Bitcoin mining is at its best time ever. Even when China is banning it, the decentralized nature of cryptocurrency keeps the activity alive, and by sorting these obstacles out, it’s just getting stronger. Bitcoin is currently above $60,000, and nobody thinks anymore that this is a bubble. Cryptocurrencies are here to stay and change the way the economy works.

Now, investing in cryptos is not just about buying Bitcoins or setting up mining places. That would be too expensive. For the small investor, there are other ways in which profit from this crypto boom. One of those ways is by investing in BTC mining stocks. Let’s see some of the best options to invest in Bitcoin mining stocks in 2022.

What is Bitcoin mining stock?

It is a stock whose value is somehow tied to using hardware power to mine Bitcoins.

From the beginning, BTC has been a decentralized currency based on the collaboration of individual miners that put their computing power to solve complex mathematical equations to secure transactions between parties and mine new Bitcoins.

Today, this activity is just affordable for big investors since competition has raised the bar so high that only application-specific integrated circuits (ASIC) combined with having the chance of mining one BTC.

This equipment is expensive and not suitable for a small investor since its initial cost is very high, but also because the cost of electricity reduces its rentability greatly.

Now, this doesn’t mean that investing in mining should be off the table. Instead, it means that if you don’t have the money to do it by yourself, the best option is to invest in companies that can. That’s where buying Bitcoin mining stocks comes into play.

How to buy Bitcoin mining stocks?

Once you have the idea of investing in Bitcoin mining stocks, you may think that it is simple, you find a mining company and then wait for the stocks to increase their price. But it is not that simple. Due to Bitcoin’s high price, it is profitable now, but many things can change, especially in a so young and volatile market.

You have to consider many things like the cost of electricity where the company has its farms, the country’s regulation and openness to crypto mining, and the resources they use to power their equipment. All these factors impact the sustainability of the company, and ultimately, your future profit. Next, we are going to check the five steps for buying BTC mining stocks.

Step 1. Select your broker

Whether you are going to invest in oil, tech, or cryptos, the selection of your broker is key.

A good broker should offer you the simplest way of investing and constantly check in to see how things are going. Most brokers also offer educational material so you can invest wisely.

Once you choose the right broker for you, opening that account won’t take you more than 20 minutes, and after you verify your identity and link your broker account to your bank account, you will be good to go.

Step 2. Choose your mining company

To invest in a company, you have to believe in the company’s project. To do that, you need to investigate extensively. This is one of the most important things you need to do. Mining BTC is as volatile as Bitcoin itself.

The profitability of the activity depends on the cost of the operation and the price of Bitcoins. If the cost of electricity is too high, when the price of Bitcoin drops, it severely affects rentability. Also, the instability of the country can make a company fail. All these are factors you need to check before you invest in some stocks.

Step 3. Decide how much you are going to invest

It is never advisable to put a lot of money into one company. A healthy portfolio has several investments that should not account for more than 4% of your capital. Once you made up your mind about what you are looking for, we recommend investing in different companies.

Different companies will have different projects, and betting on just one will increase your risk exposure.

Step 4. Check your investments regularly

The coin price will constantly go up and down, which every investor has to know when investing in BTC. In addition, market developments frequently affect mining farms, so you need to check in to see how things are going or if it is time to move on.

Step 5. Look for other opportunities

You don’t have to marry a company. Although this is a long-term race, and you want to wait to see how much money you can make in the next few years, new mining projects come out every day, and maybe some of them will be better than those you are investing in the first place. So, you don’t want to be jumping from one company to another, but once you are sure that a company’s project is better, you shouldn’t be afraid of betting on that new one.

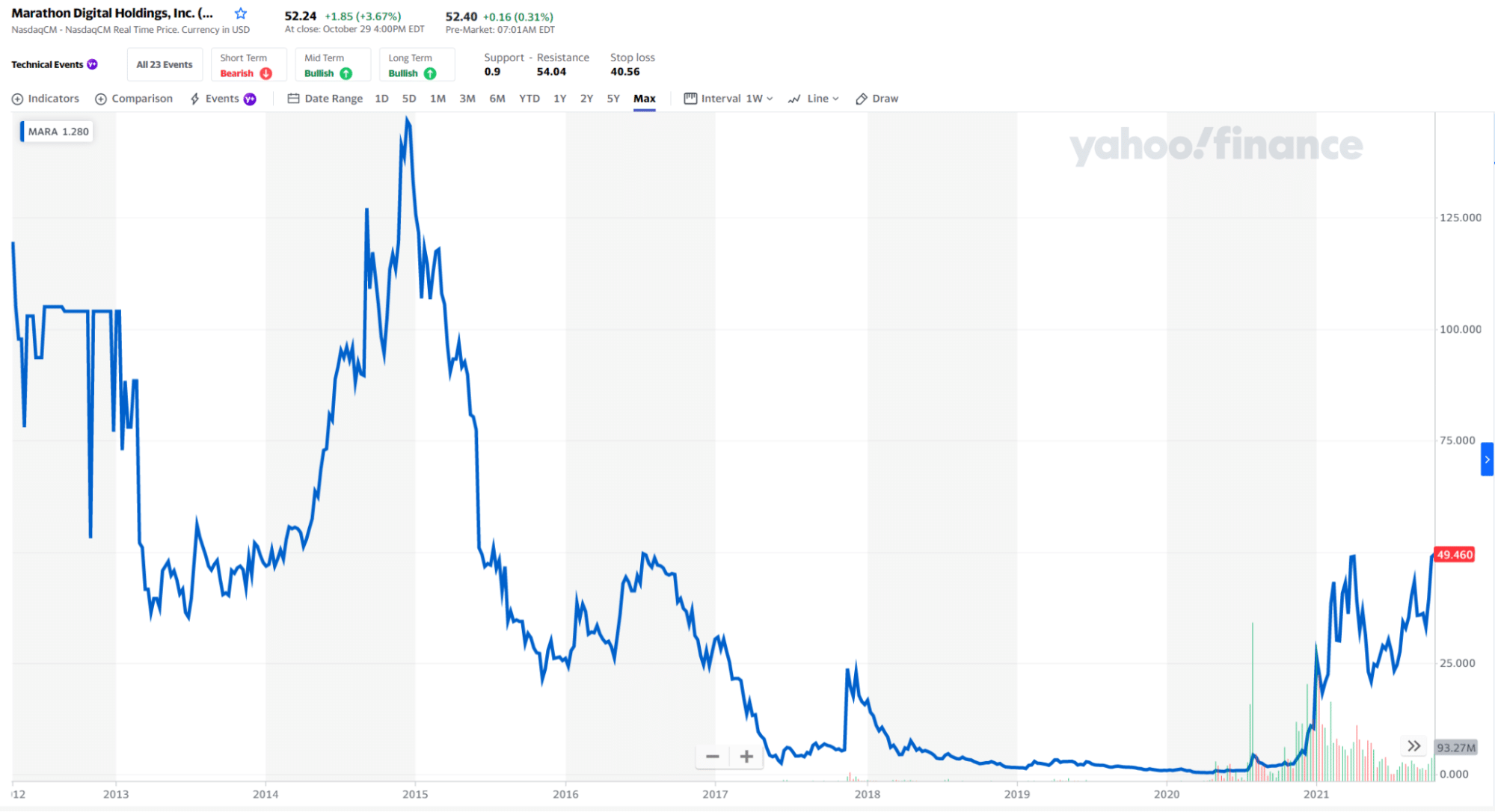

1. Marathon Digital (MARA)

Price: $50.39

EPS: 0.87

Market capitalization: $5.021B

Marathon Digital Holdings, Inc. engages in mining cryptocurrencies. It is based in Las Vegas and is one of the most exciting mining companies today. Its stock price has increased by 200% since the end of 2020.

Marathon Digital’s stock price is above $50

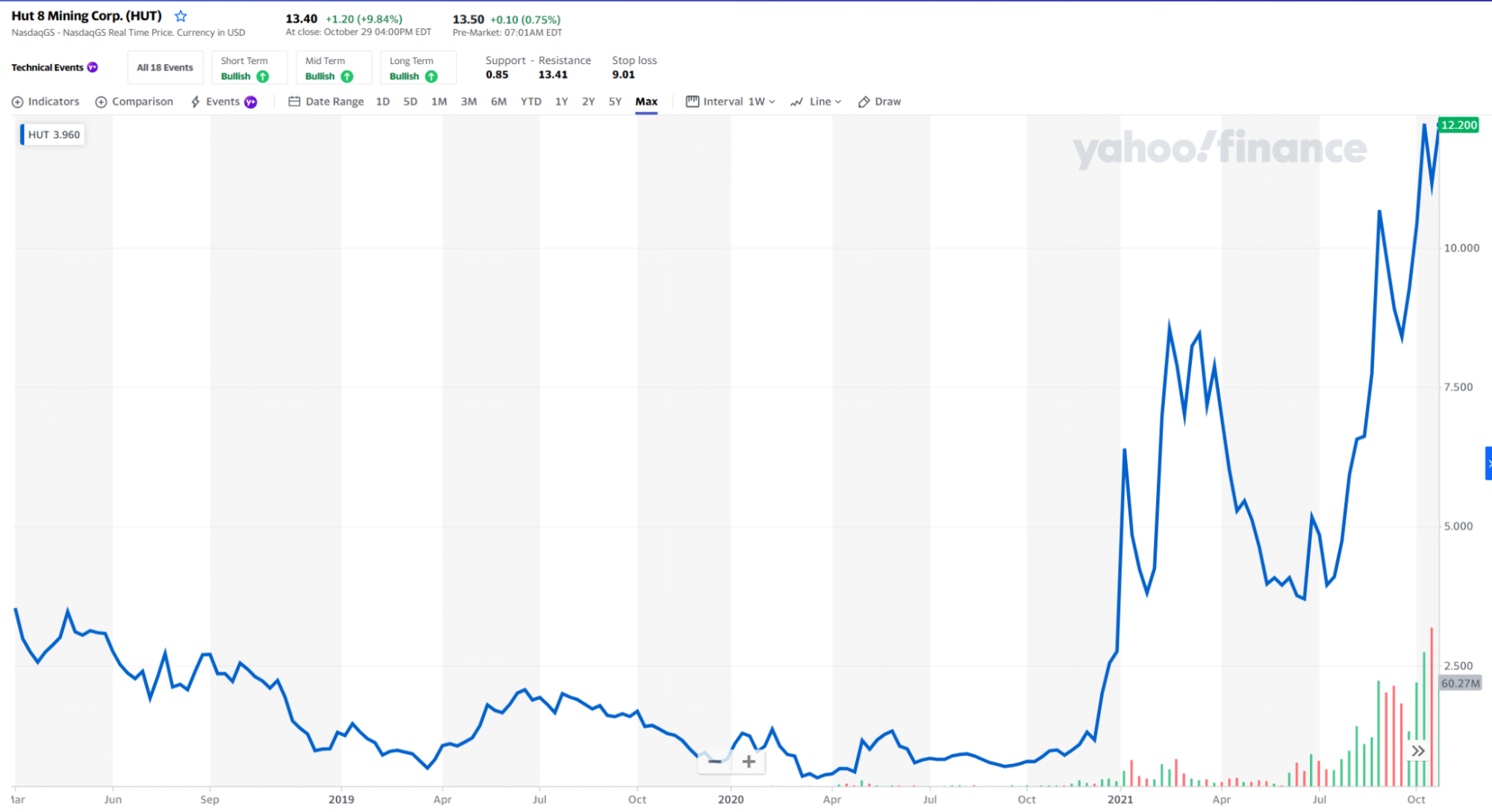

2. Hut 8 Mining (HUT)

Price: $ 12.20

EPS: 0.30

Market capitalization: $2.002B

Hut 8 Mining is a cryptocurrency mining company with the required infrastructure to mine only bitcoins. Among the projects of the company is to increase to 2.5 quintillion guesses per second.

Hut 8 Mining’s stocks cost ten times what they cost at the end of 2020

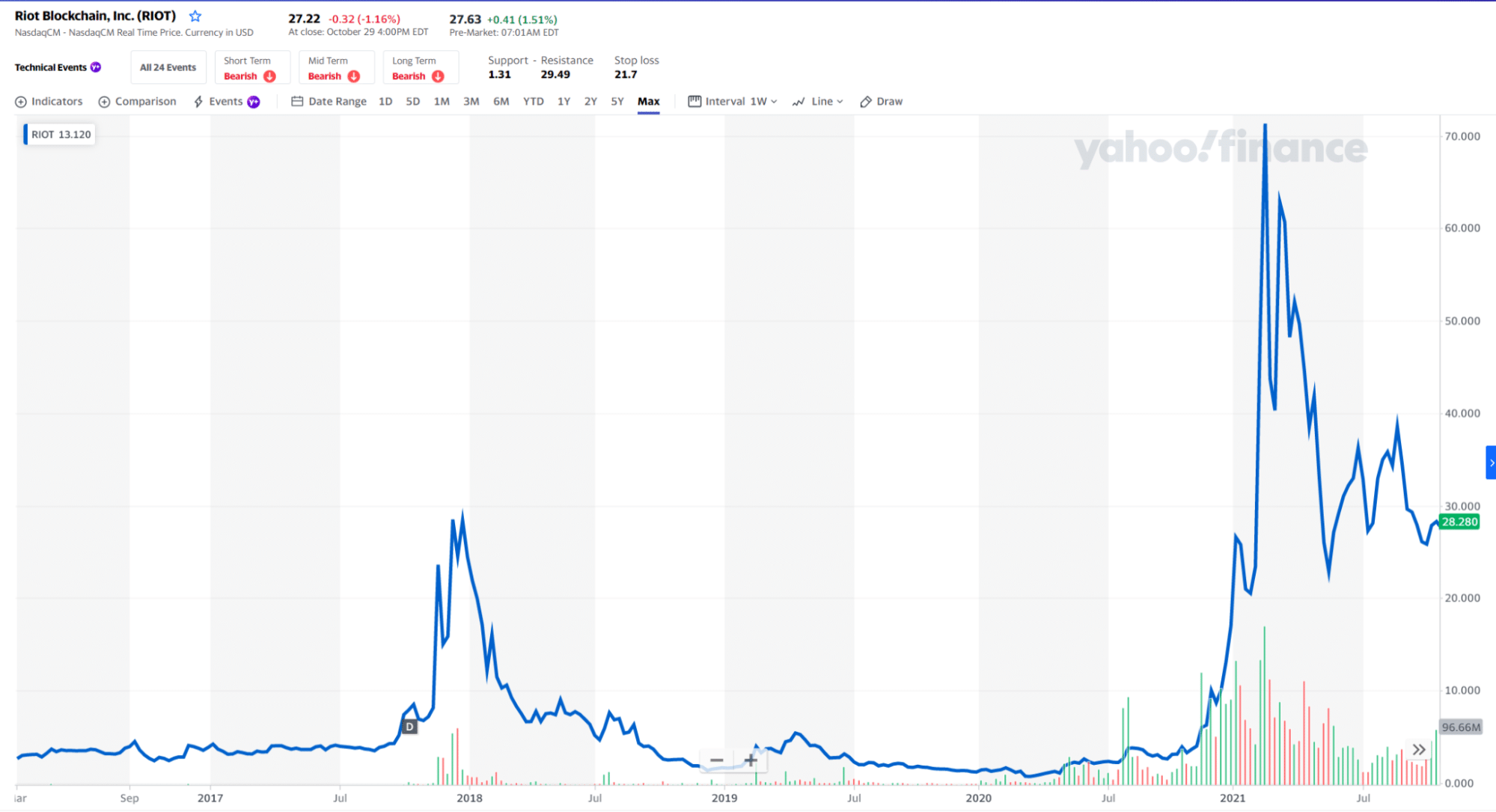

3. Riot Blockchain (RIOT)

Price: $27.54

EPS: 0.42

Market capitalization: $ 26.42B

Our last recommendation is Riot Blockchain. This company is the second biggest mining company in North America. It was founded in 2000, and its headquarters are in Castle Rock, Colorado.

Riot Blockchain reached its peak in February and now is close to $30

Final thoughts

Cryptocurrencies are seen right now as the gold of our time. Everybody wants their piece. But you have to be careful because many people lost their money mining gold. This can also happen if you invest in the wrong companies.

Investing in Mining companies is an affordable way of participating in the crypto world, but the risk is the same. Therefore, you must research before making any decisions.

Comments