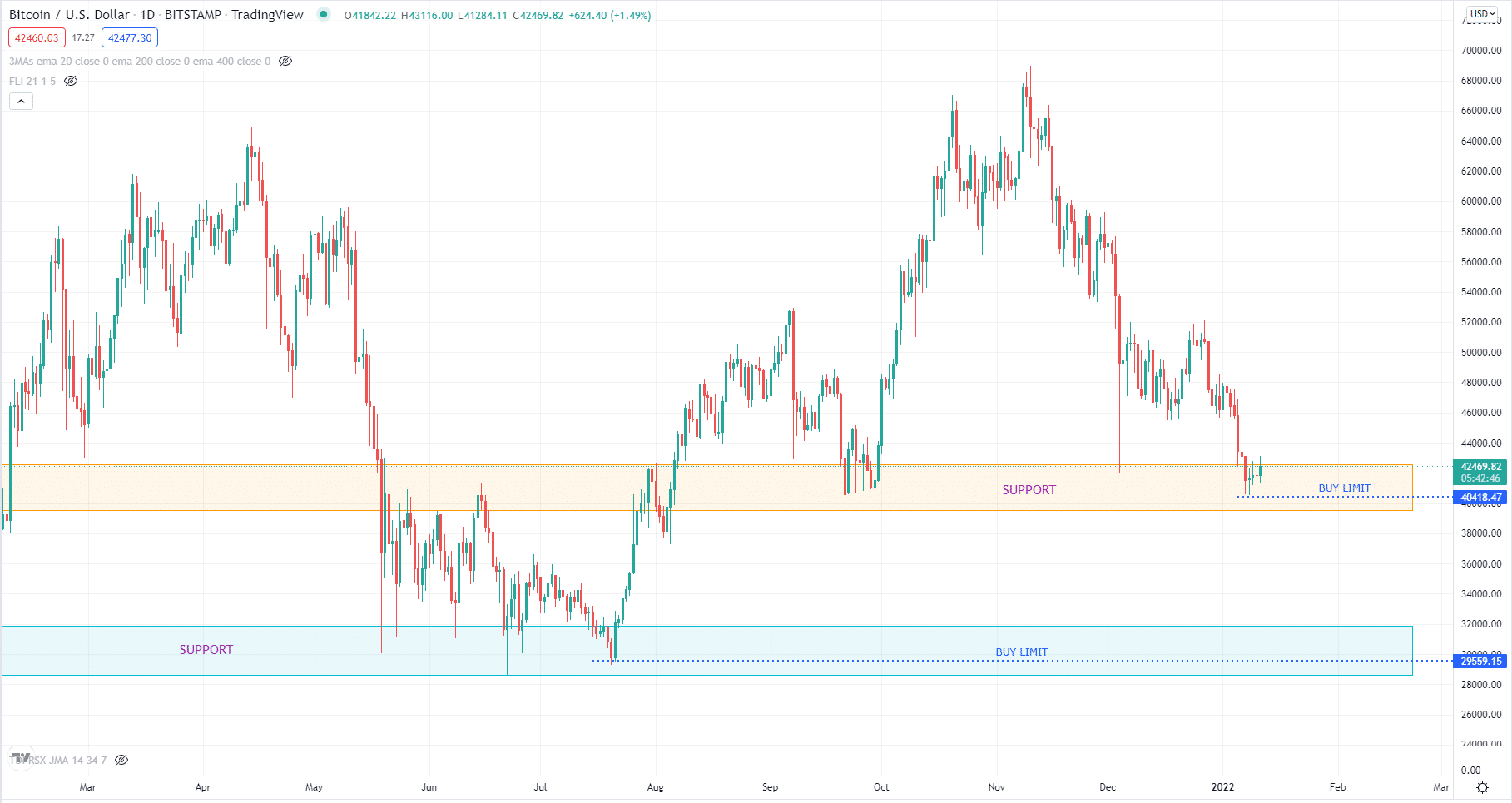

Sample buy limit orders for BTC

Take advantage of limit orders

Several trading platforms allow you to take long trades only. Depending on your strategy, this can be either good or bad. One good thing about this functionality is that taking buy trades allows you to simplify your market analysis.

You can use a buy limit order to enter trades at great prices instead of a market buy order. Just place your buy order at a support or demand area close to the current price. See sample entries in the above Bitcoin daily price chart.

Get the best leverage

Leverage can range from five to one thousand. Aiming for high leverage is not a good idea. The higher the leverage, the higher the risk. You should not use more than five times leverage as a beginner in crypto trading. At present, this applies to BTC and all altcoins because all coins seem to move in unison and fluctuate in similar degrees.

Final thoughts

Before you engage in crypto trading, you must understand if the broker you consider using provides leveraged accounts or leveraged crypto products. If that is the case, decide how much leverage you will assume. If you see that a crypto product has x300, that means the product has 300 times the margin. If you are a novice trader, select assets with x5 or x10 leverage and not more.

Comments