Defense stocks have gotten a boost since Russia invaded Ukraine. Drone technology has grown in more recent years, and the market has expanded. In earlier days, drones were heavily used for military use only, but the technology is now available for commercial use.

Just a few years ago, drones were still considered science fiction. However, about 322,000 commercial drones and more than 529,000 recreational are registered with the US Federal Aviation Administration. The global drone industry is projected to grow 12.3% annually, nearing $41 billion by 2027, according to Brandessence Market Research.

Might you be interested to know some drone stocks that can add value to your investment portfolio? Therefore, we bring you the top three drone assets with potential in the long run.

What are drone stocks?

Many people outside of the drone industry might suggest companies such as Boeing, Nvidia, or Ambarella when it comes to drone stocks. However, these companies do a lot more than drone technology, and therefore their business model is not exclusively focused on or ultimately relying on drones.

How to buy drone stocks?

Finding these assets to buy can be a little challenging when finding drone stocks to buy. This is because most consumer drone companies are not publicly traded. To find the best, we’ll have to focus on defense contractors or tech companies that use drone technology.

However, you need to sign up with a broker before buying stocks.

Top 3 drone stocks to buy in 2022

Drone technology is completely changing how our world operates, and many investors are looking to capitalize on this booming trend. If you’re interested in investing in the aerial tech industry, look at what companies in this industry do and how the stocks have historically performed. Keep in mind that positive past performance doesn’t guarantee that a stock will continue to rise in the future.

While it’s impossible to track each drone company in such a fast-moving industry, we’ve done our best to highlight the most significant players.

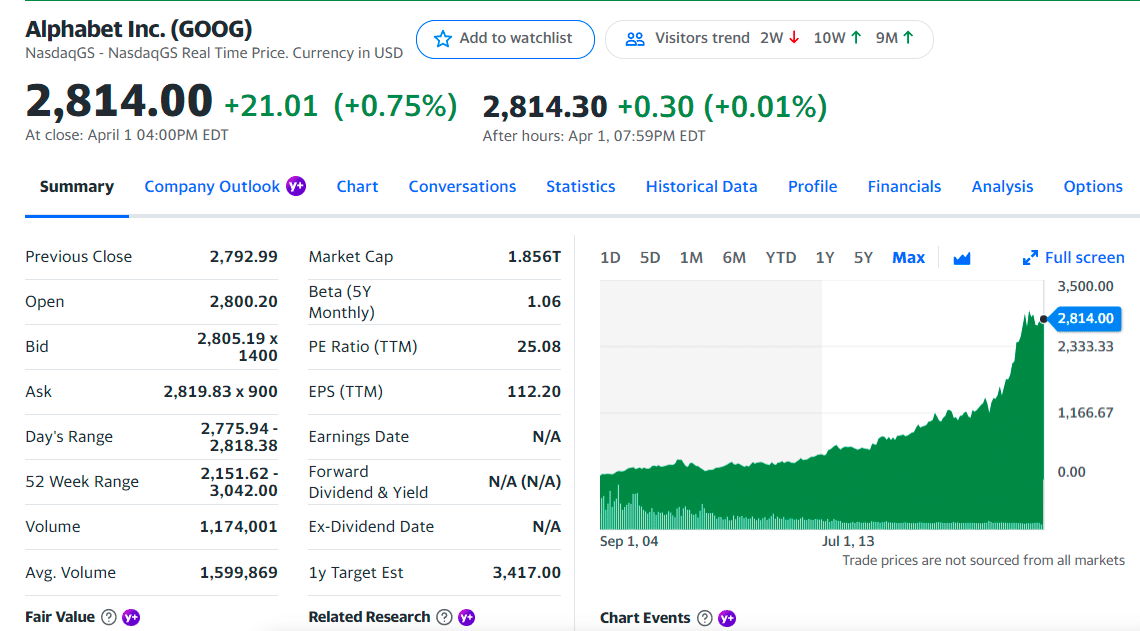

No. 1. Alphabet Inc. (GOOG)

Price: $2814.00

EPS: $49.16

Market cap: $1852.708B

GOOG summary

Alphabet Inc. is the parent company of Google and provides online advertising services in the US and internationally. It operates through Google Services, Google Cloud, and other bets segments. The company’s subsidiary Wing develops technology for drone-based deliveries.

As of the end of the first quarter this year, 159 hedge funds out of the 866 tracked by Insider Monkey held stakes in Alphabet Inc., worth over $29 billion. This is compared to 157 hedge fund holders in the previous quarter, with a stake value of roughly $20.5 billion.

GOOG price chart

Project Wing is a drone delivery company started by Alphabet, Google’s parent company. In 2017 they launched a delivery program in Australia that carried burritos and other food to remote regions. It is leading the charge on US drone deliveries, gaining approval from the FAA as a certified air carrier, and partnering with FedEx and Walgreens to deliver goods to US homes.

The first three holdings:

- Microsoft Corp. — 0.36%

- Amazon.com Inc. — 0.35%

- Meta Platforms Inc. — 1.2%

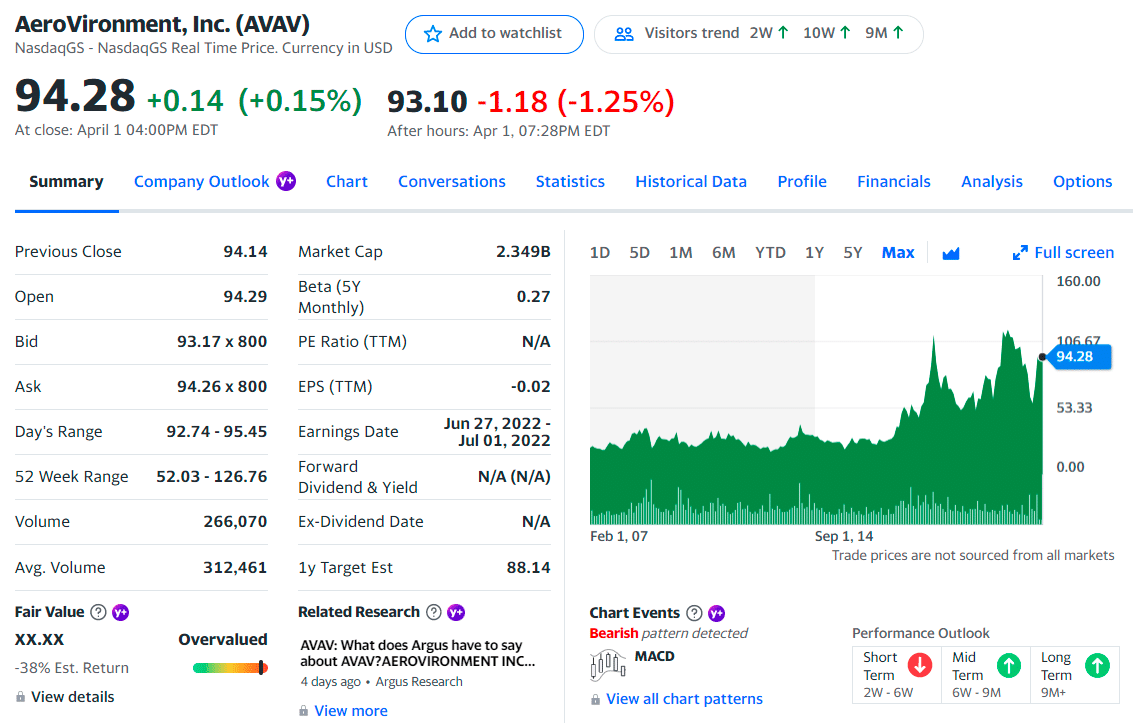

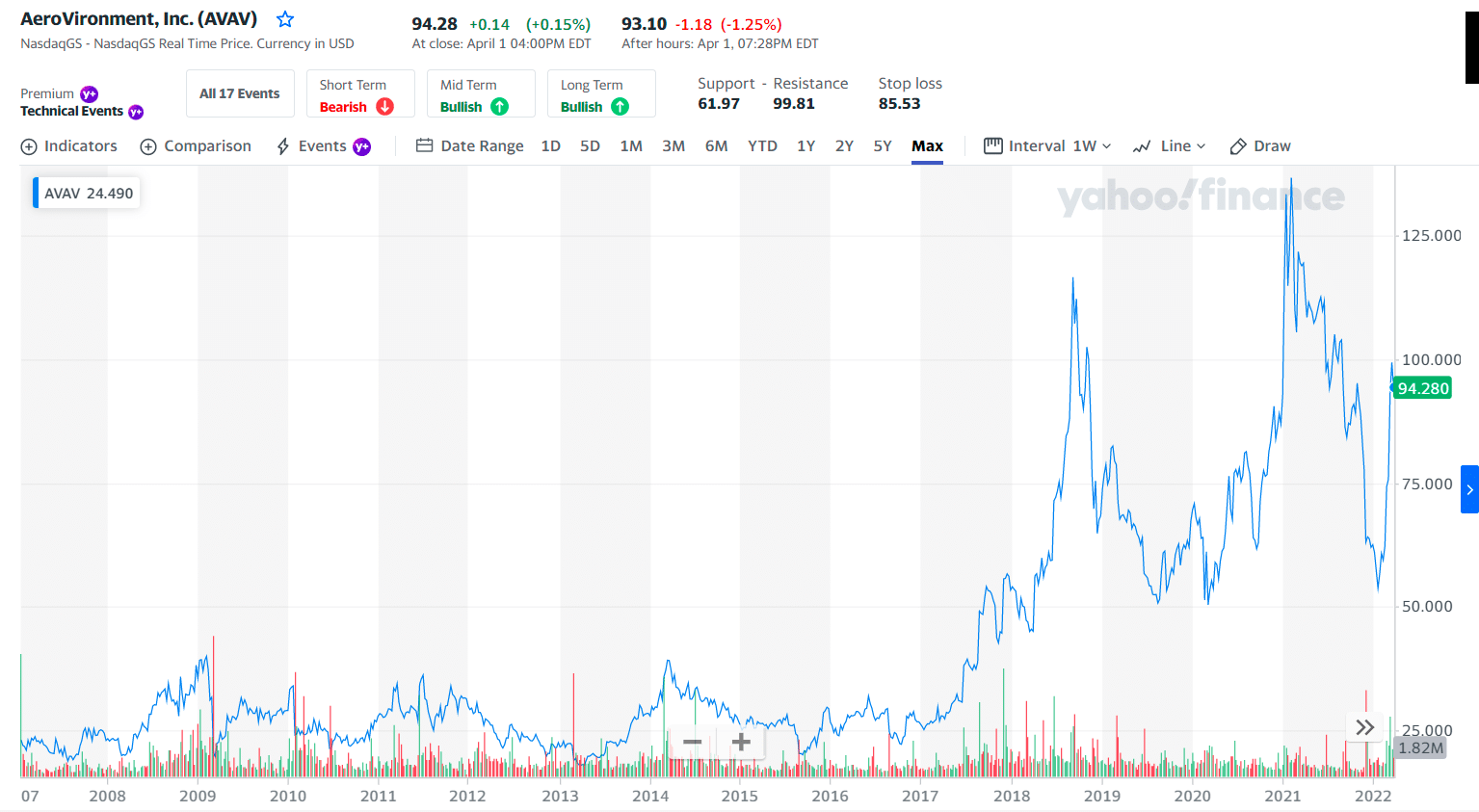

No. 2. AeroVironment (AVAV)

Price: $94.28

EPS: $0.53

Market cap: 2.349B

AVAV summary

While not as large as some of the other drone stocks, AeroVironment (AVAV) is the Pentagon’s top provider of drones. The company says its Raven drone “is the most widely used unmanned aircraft system today.” It’s now developing small hand-launched drones for the military.

In April, AeroVironment built the Mars helicopter Ingenuity for NASA, which performed the first controlled flight on another planet. The helicopter was initially set to perform only a handful of flights but has completed 18 successful flights as of December. The achievement caught the world’s attention and has already lined up more customers for AeroVironment.

Oil giant BP, the National Park Service, and law enforcement agencies have used AeroVironment’s drones on the commercial and government side.

AVAV price chart

The first three holdings:

- Lockheed Martin Corp. — 1.04%

- Huntington Ingalls Industries Inc. — 1.6%

- AAR Corp — 0.39%

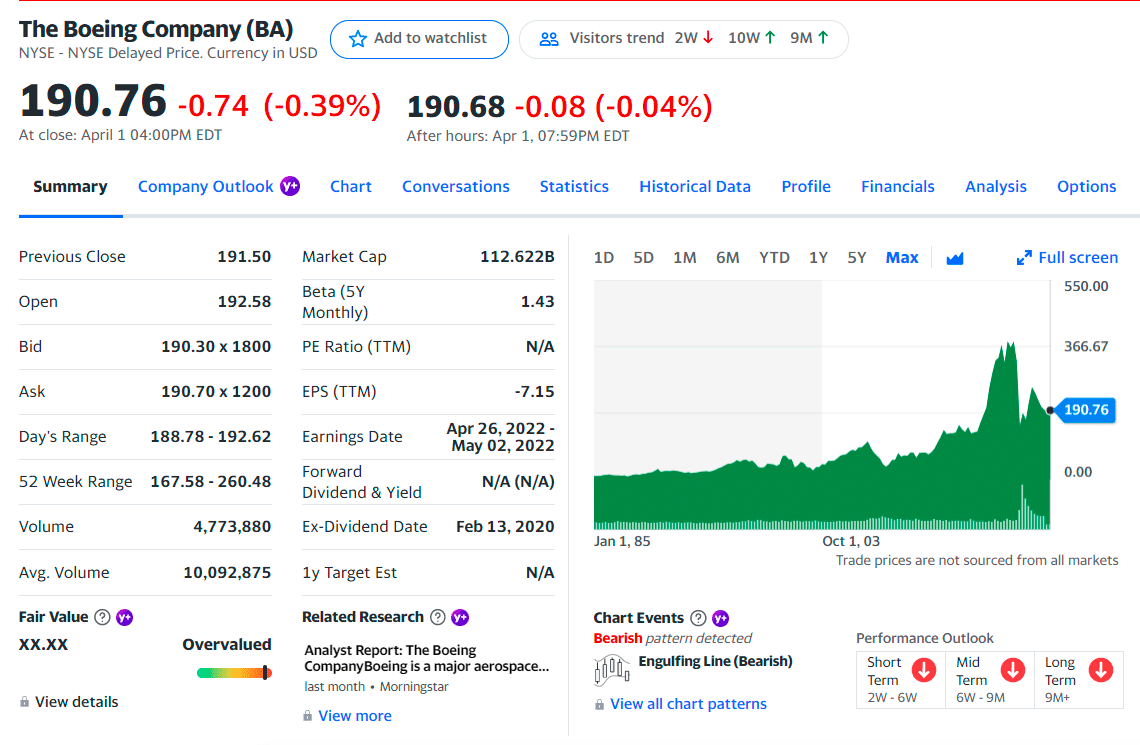

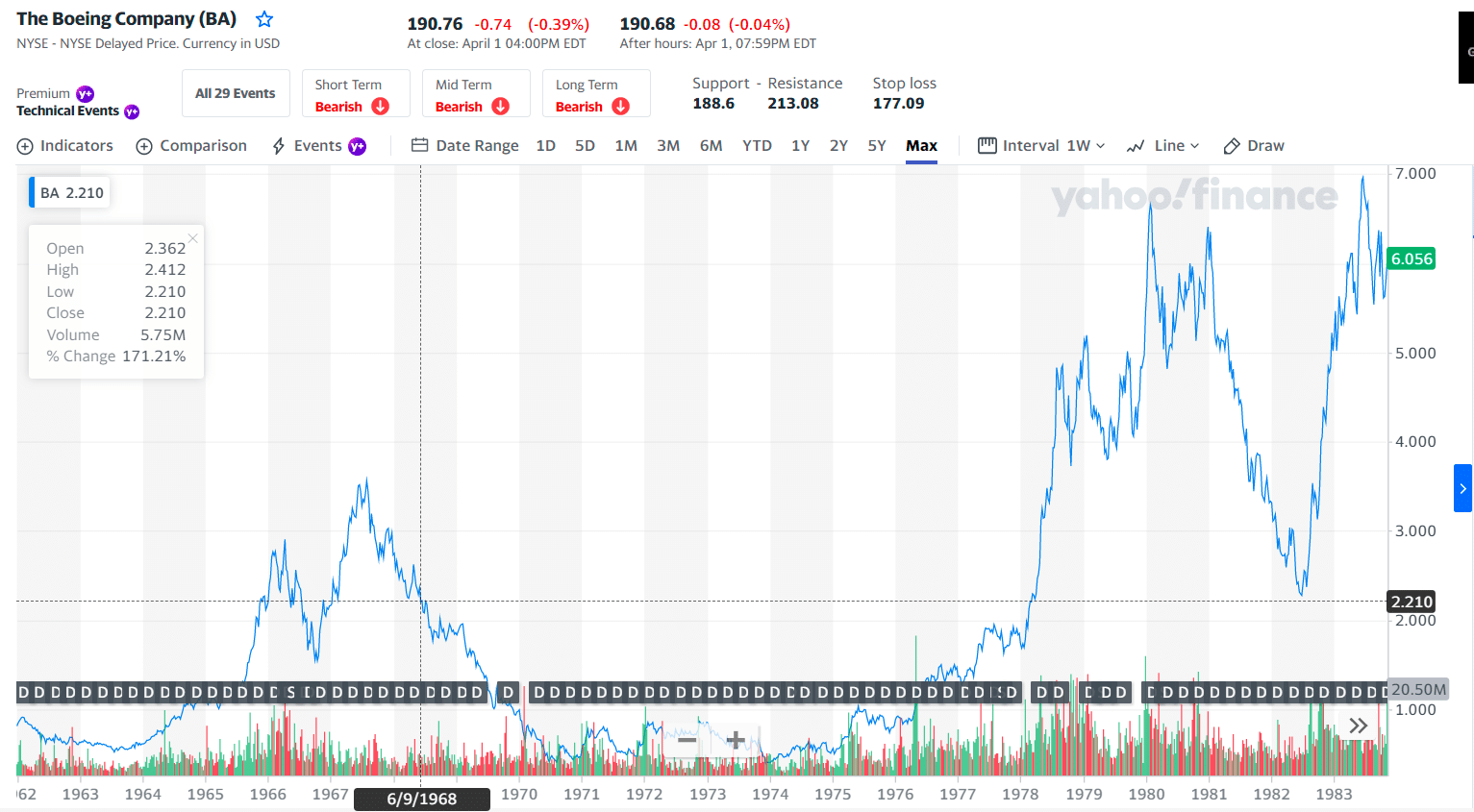

No. 3. Boeing (BA)

Price: $190.76

EPS: $0.92

Market cap: 112.622B

BA summary

Other than being one of the world’s leading manufacturers of commercial airplanes and military aircraft, Boeing is also looking to bring its 100 years of expertise into the drone market. Although drones only make up a small part of the company’s yearly income, many forecasts tell of growing revenues and demand for Boeing drones.

The company’s stocks have been struggling overall in the past few months. Their shares are trading by -0.68% year-to-date and -2.59 over 12 months. This can be attributed to the restriction of the pandemic on mobility, reducing travel, and, as a result, the demand for commercial planes. The company has weathered many storms over the decades and always comes back stronger afterward. And when looked at over five years, the company’s stocks have gained by 24.20%.

Boeing stocks represent an investment not only in drones but in a diverse portfolio with a plethora of sectors from which to pull profits.

BA price chart

The first three holdings:

- Newport Trust Co. — 7.53%

- The Vanguard Group, Inc. — 7.03%

- SSgA Funds Management, Inc. — 4.56%

Final thoughts

Drone technology is changing how we do so many things in our economy. This extends far beyond the military to HD video recordings, deliveries, aerial maintenance, and potentially even travel.

These top drone stocks are a great way to invest in this exciting new technology.

Comments