In the investment circles, investing for a regular income calls for adopting one of the time-tested strategies, dividend investing. It is the art of picking equities and other investment instruments that payout dividends at predetermined intervals.

Couple this with high-yield stocks, and as an investor, you have a formula not only for a regular income stream but accelerated wealth growth. Furthermore, it is a strategy used to hedge against rising inflation hence ensuring enhanced purchasing power.

Here we take a look at:

- Where to find information on dividend stocks?

- What are the indicators of outstanding dividend-paying stocks?

Where do you find information on dividend stocks?

Dividends refer to the share of a company’s profits distributed to its stakeholders in cash, additional shares, or any other relevant asset. To get accurate information to help you pick the best dividend stocks, below are your best bets.

№ 1. Fundamental information providers

Many websites provide financial data and all the information an investor needs to make an informed decision. In addition, to stay competitive, most of these websites offer tools and summary analysis in addition to their in-house analysts’ opinions on different investment vehicles.

Websites such as Bloomberg, CNBC, YahooFinance, Morningstar, Wall Street Journal, and others provide investors information on the best dividend-paying organizations, the current dividend per share, and when the dividend payout happens.

In addition, they provide data on any press releases relating to the company and other fundamentals that might impact the dividends.

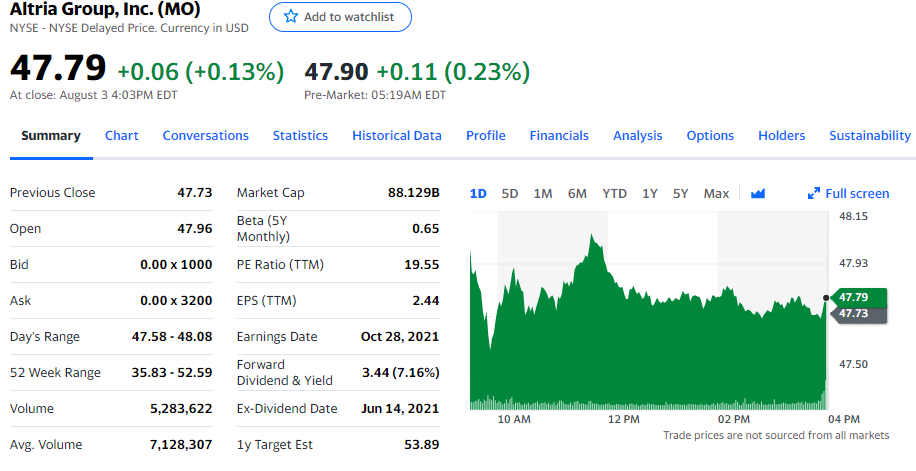

Altria Group, Inc. (MO)

By searching any company or ticker on the YahooFinance website, you get a summary of all the company vitals. The chart above shows the forward dividend and yield, the ex-dividend date, the earnings per share, and other information necessary to decide whether to invest in this equity.

№ 2. Specialty providers

Come as either paid subscriptions, free subscriptions, or a hybrid of both. Such websites provide their subscribers with comprehensive information on dividends and other investment asset performance metrics. Investors get exposure via the website and newsletters on analysis tools, dividend stock screeners, high-dividend yield rankings, and ex-dividend dates.

№ 3. Stock exchange

All the stock exchanges provide tools and information on the equities listed with them. Therefore, dividend data on the stock exchange website is up to date to ensure that investors have all the necessary information to make informed investment decisions. A look at the NYSE shows that investors can analyze ex-dividend dates and filter this information date-wise.

On the other hand, the NASDAQ provides analysis tools, a dividend calendar, and a screener with rankings on the dividend equities.

№ 4. The SEC

It is a legal requirement for all publicly listed companies to report their dividend payout to the securities and exchange commission bi-annually and annually. This information is in the public domain and accessible via the SEC system, the EDGAR. It also has information on companies’ financials and operating activities.

№ 5. Brokerage firms

Brokerage firms on request provide information on equities of interest, especially traditional call brokers. Any investor using an online brokerage firm and account has an advantage in screening for dividend stocks. Such accounts have analysis tools, information on ex-dividend dates, peer comparisons, and a feature for combining assets and generating performance reports.

What are the indicators of outstanding dividend-paying stocks?

The indicators below should form the building blocks when screening for dividend stocks to ensure wealth accumulation and regular income.

№ 1. Profitability

Long-term profitability is an ideal indicator of resilience and growing concern in the face of a changing global landscape. Any company can experience sporadic profitability but what you need for sustained income is a company that has demonstrated year-on-year growth. The best measure of profitability and growth is earnings growth, with the ideal range between 5%-15%.

To make it among a bonafide dividend-paying company for consideration in income investment, an organization should have a minimum 5-year track record of paying dividends consistently.

№ 2. Industry trends

It would be very unfair to compare tech stocks to those in the industrial sector. These two segments are growing at different rates and are affected by very different factors. As such, when screening stocks, pair up equities depending on their industry segments first, and then identify the industry trends to get the big picture before investing.

The energy sector has been a very resilient economic segment and consistently boosts established companies that pay dividends. However, rather than invest in the old school fossil fuel companies, go for green-energy companies since the world is moving towards clean energy.

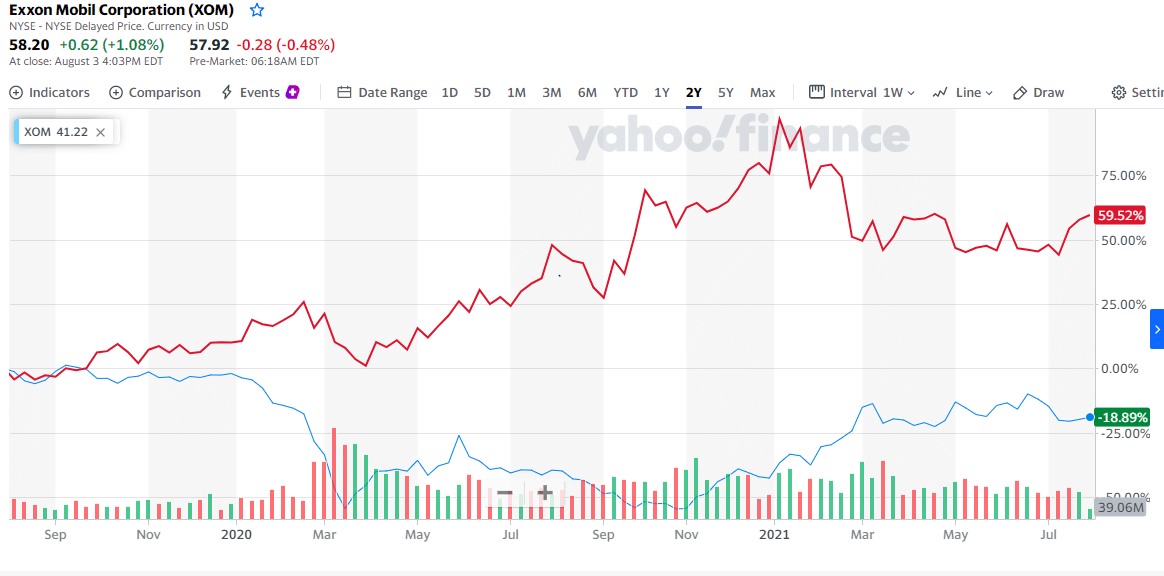

Exxon Mobil Corporation (blue line) and Clearway Energy, Inc. (red line)

In the last two years, Clearway Energy, Inc., a clean energy corporation, has grown +59.52% compared to Exxon Mobil’s, a prominent energy player but with significant interest in fossil fuel, -18.89% growth.

№ 3. ROCC

The ROCC, Return on Corporate Capital indicator, is relatively new compared to its predecessor, the return-on-investment ratio. It is a measure of how the management of an organization can optimally utilize borrowed capital to make organizational profits. It is a ratio that pits total net incomes against the total obligations:

- ROCC= (net income + interest expenses + income taxes) / (net total assets – total liabilities + interest bearing obligations)

Individual company ROCC is compared to average peer values as classified by the SEC. A negative divergence shows mismanagement, while a positive correlation indicates a healthy organization, management-wise.

№ 4. Free cash flow

Cash flow is a measure of a company’s ability to meet its short-term and medium-term obligations. A high free cash flow yield indicates the ability of organizations to pay their current dividends and future dividend growth: it is the freed-up cash flow balance net of capital expenditure.

Final thoughts

Dividend stocks are a great way to accumulate wealth and achieve financial independence. However, it takes careful research and a structured approach to identify the top dividend-paying stocks.

Comments