Cash flow (CF) is a track record kind of statement that reports every transaction, either for buying or selling, to note the overall business health. Several investors, business owners, and institutions utilize this to track and manage money profited from investing or other financial activities.

Long-term investments in fixed assets generate CF. So, if you’re looking for a calculated statement of the investments you’ve made, then you’re at the right place.

Let’s find out the top five investing activities in 2021 and learn how to calculate your CF by yourself.

What are investing activities?

Now you know what investing activities might entail, and you achieved that. In the investment world, activities involving the acquisition of long-term cash resources, such as the sale of an asset, are usually considered investments.

There are many types of investment activities, and you can choose any that appeals to you. Transacting or withdrawing funds from the business is considered cash flow. Long-term assets are sold when the CF from them increases, whereas they are purchased when the CF from them decreases.

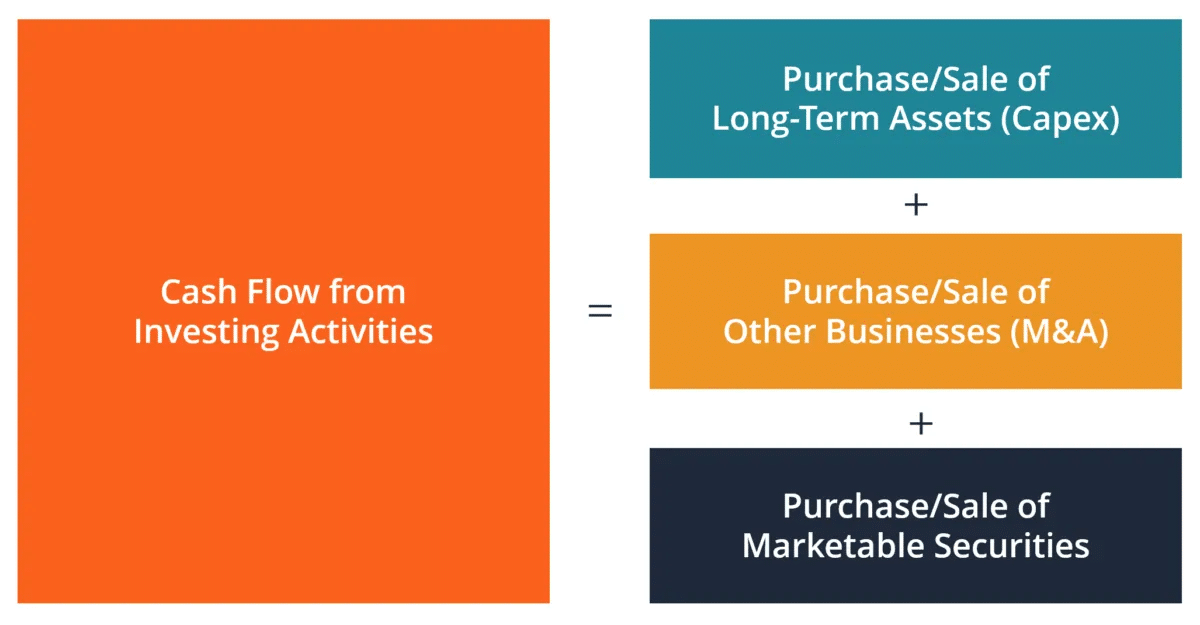

How to calculate the cash flow from investing activities?

In investing, earnings are tracked and shares are generated from long-term assets. This activity has the highest impact on CF among other activities.

Every cash flow statement is divided into three sections of activities:

- Operating

- Investing

- Financing

CF is composed of defined parts that are responsible for specific tasks and report cash flow issues arising in any of the sessions so they can be addressed as quickly as possible.

Three types of cash flow statements

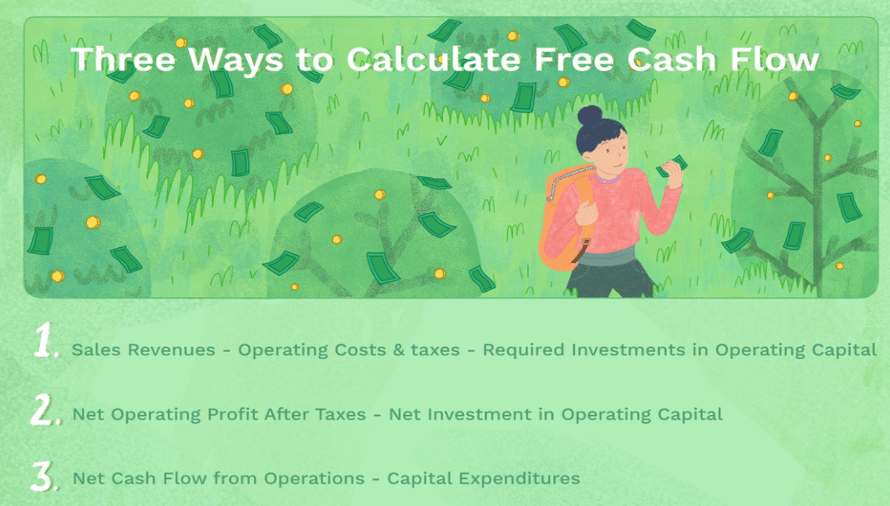

Accounting software provides an automatic method for generating a cash flow statement for your investing activities. CF is tracked and recorded automatically in order to make a financial statement.

Otherwise, you can also feed the property sales like the money received in change, through stock’s sale, or any other market securities by yourself. Following this, you have to subtract the spent amount on making any property purchase. Then, the total sum is recorded in the final CF statement of investing activities.

You should however ensure that you do not include an average income, expense, interest rate, or debt in the cash flow statement. These factors negatively affect CF statements, resulting in understated or overstated statements.

Top five examples of investing activities

Let’s explore some of the top investing activities.

Sale of equipment

As long-term assets, equipment is the property that firms and owners can use, invest in, or replace whenever they have the need. These activities generate profits that are included in investment.

Imagine an aeroplane part factory, for instance. Due to increased orders, the owner relocates to a more prominent location and installs a more advanced facility. A new plant is purchased after the old one is sold.

Additionally, he sells his old equipment like laser cutters, welding machines, and industrial machines. This brought him $50,000 in revenue. CF statements record all transactions relating to investing activities.

Purchase of equipment

Following the same example, the factory owner now has to buy new equipment to run his new plant after selling his old machines. So, he makes purchases of nearly $145,000 for new machinery.

Sale of building

Then, the factory owner sold his factory building for 750,000 USD in May, more than the expected rate.

Purchase of marketable securities

As the owner earned more cash than he expected, he decided to invest the remaining amount in the stocks because of the ability to transact or liquidate when wanted conveniently. Therefore, he researched the appropriate and positive stock purchase first, and then, he purchased technical stocks for $40,000 in September.

Investment in a second business

With the remaining amount, the factory owner agreed to be a 25% partner in his brother’s new business by investing nearly $75,000 in the new business in October.

Later at the year-end, he calculated his cash flow from investing activities which showed $660,000 net cash. He learned that he invested a good amount in his business and his overall yearly investment activities.

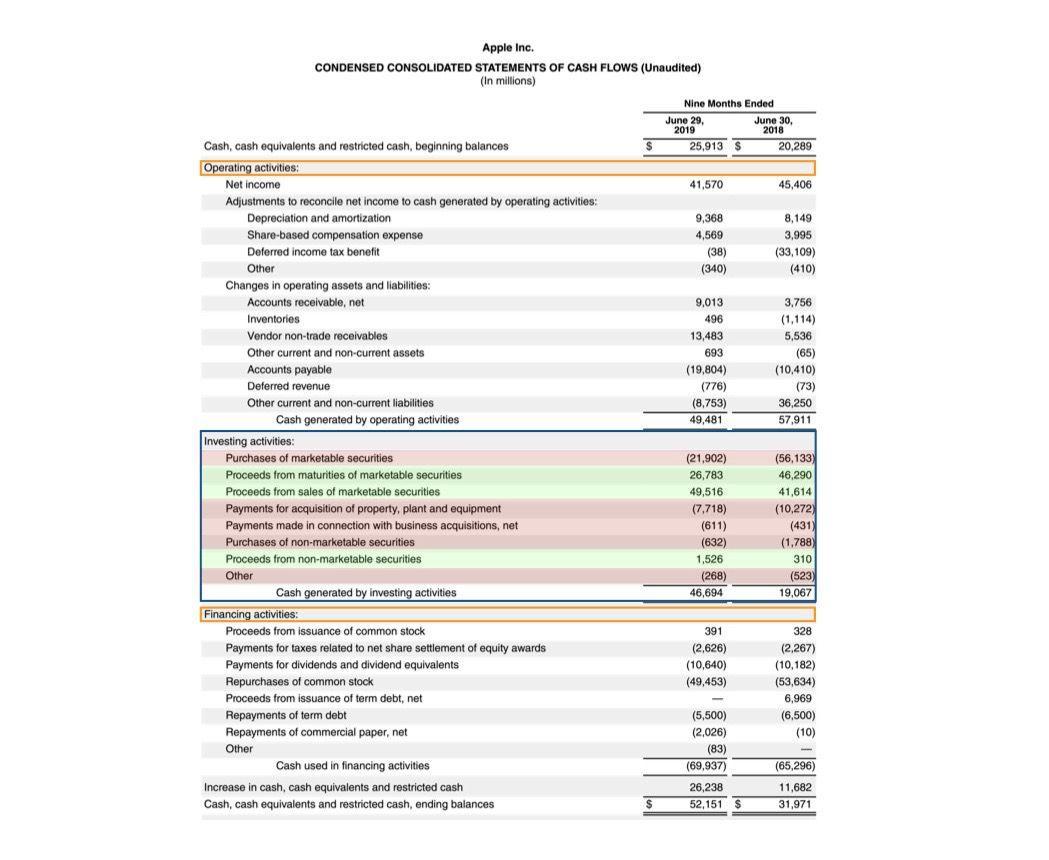

Example of CF statement from investing activities of Apple Inc.

Advantages and disadvantages

Analyzing any reporting indicator comes with some advantages and disadvantages. It is important to note that only a comprehensive investigation of all reporting documentation can be truly effective when an investor analyzes a company.

| Advantages | Disadvantages |

|

|

|

|

|

|

Final thoughts

For investors, particularly those who operate business accounts, CF is an indispensable step. A company can avoid investing in assets that otherwise can exceed their cash budgets by purchasing the assets instead.

Keeping cash flow positive doesn’t necessarily imply that the company is in trouble financially. To grow your business for the long term, it is best to use a CF statement that does not take too much time.

Comments