If you remember cassette tapes, you might place a Memorex commercial that ended with someone sitting in an armchair in front of a stereo. There was such a “real” sound coming from the tape that it seemed like the person was in the wind tunnel.

Another commercial had a video with such high fidelity that it could break a wine glass. Commercials seemed to end with the question, “Is it live, or is it Memorex?” Or maybe you’re the movie type, and the concepts of The Matrix provided your first glimpse of a world where what you see isn’t real.

These two examples involve characters finding and interacting with worlds that do not exist. It’s all fiction, but technological breakthroughs make virtual worlds a reality. However, are we so far along that traders should consider VR stocks? Do you think that would be the same as funding in something that does not exist?

What are virtual reality stocks?

It is a simulation of one’s surroundings where one interacts with sensory impressions, such as sights and sounds, and one’s actions partially determine what is happening. On top of that, this is a technology that allows one to create or access virtual environments.

VR is a form of artificial reality that gives you a simulated visual experience similar to or different from the environment around you. Entertainment, business, and education are among the industries that use them. As VR technologies continue to advance, more advanced extended reality or XR versions of VR will also be available. Immersive VR and text-based VR are two types of it.

The standard VR technology relies on multi-projected environments and virtual reality headsets that display realistic images, sounds, and other sensations that simulate the user’s presence in a digital environment.

With VR tools, you can experience any visual experience, whether traveling, exploring, or learning. Now, businesses are utilizing VR tools to their advantage.

How to buy VR stocks?

The stock market allows investors to buy virtual reality assets. Various securities are available for purchase and sale, such as bonds and commodities.

Millions of people use VR every day to immerse themselves in a digital world. Using VR, the user can experience an immersive world and simulate experiences similar to those they would encounter in the real world. iTechArt, a VR/AR company that creates apps for VR/AR, is one of the best VR stocks to invest in today.

Top three VR stocks to buy in 2022

Here are three of them to consider if you’re interested in investing in virtual reality.

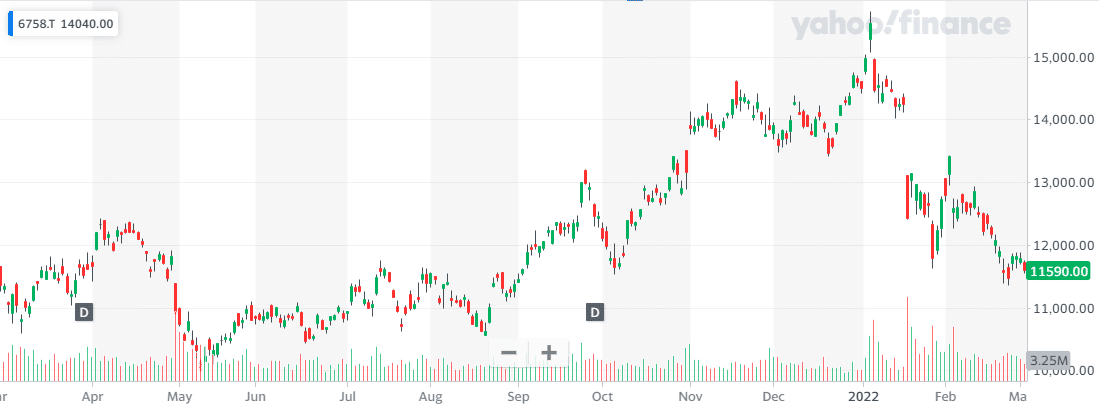

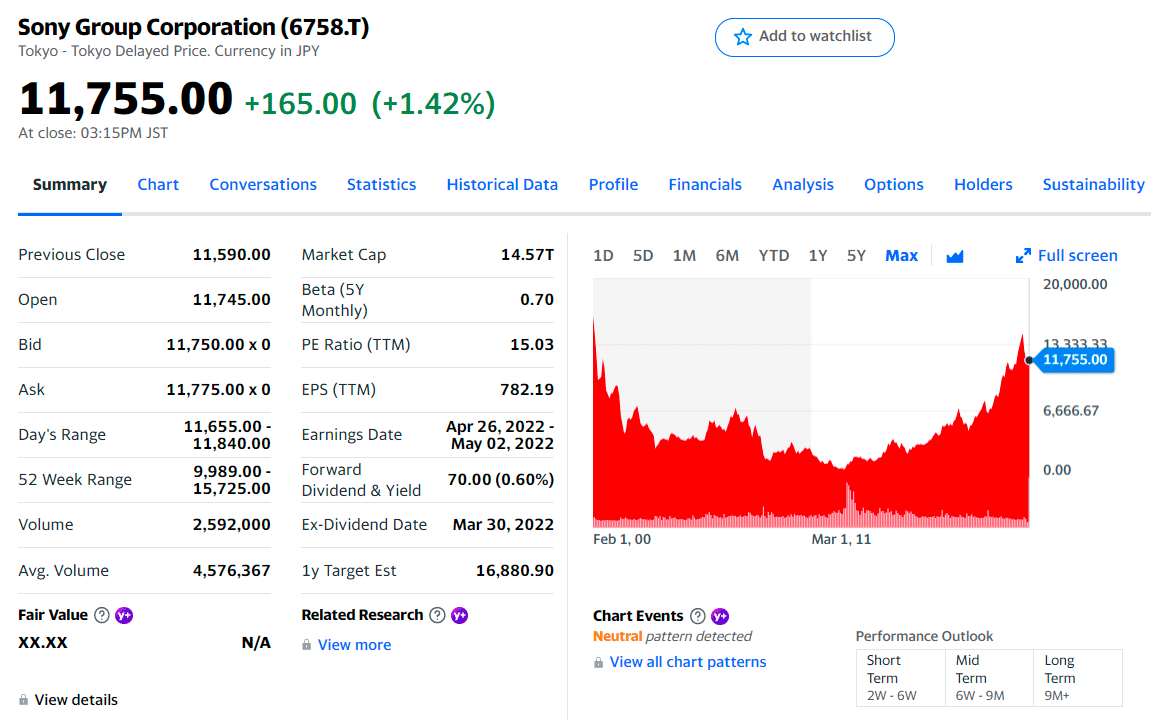

1. Sony Group Corporation (6758.T)

Price: $11,75

EPS: $782.19

Market cap: 14.366B

Sony Group Corporation price chart

Sony designed a virtual reality headset that works with its popular PlayStation gaming console, the VR. By powering the headset with the PlayStation 4 (or PS5), Sony can offer one of the best gaming experiences possible in VR. However, Sony may struggle to leverage its VR applications due to its PlayStation branding and specialized chipset.

Since its launch in 2016, the PS VR has been one of the top-selling VR headsets. Facebook’s Oculus Quest 2, released in October 2020, has sold better than PS’s version despite the delay. Sony is currently developing a VR device compatible with the PlayStation 5 and represents a significant upgrade over its current model. Even so, Sony may find it challenging to move beyond the gaming industry in VR and make the most of the technology.

6758.T summary

The first three holdings:

- PRIMECAP Management Co. — 2.08%

- Aristotle Capital Management LLC — 1.07%

- Fiduciary Management, Inc. — 0.33%

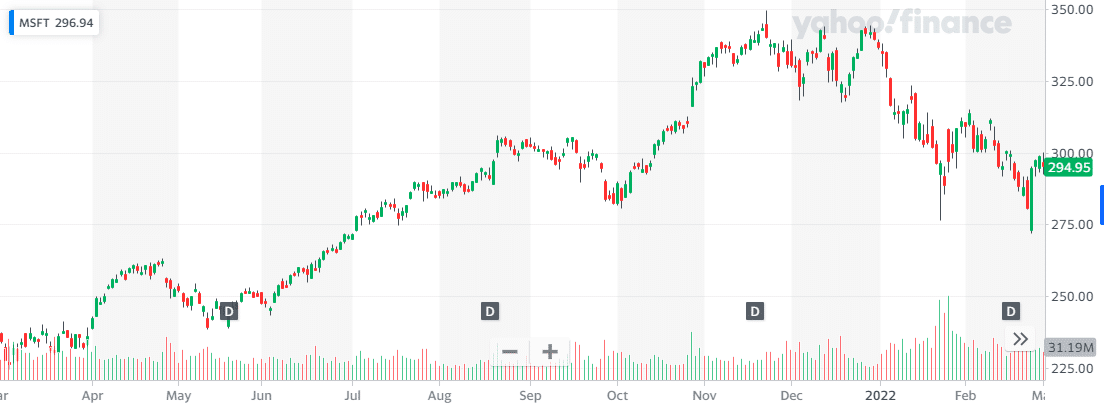

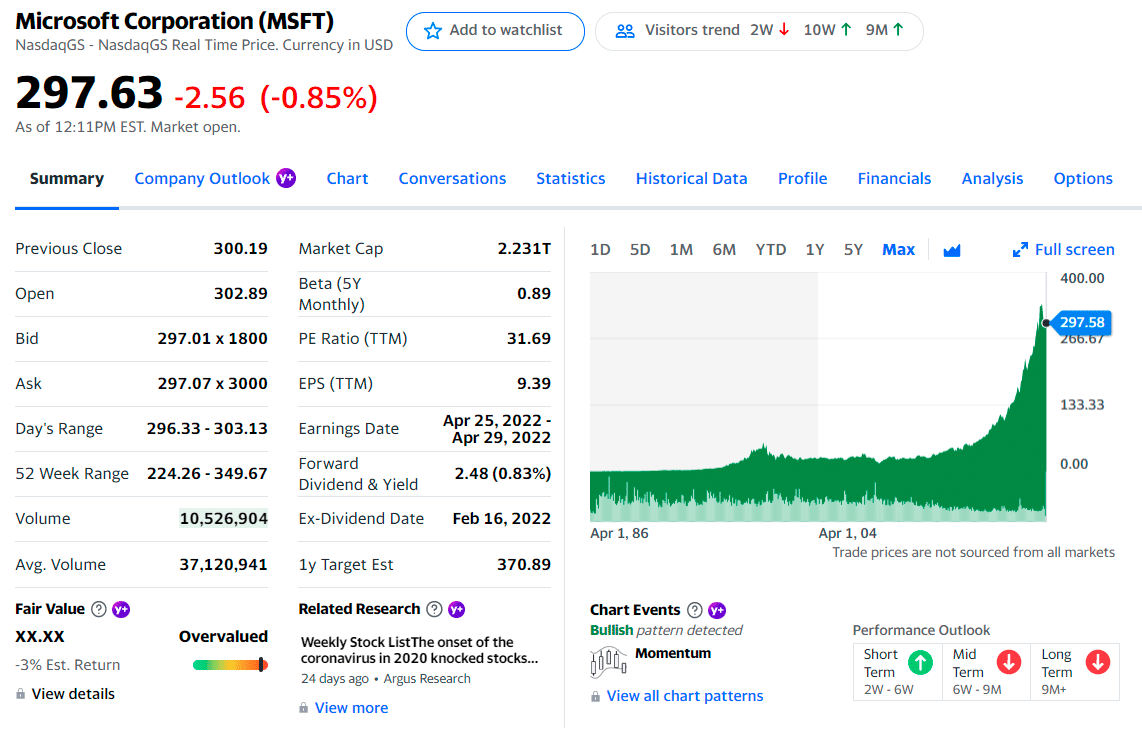

2. Microsoft (MSFT)

Price: $297.63

EPS: $9.39

Market cap: 2.223B

Microsoft price chart

Although Microsoft hasn’t announced their VR hardware and said anything about the technology, they have discussed VR and AR technology and some tools they are developing within the respective technologies. As a leader in innovative technology, Microsoft is ready to prove itself in the virtual world. Since they’re the second-largest console manufacturer, they already have a massive following with their services, including “Xbox Game Pass,” available across their platforms.

In the list of virtual reality stocks, some believe Microsoft should be on top, but as tech geeks, we think it should be third. Look at their investments platforms now before it’s too late and the price increases.

MSFT summary

The first three holdings:

- The Vanguard Group, Inc. — 7.80%

- SSgA Funds Management, Inc. — 4.04%

- BlackRock Fund Advisors — 4.45%

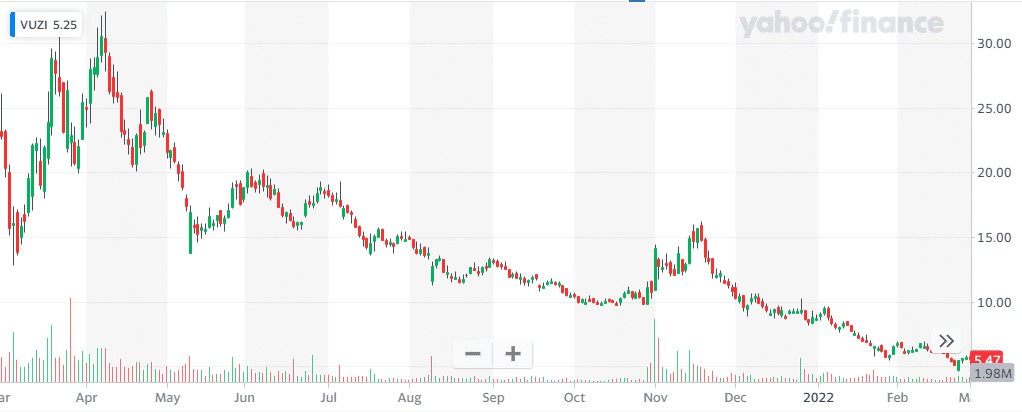

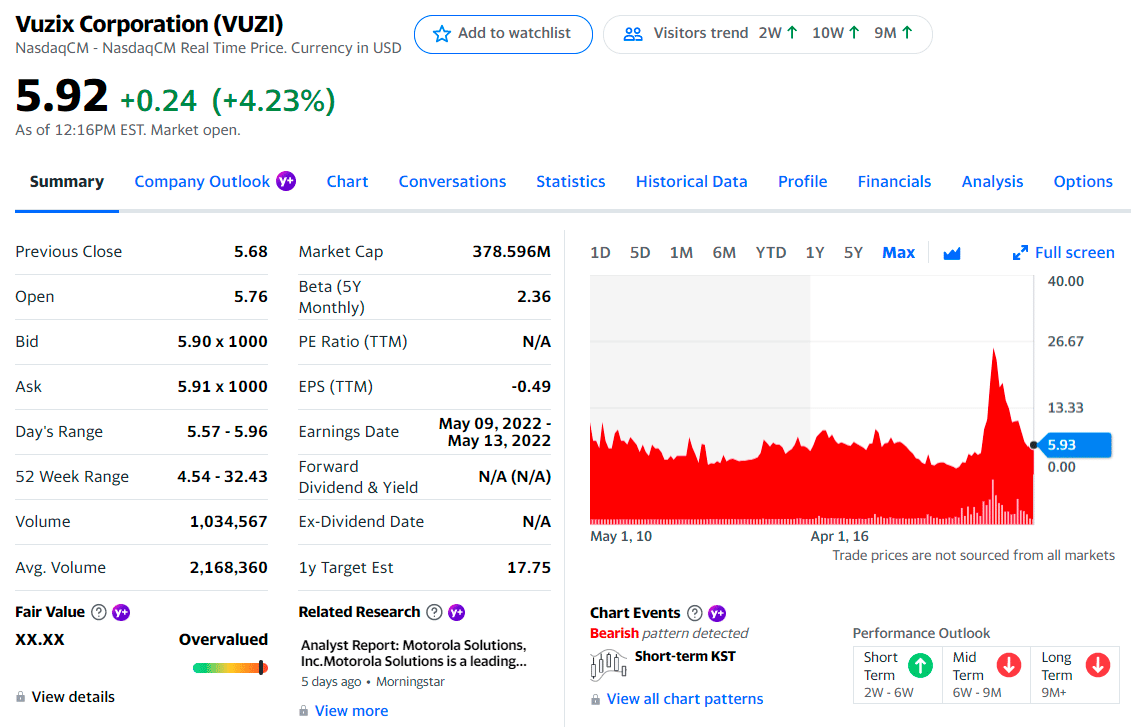

3. Vuzix Corporation (VUZI)

Price: $5.95

EPS: $-0.49

Market cap: 332.794B

Vuzix Corporation price chart

Vuzix designs, manufactures, markets, and sells wearable computing devices and AR wearable displays. In addition to smart glasses, the company offers augmented reality (AR) headsets. Aside from that, Vuzix also provides engineering solutions and support to third parties such as original equipment manufacturers (OEMs) of waveguides.

Furthermore, Vuzix announced its smart glasses, the M400-C. Those are the latest additions to the M-Series smart glasses range. The M400-C has the same form factor as the flagship M400 smart glasses with an autofocus HD camera. While this latest edition is not a standalone computer, it functions as a USB-C peripheral. Investors will appreciate that the company is currently shipping a limited number of units to a Windows mobile phone manufacturer.

Additionally, the company announced that over 40 warehouses are now using its Smart Glasses to support the supply chain operations of a Fortune 50 online retailer. There is great excitement for the company as the most significant companies utilize their products to operate in the world.

VUZI summary

The first three holdings:

- ARK Investment Management LLC — 11.38%

- BlackRock Fund Advisors — 5.56%

- SSgA Funds Management, Inc. — 4.81%

Final thoughts

A VR experience that is truly unforgettable promotes human connection, compassion, and cultural understanding. Eighty-one percent of VR users recommend it to others. This technology has the potential to create viral brands.

Virtual reality will grow both due to the physical hardware you wear and the digital content that creates imaginary worlds. As a result, virtual reality stock opportunities can simultaneously profit from either or both fields.

Comments