Are you planning to invest your wealth? Here is a quick question for you; have you completed your homework? Well, you’re not getting admission to a high school, yet you have to do your homework if you want to take your investment to some point.

In business language, this is DD. You might have heard this term in the market. If you’re a new investor or unaware of DD, this article is a must-read for you. Always keep in mind that your homework should be completed before you click the buy button.

What does DD mean?

In stocks, DD stands for ‘due diligence, which means investigating the company you’re going to invest in. It involves collecting facts about the company. Due diligence makes sure that you’ve all the necessary details to act upon your decision of potential investment.

While performing due diligence, you’ve to investigate different aspects of the company, its stocks & relativity with the industry. To get all these details, you can visit the company’s website. But, don’t just rely on it; use several sources. So, you will be able to unveil a clearer picture.

How to perform Due Diligence?

No, you don’t have to study only the performance of the stocks. There’s a lot more stuff to go through. It would help if you had a glance at the company’s financial records; have a stare at the company itself & its competitor. It seems so basic. Keep in mind; it is essential as well. We’ve sorted out a simple checklist to follow for DD.

Checklist for Due Diligence

You can pay someone to perform DD for you. Rather than relying on a third party, we’d recommend you to research on your own. This way, you’ll be aware of what you’re getting into. Here’s a list of easy steps you can follow yourselves

DD checklist:

- Market capitalization

- Financial records

- Competitors

- Valuation multiple

- Administration

- Balance sheet analysis

- Stock price history

- Stock options & dilution

- Expectations

- Risks

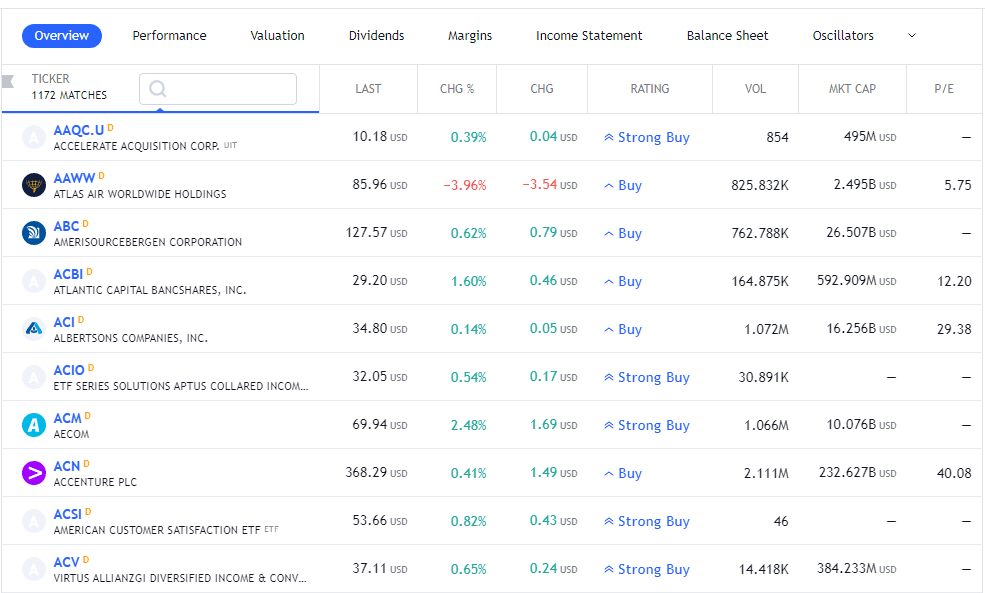

Market capitalization

In this step, you’ve to draw a virtual diagram of the company in your mind. Then, figure out why you would prefer to invest in this company. Then, find out the potential size of the company by calculating the market value of its shares. You don’t need to point out whether it’s true or false. Your only goal should be the collection of information that will help you to analyze the financial records.

Financial records

In this step, your goal is to study the revenue, profit & margin trends of the company. First, look up the financial records for at least the past two years. Note the spikes and consistency in the expenditure graph. Also, monitor the profit rate. Finally, observe trends of the P/S (price-to-sales) ratio & the P/E (price-to-earnings) ratio.

Competitors

Till now, you’ve made an image of the company size and its earnings. Now, it’s time for comparison. Compare the company with its competitors in the industry, at least two. That’ll show you how the business model of the company works. Mere reading about the competitor companies will help you understand your target company’s operational flow.

Overview of various stocks

Valuation multiple

In this step, your goal is to identify whether the company is a growth stock or value stock. You’ll have to observe PEG (price/earnings-to-growth) ratio. Also, compare it with the competitive stocks. There’ll be chances you might choose another investment company. It’s like peeling fruits & finding the other one better inside.

Administration

It’s time to read about the ownership of the company. Observe that it’s managed by founders or sold to others. Also, review the claims of directors. Meanwhile, check their backgrounds. If the company claims that some celebrities or a famous businessman have invested in their company, check the amount of their investment; you’ll get the signal for your decision. Consider low shareholding a red flag.

Balance sheet analysis

The next step is to examine the balance sheet. It’ll spill the tea on the assets & liabilities of the company. Also, have a glance at cash levels and the amount of debt held by the company. If you find any vagueness in the sheet, go through the company’s financial statements and annual reports. Till this point, your perspective will get deeper.

Stock price history

On this step of due diligence, look for the short-term and long-term price fluctuations. Watch if they have been volatile or steady. More volatility in stocks indicates short-term shareholdings and more risks. Carefully observe the profit history in the stock price.

Price chart of a company to observe profit trends

Stock options & dilution

In this step, you will need to drill down into the reports to find the expectations. Look for the number of available shares and how they can change under different situations. Pay attention to shady practices made by the company.

Expectations

At this stage of due diligence, you want to determine the company’s revenue and profit predictions in the coming two to five years. Then, estimate the future picture of the company from all the details you have accumulated so far. Consider partnerships, intellectual property, joint ventures, long-term trends while making expectations.

Risks

As an investor, you should have a healthy critical mindset, ready for the worst scenarios, consequences, and backup solutions. Be aware of the risks regarding your investment. View the threats from both points, i.e., individual company view and market view. Please don’t use a loan for investment; it can put you in danger.

- See if the stocks are relatable to current or coming issues?

- If the company is eco-friendly?

- What is the volatility rate of the stocks?

- How can the loss affect you economically?

All of these are risks for a potential investor. You can lessen these risks by performing due diligence.

Final thoughts

By performing DD, you’ll be confident about your moves. But, most importantly, due diligence makes sure that you’re investing in the best stocks that would yield a good pay-out.

Comments