It can be challenging to determine which tax expert best fits your needs when looking for a professional to assist with issues involving your personal or business finances. A specialization in economic guidance is characterized by many classifications that look like an ambiguous mishmash on a nametag.

Tax attorneys and CPAs may both help you with a range of sales taxes, but their duties are distinctive. Hence, having an attorney-CPA on your team is the best choice since they are qualified and trained in both disciplines, providing you with a complete level of support.

We have outlined what each type of tax specialist is, so you can choose who is suitable for you. Let’s learn when to call on their services.

A tax attorney’s role

Tax lawyers have completed law school, taken their state’s licensing examination, and focused their practice on tax matters.

Although CPAs are competent in setting budgets and producing tax forms, tax professionals are more planning and dispute-oriented. They are principally educated to assist businesses in minimizing their tax burden using asset management or defending them in tax-related cases.

Tax attorneys also provide one significant advantage that a CPA doesn’t quite have: confidentiality. Client-attorney privilege protects any information you offer your tax attorney, which means they cannot be called as a witness on you. An attorney will meet with you at no expense or obligations to evaluate your situation and provide you with constructive advice on whether you can hire a tax professional.

This provides a unique benefit if you face potential criminal prosecution from the IRS and avoid having talks with your tax professional to use against you accidentally.

Role of Certified Public Accountants (CPA)

CPAs devote their considerable study to a wide variety of accountancy disciplines. CPAs were some of the most flexible financial advisors accessible, offering services ranging from auditing and taxation to accounting and company planning.

CPAs, who are often regarded as the most trustworthy advisors in their field, are a great replacement for year-round financial recordkeeping and tax processing. Nevertheless, their varied level of expertise and strict schooling needs set them apart from all the other accountants.

Yet, among the most significant benefits, a CPA can provide the basis for assessing or examining a bank’s business data to assess issue areas that need to be addressed and areas where you are in top form.

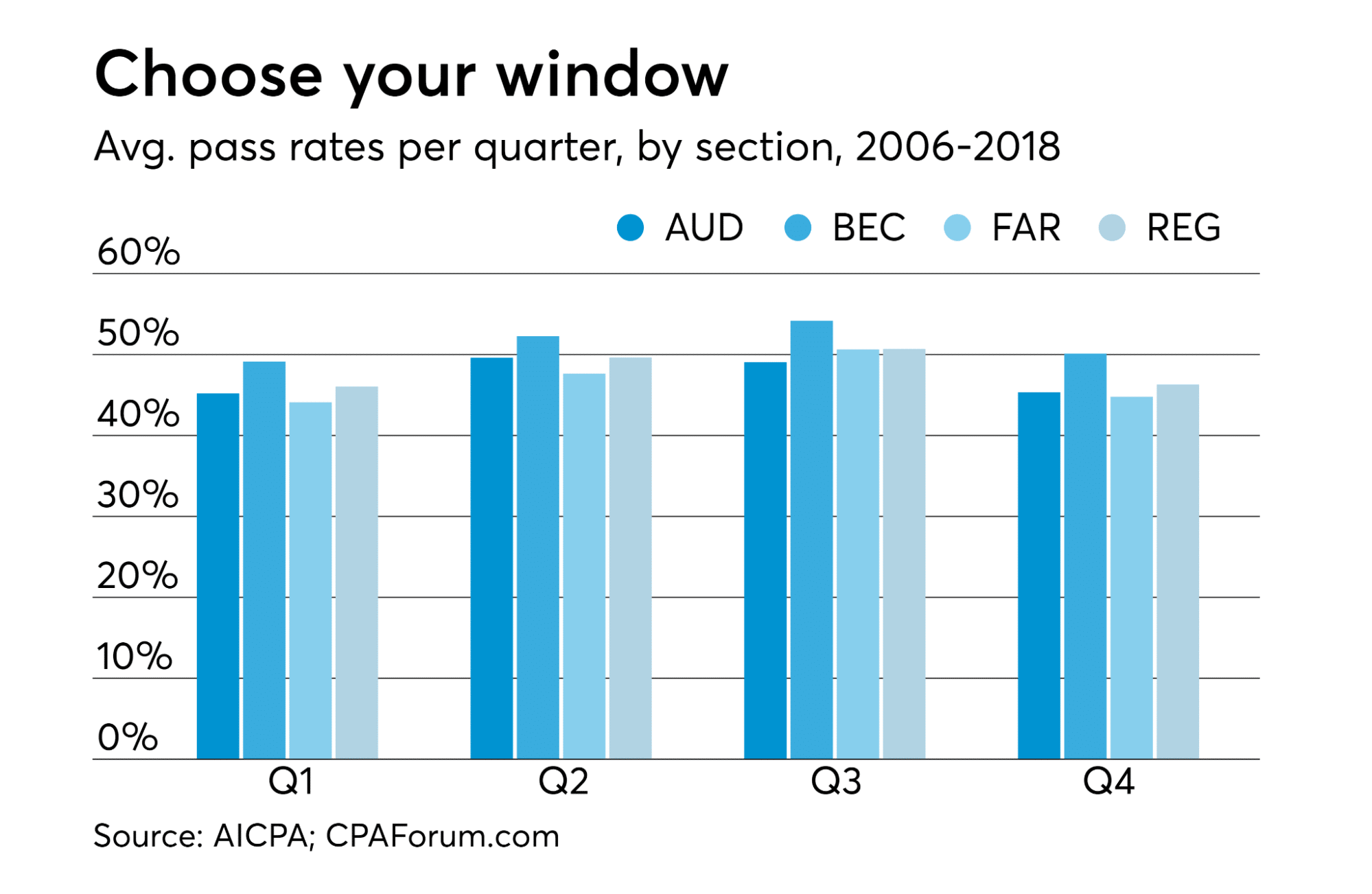

CPA exams pass rate, 2006-2018

This hardly allows you to make better-informed business decisions. Still, it also guarantees that you comply with IRS laws, which may trip you up with expected tax fines and even help your organization achieve greater lending rates.

The advantages of a dual-certified expert

A tax attorney is often used for more specialized and sophisticated tax concerns. Meanwhile, CPA is typically used regularly to support your bank records and prepare your taxes. The benefits of having two different experts are difficult to overestimate.

Not only do dual-licensed attorney-CPAs have the accounting knowledge to comprehend the technical intricacies of your company’s financial statements. They can also assist with the corporate structure to decrease tax responsibilities and perhaps keep you out of IRS problems.

CPA exam format

Furthermore, you may well be likely to save money in the future by employing a specialist who does have the experience and abilities to assist with both important company choices.

With the higher revenue of combining a tax attorney and a CPA into one expert, it is simple to understand why small businesses might profit from hiring a dual-certified attorney-CPA.

Finding the best type of tax assistance for you

Consider the tax issue at hand if you’re debating whether to engage a CPA or a tax attorney.

| CPA | Tax attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

Final thoughts

CPAs and tax lawyers can both assist with taxation, credit card service, and reducing tax consequences. CPAs may be more knowledgeable about the money perspective of tax preparation, but an attorney can give additional counsel in the event of difficulty or potential complications.

Trust an attorney if you require counsel in a tax defense lawsuit. An attorney can also assist you in resolving cases that involve large tax liabilities and other challenging issues.

Comments