Markets seem to be undergoing major transitions during the first quarter of many firms. It’s either a bullish or bearish trend at any given moment. When it comes to change, this time, we’re talking about transition.

The reason why A-rated stocks to purchase now and through 2022 are so important is because of this. Tesla (TSLA), Shopify (SHOP), and Roku (ROKU) have been some of the market’s biggest winners over the past few years.

Remember that today’s global economy is founded on just-in-time inventory, which has been ingrained in the brains of most customers regardless of where they live. This article highlights the most expensive stocks in 2021and worth buying In 2022?

What are expensive stocks?

Although the stock price is a measure of market worth, it is also dependent on how many shares there are in the business. The reason certain stocks are so expensive is that the firm has never or seldom divided its shares.

So how high may a stock’s price rise before it’s too long to wait? When it comes to stock prices, there is no limit to how high they may go, and strategic and long success is defined by its business. However, a high stock price does not always mean that the firm is successful.

Expensive stocks to buy in 2022

Here are the top three expensive and worthwhile stocks for 2022.

1. Cohu (COHU)

The world’s leading semiconductor companies use Cohu’s testing and handling equipment to speed up the production process of delicate and extremely precious computer chips.

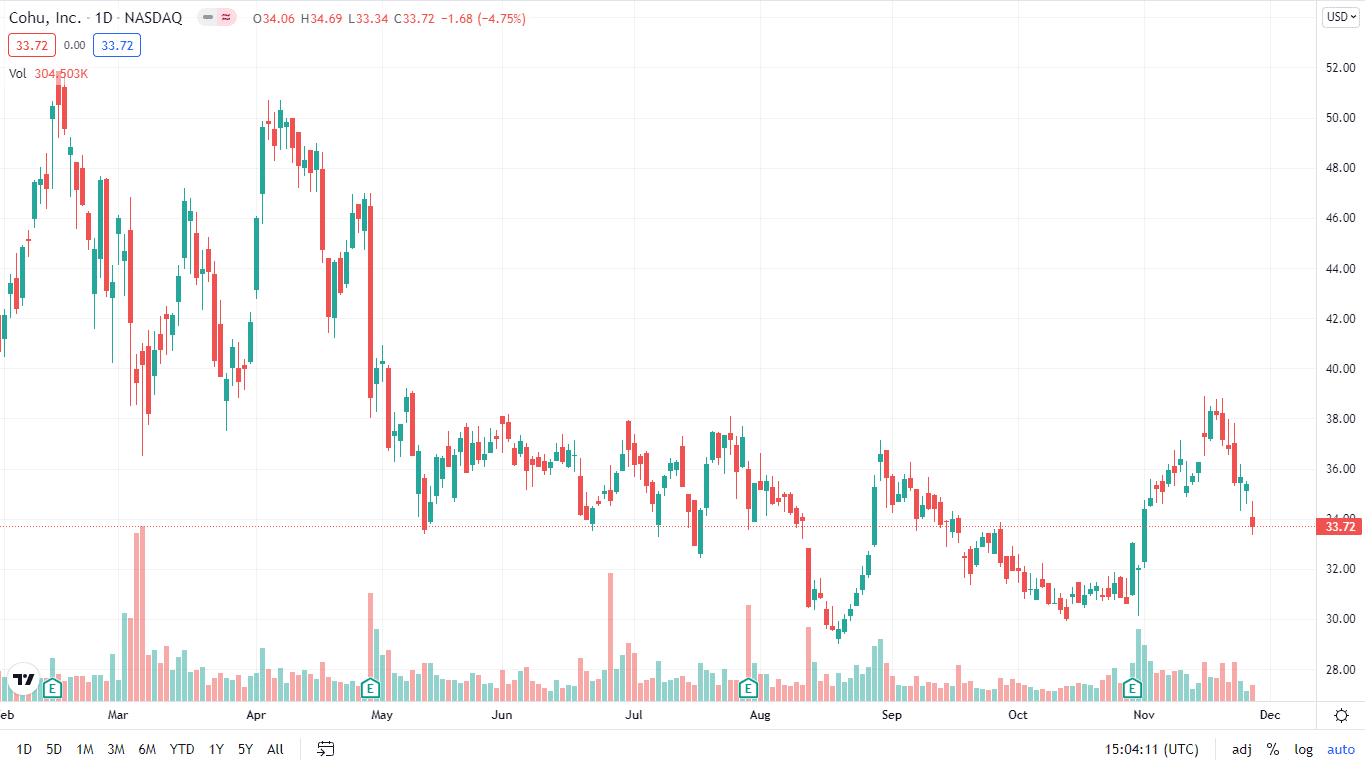

Cohu price chart

Cohu is concentrating its efforts on the automotive industry to address these difficulties, accounting for 18 percent of its sales. Neon is intended to identify faults in some of the world’s tiniest automotive-related semiconductors while still processing them at rapid rates to reduce production delays.

Price

For Cohu Inc, the median price target for the 12 months is 45.00, with a high estimate of 51.00 and a low estimate of 30.00. The recent price of Cohu is 33.72. That represents a 33.25% increase from its last close of 33.72.

EPS

Its EPS value for the third quarter of 2021 is 3.36. The next quarter is expected to come up with the same results.

Market capitalisation

Cohu has a market cap of $1.64 billion as of November 2021. We estimate that Cohu is the 3750th most valuable company in the world by market cap. Essentially, market capitalization measures how much a company is worth based on its outstanding shares in the market.

2. GoPro (GPRO)

At $499, GoPro’s new HERO10 Black camera produces footage in 5.2K high resolution, which the firm claims are its most similar rival. It has traditionally sold its cameras via some of the world’s top retailers, but GoPro.com is presently changing to a more direct customer strategy. Keeping the retailer’s cut implies that the corporation now has a bigger gross margin.

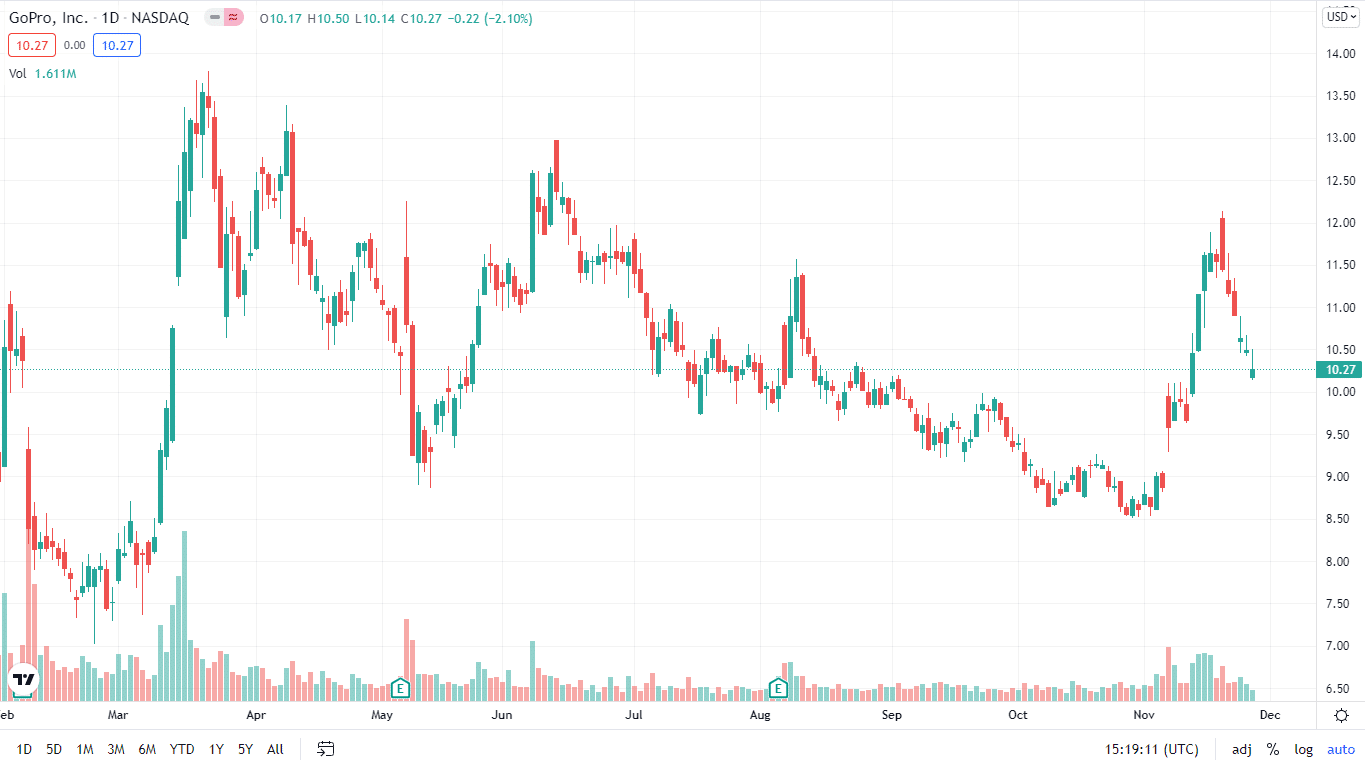

GoPro Price chart

Price

On November 28, 2021, the price of GoPro was 10.26 USD. Its 52-week high is $13.79, while its 52-week low is $6.61. Analysts forecast that GoPro Inc. will reach a median price of 11.00 in the next 12 months, with a high estimate of 15.00 and a low estimate of 9.00. In comparison to the last price of 10.26, the median estimate represents a +4.66% increase.

EPS

GoPro EPS value for this quarter of November 2021 is 2.25.

Market capitalisation

GoPro Market Capitalisation value is 1.6B in November 2021.

3. Snap

The Snap Inc. camera company makes cameras. Using their products, people can express themselves, live in the moment, learn about the world, and have fun together.

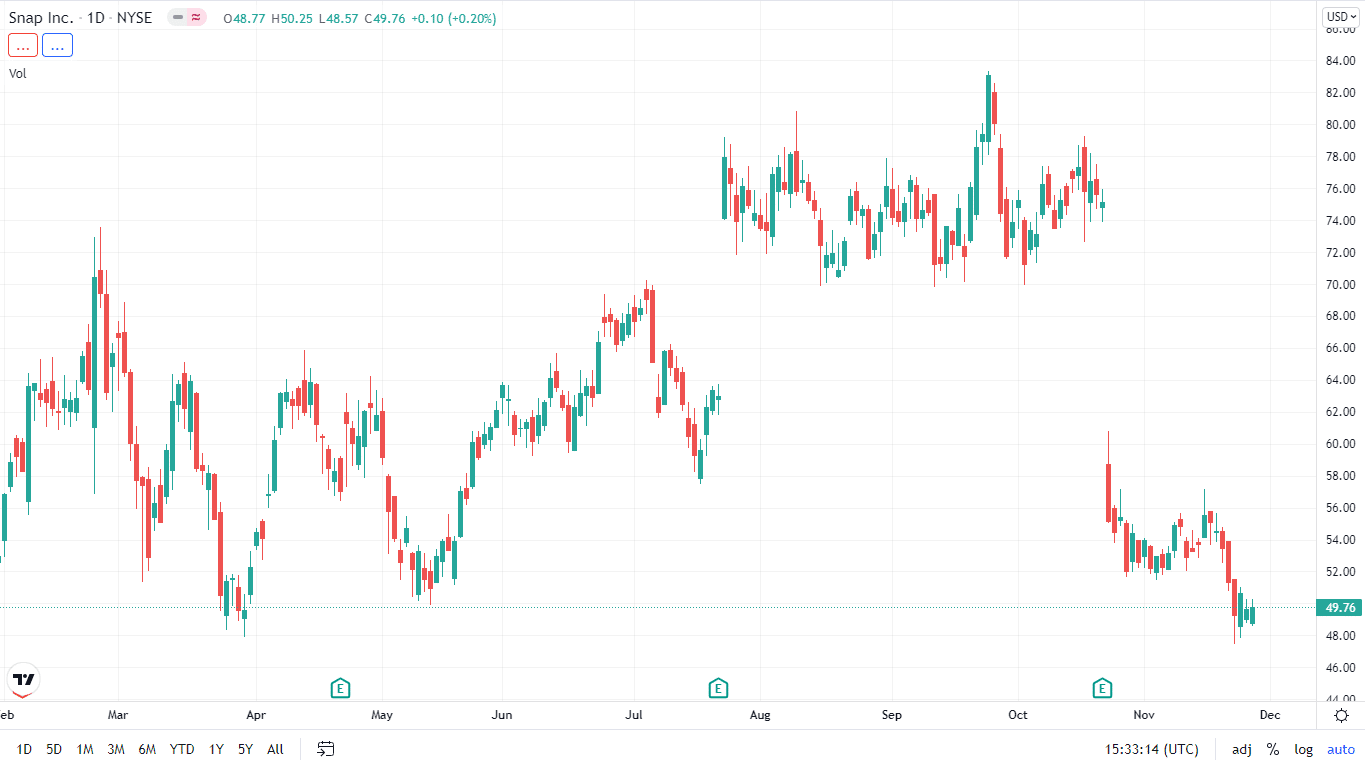

Price

Its price value on November 28, 2021, is 49.76. That represents a 50.60% increase from the stock’s last price. In contrast, its 52-week price ranges from 52-wk low (43.26) to 52-wk high (83.34). With a median target price of 75.00, the analysts offering 12-month price forecasts for Snap Inc have a high estimate of 104.00 and a low estimate of 53.00.

Snap price chart

EPS

Snap EPS value on November 2021 is -0.41.

Market capitalisation

Snap had a market cap of $80.10 billion in November 2021. Snap is ranked 199th in the world’s most valuable companies by market cap.

How to buy expensive stocks?

Here are the steps to buy expensive stocks.

Step1. Choose a broker

The broker allows you to buy and sell a stock, keeps the stock in an account for you, and collects any paid dividends. As part of the process of opening an account, you’ll need to give some basic financial information, including your bank account details.

Choosing a broker online is a good place to start. Most brokers don’t charge any fees for stock trading and don’t need a minimum account balance to get started. Alternatively, if you want to trade less frequently, you may use a trading app.

Step 2. Evaluate your investment

Calculate how much stock you can afford to acquire at the moment before moving further. There’s good news if you’re just getting started in the stock market: Many brokers enable you to buy and sell fractional shares. So you may even acquire a fraction of a stake on the most expensive stocks. It’s okay to start small. If you use no-commission internet brokers, you may save a lot of money.

If you’re planning to spend more than a few thousand dollars, it’s a good idea to diversify your portfolio by purchasing many stocks. If you’re planning to spend more than a few thousand dollars, it’s a good idea to diversify your portfolio by purchasing many stocks.

Step 3. Analyze the stock market properly

To make an informed decision on whether or not to invest in a certain company, you’ll need to do some research. A lot of time and effort is required if you want to achieve.

You’ll need to know about the firm, its goods, balance sheet, and industry to make an informed investment decision. As a result, you’ll have to check out the company’s SEC filings (SEC). If you want to know more about what you’re investing in and its potential, here is the best place to start. In addition, you may employ some of the best strategies of the experts, including doing your study, to your advantage.

Step 4. Place your trade

A limit order is a form that allows you to only buy or sell at a specific price or better. This sort of order will enable you to buy or sell at the current market price. You won’t be able to influence the price at which you trade. In the absence of a superior offer, the order will not go through. Depending on the broker, limit orders may remain in effect for up to three months.

With only a few shares or when the stock is extensive and liquid, market orders are preferable. Limit orders are better suited to smaller companies with fewer shares traded or many shares and not wanting to impact the price.

Step 5. Track your stock

An investor’s journey does not end with the purchase of shares. Track quarterly or yearly profits and stay on top of market trends to keep up with your new employer. Moreover, if the firm is doing well, you might increase the money allocated to this position. Then, as your knowledge increases, you may expand your portfolio by purchasing other stocks.

It is almost certain that your stock price will fall at some time, even if it’s only for a little period. The more you know about the firm, the better you can determine if it’s time to buy additional shares at a discount or to sell.

Final thoughts

If you have a small amount of money, you may start investing. As a novice investor, you need to know your limits, which is more challenging than picking the appropriate investment. Finding out the minimum deposit requirements and comparing the commissions to different brokers will need some research.

Individual equities are likely to be too expensive to be a cost-effective way to diversify your portfolio with a little sum of money. However, one can buy the stocks from the list mentioned above in 2022 to increase stock exchange profits.

Comments