Minerals’ most significant product line is salt, accounting for approximately 82% of its sales. It offers a variety of applications, but highway deicing is Compass’ primary market. Roughly 80 percent of what we produce goes for deicing roads; the rest goes into the consumer, industrial, and agriculture markets.

During the trading day on Monday, 28th February 2022, Scorpio Bulkers Inc. stock rose from $5.66 to $5.93, a 2.95 percent gain, marking its third straight day of gains. The next few days will be important in determining whether it can continue to gain or take a short break. Stock prices fluctuated 9.62% during the day, ranging from a day low of $5.51 to a day high of $6.04.

Let’s explore the top three salt stocks to find the best of them.

What are salt stocks?

An essential aspect of salt investment’s business is producing and marketing salt. It has served as an essential mineral and fundamental to civilization for millennia. During the Phoenician era, the product served religious offerings in Egypt and trade between the Mediterranean Empire and Phoenicia. Ancient Assyrians originated a ritual of salt spreading to signify their defeat of conquered cities. Romans built “salt roads” like the Via Salaria to transport salt from the Adriatic Sea across the empire to the capital.

The Romans paid their soldiers with salt for a time, which led to phrases like “salt is worth his weight.” The word “salary” is derived from this too. Therefore, it was critical in preserving foods.

This demonstrates its value as a necessity in early civilizations, as evidenced by its use as a currency. In addition, Chinese proverbs mention salt as one of the seven elements of life, and saltiness is one of the five flavors of Chinese cuisine that form its cosmology.

The production and trading of salt have led to cities and empires worldwide.

Consumers and businesses alike use salt for a variety of purposes. Among the most prominent players in this highly stable market are Compass Minerals.

The Compass product line includes specialty fertilizers, which will provide a path for further growth. The company’s mission is to grow and share those returns with shareholders.

Top three salt stocks to buy in 2022

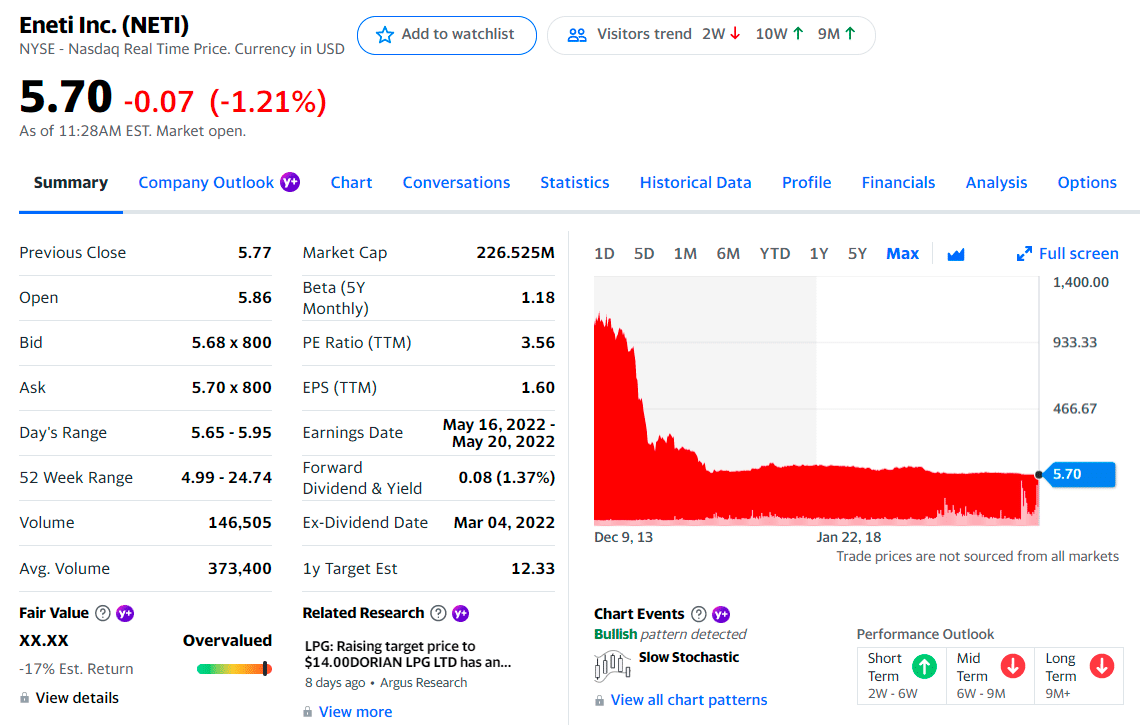

No. 1. Eneti Inc. (NETI)

Price: $5.70

EPS: 1.60

Market cap: 233.678M

Eneti Inc (NETI) price chart

The price-earnings ratio for SALT is 3.25, higher than the relative earnings of only 1.97% of US companies.

Concerning revenue growth, Eneti Inc (NETI) revenue grew 259.21% over the past 12 months; that beats the revenue growth of US companies that grew 97.42%.

Our measurement of shareholder yield, a measure of dividends and stock repurchases paid to shareholders, shows that Eneti has a dividend yield of 74.42%, higher than 97.1% of the stocks in our set.

According to their financial statements, market capitalization, and price volatility, the following stocks are qualitatively similar to Eneti: DSX, EPRT, DOC, HT, and PEB.

NETI summary

The first three holdings:

- Handelsbanken Fonder AB — 4.27%

- Encompass Capital Advisors LLC — 3.60%

- Condire Management LP — 2.46%

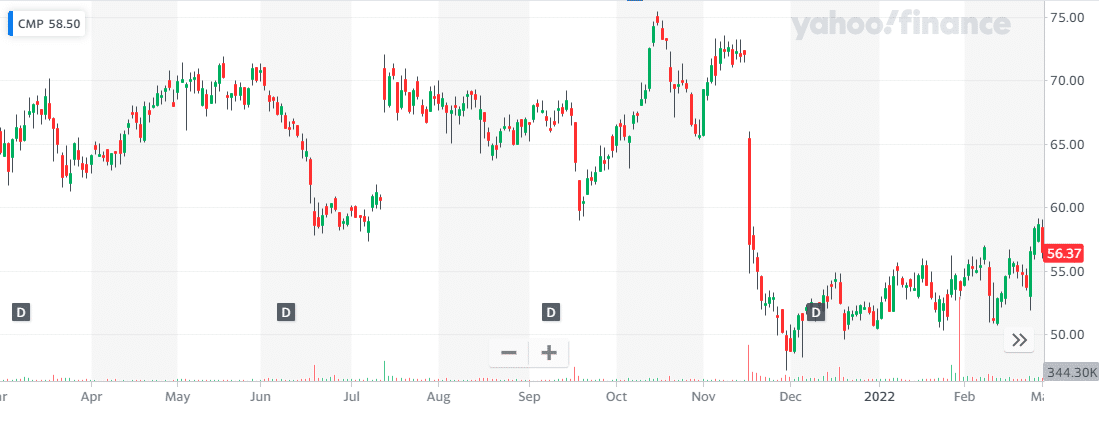

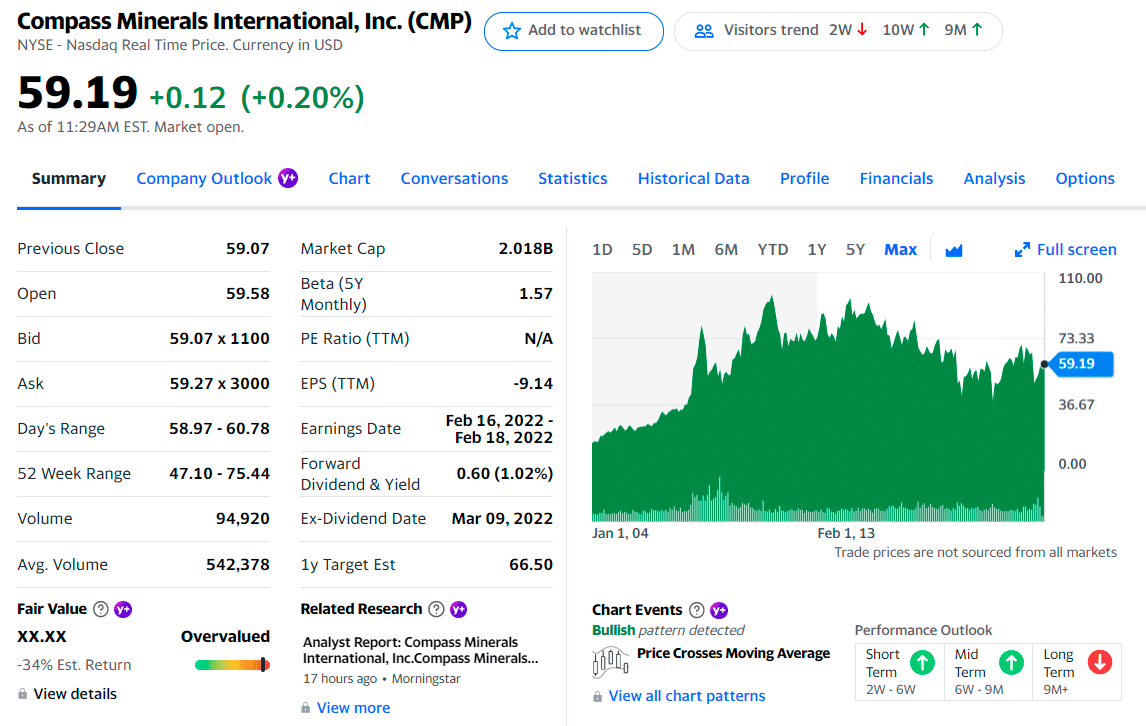

No. 2. Compass Minerals (CMP)

Price: $59.19

EPS: -9.14

Market cap: 1.995B

Compass Minerals price chart

Compasses Minerals was founded in its present form in 2001, following a leveraged recapitalization from IMC Global, and listed on the New York Stock Exchange by the end of 2003. Even though it is a relatively new company, parts have existed since the 1880s. The company’s primary markets are North America and the United Kingdom. As a salt and fertilizer marketer in North America, CMP also produces deicing salt and operates document storage facilities at its salt mines in the United Kingdom. CMP markets potash sulfate for higher-value agricultural products in Central and South America and Pacific Rim countries.

CMP reports two product lines: salt and specialty fertilizer. The company also maintains document storage facilities in the United Kingdom. The DeepStore store’s information for private and government purposes in previously excavated United Kingdom underground mine areas. CMP does not break out the revenues associated with their document storage market, which does not have a significant market share in their financial statements.

CMP summary

The first three holdings:

- BlackRock Fund Advisors — 10.24%

- The Vanguard Group, Inc. — 9.82%

- Van Eck Associates Corp. — 9.08%

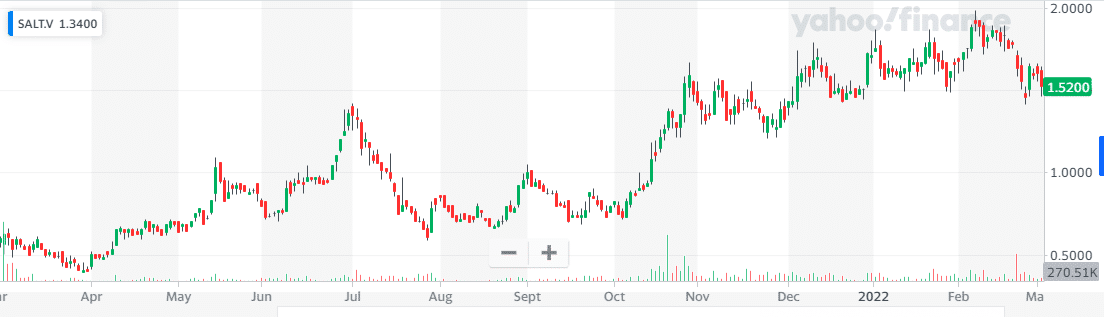

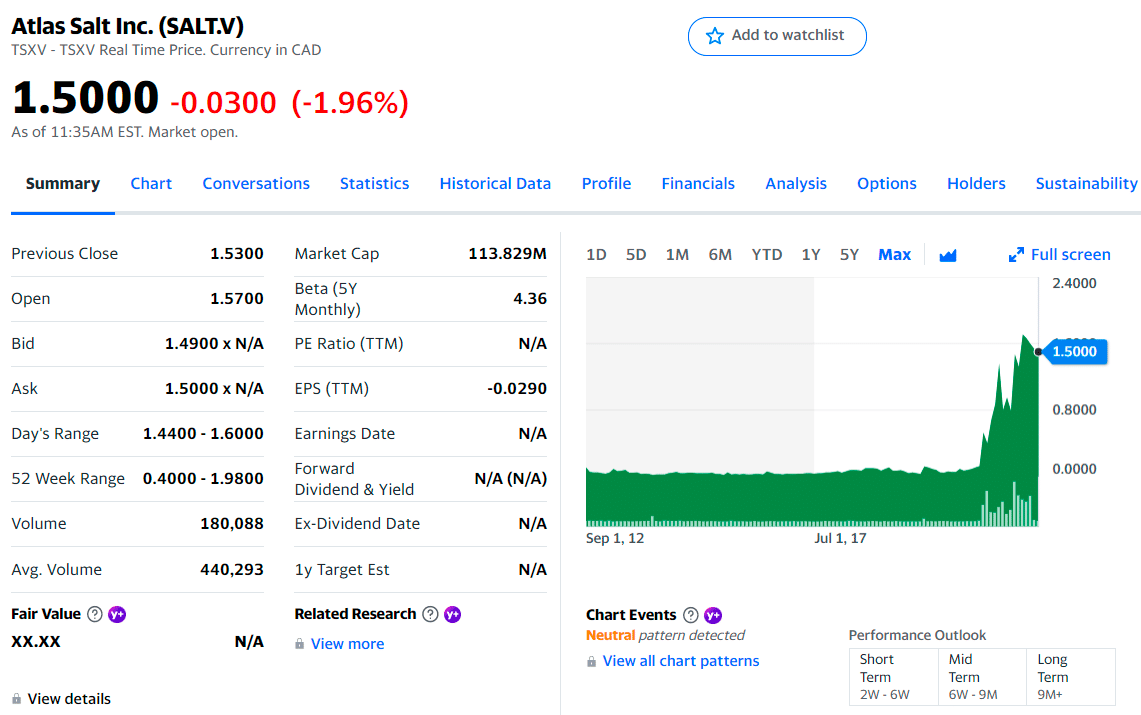

No. 3. Atlas Salt Inc. (SALT.V)

Price: $1.50

EPS: $-0.0290

Market cap: 115.347M

Atlas Salt Inc. price chart

In Newfoundland and Labrador, Atlas Salt Inc. is a junior mining company engaged in mineral exploration, evaluation, and acquisition of mineral properties. Among the mineral deposits explored by the company are potash, salt, gypsum, and others. The company holds 100% ownership of the Great Atlantic salt project in Western Newfoundland’s Bay St. George Basin.

Furthermore, the company owns a stake in the Ace Gypsum project, located within the dormant Flat Bay Gypsum Mines to the southwest of the Great Atlantic Salt Deposit and the Black Bay Nepheline project in the southern border of Labrador. About 5,500 hectares of property were in Western Newfoundland’s Bay St. George region and in Black Bay, Labrador, where the company held 19 mineral licenses.

Before August 2021, Atlas Salt Inc. operated as Red Moon Resources Inc. This Canadian company was founded in 2011 and had its headquarters in St. John’s. Vulcan Minerals Inc. is the parent company of Atlas Salt Inc.

The first three holdings:

- Capital Research & Management Corp. — 3.38%

- Arrowstreet Capital LP — 0.95%

- BlackRock Fund Advisors — 0.76%

Final thoughts

One of these salt stocks, “Scorpio Bulker’s'” share price, increased by 20.04 (inf%). Buying SALT now is a good idea if you think its price will continue to rise.

Ultimately, neither metric nor any other individual can tell you whether to buy salt stocks at this time. Only invest when you think the time is right and be comfortable with the risk involved.

Comments