Not many people understand this, but some risky investments can end up making you lose more money than you invest. Those investments are more common than you may think. They can only be made through something called margin accounts. You could ruin your account and leave yourself in debt if you misuse this investment.

So you could ask, why would anyone want to open the door to that kind of risk? The answer is pretty simple, the rewards are attractive and can make you earn a lot of money. If you want to know what to do to avoid losing the money you don’t have, go through this article and learn to invest smartly.

Can you lose more money than you invest?

Common sense may make us think that it is impossible to lose more money than we put in when we invest in stocks. And that makes total sense because once we buy a stock, this is an asset that belongs to us, so there is no way we could lose money.

The only way that could happen is that the stock price goes below zero (which is not possible), so we would have to pay someone to buy the stock from us. And even in that scenario, it is not like we have to pay dividends to anyone to keep the stocks.

But the truth is that you can not only lose money by buying a stock but also by selling it. Let’s see how this could happen.

How can you lose more money than you invest?

The key concept here is leverage. A margin account allows you to borrow money or stocks from your broker to trade them and return the money at the end of the established period through leverage.

So, there are two ways in which you could end up losing money. Let’s see how these two trades can go against you.

Borrow money to buy stocks

Imagine you want to buy 100 shares at $50 each. Depending on your brokers, you could get up to 50% of the investment borrowed from your broker. This would mean that for the $5000 you need to get the shares, you would put down $2500 from your pocket, and the other $2500 would come from your broker.

If the price of the stocks falls, you’ll be naturally losing money from the depreciation of your asset. Therefore, if the share depreciation is greater than the percentage of money borrowed, that is 50% in this example, the money you invested would not be enough to pay the amount loaned to you, so you would end up owing money to the broker.

Imagine that after a month, the price of the stocks falls to $20 per share. By selling all your shares, you’ll still owe $500 to your broker. Your total capital is now $2.000, and now it’s time to pay your broker.

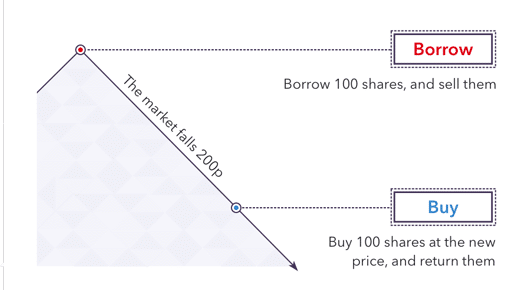

Short-selling

Here the mechanism is a little different. When borrowing money, you lose money if the stock price falls. When borrowing stocks, you lose money if the price goes up. Here is how it works.

Let’s say you borrow 200 shares at a price level of $10. Then you sell the stocks borrowed to you. You make $2000 from selling. If the stock price drops, that’s good for you because you would buy back the same amount of stocks to return them to your brokers at a lower price.

However, if the price rises, let’s say to $20, to buy back the same 100 shares, you would have to pay $20 x 2000 = $4000. That’s the double you made from the short selling.

Cash accounts: what they are and how they work?

Margin accounts, which let you move more money than the one you have on your balance, could cause these problems. These margin accounts could have significant benefits but should be managed carefully. That’s why they are for advanced traders, and not everyone has access to them. For most traders and investors, the option to go with is cash accounts.

These accounts are limited by the deposit you made into your shares accounts. This way, you risk your own money, and there is no way for you to lose more than what you own. Comparing the risks of both accounts, it is much more likely that you end up losing the money you don’t have on a margin account than losing all of your money on cash accounts.

To lose all your money in cash accounts, the company would have to go bankrupt and lose all its value. While in margin accounts, you need a movement against you big enough to wipe out your earnings and lose all your money, and that’s much more common.

Top 5 steps to protect your money when investing

Some regulations keep you away from bankruptcy, or at least they protect you against ending up owing money to your broker. However, the point is that margin accounts can be a great tool to make a lot of profits, but you need to be very careful about how you handle it. Here are some steps you should consider to avoid losing all your money and more.

Step 1. Think over the long-term investing

Everyone with a little knowledge will tell you that you won’t get rich overnight. Stock investment is a profitable activity, but it is a job like any other. Only long-term investment and effort will make money. It would help if you considered the long term when investing in stocks, so you do not put all your eggs in one basket. You are unlikely to get rich, but there is a good chance you could lose everything overnight.

Step 2. Consider how much you invest

It’s not just a matter of where to invest, but also about how much you invest. A rule of thumb says you should only invest about 4-5% of your money on each stock. Also, the amount of money you put in your account is important. You should only invest money you are “comfortable” to lose.

Step 3. Consider diversifying your investments

If you put only 5% of your capital in one stock, we are already saying what you should do with the remaining 95%. You must diversify your portfolio by buying different stocks in different industries because sometimes it is not just about a company performing poorly. Sometimes a whole industry can do badly.

Step 4. Trust the experts

Some guys have spent their entire lives studying the markets and made a living out of it. So, if you have access to their opinions, it’s only logical to listen to them and invest based on their opinion. Of course, they will be wrong sometimes, and also some experts are better than others, but it doesn’t hurt to review their opinion and make your mind after you listen to what they have to say.

Step 5. Protect against losses

If you sign up and start trading on a margin account, there are still options to protect you against losses. You can set up stop-loss orders and other stop-limit strategies to protect you if the price goes against you.

With this strategy, the broker automatically takes you out of your position and cuts your losses before it’s too late.

Comments