Various new financial products have been introduced to investors as decentralized finance (DeFi) has gained popularity in the crypto world.

Liquidity pools (LP) are a critical outcome of DeFi, as are the tokens that go along with them (LP tokens). Many DeFi protocols use liquidity pools for token swaps, borrowing and lending protocols, yield farms, and on-chain liquidity insurance.

Let’s dig deeper into LP tokens and how you can profit from them.

What is a liquidity provider & liquidity pool (LP)?

A market broker or a financial institution that acts as a professional market maker on both sides of a transaction is an example of a liquidity provider.

A wide range of firms in the market provides liquidity. These institutions include central banks, commercial and investment banks, hedge funds, foreign investment managers, forex brokers, retail traders, and high-net-worth individuals.

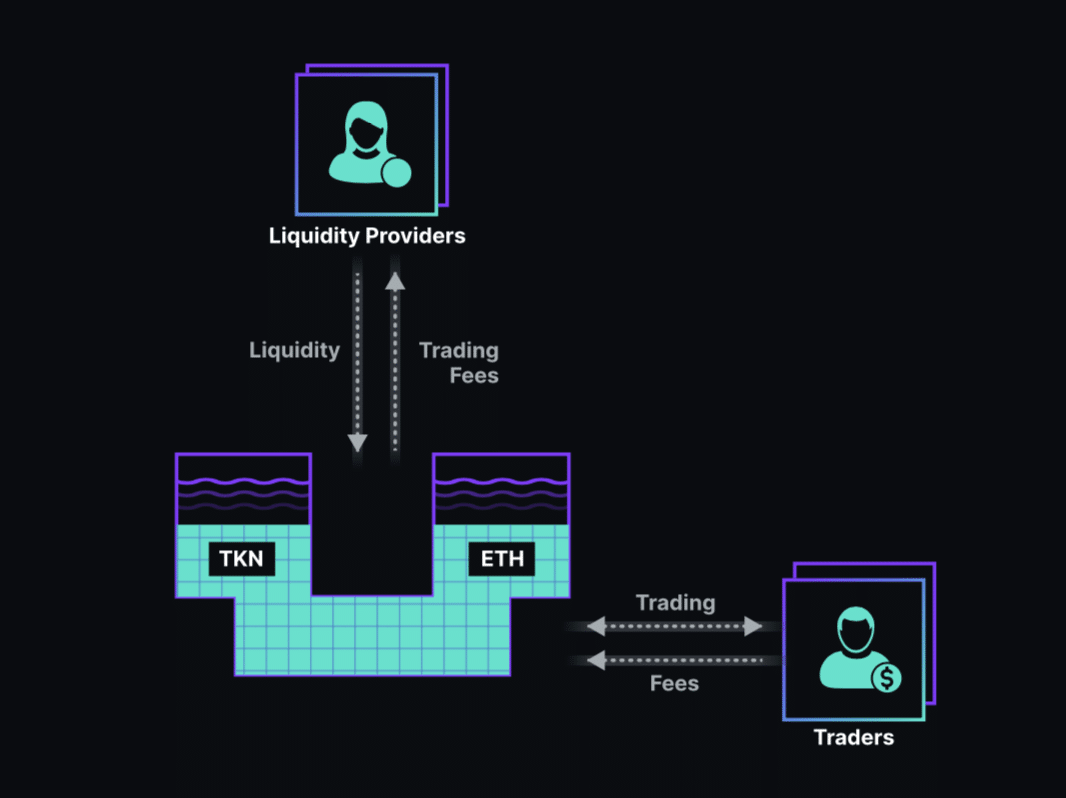

A liquidity pool is a collection of tokens that have been locked within a smart contract to facilitate decentralized token exchanges, lending, borrowing, and other on-chain activities.

If you want to participate in a liquidity pool, you’ll need to deposit equal amounts of tokens from token A and token B to join the pool, which is called LP AB. Uniswap, Pancakeswap, and Raydium are all decentralized exchanges (DEXes) that depend on liquidity pools to operate.

How do LP tokens work?

To begin, let’s take a look at a simple situation. You own 10 percent of the liquidity pool if you give $100 in crypto assets to a pool worth $1000. Consequently, you are eligible for a share of 10% of the LP tokens in the liquidity pool.

The DEX may harvest LP tokens in return for incentives to fix a liquidity issue. LP tokens may be transferred and staked on other platforms. Having a large number of LPs increases your advantages.

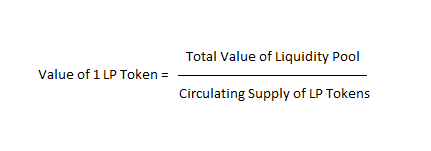

How to calculate the value of an LP token?

Let’s look at manually valuing a single LP token (of any liquidity pool).

LP token formula

The total value of the pool and the total number of LP tokens in circulation are both required. For this, we’ll need the contract address of the liquidity pool.

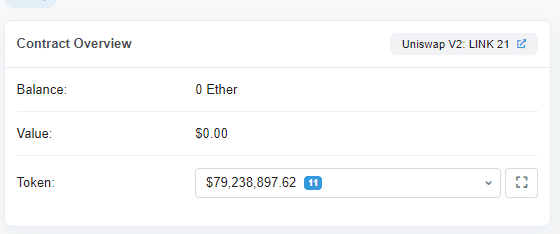

Once we’ve found the address, we can use etherscan or any other blockchain explorer to go to this page, revealing the contract’s total value. For example, Uniswap’s LINK-ETH pool now has a value of $79 million.

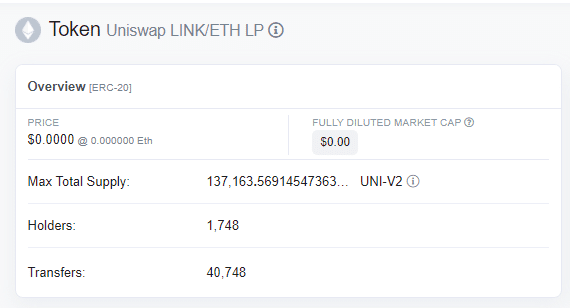

The circulating supply of LP tokens may be obtained by heading to the token page for the contract address.

Assuming these numbers are correct, we can calculate that 1 LP token in the Uniswap Link-ETH pool has an intrinsic value of $577.69.

Now that you know how LP works and calculate its value, let’s move to how you can profit from LP tokens. Here are five steps to consider.

Step 1. AMMs

For LP, AMMs are a must-have. AMM is a decentralized system that prices assets using a formula. Instead of a standard exchange’s order book, assets are valued using an algorithm.

Before the introduction of LP tokens, all assets in the Ethereum ecosystem were unavailable while in use. When staked, tokens are usually locked up. The process is usually part of governing a network.

AMM flow process

When it comes to DeFi, this worry may be alleviated by utilizing LP tokens to create readily convertible assets in AMMs.

The LP tokens enable numerous uses of the same tokens, independent of if they are staked in a platform improving the actual performance or invested in a DeFi app.

The indirect kind of staking enabled by LP tokens can aid in resolving the issue of a restricted crypto liquidity pool. However, rather than staking LP tokens, this strategy stresses evidence of ownership.

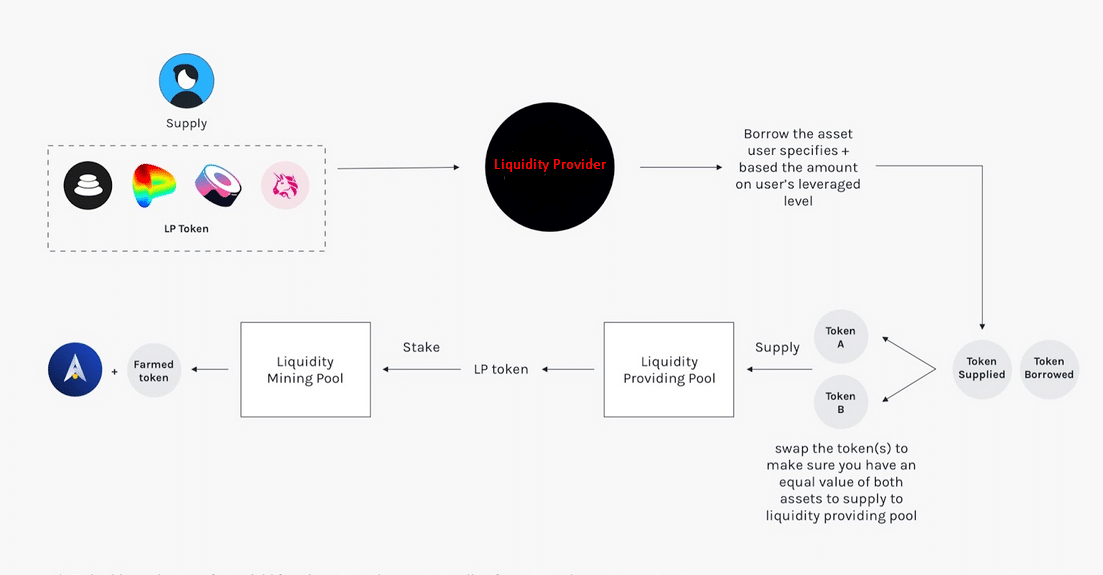

Step 2. Farming with LP tokens

Putting money in a bank account and expecting interest is the same as farming. As part of a DeFi scheme to improve liquidity, users will be forced to hand over their crypto assets temporarily.

It is not uncommon for currency owners to donate ETH and USDT to liquidity pools. The risk of losing their crypto assets can be compensated with an income. While yield farming generally offers a modest annual percentage yield (APY), one may achieve 1,000% to 3,000% if one begins early enough.

LP farming process

Joining liquidity pools does not provide as much benefit as LP token farming. There are, however, additional risks involved.

Step 3. Revenue share

Liquidity pools allow dApps to generate revenue by supplying services and charging users for them. A portion of the money goes to LPs.

Because protocols frequently allocate income to other stakeholders, it is critical to understand the revenue sharing structure and how much is distributed to you as an LP.

Revenue is frequently distributed to:

- Holders of their governance token. Typically by burning token supply, which is the conceptual counterpart of share buybacks in traditional finance.

- Protocol development group

The predicted fee profits of an LP may be thought of as a function of supply and demand. Higher demand generates more money, yet a higher supply (pool size) requires more persons to share revenue.

Step 4. Hedging against IL

The proportion by which a pool is worth less than what it would have been if the tokens were just stored outside the pool is referred to as impermanent loss (IL).

Hedging tactics can be modified to lower IL if desired. For example, losses in options are limited to the cost of acquiring the option, whereas winnings are unrestricted.

Meanwhile, the bidirectional nature of IL may be mitigated by owning a portfolio of call and put options with varying strike prices. However, a lack of option liquidity might jeopardize this approach.

Step 5. DeFi liquidity

The most liquid currency in the DeFi ecosystem is Ethereum. Since it is Ethereum’s original asset and can be traded on every decentralized exchange (DEX), it is almost entirely built on the Ethereum network.

For a governance system to work, tokens typically need to be locked up. Tokens can be used as liquidity providers when they are staked in platforms or invested in DeFi products.

It is possible to stake the LP token without staking the actual tokens, which helps overcome the issue of limited cryptocurrency liquidity.

Final thoughts

The straightforward explanation of how liquidity provider tokens function provides a comprehensive insight into DeFi’s possibilities.

Decentralized exchanges like Uniswap and Balancer, which rely on decentralized LPs, are at the heart of the emerging DeFi ecosystem. However, when it comes to these exchanges or other DeFi solutions, liquidity providers put their money into liquidity pools for their customers.

Thanks to liquidity pools, other traders and platform users may do business, which supplies the required resources.

Comments