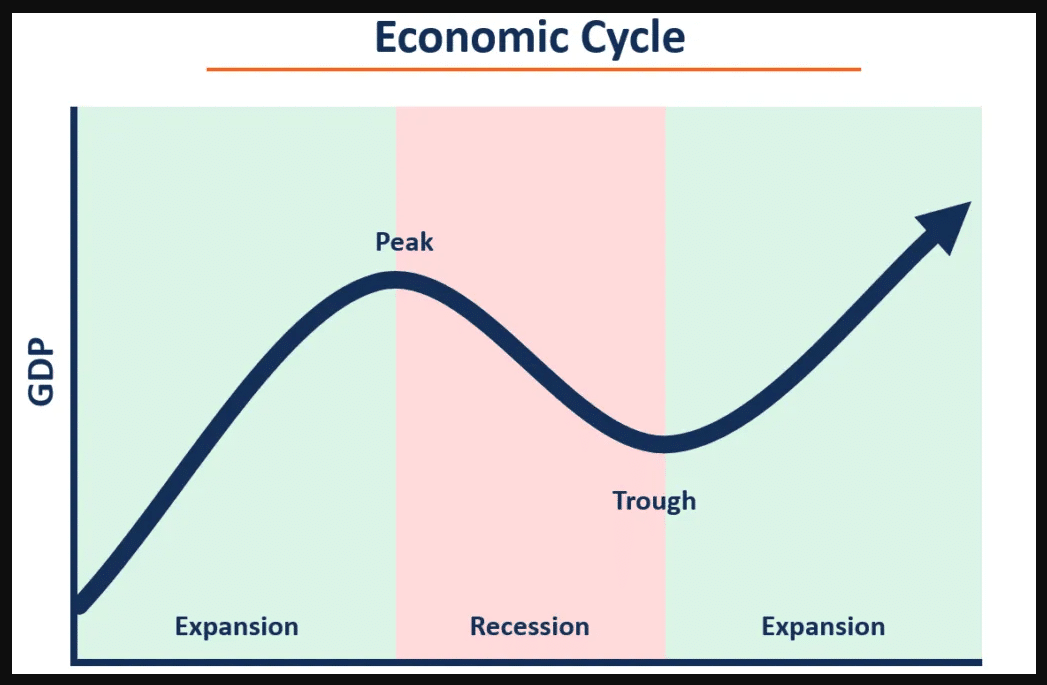

Economies go through different phases, from accumulation to markup, distribution, and markdown. The same principle works in cyclical stocks. Why do some stocks experience growth and decay?

Because cyclical companies typically market consumer discretionary products, they depend on consumer spending for their revenues. In a thriving economy, consumers spend more, and in a receding economy, consumers spend less.

This makes investing in cyclical stocks challenging for investors. You can make a good amount of money during the good times, and you can lose big time when caught at the wrong time. This was the case when the Covid-19 pandemic broke out and crippled many businesses worldwide.

Investing in this sector then requires good timing. Apart from this, there are other considerations you must make if you want to invest in this sector. You will learn this and more in this article.

What are cyclical stocks?

They are companies whose valuations are affected by systematic or macroeconomic changes in the economy. As already pointed out, these stocks are engaged in selling consumer discretionary items. Like the economy, cyclical stocks follow the expansion and recession market cycles.

Some of the companies considered cyclical stocks are businesses engaged in airlines, car manufacturing, construction, clothing, furniture, hospitality, and tourism. When the economy is good, you may want to do a home upgrade, purchase a new car, travel to great destinations, and go shopping.

On the other hand, you may cut costs on the above expenses when the economy is terrible. In the worst case of recession, cyclical stocks may become irrelevant and bankrupt.

Economic cycle

How to buy cyclical stocks?

Buying cyclical stocks is the same as purchasing any other stock. It would help if you first found a brokerage firm offering the cyclical stocks that you want. The next thing to do is select cyclical stocks that meet your criteria. Several stocks are considered cyclical, as pointed out in the previous section. How do you pick the best stocks to invest in?

You can create a list of top cyclical stocks in the market generally based on market cap. Then you can cull out stocks not meeting specific criteria. One criterion you can use is the price/book ratio, which is a better tool than the price/earnings ratio. The P/B metric shows if a stock is properly valued or not. A high P/B ratio may indicate that the stock is overvalued, while a low P/B ratio may mean one is undervalued. You can compare the P/B ratio of one stock against those of other stocks in the same sector.

Top three cyclical stocks to buy in 2022

Below are three of the best cyclical stocks you can buy in 2022. These stocks are good investments primarily because of longevity and growth. Consider them in your search for the best stocks.

No. 1. Caterpillar (CAT)

Price: $218.39

EPS: 9.35

Market capitalization: $112.299 billion

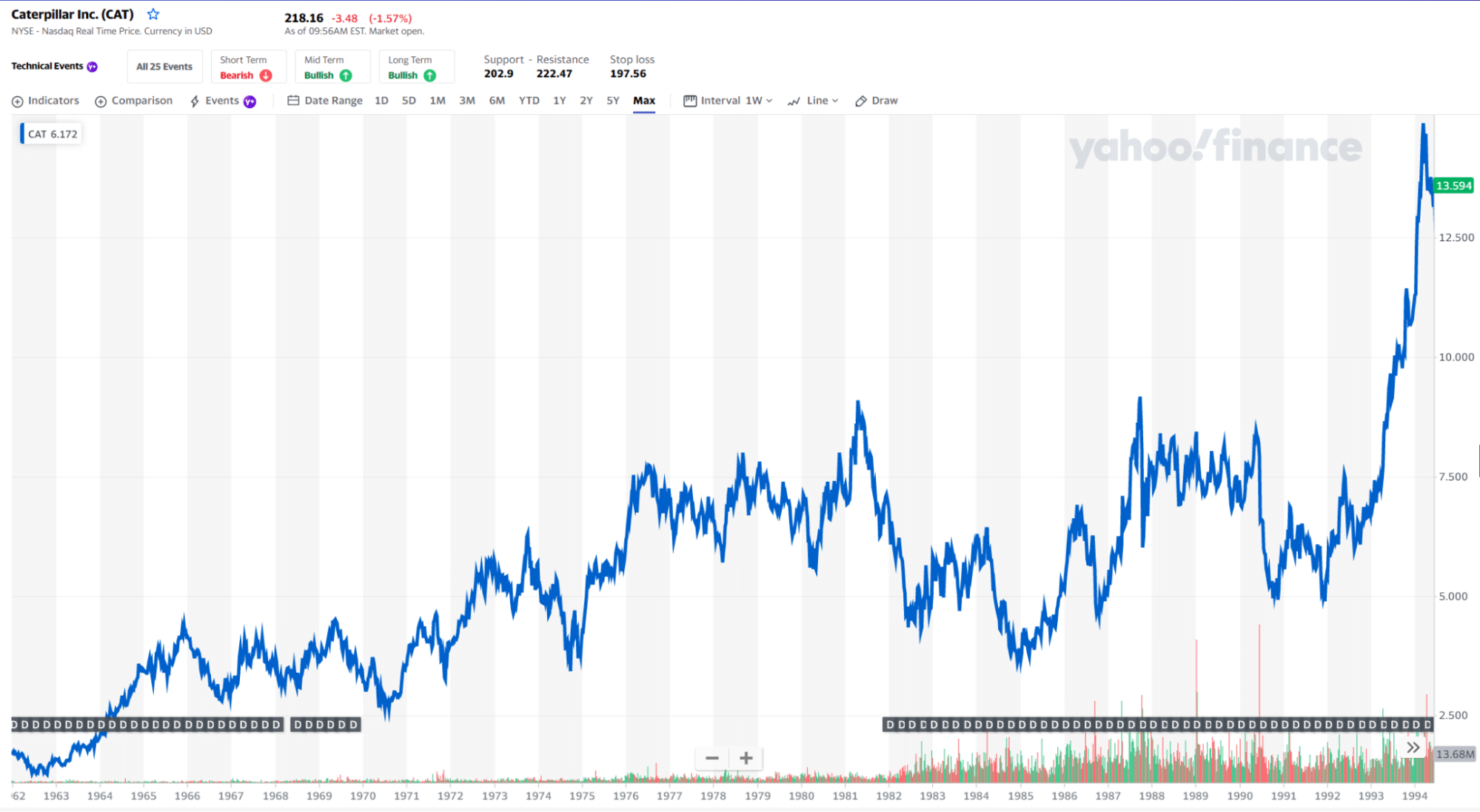

CAT stock price chart 1962-2022

Established in 1925 and based in Illinois, Caterpillar manufactures and sells construction equipment and machinery. This firm counts among the biggest manufacturers of construction equipment across the globe. It also markets financial products and engines. The CAT stock provided investors with a 100 percent return last year.

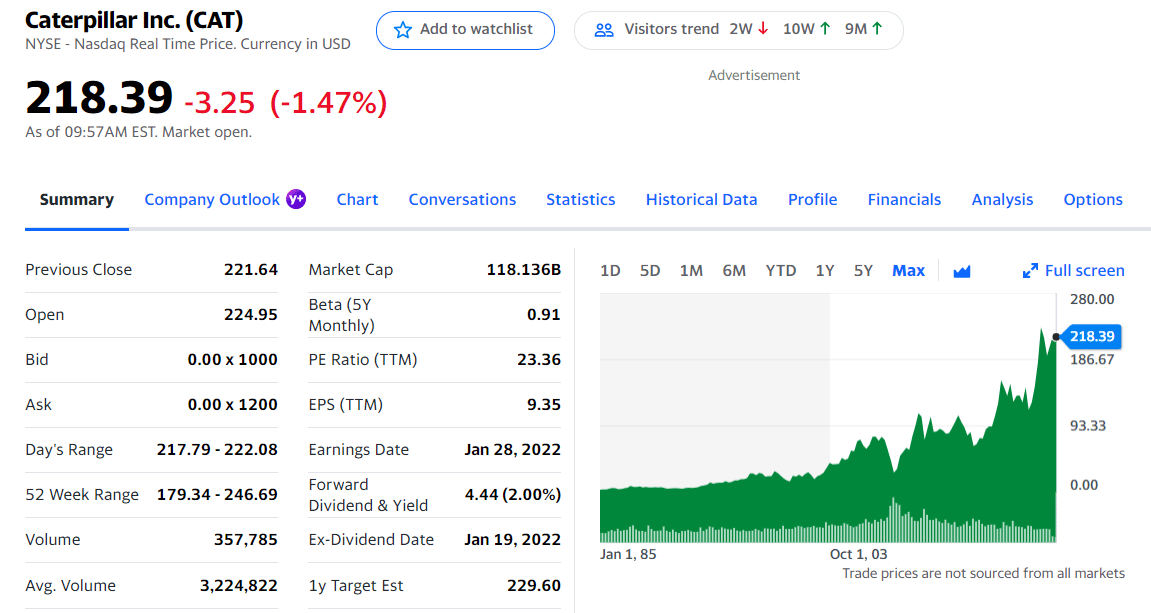

CAT stock summary

Caterpillar is a stock that shows a fantastic trend year after year. Over the past five years, its share price was volatile, but it could generate profits in four out of those five years. Another good thing about this stock is that it has continuously given out dividends to shareholders since 1981. You can see a clear step-up ladder formation in the monthly chart, indicating this market is in a bull run.

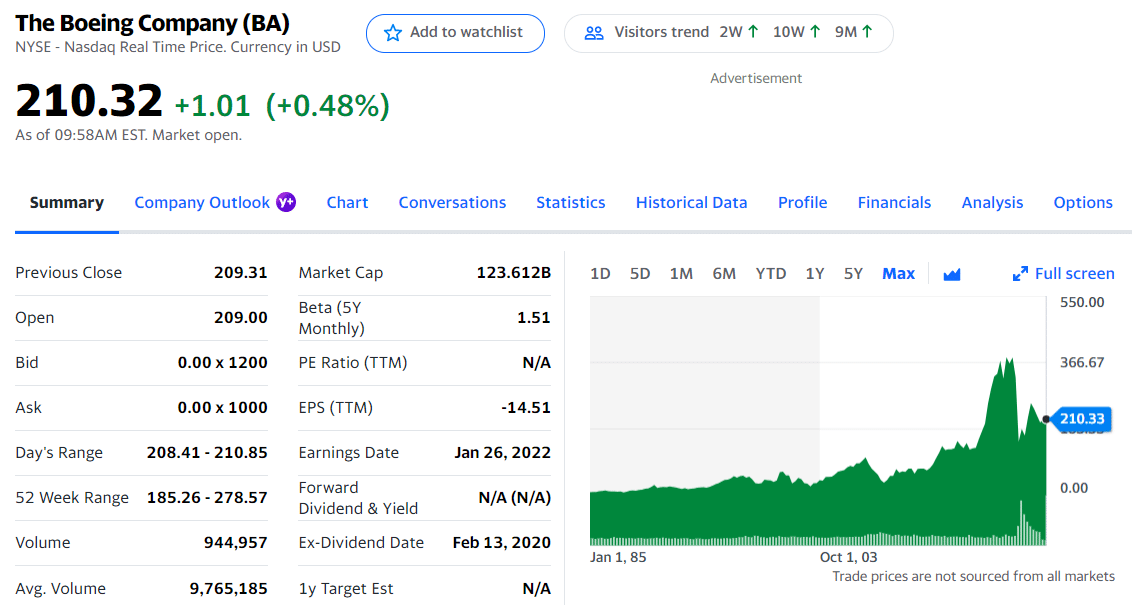

No. 2. Boeing (BA)

Price: $210.32

EPS: -14.51

Market capitalization: $121.107 billion

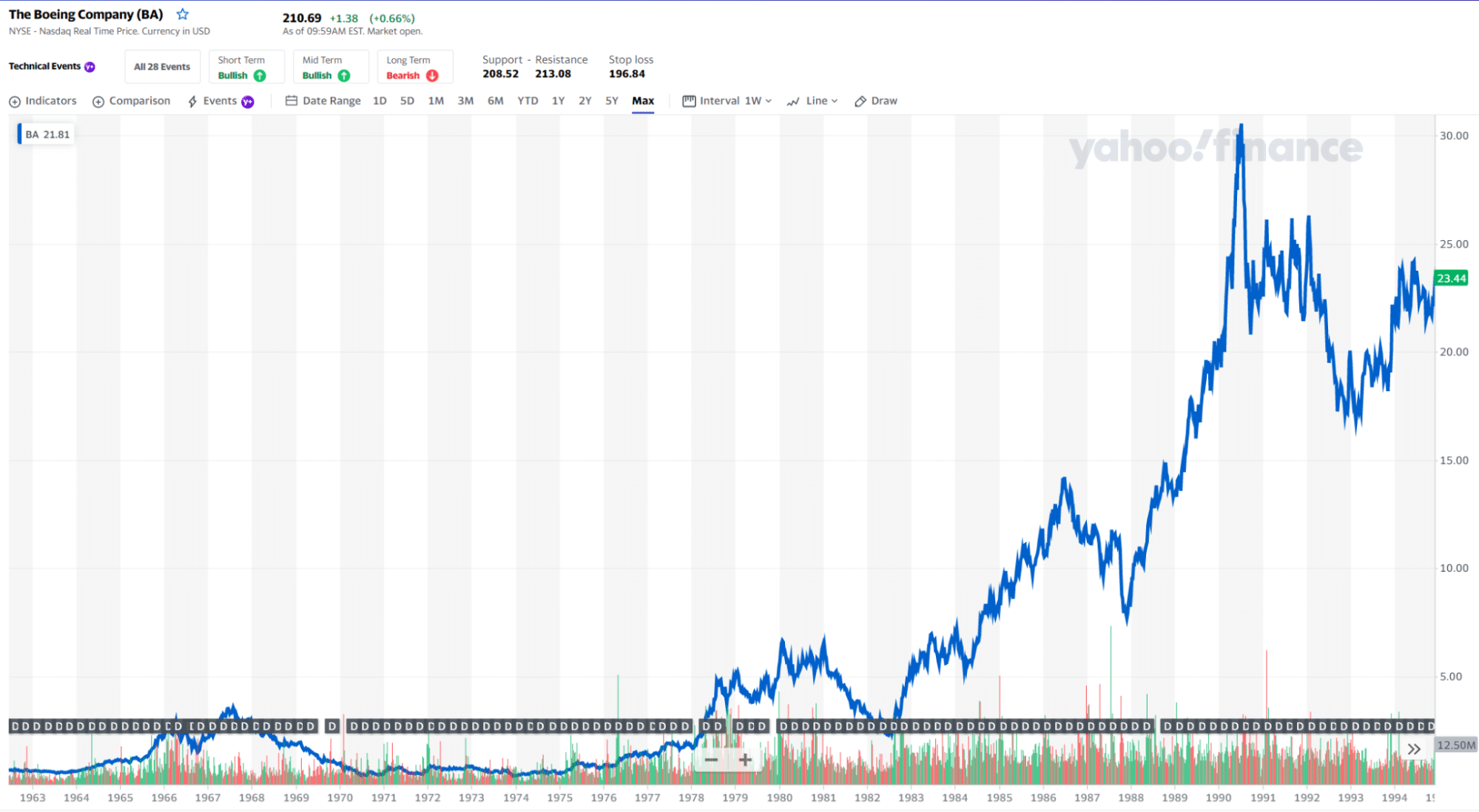

BA stock price chart 1963-2022

Based in Illinois, Boeing creates and markets rotorcraft, airplanes, satellites, rockets, missiles, and telecommunications devices. In addition, the company provides services related to engineering, logistics and supply chain management, modifications and maintenance, and aircraft spare parts. The BA stock managed to generate over 69 percent of profits that investors enjoy from last year.

BA stock summary

Like Caterpillar, Boeing is an evergreen stock. It has been in the stock market since 1962 and has been able to give out dividend payments to stockholders since the beginning. The stock saw steady growth except for the last two years (2020 and 2021).

Although the stock encountered losses during the first quarter of 2020, it shows signs of recovery as it prints a step-up ladder formation on the weekly chart. At this time, the price is looking to break to the upside of a falling channel, which may mark the beginning of an uptrend.

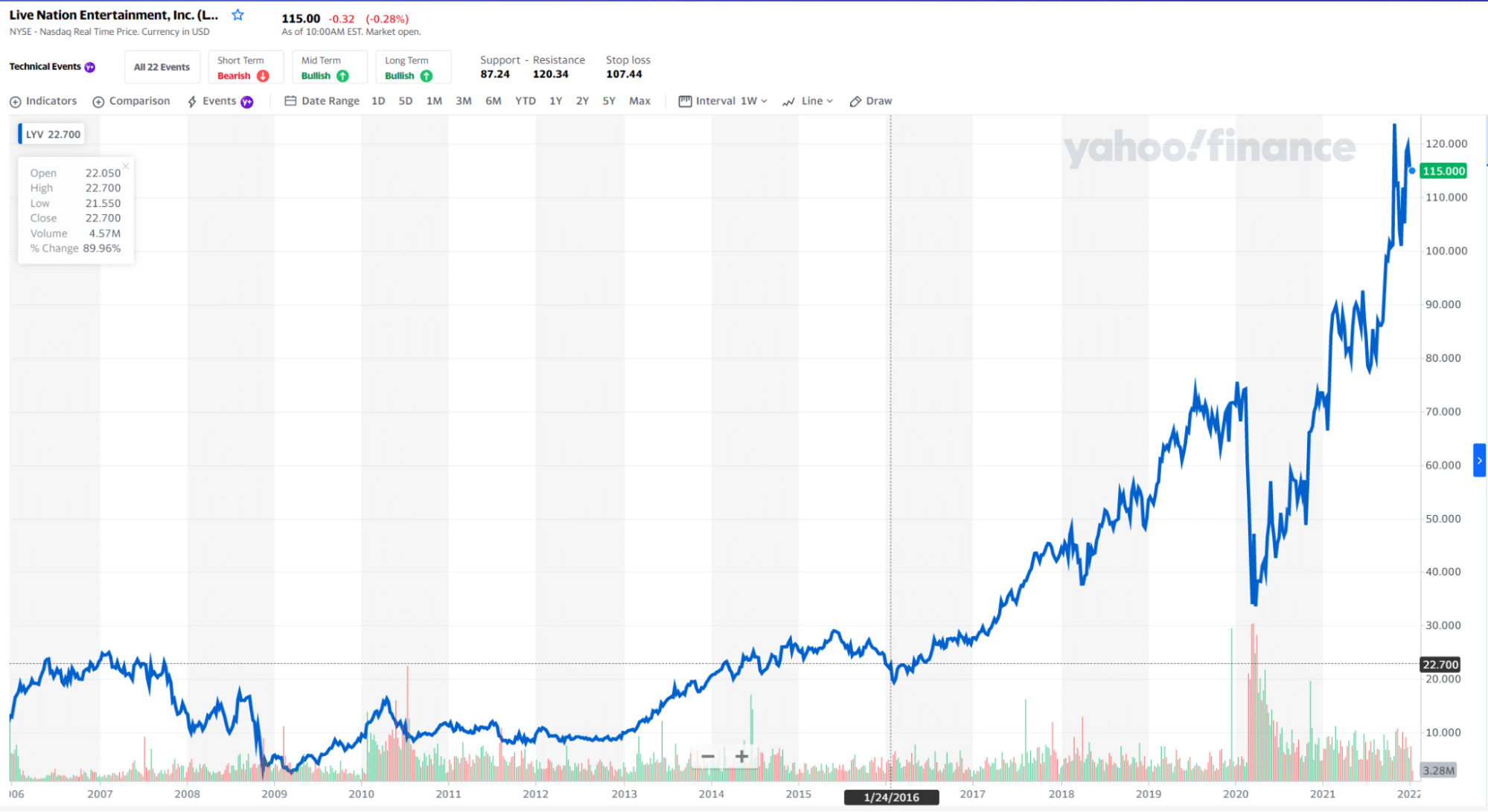

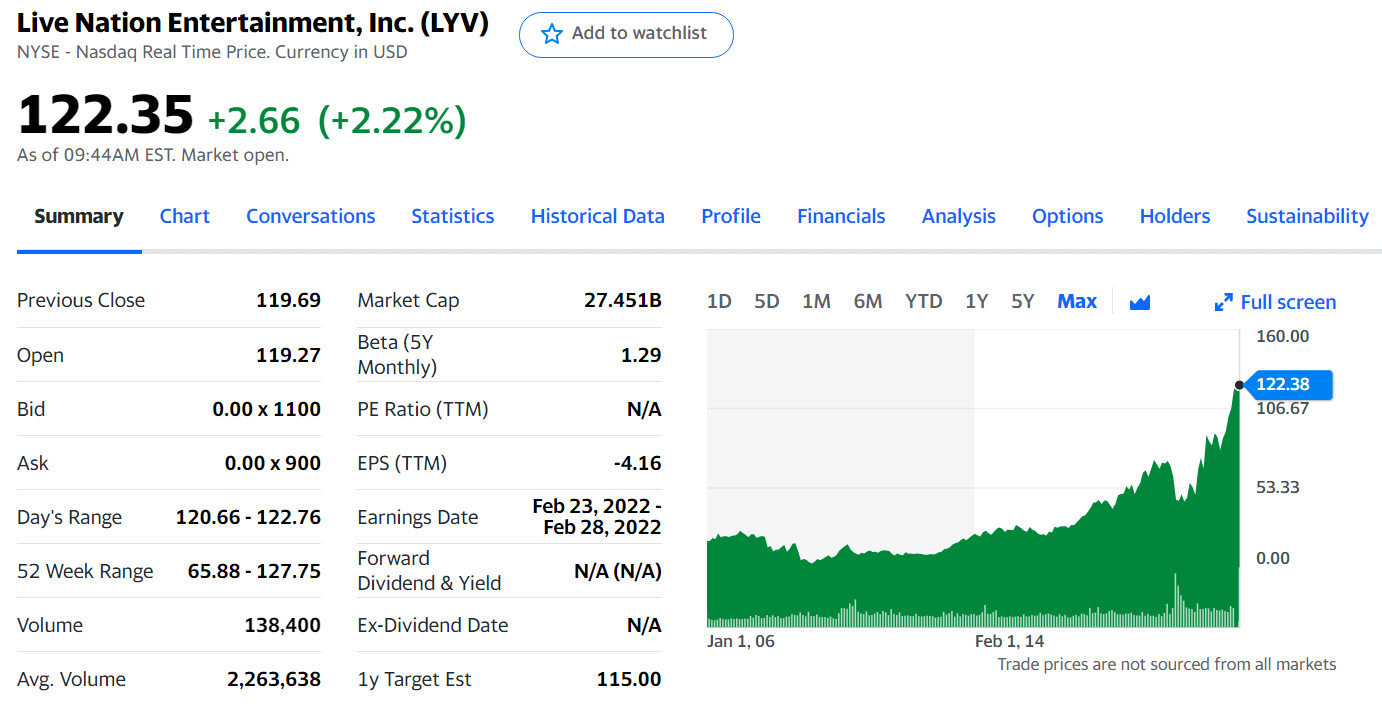

No. 3. Live Nation Entertainment (LYV)

Price: $122.35

EPS: -4.16

Market capitalization: $27.451 billion

LYV stock price chart 2006-2022

Built in 2005 and headquartered in California, Live Nation Entertainment specializes in managing, operating, and promoting ticket sales for locally and internationally live events. Apart from this, the firm manages music artists and owns and runs entertainment locations around the world. Last year, the LYV stock gave investors a 33 percent return for their investments.

LYV stock summary

Live Nation is a relative newcomer to the stock market compared to the previous two stocks. Despite that, it made massive gains in the past five years. The biggest gain came in 2021, where it generated a return of 62.5 percent from the previous year (2020). At this time, the asset is strongly bullish in the monthly, weekly, and daily time frames.

Final thoughts

Investing in cyclical stocks can be both rewarding and risky. It is rewarding in the sense that these stocks could multiply your investments quickly when the economy is strong. It is risky because their prices could go down quickly during market upheavals.

In this situation, what you can do is limit your allocation to cyclical stocks and consider adding defensive stocks to your portfolio. Defensive stocks are just the opposite of cyclical stocks. They tend to weather the storm during economic turmoil, allowing your investment to survive during recessions.

Comments