Exchange-traded-fund is a collection of financial securities allowing investors to own portions of various assets in a single and combined fund. Moreover, ETFs are cost-effective as they nullify the expenses of holding every stock share independently.

Traditional ETFs are passive investments that track a benchmark index or market sector and derive their proportional value from these underlying assets. However, with the evolving needs of investors, many unique and innovative ETFs have become available, such as inverse Treasury ETFs, which operate in contrast to the regular ones.

Inverse ETFs have gained the attention of speculative and short-term traders to maximize their profits in unhealthy economic conditions. But investing in inverse bond ETFs requires substantial expertise and risk tolerance due to the associated liabilities.

You may be conflicted about the decision to invest in inverse Treasury ETFs. Read this article to learn about the working of these specific funds and the best inverse ETFs to invest in 2022.

Inverse Treasury ETFs: how do they work?

Inverse ETFs

They work in opposition to the standard ETFs by increasing their value when its index falls in value. They possess an inversely proportional relationship with the prices of their underlying assets; hence shareholders invest in these funds when they expect a waning of the connected index.

Inverse ETFs are useful for hedging purposes and protect against losses in the financial market. In addition, they extract profits from increasing interest rates as they move in an opposite direction to the asset price.

These funds work by a mechanism of short selling. For example, if an iShares Russell 2000 index (IWM) loses 2% of its value, its inverse ETF will increase 2%. Moreover, they utilize derivative securities, including futures, options, and swap agreements, for this inverse functionality.

There are many leveraged inverse ETFs that do not work straightforwardly. This type carries the risk of leveraged positions and can multiply the gains or losses by two-fold or three-fold. For instance, if an index has a 1% decline, its 2-inverse Treasury ETF would increase 2%.

What to check before choosing inverse Treasury ETFs?

It is imperative to prudently plan out your goals and risk appetite before investing in the inverse ETFs. Due to the compounding risk on inverse funds held for more than one day, they are not a strategic choice for cautious traders.

They operate differently from the traditional ones and demand an enhanced comprehension of the financial ecosystem. Before investing in inverse funds, investors should review the economic health of a company/country and forecast the path of interest rates.

Generally, inverse Treasury funds have higher expense ratios than traditional ETFs as they are “active funds.” Still, investors need to gauge the expense ratios and “tracking difference” of various inverse ETFs to pick out the most appropriate one.

Moreover, investors need to avoid long-term holding of inverse ETFs as underlying assets eventually bounce back to high prices, and there is a regular re-adjustment of leverage.

Consideration of tax costs, commissions, and fees are also necessary to derive maximum benefits from your investments.

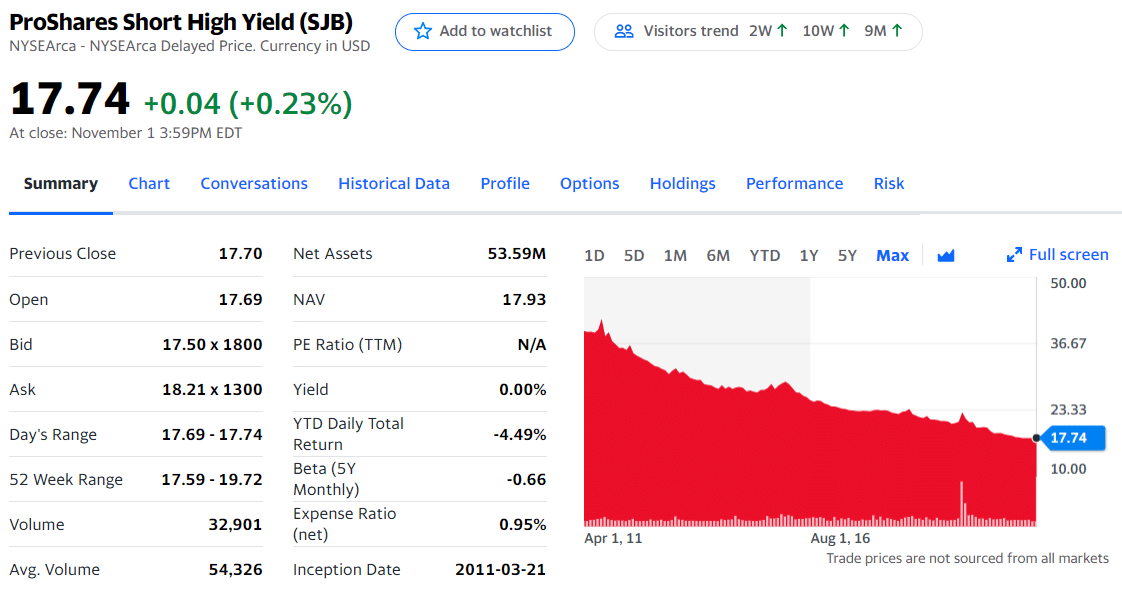

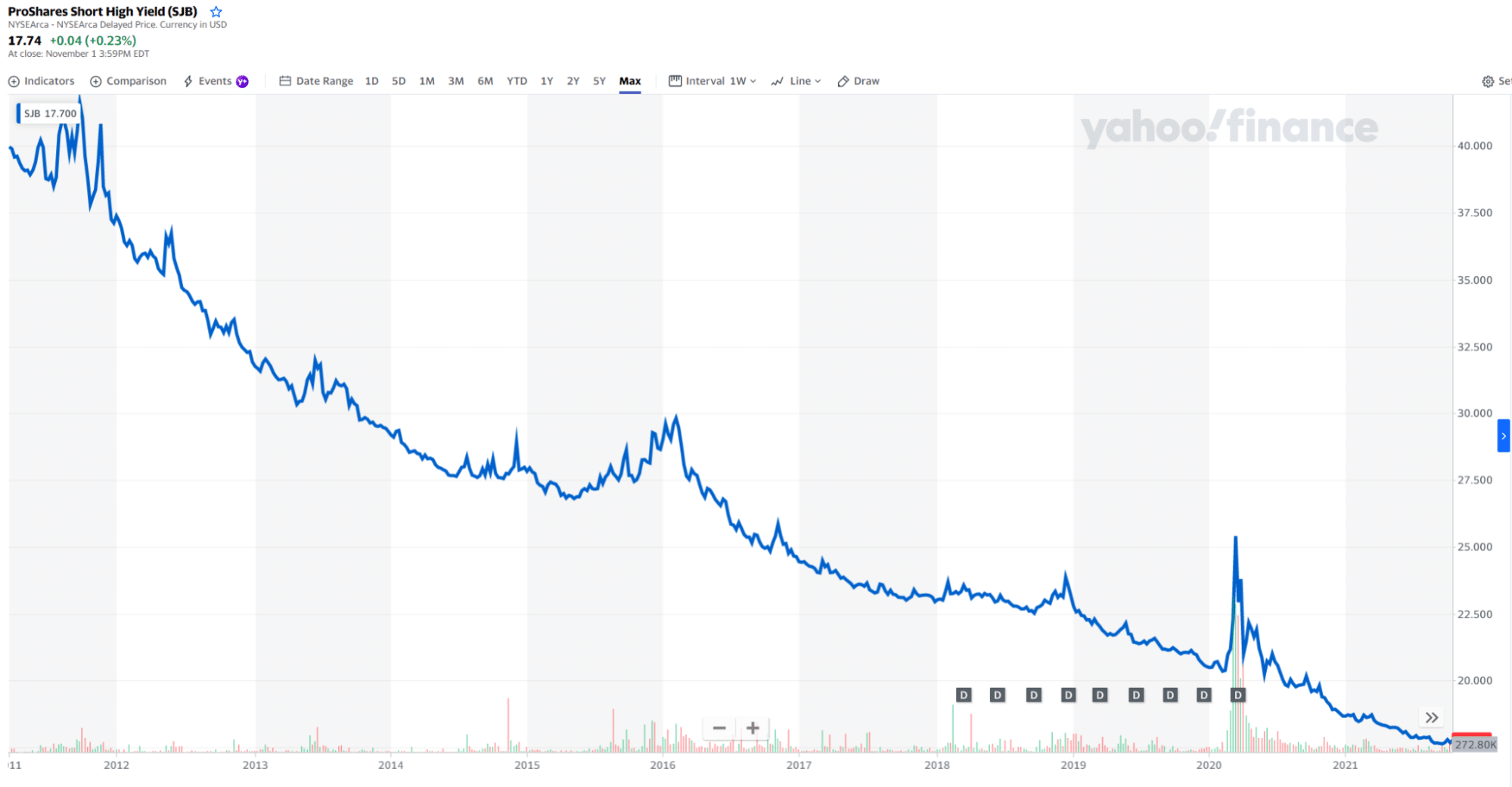

1. The ProShares Short High Yield (SJB)

Price: 17.70$

Expense ratio: 0.95%

The ProShares Short High Yield delivers an inverse exposure of Markit iBoxx $ Liquid High Yield Index, with NYSE Arca as its primary exchange. This ETF consists of USD corporate bonds that have a below-investment-grade rating. These junk bonds are high-yield bonds as they have high-interest rates to neutralize the risk.

SJB chart

SJB has been functional since 2011 and generates investment returns for a single day, before fees and expenses. This inverse ETF’s total net assets are approximately $60.20 million with $3.4 million outstanding shares.

In addition, the expenses of SBG stand at 95 BPS with a three-month average trading volume of 55,198. The asset division of its underlying index is as follows:

- US dollar: 85.78%

- United States Treasury Bills 0.0%: 14.22%

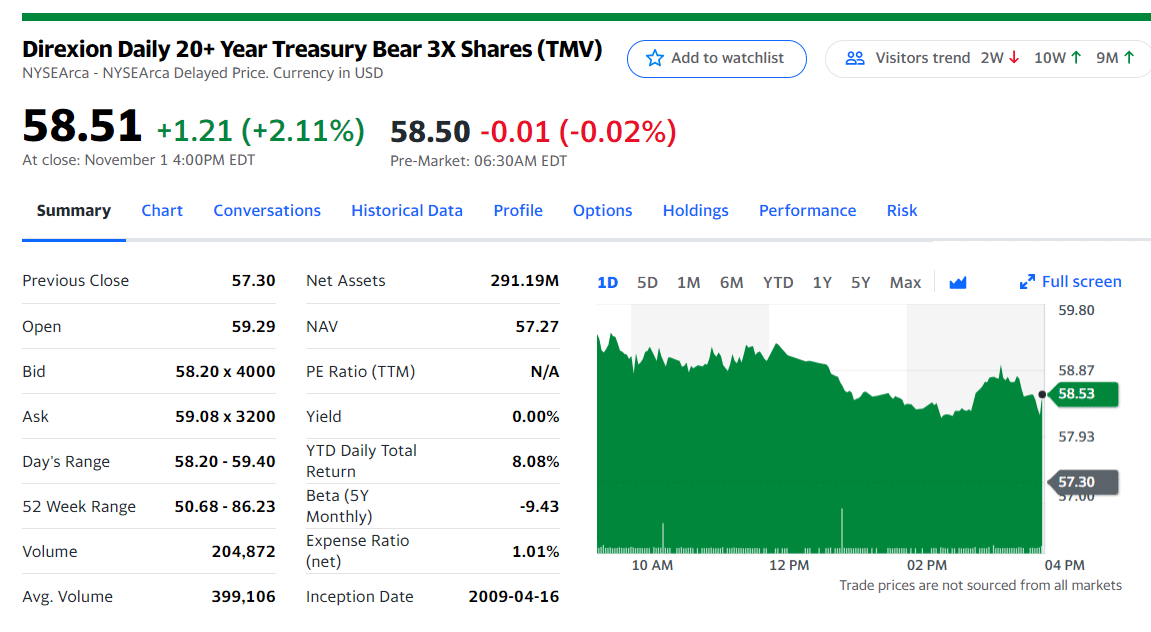

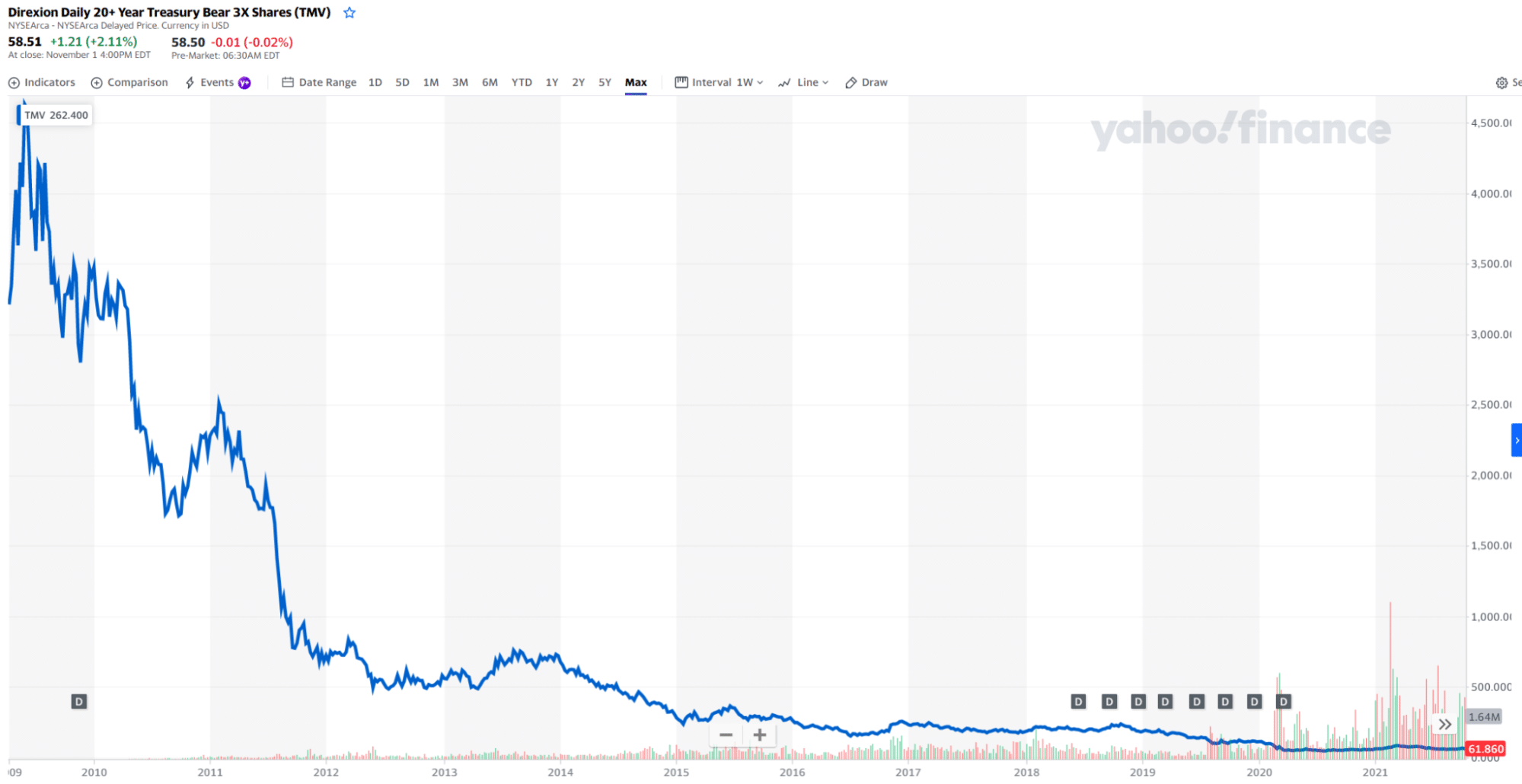

2. Direxion Daily 20+ Year Treasury Bear 3x ETF (TMV)

Price: 61.10$

Expense ratio: 1.04%

Direxion Daily 20+ Year Treasury Bear 3x ETF provides a three-fold short-selling exposure to the NYSE 20+ Years Treasury Bond Index. This index consists of US Treasury assets with a remaining maturity of more than 20 years. TMV delivers an inverse three-fold return of the underlying index in one day.

This inverse ETF has been operational since 2009, with NYSE Arca as its central exchange. Its total net assets are $359.9 million with $5.6 million outstanding shares.

TMV chart

Moreover, TMV’s average trading volume for the last one and three months is 438,313 and 382,739, respectively. In addition, the YTD daily total return of this fund is around 8.08%

Investing in leveraged securities carries a high risk as the returns can markedly diverge from the regular index returns. It is advisable to learn about the economic regulations and US Treasury policies before investing in the Direxion 3x fund.

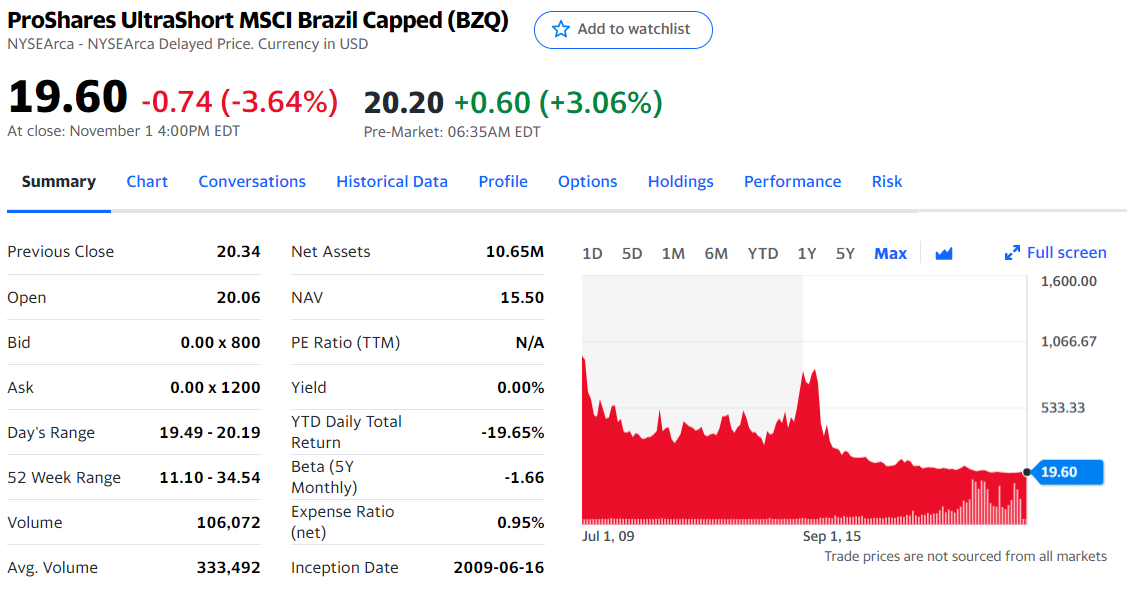

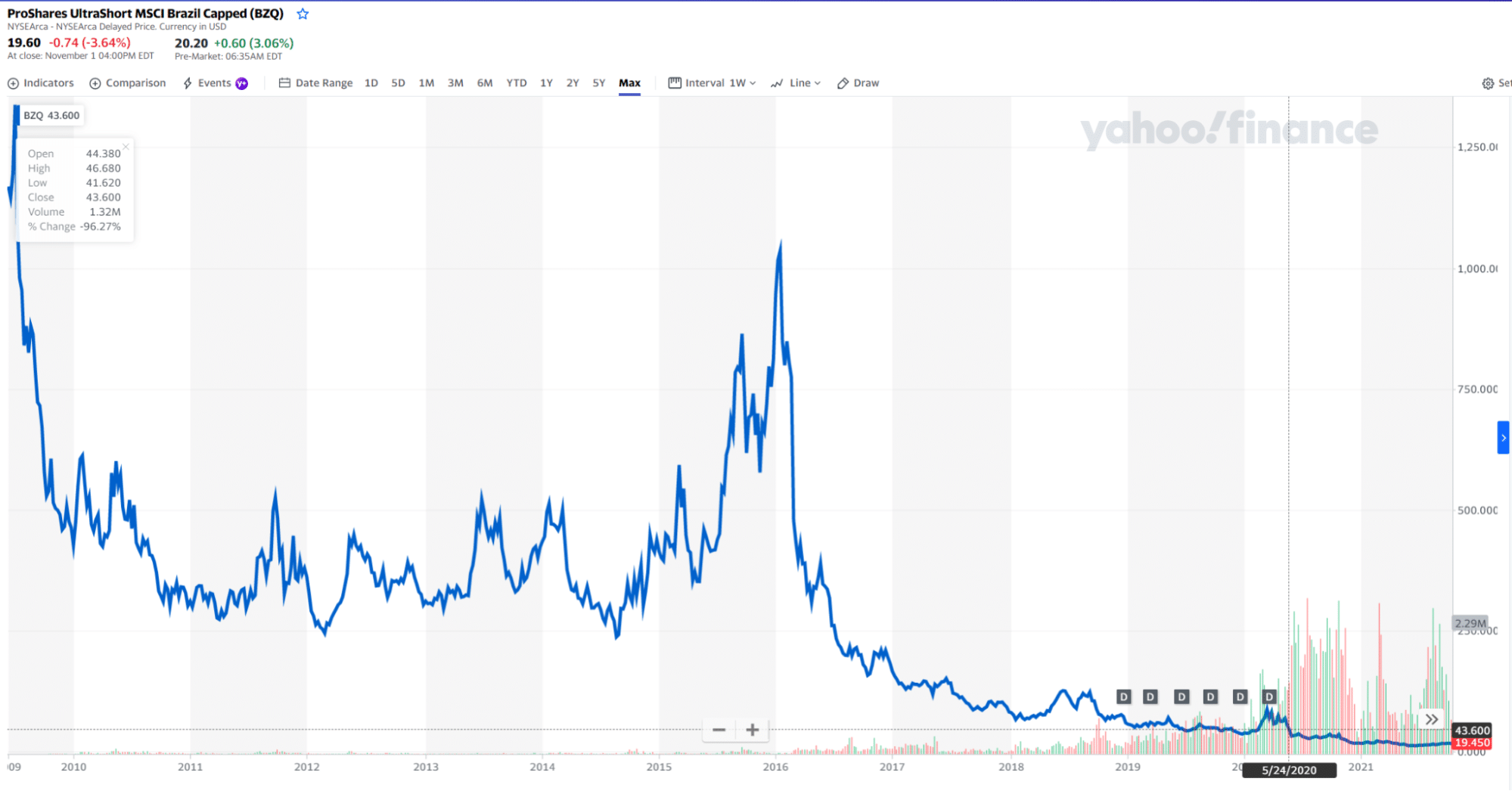

3. ProShares UltraShort MSCI Brazil Capped (BZQ)

Price: 18.82$

Expense ratio: 0.95%

ProShares UltraShort MSCI Brazil Capped offers an investment outcome two times (2x) opposite of MSCI Brazil 25/50 Index. This index tracks the equity performance of the Brazilian market and consists of large and mid-cap companies.

BZQ seeks to generate inverse two-fold returns in a single day, from one day’s NAV estimation to the next day. Holding this ETF for longer durations can produce significantly different results, including a different return amount or an opposite trajectory.

BZQ chart

This fund has been functional since 2009 with total net assets of $17.8 million. Moreover, the number of outstanding shares stands at 0.9 million. BZQ’s trading volume of the last one and three months is 259,659 and 337,330, respectively.

Final thoughts

Inverse Treasury ETFs are excellent to counter falling bond prices. Most of them exhibit maximum efficiency in a single day, and long-term positions may face disparate results. Thereby, they are beneficial for a bearish short-term outlook.

SBJ, BZQ, and TMV are the inverse funds with great potential to guard against increasing interest rates and falling bond prices. However, before investing in leveraged inverse funds, it is crucial to analyze a state’s financial and economic policies for gaining profitable returns.

Comments