Penny stocks have a well-deserved reputation for being low-quality, risky, and having a lot of volatility. However, if you do a lot of research, you might find hidden jewels in the most unlikely places.

January was a bad month for penny stock traders. So far, February has been better for them. While 2022 has been crazy, researchers have started to see minor signs that more good things will come.

A few things have caused the stock market to be very volatile in the last couple of months. But, of course, many things could happen in the future, like rising interest rates, inflation, political uncertainty, and the pandemic. All of this has made the stock market more volatile for a long time.

What are hot penny stocks?

In general, penny stocks are described as trading for less than $5 a share. One of the big things about investing in 2021 was the rise of penny stocks and other risky stocks.

In the blink of an eye, multiplication took place. However, 2022 is likely to be different. With the possibility of a rise in interest rates, there will be fewer funds for industries to grow more business.

How to buy stocks?

Purchasing stocks on the stock exchange market is as simple as the steps below.

Step 1. Find a good broker

If you want to buy and sell stocks, you can use the broker. You can also get dividends from the stocks you buy. To open an account with the company, you need to give them basic financial information, like your bank account number, to do so.

The first step is to look for a broker on the internet. Most brokers don’t charge fees or require a certain amount of money to start trading. However, if you want to trade less often, you may need an app.

Step 2. Calculate the suitable investment funds

Make sure you know how much stock you can get at the moment before you go. For individuals who are just starting to invest, the good news is that many brokers allow you to trade fractional shares. There, you might be able to get a small amount of the most expensive stocks. Using no-commission online brokers could save you a lot of money.

Step 3. Research on the stock market

To make smart investments, you first need to know a lot about the company, its goods, finances, and industry. As a result, you’ll need to look through the company’s SEC filings. This is the best place to learn about the business and its opportunities. If you want to get help from professionals, like analyzing, you might be able to do that.

Step 4. Make a trading plan

Buy or sell stocks at the market price. You won’t be able to change the price of a market in any way. If you want to buy or sell something at a specific price, you can use a limit. For some brokers, limit orders can last for up to three months at a time.

Market orders work better when there aren’t many shares available, or the company is very liquid. If your company is small and you don’t want to change the stock price, limit orders are better because fewer shares are traded.

Step 5. Keep track of your stock in the market

The process of investing doesn’t end when you buy shares of a company. Keep track of your company’s quarterly or annual earnings, as well as market trends. If your company is doing well, you might get a raise in profit. As you become more knowledgeable and skilled, you may want to add more stocks to your portfolio.

Top three hot penny stocks to buy in 2022

Here are the top three hot penny stocks to buy in 2022 to make a good profit.

No. 1. HIVE Blockchain Technologies Ltd. (HIVE)

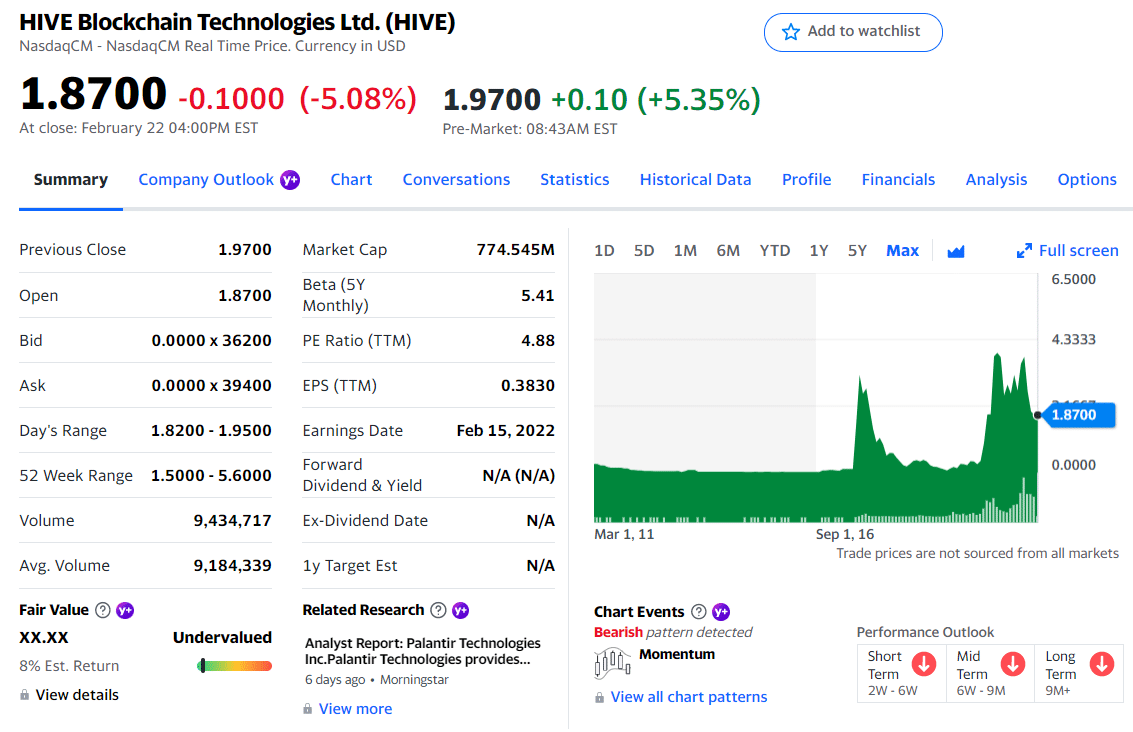

Price: $1.87

EPS: $0.4

Market cap: $809 M

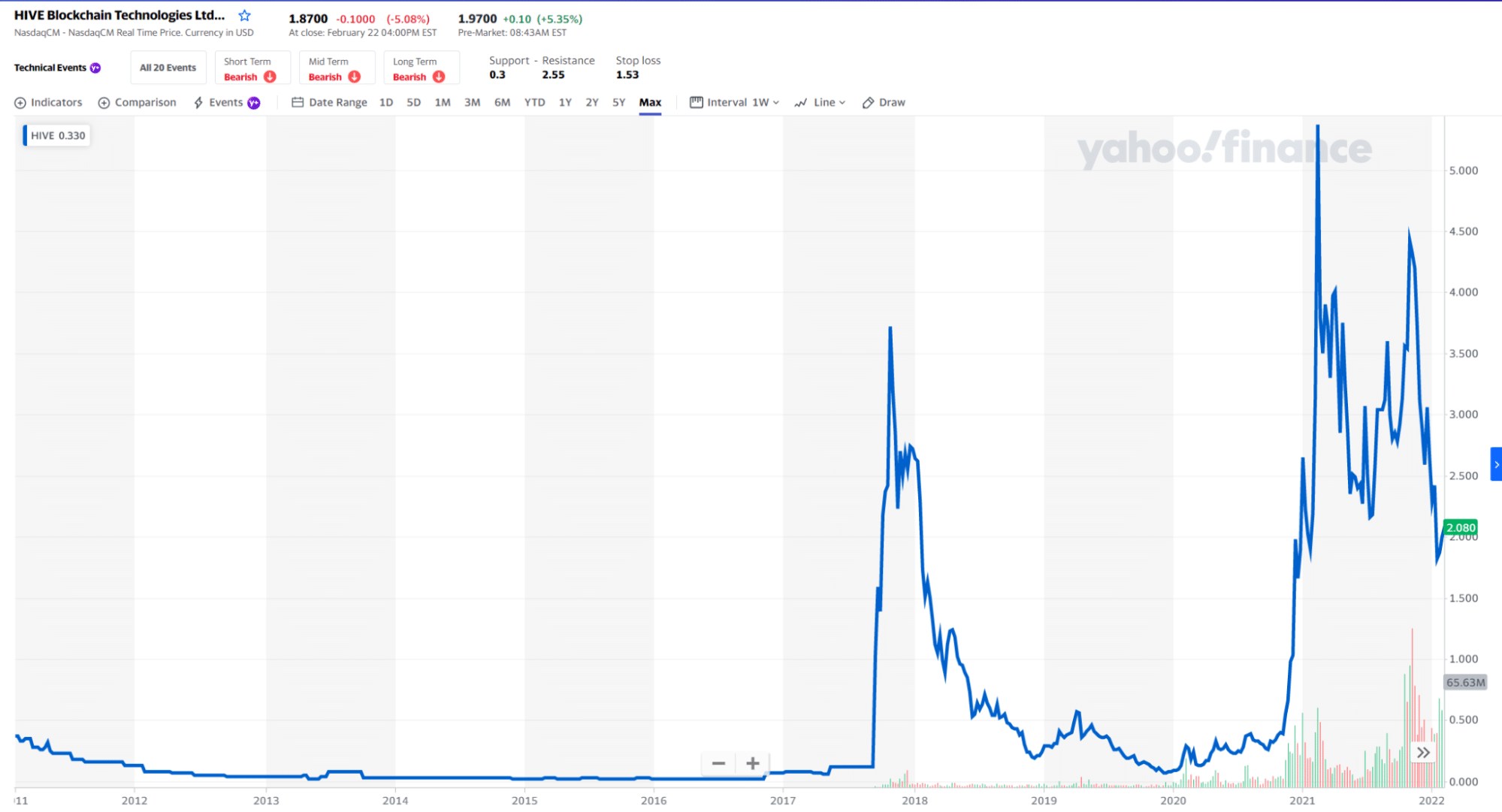

HIVE price change

HIVE’s stock hit a high of $5.75 in November 2021. However, with Bitcoin falling a lot, the stock has dropped to the current level of roughly $2. As long as Bitcoin keeps going up, it wouldn’t be surprising if the stock tries to get back to its highs.

Hive Blockchain, in general, is a company that mines a lot of different things. It also mines Ethereum. Hive, like most other miners, has grown its mining capacity quickly, which has led to a rise in revenue. Strong growth is expected to continue until 2022 if the hash rate increases.

HIVE summary

First three holdings of HIVE :

- Invesco Ltd. — 3.04%

- Mirae Asset Global investments Ltd. — 0.91%

- FMR Ltd. — 0.74%

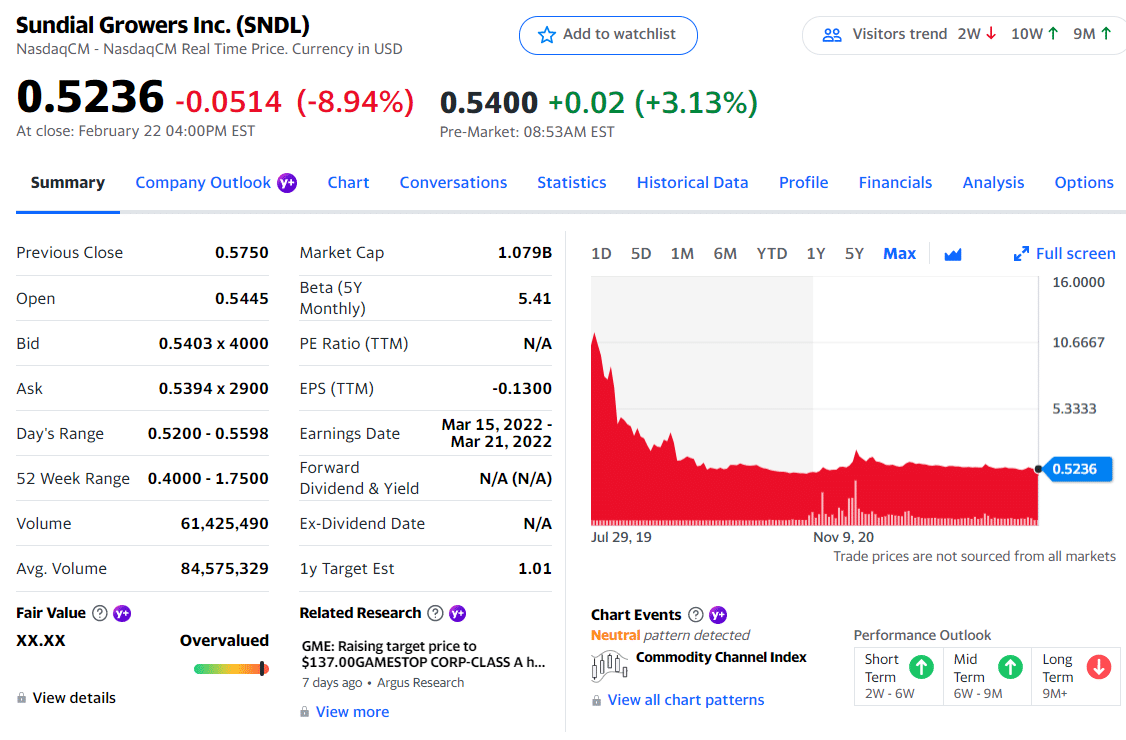

No. 2. Sundial Growers (SNDL)

Price: $0.52

EPS: $-0.18

Market cap: $1.18 B

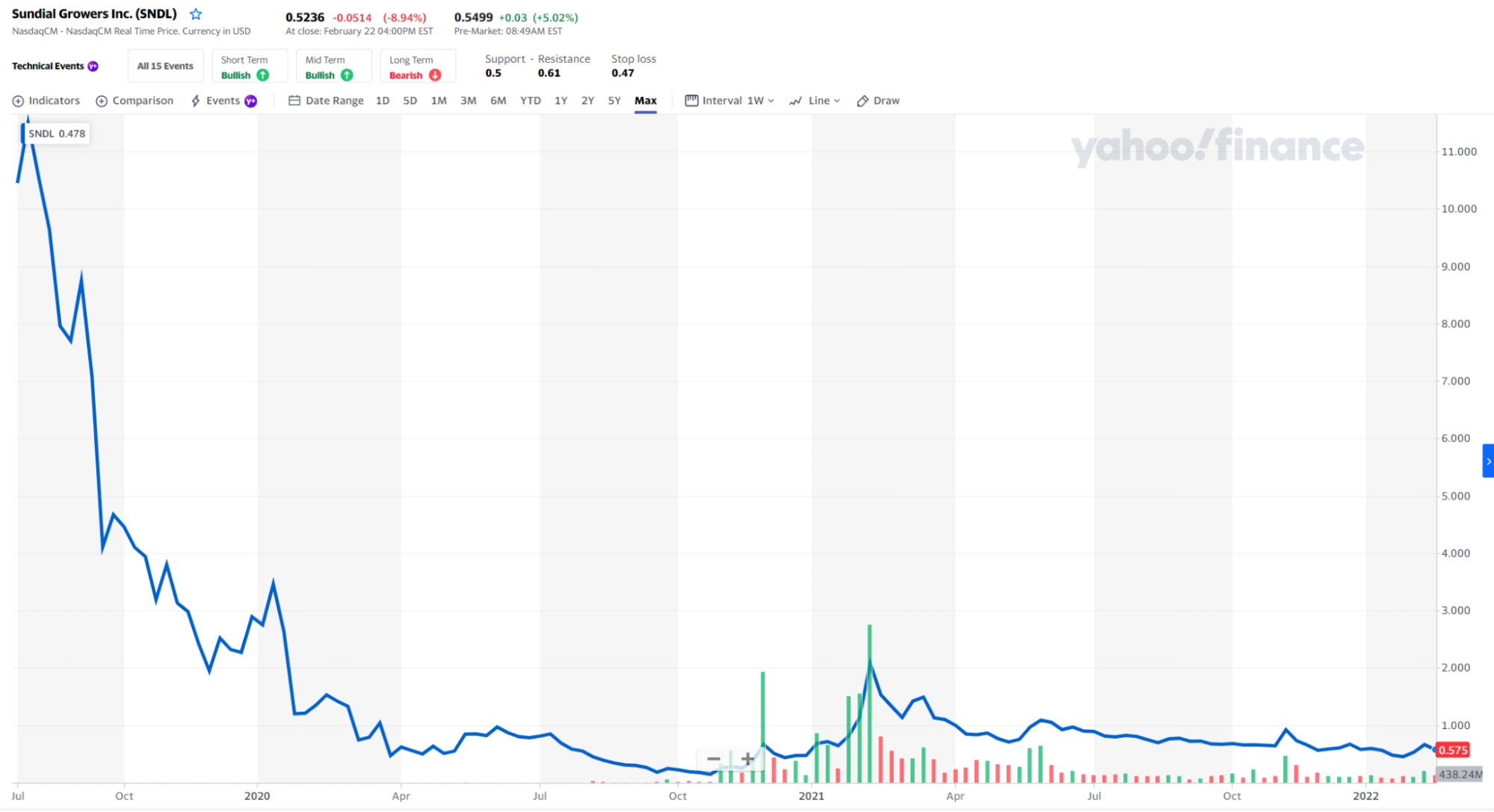

SNDL price change

Among penny stocks that cost less than $1, SNDL looks like a good buy that will quadruple next year. After President Joe Biden’s election-related boost, cannabis stocks decreased. However, it looks like most of the sector’s stocks are trading at reasonable prices, and the selling is too much.

There are a lot of things that could make Sundial Growers. In 2021, the company’s investment department made more than $20 million in sales. In addition, a $571 million cash buffer can be used to invest in many different sectors so that the division could be a long-term source of money.

Sundial also has its brands. The company’s retail presence in Canada is growing, which means there are more growth opportunities. In addition, as soon as cannabis is legalized on a federal level in the United States, more room for growth will be needed.

SNDL summary

First three holdings of SNDL:

- ETF Managers Group, LLC — 1.7%

- Susquehanna International Group, LLC — 1.4%

- Mirae Asset Global investments Ltd. — 0.97%

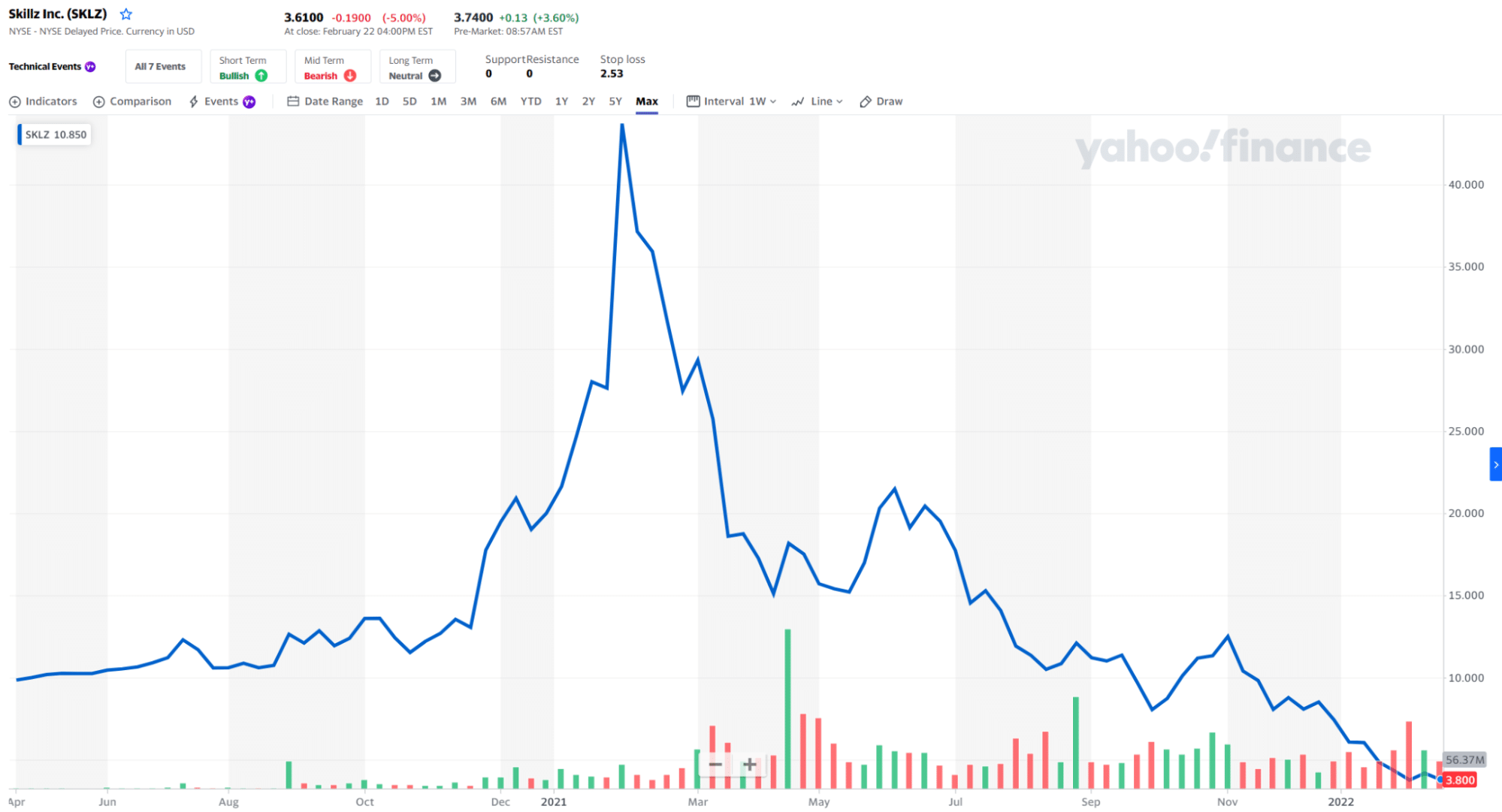

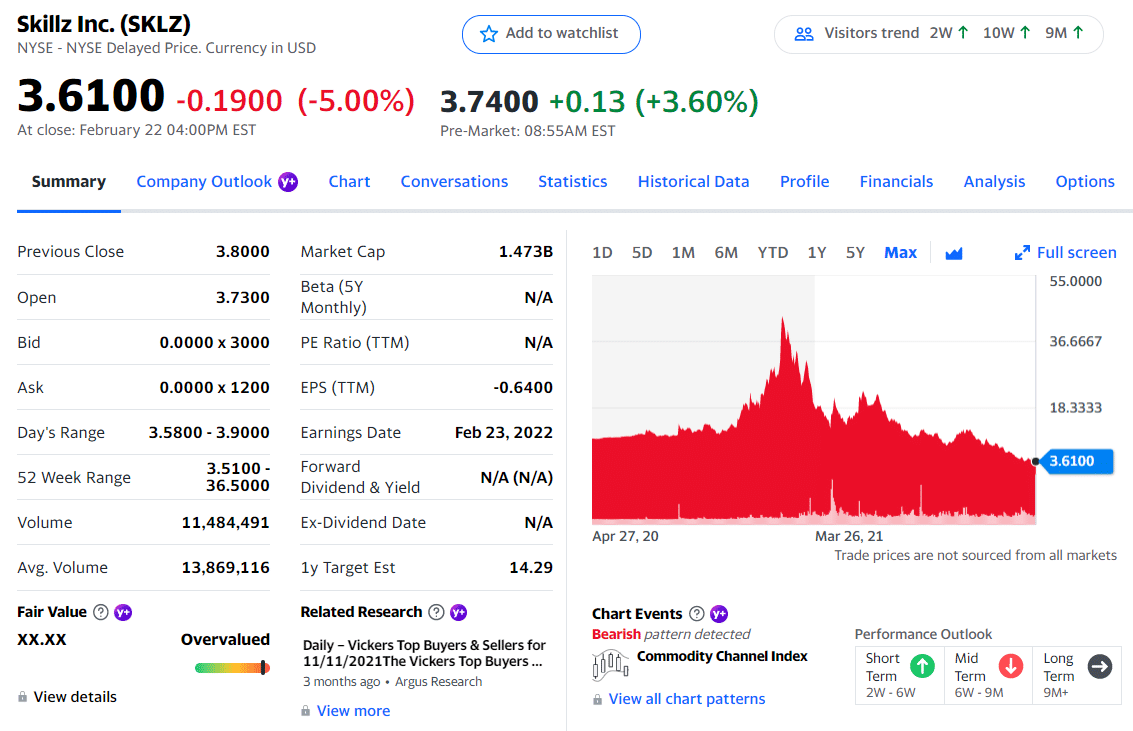

No. 3. Skillz (SKLZ)

Price: $3.61

EPS: $-0.34

Market cap: $1.55 B

SKLZ price change

SKLZ has recently experienced good news in the business world. Skillz said that they would be coming to India in January 2022. According to a new report, mobile gaming is expected to be worth $5 billion by 2025. This launch is expected to help monthly active users grow in the coming quarters.

In addition, Skillz has an excellent financial situation. As of the third quarter of 2021, the company has $540.3 million in cash and other assets. In December 2021, the company also got $300 million through a senior note issue. The company can make strategic investments because it has a lot of revenue.

SKLZ summary

First three holdings of SKLZ:

- Ark Investment Management — 7.1%

- Atlas Venture Associates IX, LLC — 6.7%

- Wildcat Capital Management LLC — 6.3%

Final thoughts

A few months ago, the stock market had a lot of chances to make money from penny stocks. To take advantage of this opportunity, investors need to know everything about how the market works.

This means that you have to read the news and think about how it might affect the penny stocks on your list and the stock market in general. Penny stocks are riskier, but they also have a better chance of making money.

To make big money in the stock market, you must be willing to invest in penny stocks.

Comments