Several crypto projects have been put forward in hopes of beating Ethereum, the second-largest crypto network based on trading volume, market cap, and other metrics. You might then ask a relevant question. Can one project overtake or bring down as big a network as Ethereum?

What are Ethereum killers?

They are crypto projects presented as better alternatives to Ethereum. One of their goals is to address the shortcomings inherent in ETH and become the blockchain of choice for users. Let us look at the flaws in Ethereum that other blockchains seek to mitigate.

One major issue in Ethereum is scalability. The original proof-of-work system becomes outdated as usage of the network picks up. As a result, the network can only process up to 13 transactions per second. This slow processing leads to high transaction costs. Another significant issue is related to interoperability. Users from other blockchains can hardly interact with the Ethereum network without first setting a connection.

Top 5 Ethereum killers to invest in 2022

Below are five competitors that present themselves as better alternatives to Ethereum and are looking to eat into the market share enjoyed by ETH.

What is Cardano?

Introduced in 2017, Cardano was widely touted as an Ethereum killer. It underwent a major upgrade in 2021, known as the Alonzo upgrade. With this upgrade, Cardano became more programmable. This change enables the network to support many smart contracts and NFTs.

ADA is the native token of the Cardano network. This token is founded on the concept of deflation or finite supply. This setup ensures that demand for the coin will grow no matter what transpires in the ecosystem. Unlike Ethereum’s proof-of-work methodology, Cardano utilizes proof of stake from the beginning. The latter mechanism is environmentally friendly and long-lasting, which is one metric in favor of Cardano and against Ethereum.

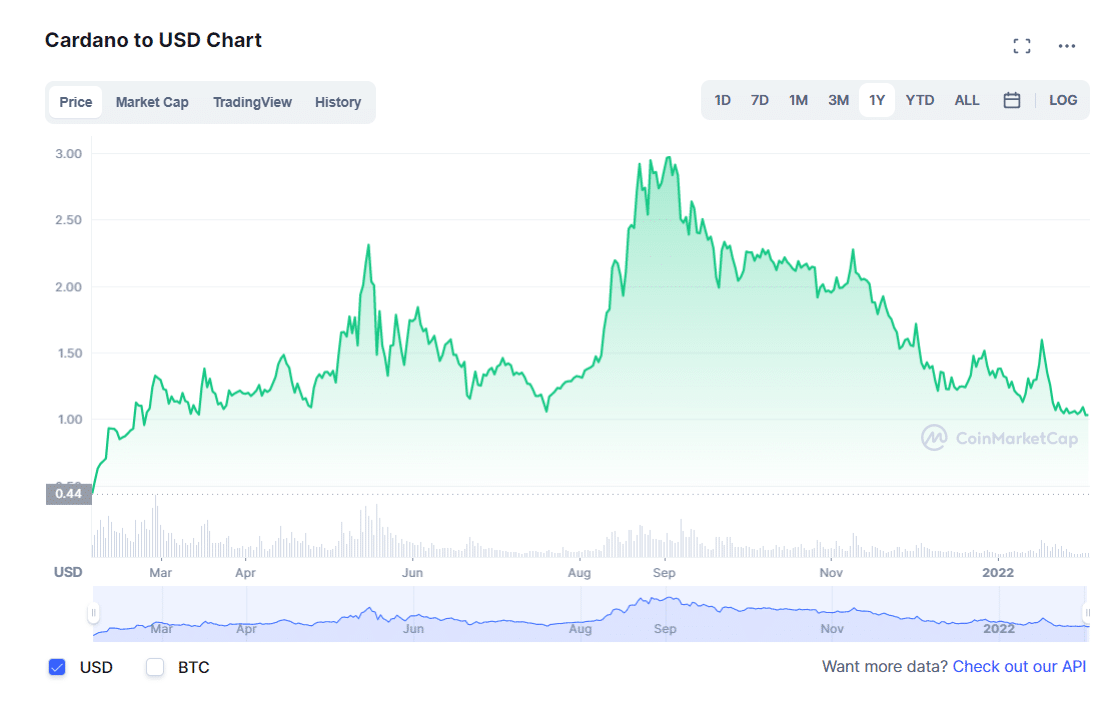

ADA/USD daily chart (1Y data)

Cardano price prediction 2025

Based on technical analysis, Cardano exhibits a bullish sentiment and is deemed suitable for long-term investment. The crypto may reach more or less $12 by 2025.

What is EOS?

Introduced in 2018, the EOS blockchain supports smart contracts and decentralized applications. This blockchain is powered by software protocol EOS.IO and is geared toward producing something fast, adaptable, and scalable. EOS focuses on DApps and is staying true to its original goal to this day.

EOS is based on the concept of delegated proof of stake (dPoS). In this mechanism, stakes are controlled and authenticators forging new blocks are randomly selected. These authenticators then get newly created EOS tokens as rewards. This system also brings to life the principle of decentralized governance, which makes staking a level-playing field for all participants.

EOS/USD daily chart (1Y data)

EOS price prediction 2025

Some of the factors that may play into the success of EOS as a long-term investment are a sophisticated algorithm and stringent security. Several projects have been built around EOS blockchain and are nearing release. Therefore, experts project EOS to hit the $100 mark by 2025.

What is Solana?

While Bitcoin generates a new block every ten minutes and Ethereum in ten seconds, Solana can do the same activity exceptionally fast, 400 milliseconds. Solana supports smart contracts at the get-go.

Boasting low gas fees and quick processing speeds, Solana will likely see massive growth. In addition, the fourth generation blockchain works on the principle of proof of history, which is a bit similar to the proof of stake but comes with timestamps that significantly boost transaction rates. The only factor holding Solana back is its mainnet being in the beta phase.

SOL/USD daily chart (1Y data)

Solana price prediction 2025

Solana has a great potential to reach great heights in terms of growth. The value of the network is bound to appreciate as limited supply will foster a price increase. By the end of 2025, experts believe it may reach a maximum price of around $450 and a minimum price of $380.

What is BNB?

Introduced in September 2020, BSC supports smart contracts and runs in unison with the Binance Chain, which works hand in hand with Ethereum Virtual Machine. BNB rose to prominence in April of 2021 after surpassing Ethereum by more than 500 percent in terms of daily transaction volume. While Ethereum processed 1.5 million daily transactions, BNB handled a staggering nine million.

Based on the market cap, the native crypto of BSC (i.e., BNB) ranked nine when the year 2021 started. At the time of writing, however, BNB is now firmly holding the fourth spot out of more than 17,000 cryptos currently in existence. It is now trading at around $374 and has a market cap of about $61.9 billion based on data provided by CoinMarketCap.com.

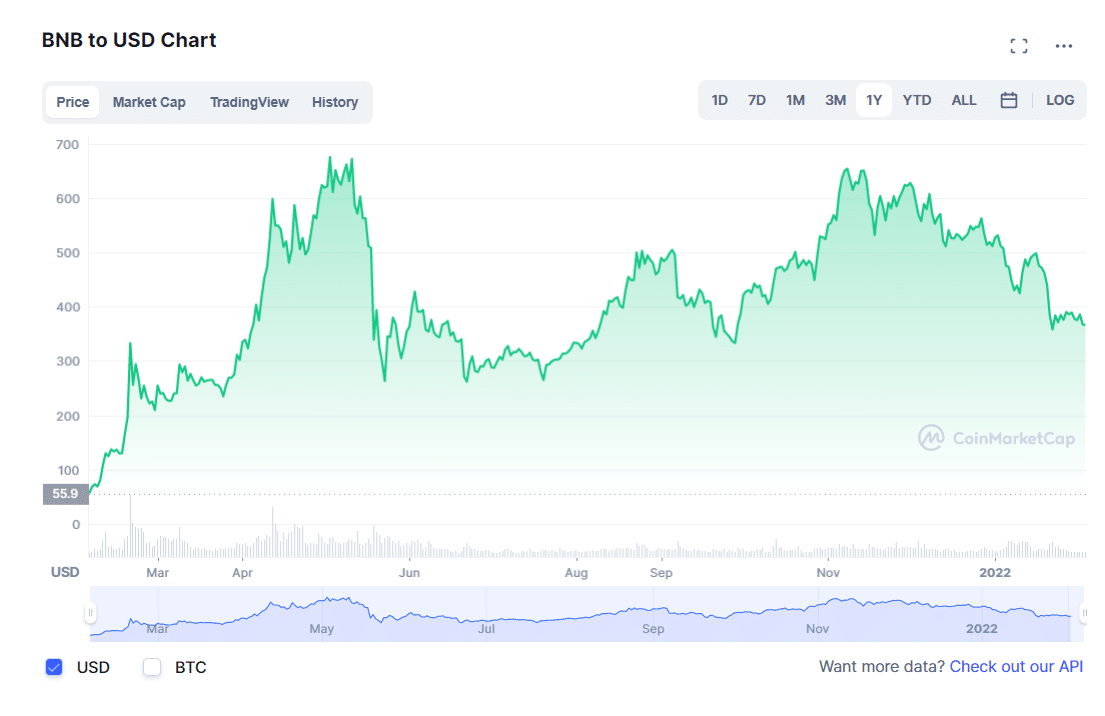

BNB/USD daily chart (1Y data)

BNB price prediction 2025

One thing that sets BNB apart from the competition, making it a good candidate for mass adoption, is its tradability across multiple digital assets. This and other cool aspects may catapult BNB to great heights. If things go as market analysts envision or anticipate, by the end of 2025, BNB may sit around $850.

What is Polkadot?

Polkadot is touted as the next-generation blockchain network. It got this reputation due to its capability to connect multiple blockchains. This feature brings forth security and scalability. Polkadot allows developers to build their blockchains (known as parachains). These individual chains utilize Polkadot’s validation system to speed up transactions and handle bulk processing.

Polkadot is responsible for the scalability and governance of the Ethereum network. It breathes new life to the concept of interoperability by introducing the parachain relay principle. The most crucial innovation brought forth by Polkadot is the resolution of compatibility issues between old and new blockchain protocols and the prevention of blockchain splinters.

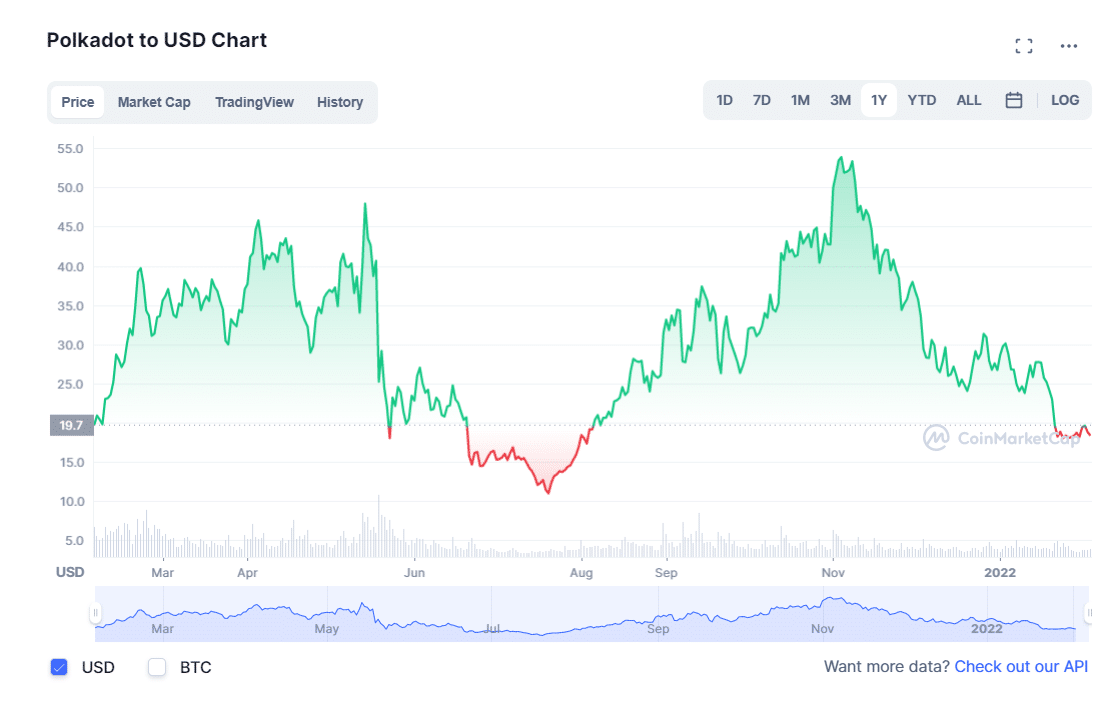

DOT/USD daily chart (1Y data)

Polkadot price prediction 2025

Having a large user base, Polkadot will likely see continuous growth in the years to come. Experts predict the coin to reach $25 in 2022 and $50 in 2025.

Final thoughts

Although the five blockchain options presented above pose a challenge to the supremacy of Ethereum, they might not be able to subdue Ethereum in the near term. We might see a wholesome competition between blockchain projects looking to achieve similar goals in different ways. This will give developers and users alike plenty of options to choose from when pushing for the satisfaction of their own unique market needs.

Comments