We have always learned about debt as a negative terminology. Obviously, who can enjoy getting properties mortgaged or drenching in student or other financial loans? But surprisingly, debt isn’t only limited to this. You can also use it positively by investing.

Lend money to others for their debt even if you have your loans and get return bonuses. You can do this by cooperating with loan programs, by buying bonds or tax lien, or with banks, to name some. In either case, you invest an amount with guaranteed repayment and bonus.

So, let’s shed more light on this positive aspect of debt, learn what it is and how this horrified term benefits you.

What is debt?

It is a term used to define a fixed amount of money that you owe or is due. In other words, one lends money to another with a promise to get it paid back, with or without interest.

It’s further divided into four subtypes:

- Collateralized or secured

- Unsecured

- Corporate

- Revolving

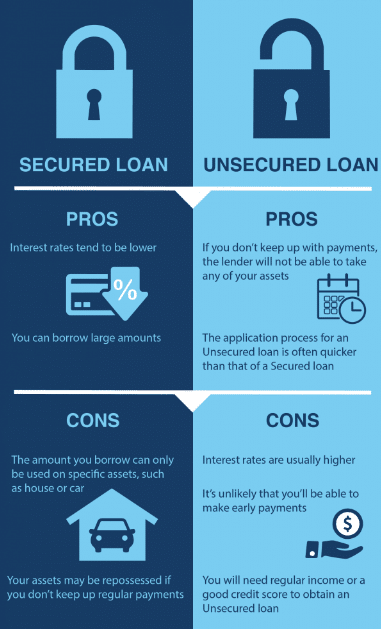

Loans related to credit cards, car or house loans, and student loans come under secured and unsecured debt.

Secured vs. unsecured loan

Corporate debts include bonds or other fundraising loans. People also apply for a new loan or debt consolidation to pay off their several previous loans. In this way, the new loan becomes the only due debt with less interest and rescheduled repayment date.

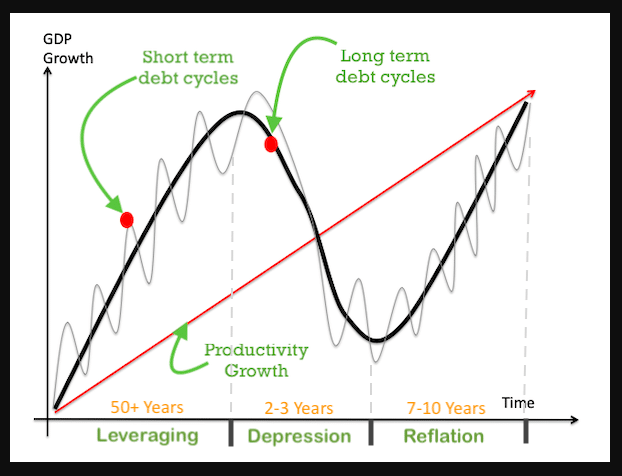

Debt period

The debt interest refers to the additional amount the borrower has to pay with the principal amount or the amount initially owed. It is denoted in percentages like 15% interest on the loan of $10,000 annual percentage yield or APY due for ten years, annually.

Debt calls for a fixed rate and a fixed repaying schedule. The debt schedule is the time limit until when the borrower has to repay the loan. However, the maturity date is the day when the borrower pays off the complete loan.

How to pay off debts?

It is profitable to pay off debt faster as it can aid you in saving a considerable amount for your other financial goals. However, it also involves strategic steps to repay the loan before or within the due date. Yet, it depends on how much loan you have, the due date, and how much you can pay.

You should pay off the most expensive debt first to reduce the loan and avoid credit risk. You can also pay more than the fixed amount monthly or more than once. Keeping the records of the bills, debt, or other finances, you can also repay the loan faster and in less time.

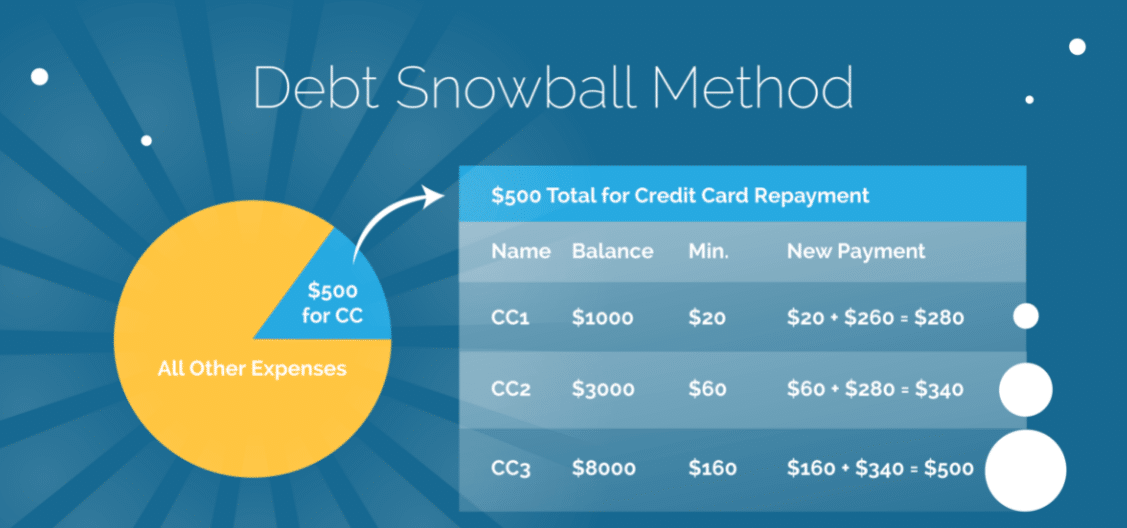

By shortening the time horizon of the loans or consolidating with others, you can also pay off your debts faster. Burrowers can also use a snowball method like below.

Pay debt faster with the snowball method

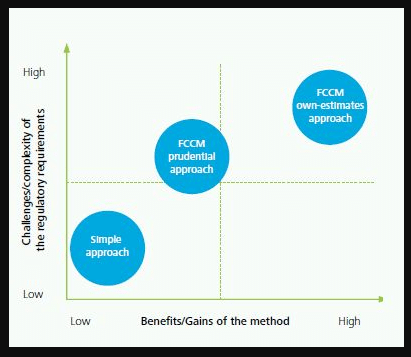

What drives the riskiness of debt?

The significant risk of debt comes when the borrower becomes unable to repay the loan. According to this, people get credit scores, and if companies can’t compensate, they get credit ratings. Therefore, there is mostly an assessment about whether they can pay back before lending them money.

Credit risk is the inability of the borrower to repay the principal and interest at the scheduled time. With the lower risk rating, the risk becomes higher that the borrower can’t repay. The borrower has to pay a higher interest rate on a higher risk rating to overcome the credit risk. So, the lower credit risk also offers benefits than higher credit risk’s riskiness.

Low credit risk is beneficial

For the lender, the time horizon also calls for the loan risk. For example, if someone lends money for a long time, or to say 30 years. There is no certainty about what can happen during this time. As a result, you can face a locked amount at the fixed interest that is considered safe from swinging market risks, and in severe cases, you can also miss out on investment options available at that time.

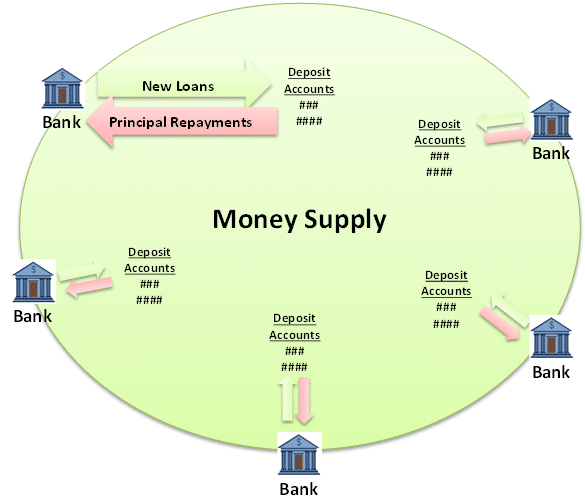

How can you make money on debt?

Now you may get to know what debt holds in it for you. So, let’s discuss how to invest in debt in multiple ways and gain profit. First, of course, the best way is to invest with other investors by either purchasing company shares from stocks or buying the debt of the borrower company.

Earn money by investing in debt

Consider that a company requires a loan of nearly $100,000. You can pay it for them under the condition of payback either individually or by pooling the money with other investors. After the maturity date, you can then divide the principal amount and interest equally among the groups.

Investors can avail themselves of different types of investing in debt opportunities. Like, in real estate debt, corporate debt, or debt owned by small business owners. There are also several options to control the debt risk in collateralized debt.

For instance, the borrower can give something as compensation to control the loan risk of higher interest. The collateral may be any art, jewelry, or asset that the lender can mark default if the borrower can’t repay the loan. The most common debt investment opportunity comes with the real estate loan. As mostly the real estate purchasing requires a large amount so they may need to borrow money.

Main advantages and disadvantages of investing in debt

| Advantages | Disadvantages |

|

|

|

|

|

|

Final thoughts

Debt is money owed to someone under a condition of payback with or without interest rate. It has both negative and positive aspects. It is on you how you manage or deal with it. By investing in debt, you can save money for higher financial goals and manage the cash flow.

Real estate debt investment is, however, the most popular and wide in range. Yet, it is vital to learn about how debt investment works to avoid possible risks.

Comments