Hydrogen fuel use is likely to increase in the coming years as more countries across the globe pin their focus on addressing climate change. Carbon dioxide emissions have gone down by five percent in 2020 but are expected to rise by 4.8 percent in 2021 as the economy recovers.

Because of this, countries worldwide are looking for ways to produce clean fuel by harnessing natural energy, such as wind, solar, geothermal, and hydrogen. In the United States, Norway-based oil and gas producer Equinor committed to investing $11 billion to develop hydrogen fuel from natural gas. The aim is to help reduce CO2 emissions from cement and steel plants.

This move is in line with the US government’s commitment to cut emissions by 52 percent shortly. Europe and China also made a similar pledge, but countries worldwide share the same sentiments. As the green energy movement gains support from both the public and private sectors, hydrogen stocks may experience massive growth in the years to come.

Let us look at some of the best hydrogen stocks of today and see if they are worth investing in 2022. Before that, let us review what hydrogen stocks are and how to buy them.

What are hydrogen stocks?

Hydrogen stocks are companies focusing on the production of hydrogen fuel cells. A hydrogen fuel cell is a clean fuel, discharging only water during the combustion process. Industries can utilize hydrogen fuel to produce electricity for various applications, including buildings, electric vehicles, trucks, electronic devices, power systems for backup, and more.

As a source of power, hydrogen fuel cells have seen increased demand over the years. Hydrogen fuel cells work in the same manner as batteries. The difference is that it does not require recharging so long as the fuel supply is continuous. In 2020, the global demand for this fuel was around $264.2 million. By the end of 2027, the demand could reach about $1,341 million.

How to buy hydrogen stocks?

Hydrogen stocks are becoming popular among investors lately. In general, the current developments in the hydrogen fuel industry look suitable for companies specializing in fuel cell products. However, more prominent market players are likely to benefit more than small market players.

Over the years, companies that produce no other products besides fuel cells have encountered losses and are struggling to survive. It would help if you considered this risk when investing in hydrogen stocks. What you can do is limit your exposure to this segment. If more prominent companies find interest in these pure-play companies, they might acquire them. Alternatively, you can invest in extensive stocks that operate in multiple industries and engage in fuel cell production.

Diversifying your hydrogen stock investment

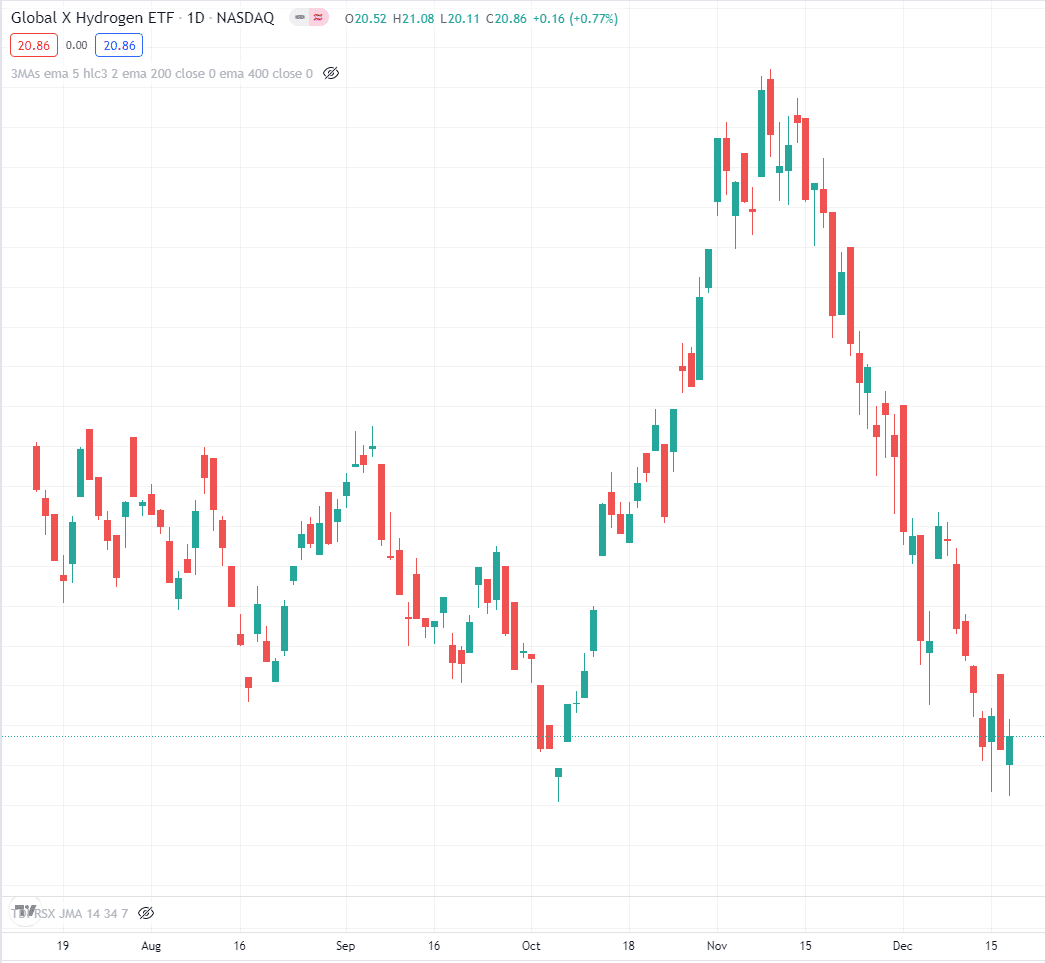

To diversify your portfolio, besides picking individual hydrogen stocks, consider getting a basket of stocks using an ETF. In this manner, you can spread the risk in several stocks with just one purchase. One example of a hydrogen ETF gaining a foothold is Global X Hydrogen ETF (HYDR).

HYDR made a NASDAQ debut on 14 July 2021 at an open price of $24.50, reached a high of $29.23 on 9 November 2021, and is currently sitting for $20.86. To buy ETFs, you must connect to a broker. There are many stockbrokers out there offering stocks and ETFs. One of the best is Robinhood. With a mobile phone and internet, you can buy your favorite stocks and ETFs anytime, anywhere.

HYDR ETF daily price chart

Top three hydrogen stocks to buy in 2022

Here are three of the best hydrogen stocks you can consider buying in 2022.

No. 1: Linde plc (LIN)

Price: $343.42

EPS: 6.80

Market capitalization: $171.106 billion

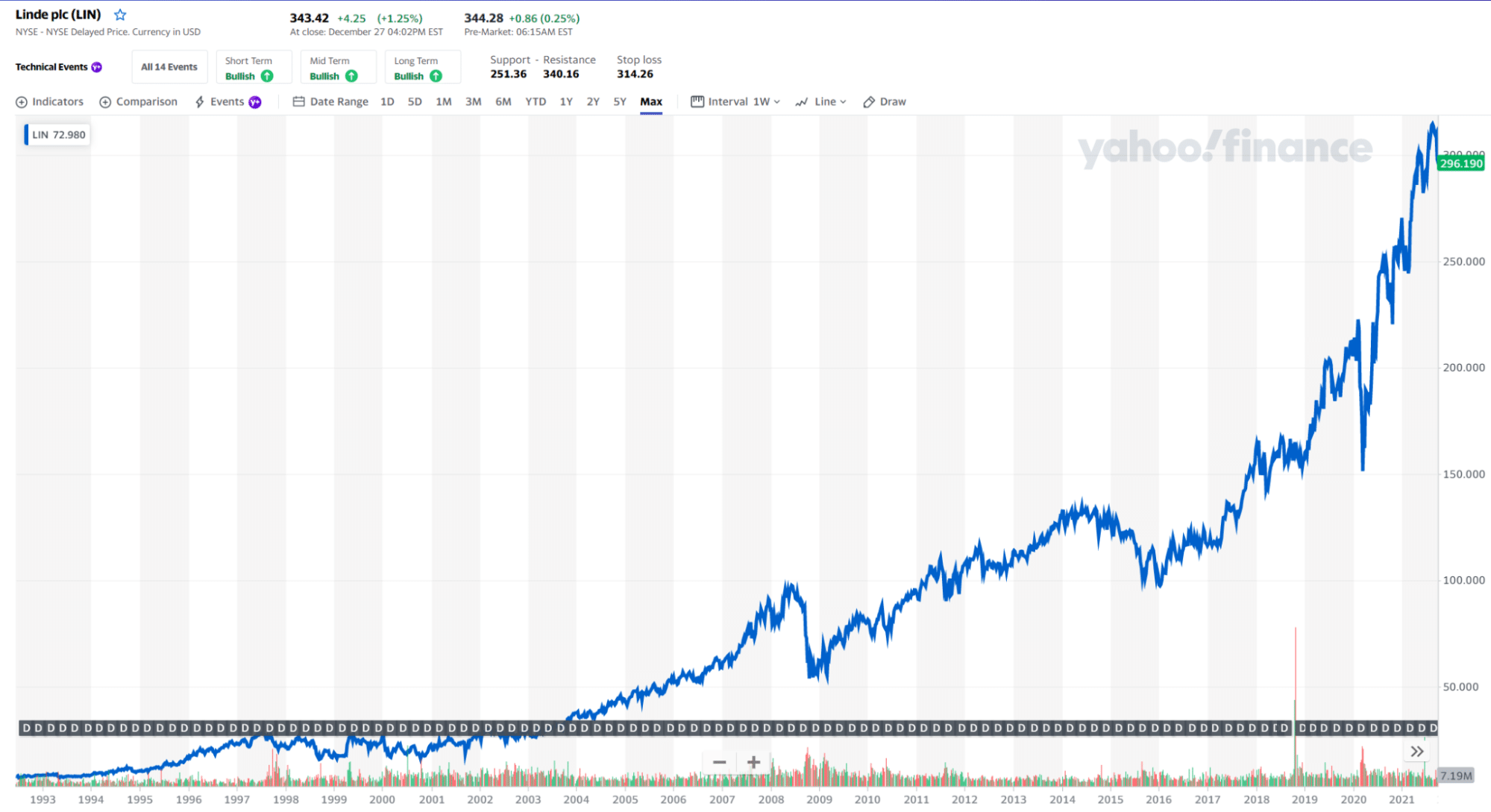

LIN stock price chart 1993-2021

Based in the United Kingdom, Linde produces various types of industrial gases, such as hydrogen, acetylene, and oxygen. This firm runs the biggest clean-hydrogen plant in the world. It harnesses wind power to produce hydrogen. Linde has successfully tested the application of hydrogen fuel to power steel plants to be able to reduce CO2 emissions.

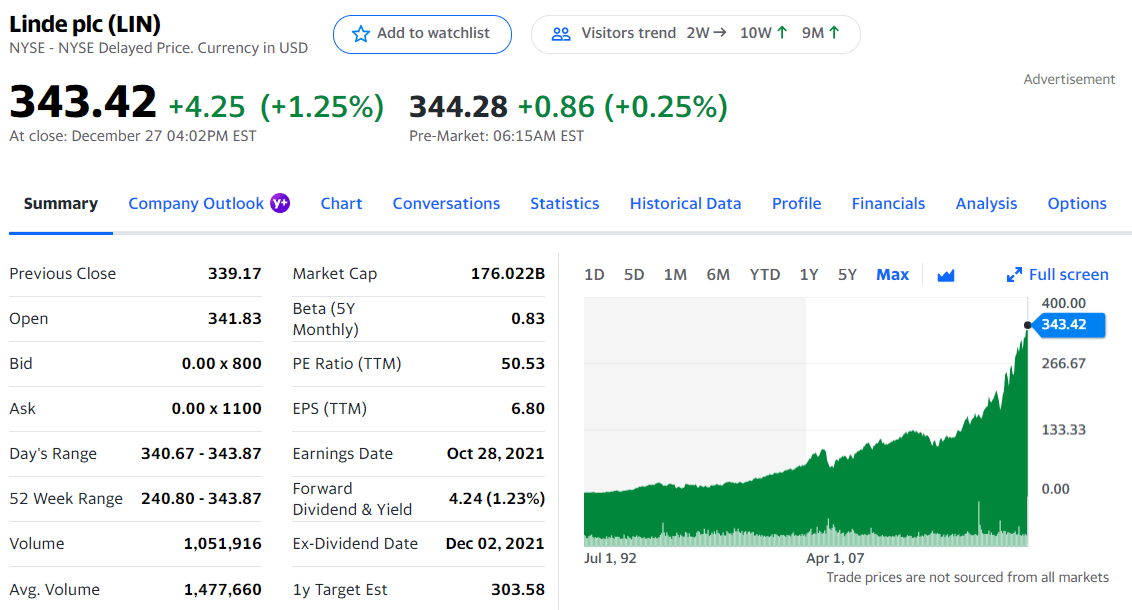

LIN stock summary

Linde’s stock grew by 16 percent in 2020, and the growth was steady compared to other similar stocks. Market analysts have a bullish bias on this stock, giving 12 buy or strong buy scores and three hold scores on the stock out of 15.

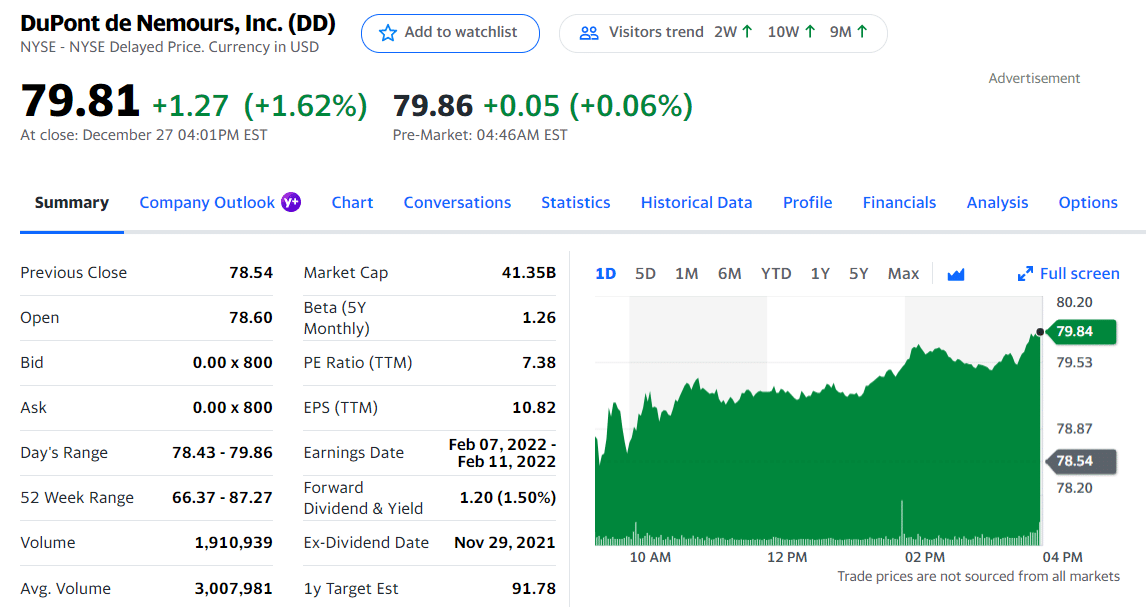

No. 2: DuPont (DD)

Price: $79.81

EPS: 10.82

Market capitalization: $39.64 billion

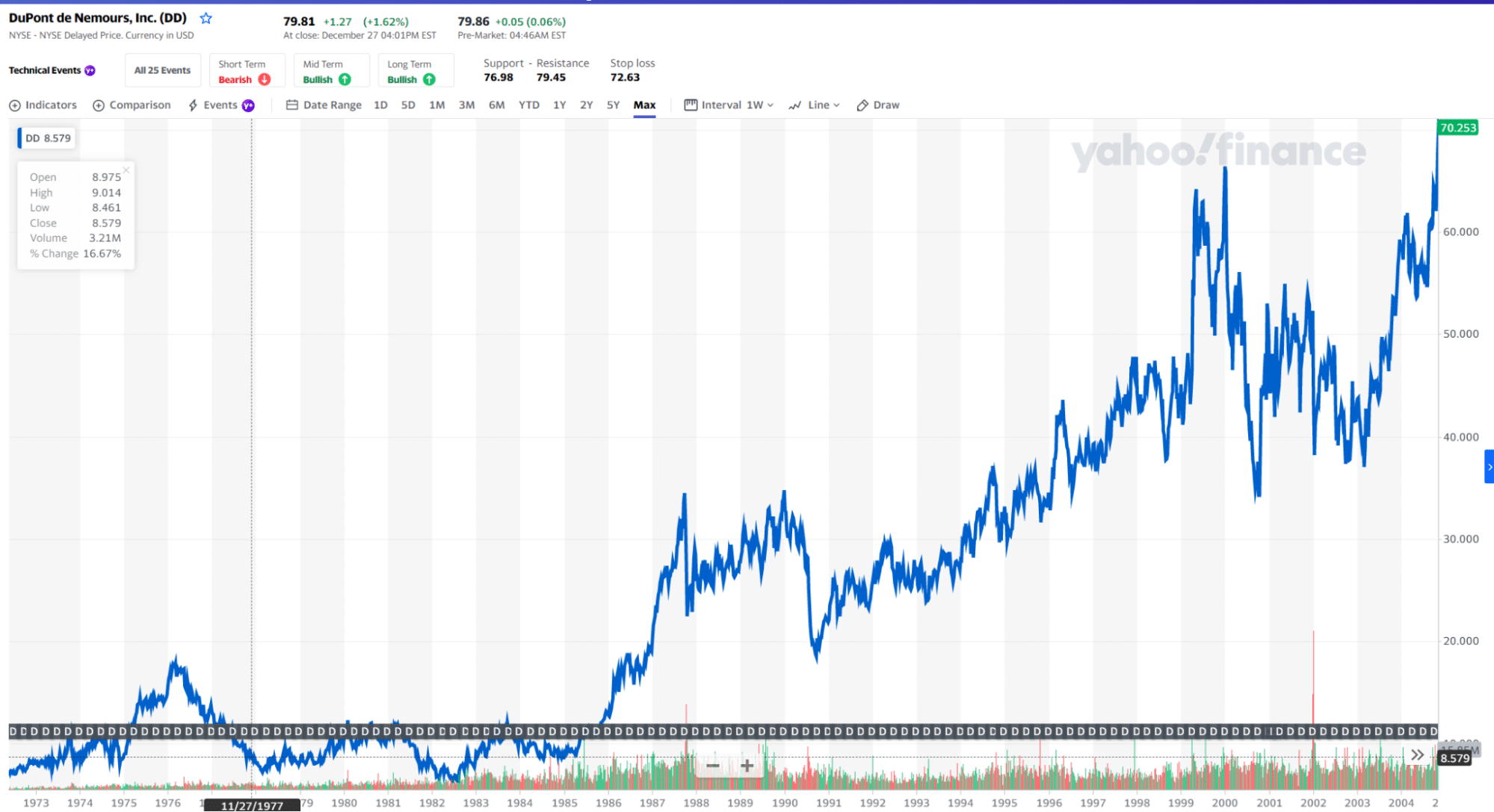

DD stock price chart 1973-2021

Headquartered in Delaware, United States, DuPont operates in the biotechnology sector and produces pharmaceutical and chemical products. The firm is not directly producing hydrogen fuel cells, but it works with a company that does. DuPont sells proton-exchange membrane (PEM) products. In 2018, it generated earnings close to $86 billion, making it number 35 in Fortune 500 companies in 2019.

DD stock summary

The stock is trading for $76.51 at the time of publishing. This suggests a potential growth of 33 percent, considering a medium-term price objective of $94. It has a positive 10.82 earnings per share, which is a measure of profitability. DuPont gives out a $1.20 dividend for a yield of 1.52 percent.

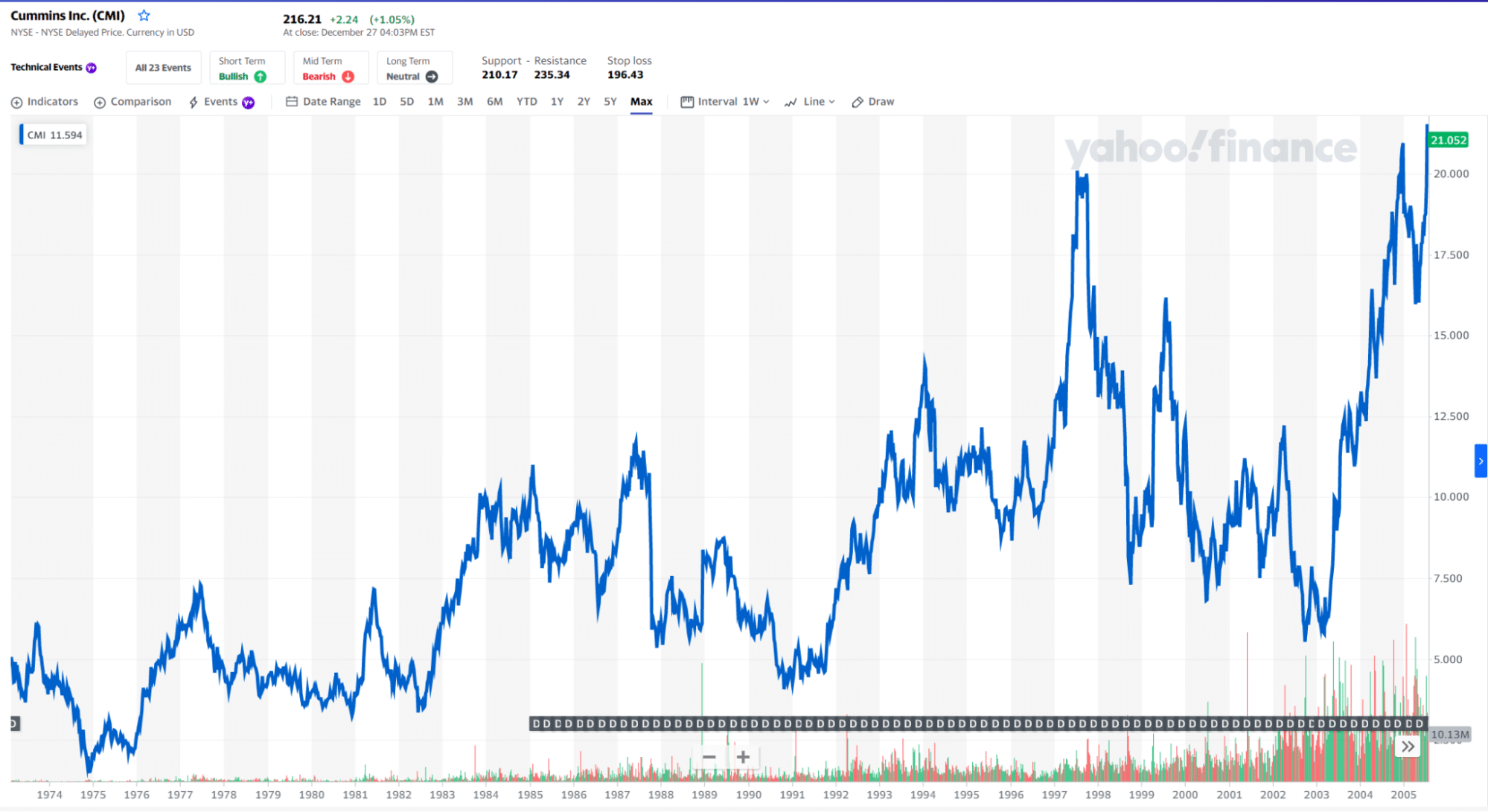

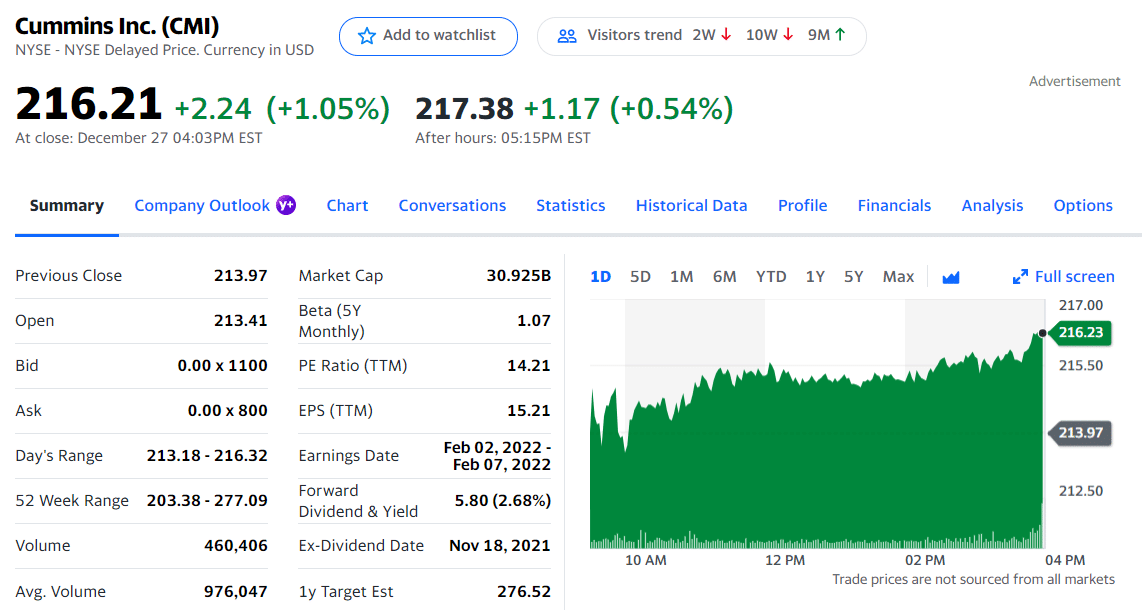

No. 3: Cummins (CMI)

Price: $216.21

EPS: 15.21

Market capitalization: $30.184 billion

CMI stock price chart 1974-2021

Based in Indiana, United States, Cummins models, creates and supports natural gas and diesel engines and associated parts. The company bought fuel cell maker Hydrogenics in 2019. Last November 2020, Cummins stated it would partner with Navistar to create semi-trucks powered by hydrogen fuel. In April 2021, the company’s hydrogen cells fuel the first aircraft that is powered by hydrogen.

CMI stock summary

At the current $211.03, the potential upside growth is 18 percent based on an average price target of $280. At an EPS of 15.21, Cummins looks attractive to investors. Currently, it pays a whopping dividend of $5.80 per share for a yield of 2.66 percent.

Final thoughts

Hydrogen fuel cells have long been recognized as effective media for storing energy similar to batteries. The adoption rate is still low at this time, though, but massive growth may be just around the corner. Governments and big corporations are seriously looking at utilizing this technology to address environmental concerns plaguing the world today. Keep this sector on your radar in 2022. Maintain a list of these stocks and take action whenever you see great developments.

Comments