ETN stands for exchange-traded note, which is a unique type of debt security. It has a maturity period like other debt securities. However, the only thing that backs an ETN is the credit of the sponsoring bank. While you can trade ETNs in exchange, they do not own any securities contained in a benchmark index.

ETNs are largely unknown among investors. Although the first ETN was introduced in 2002, there are very few ETN assets in the market. At present, the US market contains only about 140 ETNs spread across various markets such as currencies and commodities.

The returns in your ETN investing are directly connected to the index’s performance being tracked with fewer investment fees. When you buy an ETN, the sponsoring bank guarantees to pay you on the maturity date whatever the underlying index gives. This is the main attraction of these funds.

While ETNs offer great features as no other market does, it is not a good policy to invest right away without knowing the pros and cons. You will learn them toward the end of this post. Let us understand ETN further in the next section.

What is ETN?

It is not equity, equity-based security, an index fund, or a commodity. When you buy an ETN, you are betting on the direction of the underlying index with a guarantee from the issuing bank. Being dependent on the benchmark index, an ETF closely tracks the index’s performance with no tracking error.

The financial structure of an ETN is comparable to the structure used by investment banks in creating structured products for institutional investors. Though they sound similar, an ETN is not an ETF. An ETN does not take ownership of the assets listed in the benchmark index. In general, ETNs are riskier than ETFs.

ETFs versus ETNs

ETNs are much like ETFs in many respects. Both are traded in an exchange and follow an underlying index. However, there are several differences worth citing. For one thing, ETNs are not subject to capital growth and dividend distribution yearly, but ETFs do. ETNs are designed for long-term investors.

In terms of tax benefits, ETNs are superior to ETFs. Meanwhile, you can associate the characteristics of ETFs to stocks and ETNs to bonds. Being less familiar with investors, ETNs are less traded than ETFs.

For example, more than 65.7 million SPDR S&P 500 ETF shares are being exchanged every day, while JP Morgan’s AMJ ETN has more than 648,000 shares. This shows that investors favor ETFs more than ETNs. The other differences between ETFs and ETNs are shown in the table below.

| Consideration | ETFs | ETNs |

| Character traits | Stock | Bond |

| Option to buy or sell the underlying index | Yes | No |

| Investor risk | Market risk | Market risk, issuer risk |

| Tracking error | Larger | Smaller |

| Payouts | Quarterly distribution | Quarterly coupons |

How to invest in ETN?

The process of ETN investing is similar to the process of ETF or stock investing. Follow the steps below when you are ready to invest in ETN.

Step 1. Open an account

You need to connect to a brokerage firm and open an account to trade securities such as ETNs. The good news is that you can do this completely online. Additionally, several brokers offer no transaction fees, no minimum account requirements, and no inactivity fees. If you think opening a brokerage account is difficult, this is not true. The process is no different from applying for a savings account.

Step 2. Decide what ETNs to buy

There are currently 140 ETNs in the United States. To find the best ETNs, you have to compare them using certain metrics. To simplify the selection process, you can use the elimination method. This means that you decide what metrics are important to you and then consider the available options based on those metrics. Here are some metrics you can use in your ETN selection process:

- Expense ratio

- Average daily volume

- Average spread

- Benchmark index

- Year-to-date return

- Assets under management

- Market cap

- Leverage factor

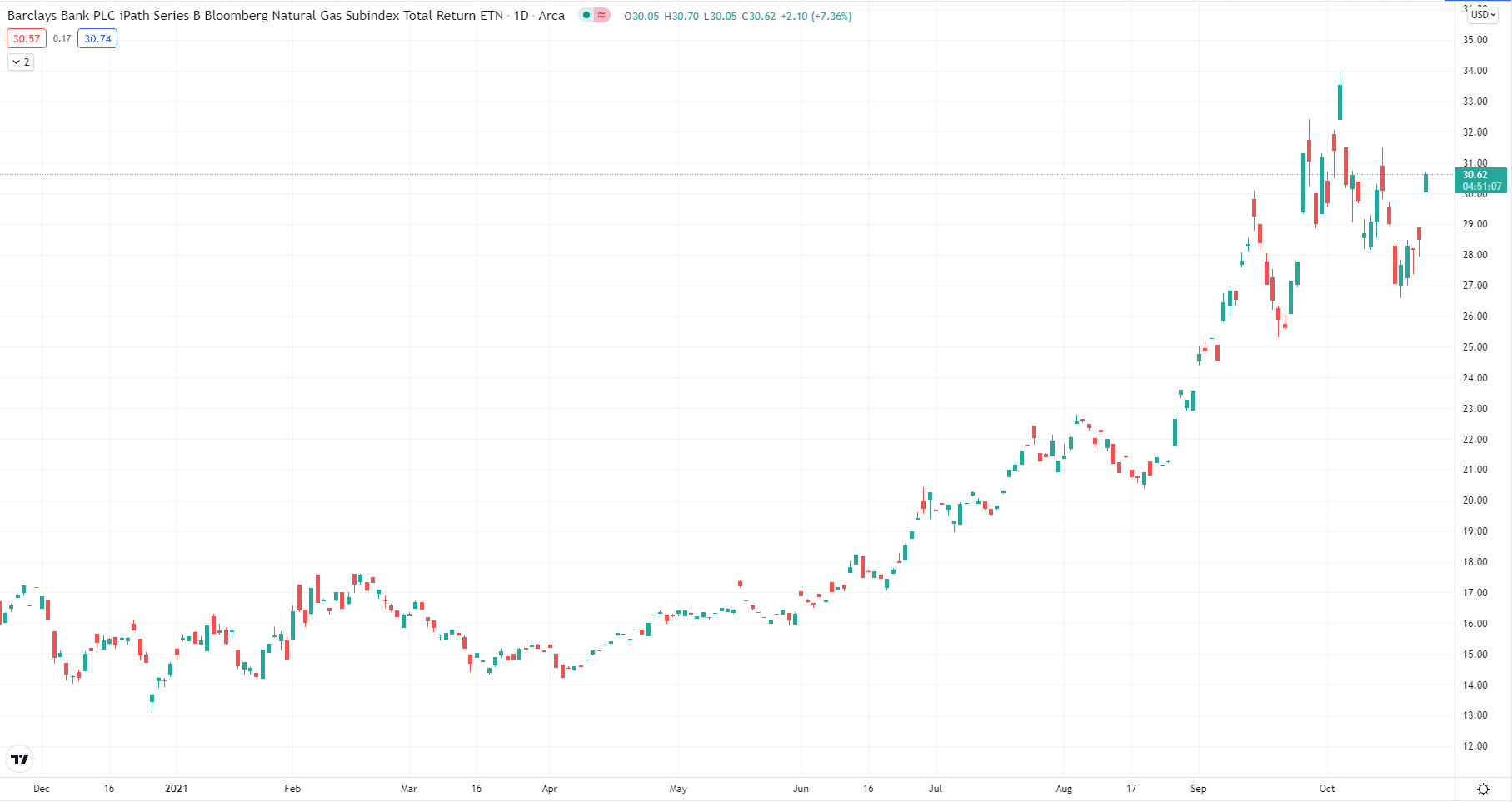

One of the hottest ETNs of today is iPath’s GAZ ETN. Achieving a year-to-date return of 112.28 percent, GAZ is the best-performing ETN as of October 2021. See its historical price movement below.

GAZ ETN daily chart

Step 3. Place your order

If you know how to buy stocks, then you know how to buy ETNs. The process is much the same. To buy ETNs, go to the trading section of your broker’s platform. Take note that short selling is possible for ETNs. Therefore, you can buy or sell at any price.

When you are ready to invest in ETNs, make sure you trade the right ETN. Check the following details of the order you would like to place:

- Ticker symbol

- Current price

- Number of shares

- Type of order

- Commission

Step 4: Monitor the performance

After you place your trade, you have to check its performance from time to time. You do not have to do this every hour or every day since you are investing, not trading. Checking it once a week is already good enough.

It is very easy to check how your investment performs. You can do it by going to the website of your brokerage firm and typing the ticker symbol. Alternatively, you can go straight to Google and enter the ticker in the search box.

| Upsides to ETN investing | Downsides to ETN investing |

|

|

|

|

|

|

Final thoughts

Investors put money in ETNs because of the promise of return corresponding to the performance of an index fewer expenses. However, this investment vehicle is riskier than stocks and ETFs. It is also not suitable for short-term investing. If you consider investing in ETNs for portfolio diversification, carefully study this market and invest only in the best ETN assets.

Comments