There are two main roles critical in financial operations. These are the CIO and CFO. Studies show that the total demand for chief executives, including CIO and CFO, grows by six percent every year. This demand may give rise to the creation of about 147,000 positions until 2024.

Both are two key roles that shape the financial stature of companies. Together, they make sure that management makes informed decisions about investments. While the CFO oversees the everyday financial operations, the CIO manages the finances and ensures the proper allocation of funds.

You will learn more about what each role means and what functions are being carried out. Also, we will put the main differences in functions side by side later so you can easily see the disparities.

What is a CFO?

The CFO is a member of the top management team running the business. The other team members are the CIO, COO, and CEO. These executive positions are common in the corporate world. You must have a reasonable degree of experience in the relevant fields to aspire for the CFO position. Having specific certifications and advanced degrees are a plus to land this job.

Naturally, you must have a college degree in economics or finance. If you have sufficient background in banking or accounting, so much the better. Although the CFO is subject to the CEO, the former is essential. CFO is a top-rank position in the financial sector. It is often the third-highest position in other sectors of business.

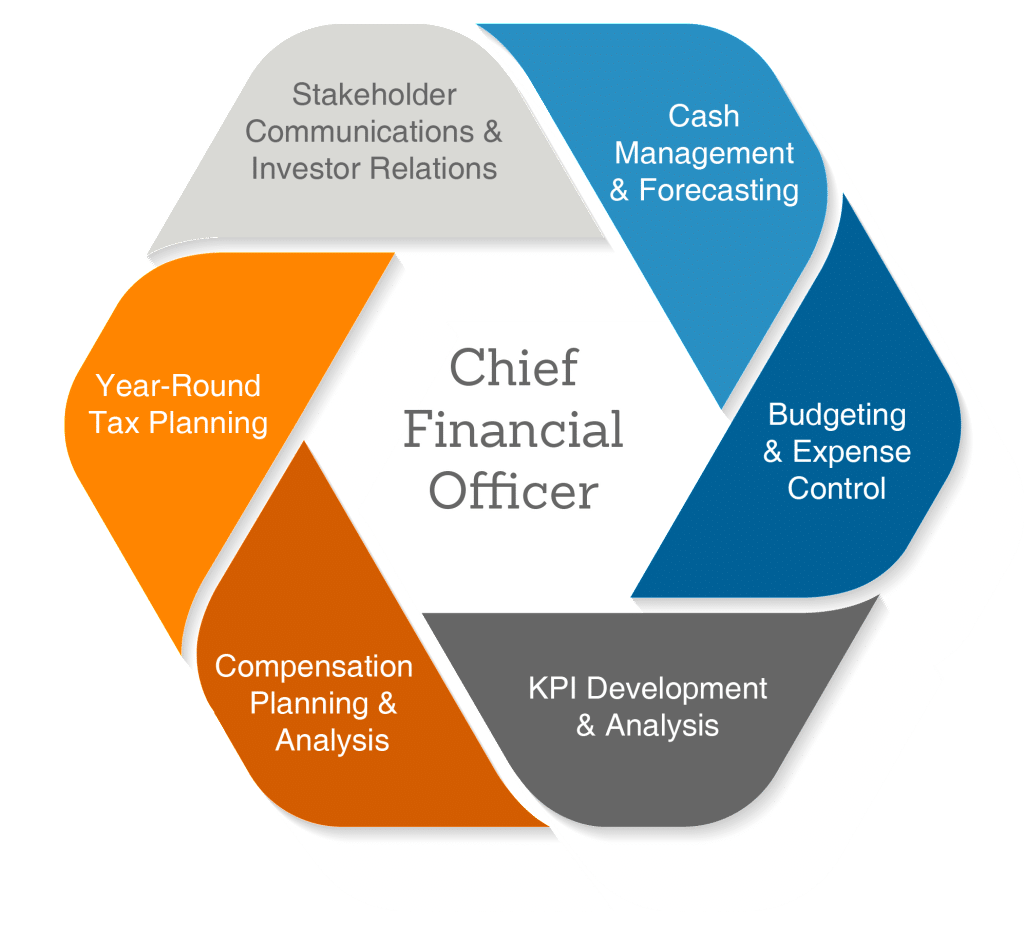

CFO roles

What do CFOs do?

To say in a few words — directs the financial operations of the company. Some of the duties include understanding the company’s financial weaknesses and strengths and suggesting solutions, performing financial planning, and monitoring cash flows.

This person is often the head of the accounting and finance department. He ensures that financial reports are completed on time and do not contain inaccurate figures, although a lower-ranking person might prepare the reports.

The person taking the CFO role provides considerable inputs in how the company conducts its investment operations, allocates capital, and handles revenue and expenditures. The CEO of the company might seek the assistance of the CFO when generating funding for different projects, performing a cost-benefit analysis, forecasting, and more.

What is a CIO?

A top management team member overseeing the business operations. He manages the organization’s investment portfolio, although he might command a team executing the investment plans. This role sets the tone of the company’s investment strategy and style.

As the size and type of business dictate, the CIO either directly carries out the investment actions or commands a dedicated team to execute the investment strategy. As he finds necessary, he may decide to outsource the company’s investment portfolio management to an expert outside the organization.

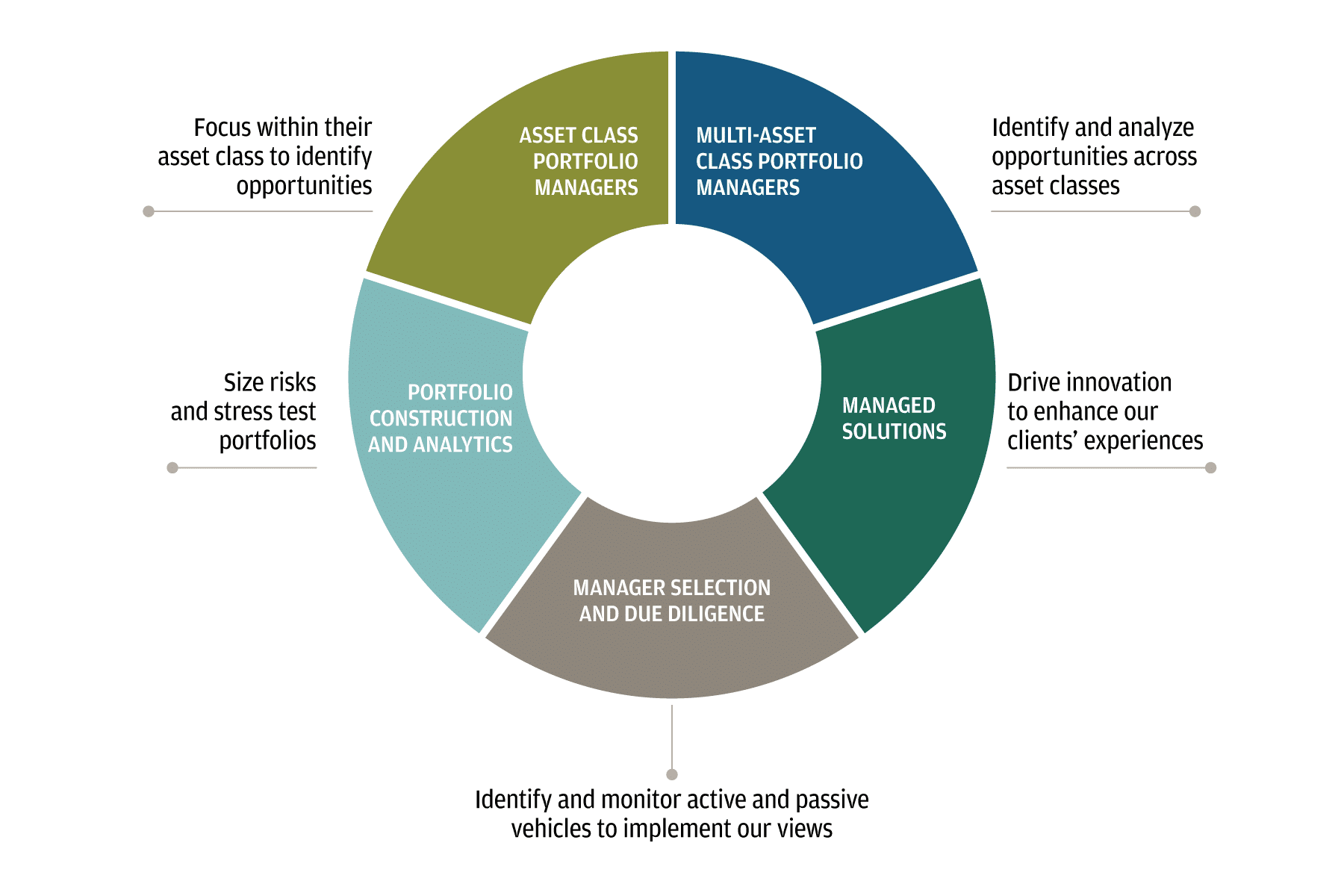

What do CIOs do?

The person taking the CIO role makes decisions about the amount of operating capital to allocate on investments, looking to limit the company’s overall exposure. He can propose which types of securities the company should put money on and how much to allocate in each. Like an investment manager, the CIO balances return and risk well. Refer to the above image.

The person holding the CIO role is expected to manage the company’s investment activities well. If he does his job correctly, the company will not worry about the liquidity of company assets and its capacity to fund the operations. Although the CIO should observe investing guidelines set by the company, he can offer suggestions or advice to the top management team on possible ways to improve the investment policy and strategy.

Chief investment officer vs chief financial officer

They have many similarities in terms of function, and several differences as well. For example, both work for the company’s financial health. However, the CIO may focus on information technology, and the CFO is heavily involved with accounting and finance. The table below points out the other differences.

| CIO | CFO |

|

|

|

|

|

|

|

|

|

|

Final thoughts

Both are high-level positions in an organization. They perform critical functions in the financial operations of the company. While a CFO is a director who handles finances, a CIO performs oversight functions on company investments. However, the scope and specifics of the roles vary in many respects. The educational requirements, scope, responsibilities, and salaries all differ.

To land in any of these positions, you must have advanced degrees in finance, accounting, or economics. Apart from education, you must prove to have a solid and lengthy experience in your profession. Relevant certifications can also help push your bid toward landing any of these jobs.

Comments