Market investment with options is much safer and more accessible than trading stocks. These commitments give a person the right to purchase (calls) or sell (puts) shares of an underlying asset at a set price and expiration date. Some popular options are incredibly active, dealing with hundreds of thousands of transactions per day.

- Are you interested in finding out the best options to start making financial investments?

- Can you sell a call option before it hits the strike price?

- Whether OTM ones are better than ITM?

You should know basic questions to start your career as an options investor. In this article, we have addressed the top five stocks for investing and trading.

What are the best options to trade?

Stocks are typically the first investment a new investor makes. Stock trading is straightforward. This type of dealing, however, provides distinct advantages. After some experience, many investors have become more familiar with options-transaction.

However, the strategies required for this trading are very different from those for stock investment. For example, a stock that adds to your portfolio strength, stability, or growth potential may not be the best stock to trade options.

Stocks of these companies are commonly listed as the top stocks for investing in options because they offer the suspense of a bit of volatility without being so volatile that the risks far outweigh the rewards.

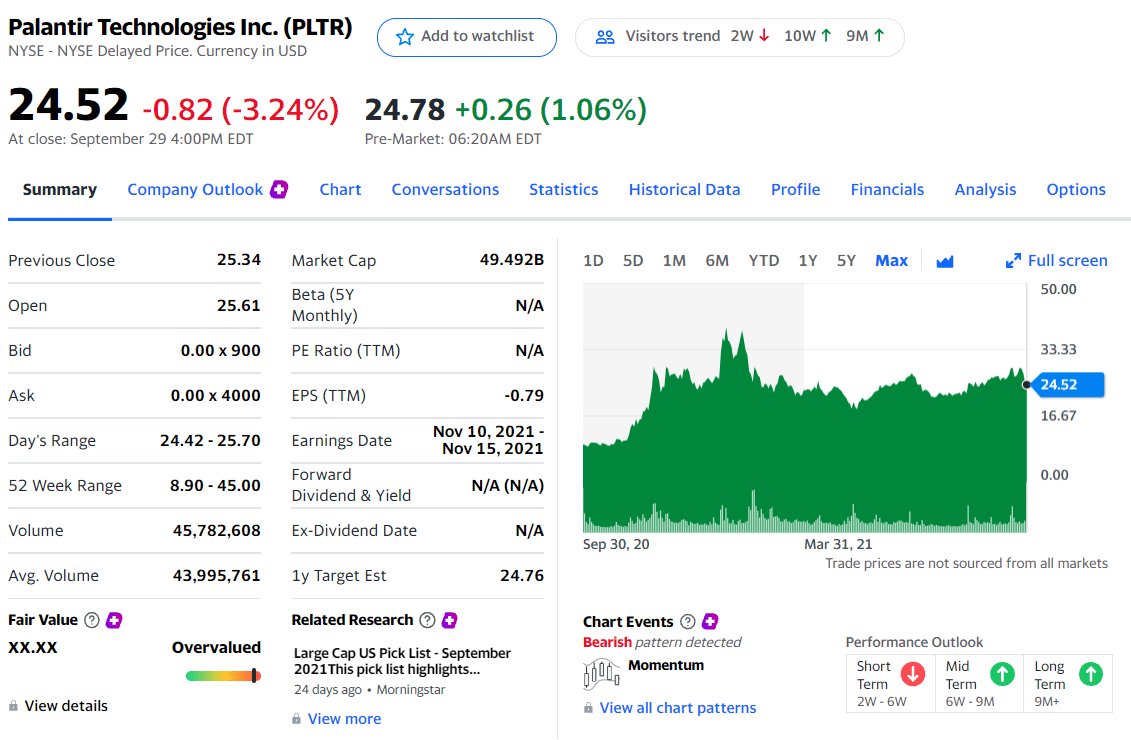

Palantir Technologies (NYSE: PLTR)

In 2003, Palantir, a big data and analytics company founded by investors like the CIA. Since it plays a significant role in the Pentagon, ethical investors find it difficult to invest. In addition, the company provides software, for example, to Immigration and Customs Enforcement (ICE) for use in deportation raids. Nonetheless, it is among the largest providers of stocks at this time.

Since the company has been making noise recently, this makes sense. Moreover, it follows in the footsteps of other mature startups such as Slack (NYSE: WORK), Spotify (NYSE: SPOT), and Asana (NYSE: ASAN) by opting for a direct listing rather than an initial public offering (IPO).

Palantir Technologies Inc. is priced at $24.52

For the first half of this year, Palantir earned $78.8 million from Pentagon contracts. This amount is higher than the prior year’s total revenue. According to the company, full-year revenues will be between $1.05 billion and $1.06 billion.

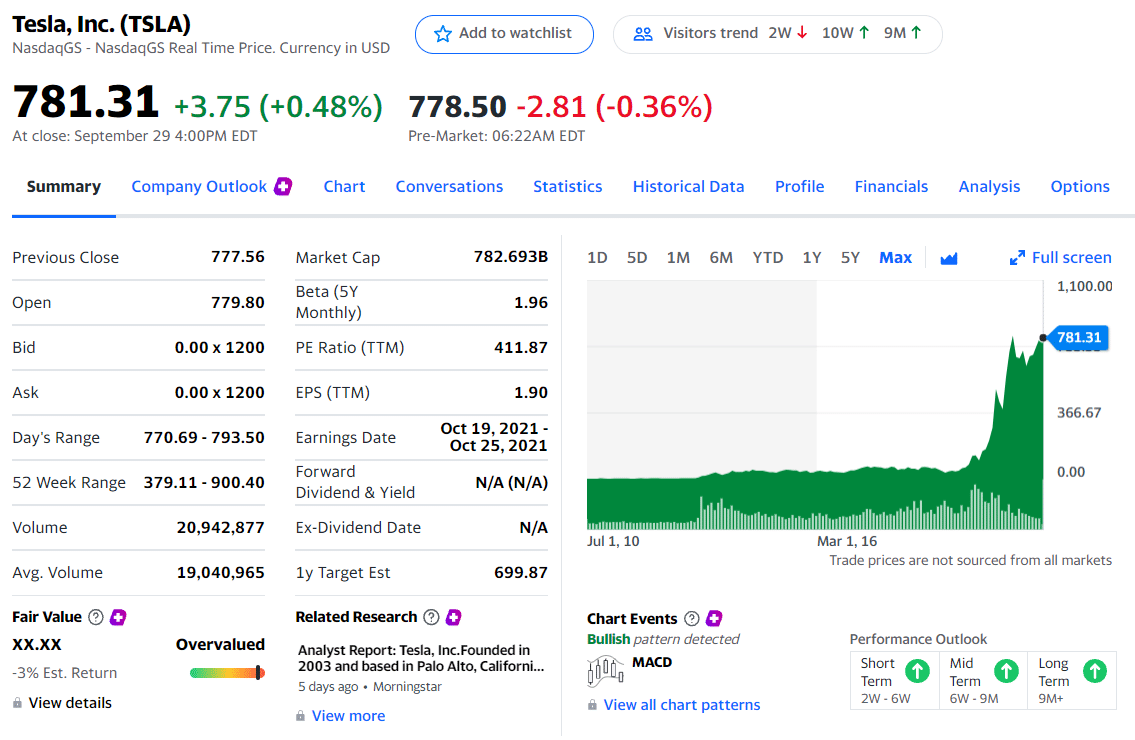

Tesla (NASDAQ: TSLA)

You can keep enjoying TSLA stock for a long time. The market capitalization of Tesla is $594.40 billion, making it the world’s largest automaker. Moreover, the company is finally delivering on its promises after several years of empty promises.

According to GAAP, Tesla reported a net income (GAAP) of $331 million in $8.77 billion. According to industry reports, Elon Musk’s electric carmaker delivered 139,300 vehicles in September. In the fourth quarter, operating expenses amounted to $1.25 billion, up 33% from last quarter. New factories were largely responsible for this increase, including Austin, Texas, and Brandenburg, Germany. Analyst Dan Ives raised his bull-case target by 25% — going from $800 to $1,000 — given the company’s expansionary attitude and foothold in key markets.

Tesla, Inc. priced at $781.31

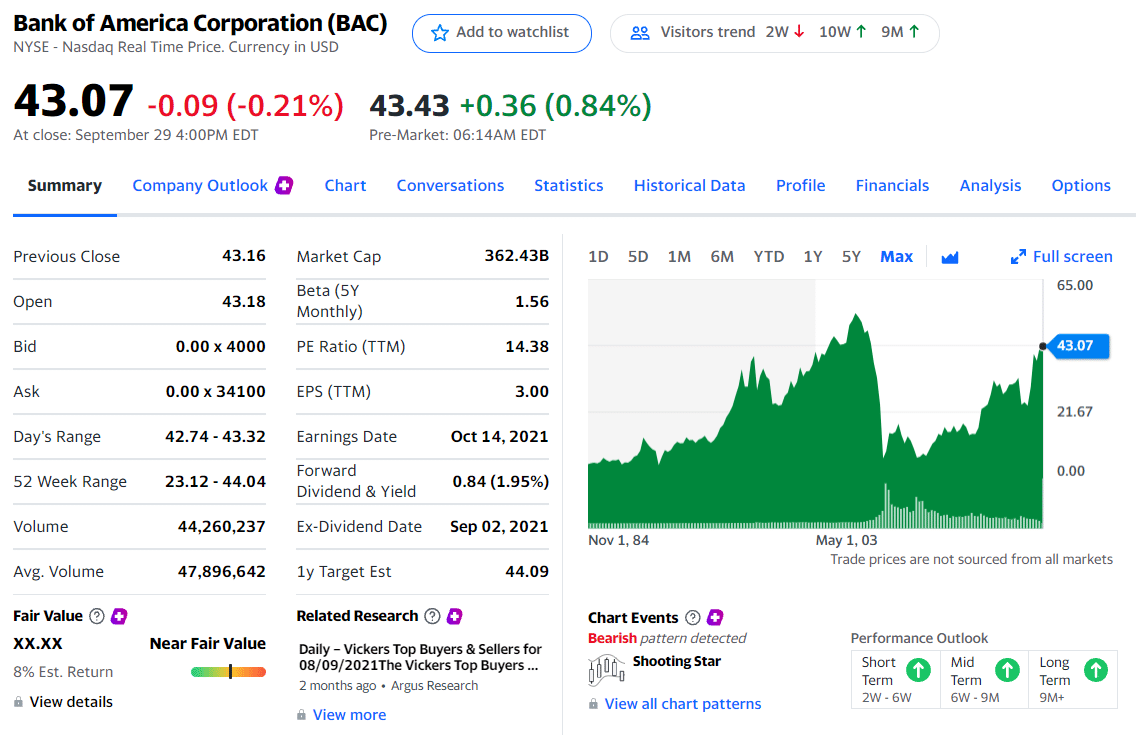

Bank of America (NYSE: BAC)

Over the long term, BAC stock performs well as a bellwether for the banking industry. On the other hand, the shorter the horizon, the more peaks, and valleys are likely to occur.

For example, stocks are down about 31% year to date, compared to the S&P 500. But are returning a good 9.7% over the past three months, illustrating how volatile the stock is. In addition, despite its size, the bank is highly sensitive to interest rate changes as it is among the largest in the United States.

Bank of America is priced at $43.07

Bank of America recently reported 20.34 billion in total revenues, 11% lower than the previous year, and did not meet the consensus expectations. In addition, the Federal Reserve instituted a near-zero-rate policy in response to the novel coronavirus pandemic, dealing a crushing blow to the banking industry. However, there is plenty of capital and assets for BAC to weather this storm.

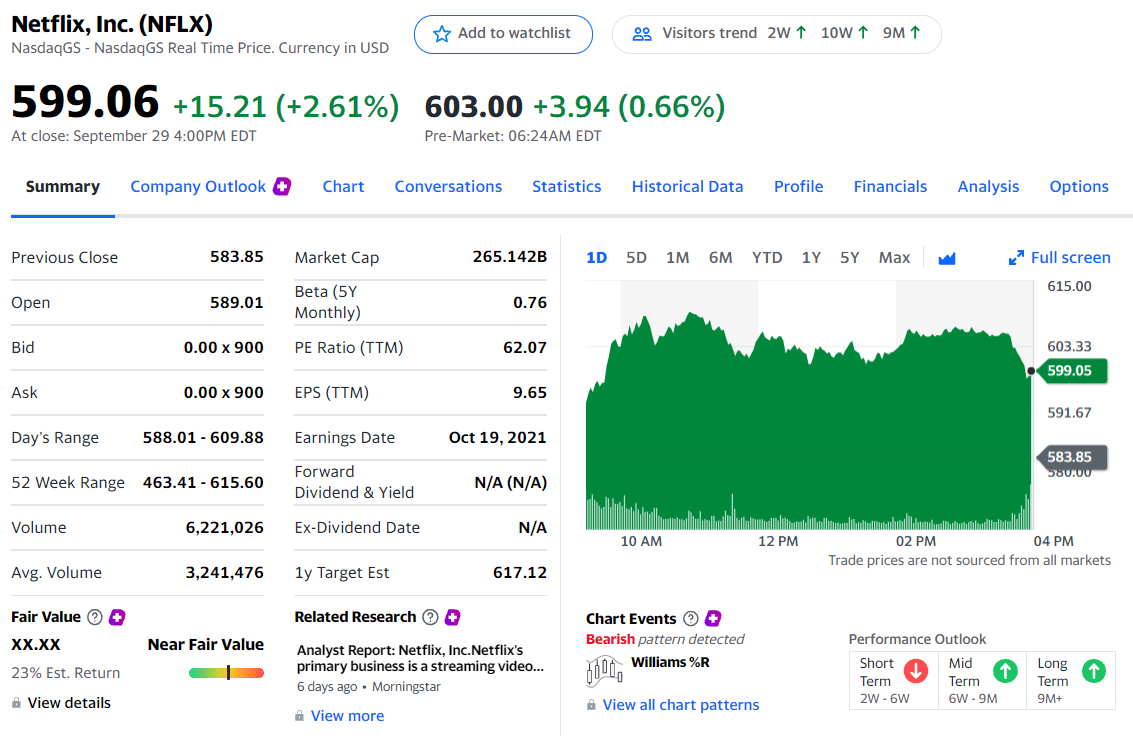

Netflix (NASDAQ: NFLX)

A pandemic can be a boon to some stocks rather than a curse. The popularity of staying at home has prompted an increase in streaming as viewers watch movies and show online instead of seeing them in theaters. As a result, several streaming companies, including Netflix, have enjoyed inflated valuations.

Netflix priced at $599.06

Apple, Disney, and Amazon are also investing heavily in their streaming services. Even though Disney disappointed analysts with its latest earnings report, investors were astonished to learn it reached $73.7 million paid subscribers in its first year. In short, you can say, competition is increasing in the marketplace.

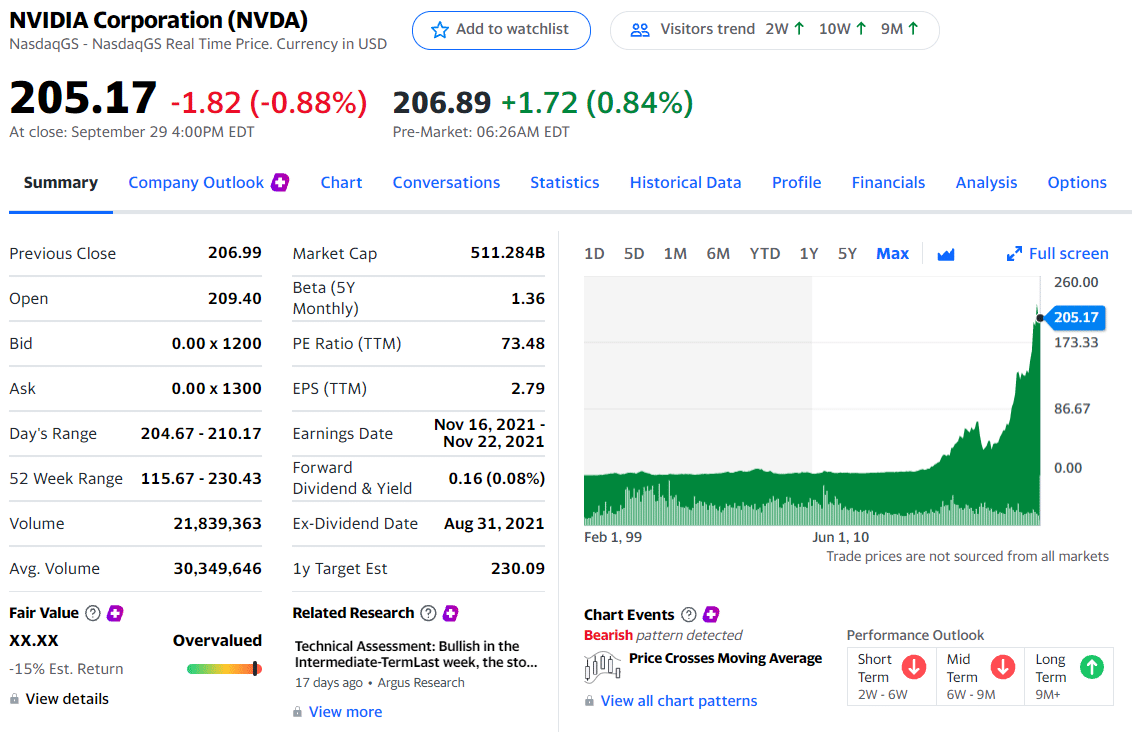

NVIDIA (NASDAQ: NVDA)

In our last entry, we have the most crucial mobile computing and automotive chip company globally. NVDA’s stock plunged during the pandemic, but it has recovered a lot since the summer. As of now, shares are trading at record highs, and they should continue to rise. As a result, share prices for NVDA are expected to rise to $700 in the next 12 months.

NVIDIA Corp. priced at $205.17

Can you sell a call before it hits the strike price?

In a nutshell, yes, you can. You can buy and sell it at any time. It doesn’t matter if you don’t own the asset at all. Whether you own the option or not affects the answer. Also, it depends upon whether it is in the money (ITM) or out of the money (OTM) at present.

Suppose you own it as an OTM. Assume you own a $100 call with a strike price of 120. The future is $20 out of the money. Let’s say there are 20 days left before expiration.

OTM ones have intrinsic value before expiration. Therefore, it will still maintain a monetary value after expiration. In this scenario, you would receive stock for which you would be charged $120/share, which isn’t recommended when shares can be purchased for $100 on the open market.

To counteract the effect of time decay, you have to determine if you believe that the price will move up enough within the next 20 days to justify selling or holding. Since long options positions are theta positive, value naturally goes down, no matter what else.

Final thoughts

Besides the fact that 90% of the options traders fail to achieve successful trades, if you learn tactics of the marketplace, you can potentially earn profits. Choosing the best one for investing and trading is key to success. Looking into a specific stock’s past and future predictions, you can choose the best for yourself.

Comments