One reason we invest is to prepare for our future and become rich. While investing is the key to financial success, it carries many risks that we cannot afford to ignore. That is why seasoned investors who understand this fact put their investment funds in multiple investment vehicles, such as bonds, stocks, crypto, and even ETFs.

One cool thing about ETFs is diversification, which spreads the risk among multiple stocks. This is the focus of this article. We will take a closer look at ETFs, and we will try to understand how much investment in these funds is necessary to become rich.

What is an ETF?

An exchange-traded fund is an investment fund that may contain different types of assets, such as stocks, bonds, commodities, and others. An ETF is meant to track a particular index. Like stocks, ETFs trade daily on stock exchanges. The first ETF was launched by State Street Global Advisors on 22 January 1993 but became obscure financial security over time. Investors buy and sell ETFs in stock exchanges like the London Stock Exchange.

How many ETFs should I own to become rich?

ETFs are another source of income that could give more push to your bid to become wealthy. This type of investment is resilient compared to other investments. Plus, you can purchase an ETF at a low price and with a low expense ratio while providing you with varied exposure to the stock market.

You can own as many ETFs as you can handle. If you are an experienced investor, owning at least ten ETFs can significantly diversify your portfolio while aiming for long-term growth. Start with two or three ETFs while you test the waters if you are a beginner.

No matter how many ETFs you have, monitoring and consistently learning strategies as you go along are imperative to ensure that you are not missing any updates on taxes, expense ratios, fees, commissions, and many more.

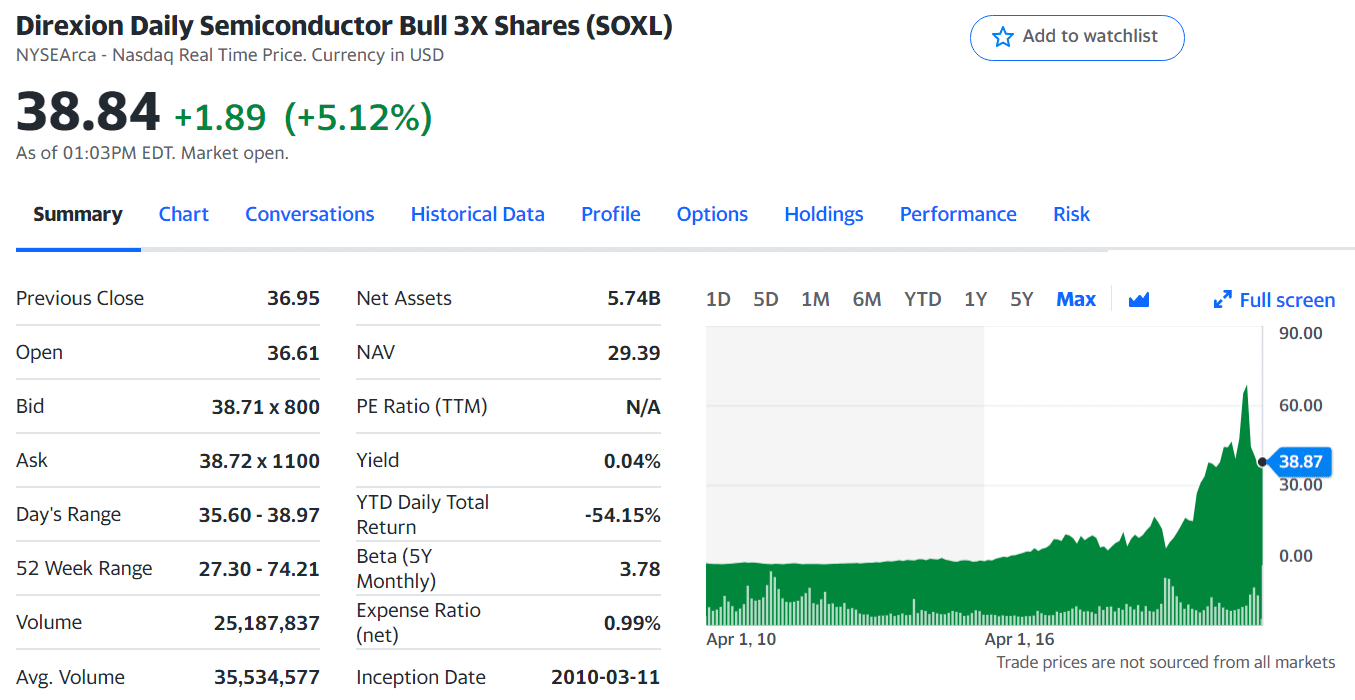

SOXL ETF summary

Figuring out how many ETFs to own to become rich is tough. First, the term “rich” is subjective. Your investment capital is another factor. For illustration purposes, let us say you have an initial capital of $10,000, and you want to reach one million dollars to become wealthy.

This example involves only one ETF, which is interesting. To make it simple, let us select the ETF with the symbol SOXL. The ETF database provides a 635% five-year return for SOXL. This means the yearly return is about 127%. Using compound interest, it will take six years for you to turn $10,000 into $1.3 million when you invest in the SOXL ETF.

Top 3 ETFs to buy and hold in 2022

ETFs are already fast becoming an investment of choice for investors navigating the stock market during crises happening the world over. The process of investing in ETFs is less complicated than any other trade instrument. This is because you can quickly get in and out whenever you want.

ETFs are also the go-to assets for investors looking for a safe haven during market volatility. Listed below are three of the largest ETFs you can consider as you dive into ETF investing.

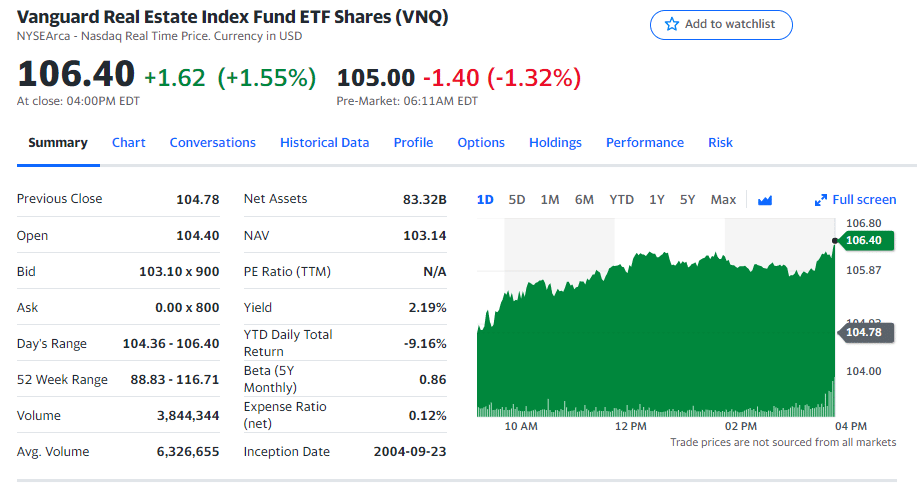

№ 1. Vanguard Real Estate Index Fund ETF Shares (VNQ)

VNQ ETF daily chart

VNQ mainly puts investment funds in real estate investment trusts, following the performance of the MSCI US Investable Market Real Estate 25/50 Index. A large portion of the main holdings of this ETF is dedicated to the Prologis stock (PLD), one of the leaders in logistics REITs. This California-based corporation is considered as the world’s biggest industrial real estate company.

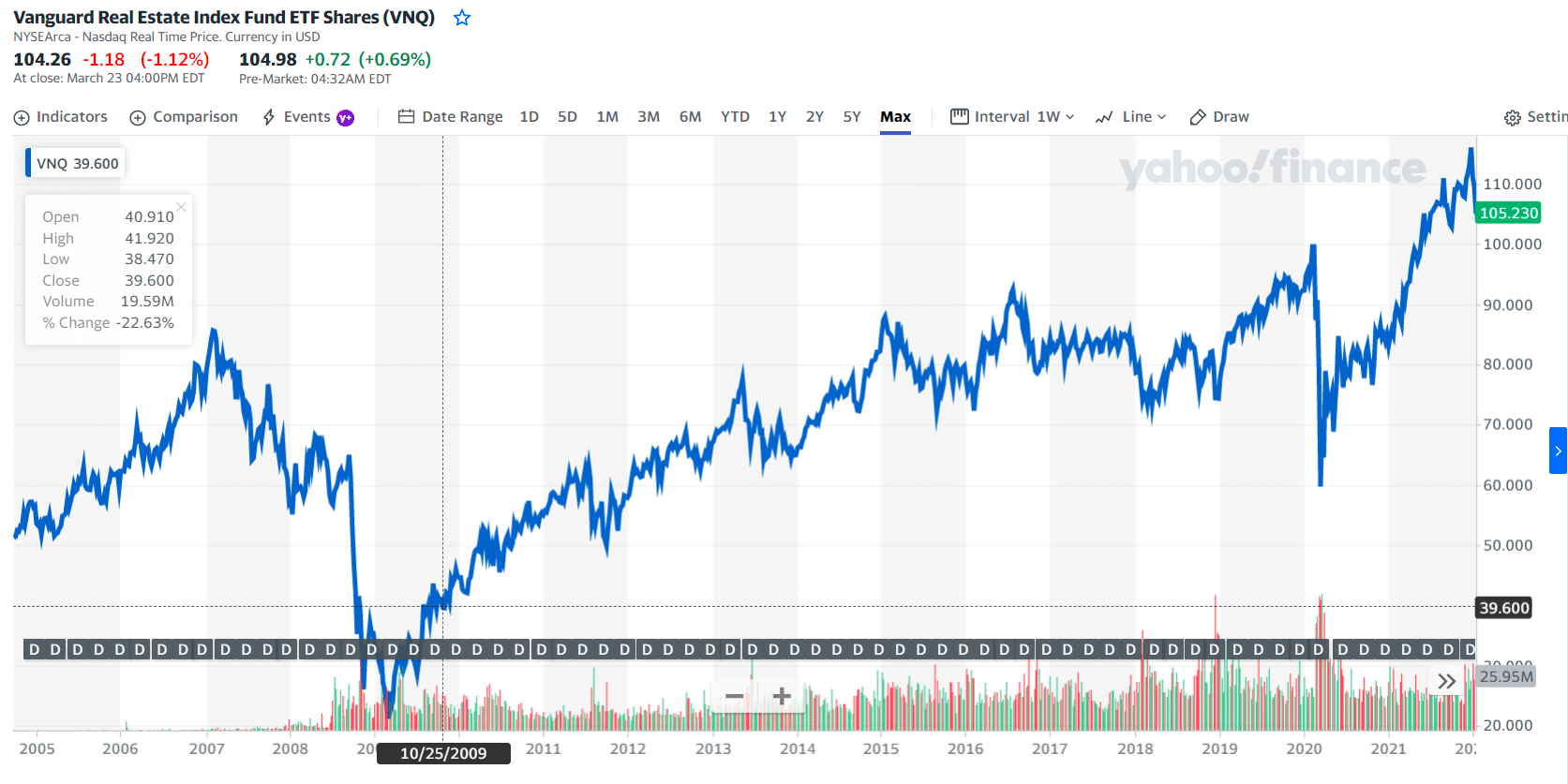

VNG price chart

The exchange traded fund holds 168 securities in its portfolio, with a total net asset amounting to $84.7 billion as of 31 January 2022. The Prologis stock under the VNQ portfolio has compelled capital structures in the real estate industry with a loan-to-loan-value ratio of approximately 25%. By the end of 2020, the company reported a revenue of 4.439 billion USD.

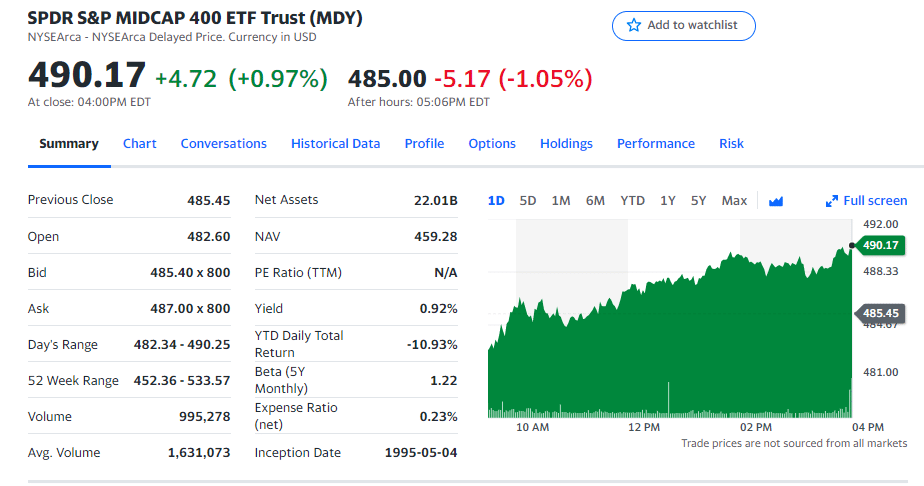

№ 2. SPDR S&P MIDCAP 400 ETF Trust (MDY)

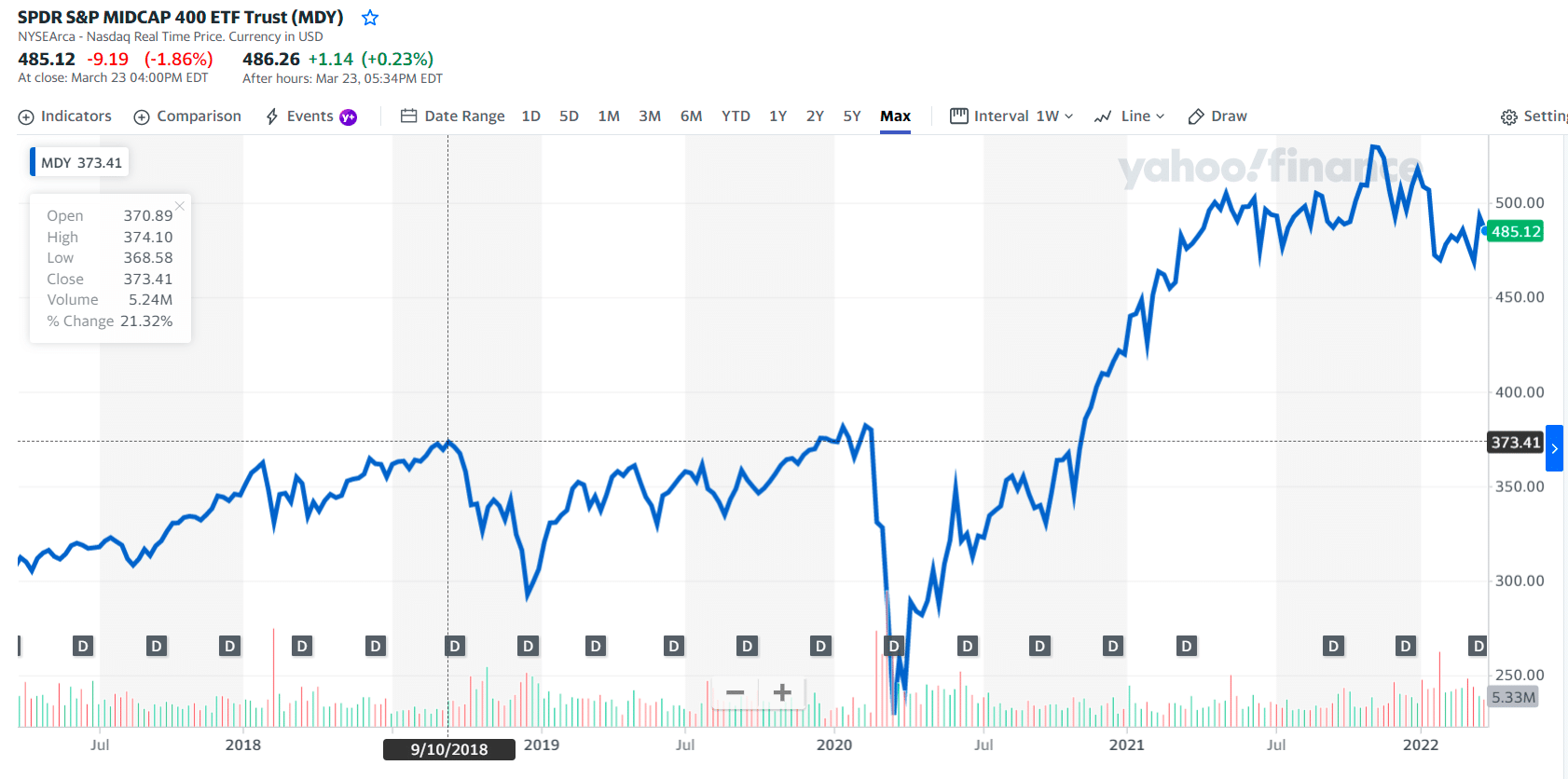

MDY ETF daily chart

MDY is tracking the price and yield performance of the S&P MidCap 400 Index, and this benchmark assesses the performance of mid-sized companies. The biggest holding in the portfolio of MDY is Camden Property Trust (CPT). This REIT is based in Texas and focuses on the acquisition and erection of apartments that house multiple families. By 2021, CPT had stakes in 171 apartment communities producing 58,588 apartment homes in America.

MDY price chart

The exchange-traded fund has nearly 19.4 billion USD in assets under management as of 10 March 2022. It ended 2021 with approximately 1.5 billion USD of liquidity and reported a revenue of 305.36 million USD, increasing 16.8 percent year over year. A holding under MDY, CPT declared a 0.94 USD per share quarterly dividend.

№ 3. Vanguard Total Stock Market Index Fund ETF Shares (VTI)

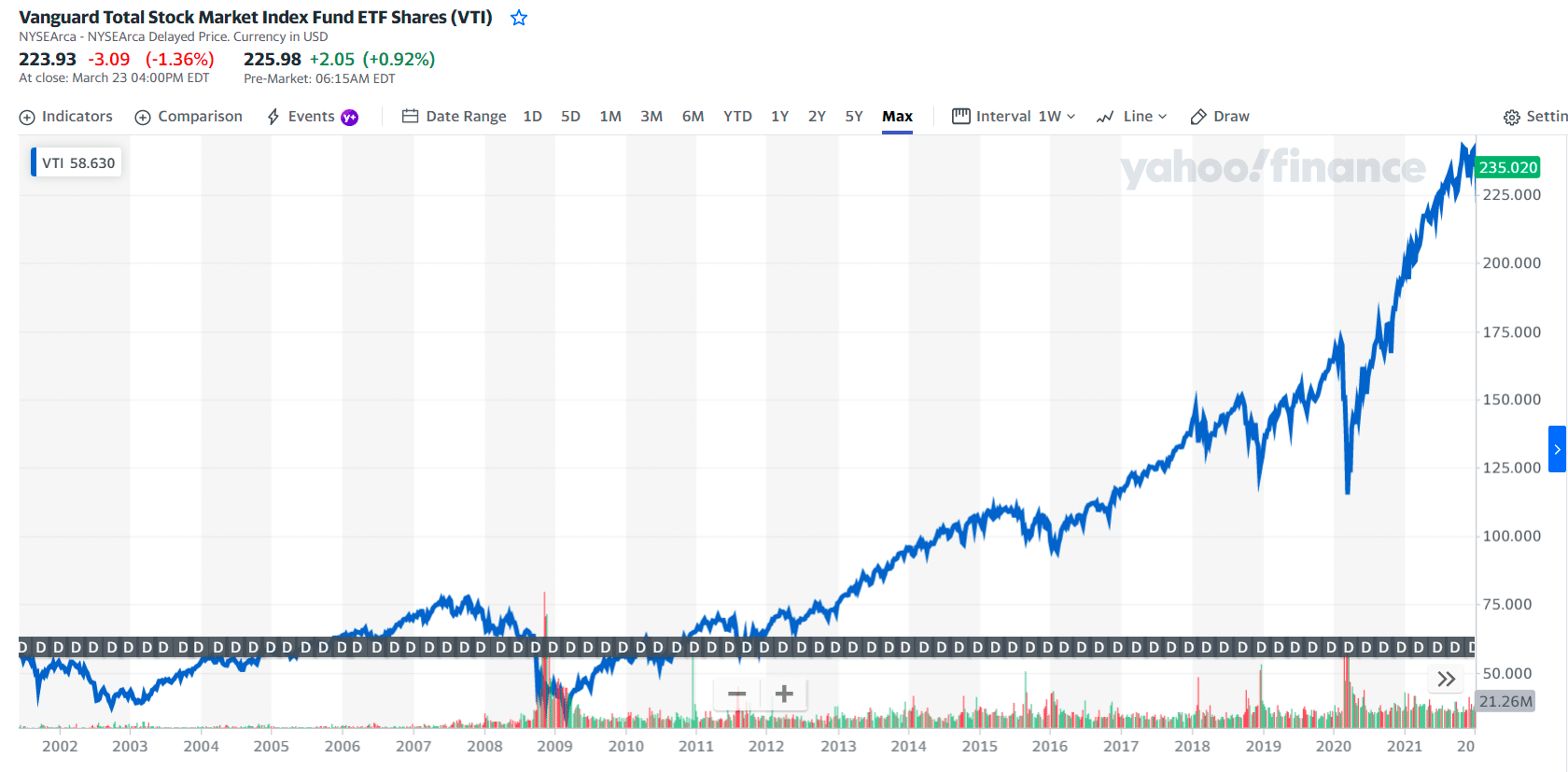

VTI ETF daily chart

VTI is a passively managed ETF that utilizes an index-sampling strategy and pursues to mimic the CRSP US Total Market Index results. VTI’s portfolio holds a diversified basket of 4,136 stocks. One of the prominent underlying securities in its portfolio is NVIDIA. It is an American designer of graphics processing units for gaming and professional markets, chip units for mobile computing, and the automotive market in California.

VTI price chart

VTI’s basket has a total net asset amounting to 1.3 trillion USD as of 31 January 2022. NVIDIA reported revenue of 16.69 billion USD upon the close of 2021. Since NVDA is extremely popular among investors, VTI holds 110 hedge-fund long positions, increasing 24.54 percent from the previous quarter. NVIDIA is also positioning itself and eyeing for more changes as it adapts to the changing market and wrestles with solid competitors.

Final thoughts

In preparation for the future, you must have a goal and a long-term perspective. Deciding on what sector your first ETF exposure would be can be challenging. The rule of thumb is to go to the sector you feel most confident about.

Your interest will build a significant difference when you feel associated with the performance of your portfolio. Plus, you will not have a hard time tracking and monitoring your ETFs. Still, starting with a long-term goal is excellent, even if you plan on making small or seasonal investments.

Comments